Consumers are back and buying with force. The US economy is beginning to gather steam, but the sudden surge in demand has created a shock to the global supply chain at many distinct points.

The domino effect is rippling throughout the global economy with no signs of letting up anytime soon.

Most consumer items are manufactured from factories throughout Asia. The supply chain chaos is effecting deliveries all the way to the local store shelves which are now showing bare spots and shortages of key consumer items.

In addition, the increase in Christmas consumer demand is adding another layer of stress on an already broken system.

With all crises come opportunities for intelligent investors.

Read on and I’ll show you my favorite companies for profits during what has now become known as “Containergeddon.”

“A bottleneck of container ships as far as the eye can see. I’ve never seen anything like it,” a friend who lives just a few blocks from the ocean in Long Beach, CA, recently texted to me.

Normally there is at most one container ship waiting to dock.

As of October 21, 2021, the Marine Exchange which tracks port traffic was reporting 108 container ships anchored or in holding areas, as posted on their Twitter feed:

The Ports of Long Beach and Los Angeles are where the global supply chain meets the US economy, specifically from Asia.

The two ports are responsible for processing 40% of all containers arriving in the US and are among the main entries for Chinese goods into the American market.[1]

More than half the items made in Asia purchased by the American consumer come in through the Los Angeles and Long Beach terminals.[2]

Many of these container ships have been anchored or drifting for months with nowhere to go. All US west coast ports are experiencing the same backlog of container processing.

It looks like the problem will only get worse before it gets better.

Our global economy is a tightly calibrated infrastructure that is designed to be in constant motion.

Every time you order something online, it is transported via a tightly knit network of factories, rails, roads, ships, warehouses and delivery drivers. When one link breaks or slows down, the impact is felt immediately throughout the chain.

Goods are not always stored or warehoused by local businesses but instead are often shipped to the factory or consumer just when it is needed.

This system of business is called ‘just-in-time’ or JIT. It was originally the idea of Taiichi Ohno, an engineer at Toyota in the 1950s. The idea was meant to minimize the waste of time and resources used in storing parts and goods in a warehouse.[3]

Ohno’s idea was that suppliers could deliver parts or goods as they were needed, reducing expenses on maintaining inventories and paying for additional labor. This idea became popular with other businesses starting in the 1980s.

Delivering products on demand relies on a well-oiled infrastructure. One break or hiccup in the system and everything comes to a stop.

We are now dealing with 4 Hiccups in the global supply chain infrastructure.

Global Supply Chain Hiccup #1

The first hiccup came when many factories throughout China, South Korea, Taiwan, Vietnam and other southeast Asian countries were shut down by COVID.

Unfulfilled orders stacked up during this downtime. It can take weeks to restart a factory.

Global Supply Chain Hiccup #2

The second hiccup came as consumer demand surged after a lull in consumer spending at the beginning of the COVID pandemic. Employees were working from home. Students were studying from home. Consumers turned their attention to home repairs and electronics.

The spike in demand collided with the factory closures throughout Asia.

Global Supply Chain Hiccup #3

A third hiccup in the global supply chain is a finite amount of containers and ships to carry those containers.

Containers and vessels were still out delivering PPE equipment for doctors and hospitals battling the COVID virus. They were not at port in Shenzhen China, for example, waiting for the next load from many Asian factories.

The scarcity of containers and vessels collided with the spike in demand to ship the products from the Asian factories. This of course caused shipping costs to skyrocket.

Before the pandemic, the cost of sending a container from China to Los Angeles was around $2,000.

One year later, shipping costs had grown ten-fold, reaching as high as $25,000 per container![4] That’s crazy!

There literally were no more containers and no more room on container ships. Orders were sitting on the docks in China for weeks and even months.

Those increases in shipping prices are now being felt by consumers and helping to fuel an economy that now teeters on the edge of high inflation.

Global Supply Chain Hiccup #4

The fourth choke point in the global supply chain is a lack of qualified truck drivers to move the containers at the US ports to their next destination along the supply chain.

A nationwide worker shortage — specifically in the trucking industry — has slowed this part of the supply chain to a crawl.

Trucks move the cargo from the ports, which includes everything from food to electronics to toys — to warehouses or directly to retailers. Because of the shortage of drivers, cargo now sits held up at ports and ships can't unload.[5]

The US is short 80,000 truck drivers according to the American Trucking Association[6]

— Thomas Balzer, president and CEO of the Ohio Trucking Association[7]

The driver shortage is due to retirements and new truck drivers needing to be trained due to COVID closures.

Many large retailers are trying to lure drivers with increased wages and offers, attractive benefit packages, and even offering free college tuition.[8]

Too few drivers means clogged ports, stalled ships, empty shelves and higher prices.

The shortage of qualified drivers is not going away anytime soon.

— Nick Vyas, executive director of the Kendrick Global Supply Chain Institute at the USC Marshall School of Business

Some larger retailers, racing against the clock to fill store shelves for the pre-holiday shopping season, are taking matters into their own hands. They are now hiring private container ships that are able to bypass the logjam to some degree.

This will only have a limited effect on supply as it takes a long time to setup logistics at the scale needed by the likes of Walmart (NYSE: WMT) or Amazon (NASDAQ: AMZN).

The feds and the state of California are both signing emergency executive orders aimed at alleviating the container logjam. Keeping the ports operating 24/7 as well as increasing load weights a truck can legally haul are two ways the government is working to clear the backlog of containers.

Unfortunately these orders will have little effect on the current supply chain disruptions the global economy is experiencing.

The global supply chain is now in a process of resetting itself and that will take a long time to unwind.

The global supply chain has a few bright spots for the intelligent investor to consider.

Cargo ship operators have been cashing in on the lack of containers and ships. Freight costs have soared in the past few months, helping to pad the bottom line and share prices of related companies.

I have found 5 companies that I believe will continue to see increased business and profits in the coming six months or longer.

How long this backup at the ports will last is anyone’s guess, but I believe that we could be looking at up to a year to clear this mess and get the global supply chain reset.

The mainstream press is loaded with articles on the global supply chain breakdowns, soaring shipping costs, clogged ports, empty store shelves and rising inflation.

That is good news for sentiment towards many ocean-shipping stocks.

High vessel demand and tight supply will cause the value of ships to rise which in turn will drive up the net asset value of companies and their stock prices.

These stocks have all seen near peak prices, but I believe there is still time to get in as the supply chain crisis drags on into next year.

Note: All charts are for the past three months unless otherwise noted.

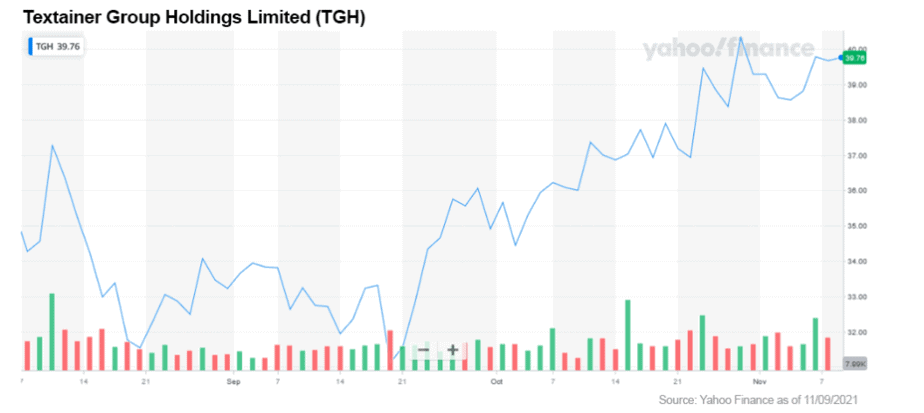

1. Textainer Group Holdings Limited (NYSE: TGH)

This company is in a perfect position for the current scarcity of containers. The current fleet utilization rate is now at 99.8% which are now being leased at premium rates.

Textainer owns, manages, leases and sells its fleet of 4.1 million containers.

The company has ordered an additional $1.1 billion in new containers to capitalize on the growing demand.

The company saw an impressive 28% growth in EPS YoY.

A strong candidate for your research in my opinion.

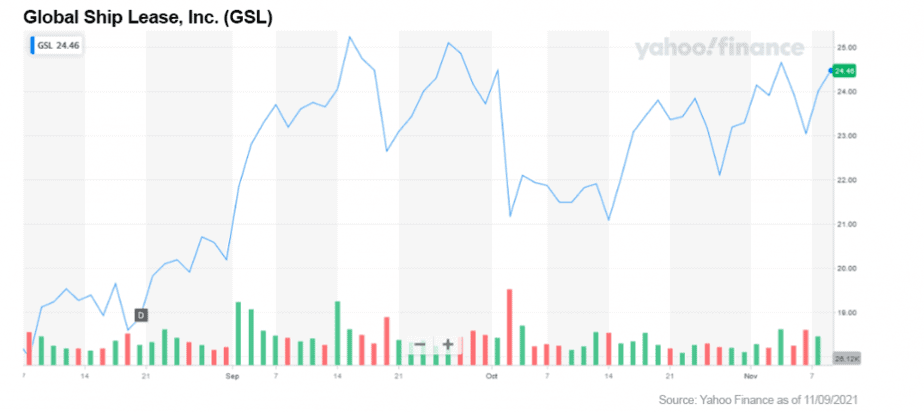

2. Global Ship Lease, Inc. (NYSE: GSL)

Global Ship Lease owns and charters container ships under fixed-rate charters to other container ship companies.

The company expanded their fleet by over 50% over the past year looking to capitalize on the increased demand for containers and container ships.[9]

Earnings have grown 40.5% per year over the past 5 years.

They also pay dividends as an added bonus.

The company share price has skyrocketed in the past year, but with current market conditions in shipping, I believe they still have legs to run.

An add to your watchlist as a minimum.

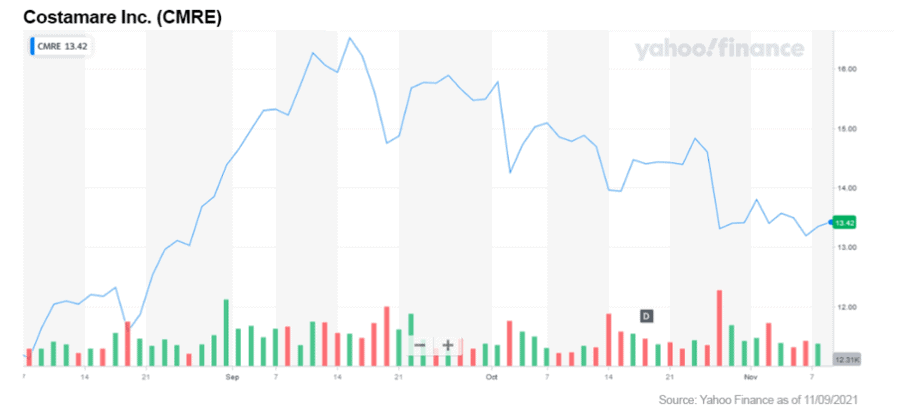

3. Costamare Inc. (NYSE: CMRE)

Costamare is another containership company that owns and charters their fleet.

As of June 2021, the company reported they had 81 containerships with a capacity of about 581k twenty-foot containers and 16 dry bulk vessels.

Their fleet is now 99.3% utilized, and the company saw their charter rates increase by more than 450% YoY.[10]

Those rates have helped bring the company earnings in the green.

Given the current container shipping scarcity, this stock is one that investors should consider while doing their research.

4. Diana Shipping Inc. (NYSE: DSX)

Diana Shipping is primarily a dry bulk containership operator. They bring the raw materials to the factories. Think iron ore, coal, grain and other materials.

They currently operate 36 dry bulk vessels with a utilization rate of 99.6%.[11]

Based on 3 Wall Street analysts offering 12-month price targets for Diana Shipping in the last 3 months, the average price target is $8.60 with a high forecast of $9.50 and a low forecast of $7.70.[12]

The company is seeing strong positive cash flows in the current market environment.

Definitely one to keep on the radar.

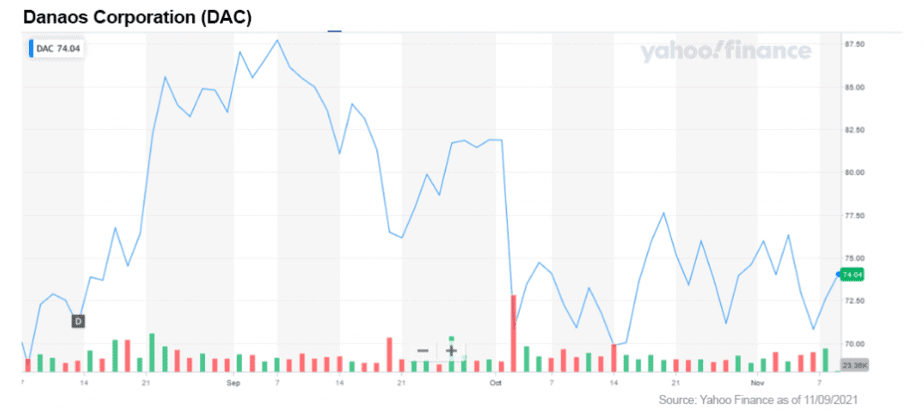

5. Danaos Corporation (NYSE: DAC)

Danaos is another containership company that is profiting from the current froth in shipping prices.

The company has a fleet of 65 containerships with capacity of just over 403k containers.

Danaos has seen free cash flow increase over 3X and a doubling of adjusted earnings per share in the past year.

The stock is still a value at its current share price trading at 0.6X its net asset value.

This is a solid company with over 40 years in the business.

A solid play that should be investigated further in your research.

As the supply chain chaos continues to unravel, shipping companies stand to profit handsomely in the coming year.

Both containerships and dry bulk good ships are in high demand with charters booked out by some of the companies I mentioned into 2023.

As an intelligent investor, it is well worth the time to look at the companies I have suggested and strike out on your own to find new opportunities in the still growing global supply chain crisis.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://sputniknews.com/20210925/biggest-la-port-faces-massive-traffic-jam-as-over-60-ships-unable-to-unload-their-cargo-1089402773.html

[2] https://www.reuters.com/business/autos-transportation/containergeddon-supply-crisis-drives-walmart-rivals-hire-their-own-ships-2021-10-07/

[3] https://www.theguardian.com/commentisfree/2021/oct/11/just-in-time-supply-chains-logistical-capitalism

[4] https://www.nytimes.com/2021/10/22/business/shortages-supply-chain.html

[5] https://edition.cnn.com/2021/10/20/economy/california-port-supply-chain/index.html

[6] Ibid.

[7] https://www.ttnews.com/articles/how-crisis-level-truck-driver-shortage-could-impact-your-shopping-habits

[8] https://abcnews.go.com/Politics/whats-causing-americas-massive-supply-chain-disruptions/story?id=80587129

[9] https://www.globalshiplease.com/news-releases/news-release-details/global-ship-lease-reports-results-second-quarter-2021

[10] https://www.costamare.com/images/results/CMRE_presentation_Q2_2021.pdf

[11] http://www.dianashippinginc.com/userfiles/6983af3e-596f-4a40-b871-a31d00bd545b/Diana%20Shipping%20Inc.%20corporate%20presentation%20030821.pdf

[12] https://www.tipranks.com/stocks/dsx/forecast