Meme stocks have been thriving for well over a year now and show no signs of slowing down anytime soon. I know, I can’t believe it either, but either way they are something that cannot be ignored as an investor.

If you have an appetite for high-risk investments in companies with borderline terrible fundamentals, then these are the stocks for you!

In this article, I will revisit the early COVID pandemic days and how it has shaped the stock market for better and for worse.

Be sure to check out my previous article on this topic from August 2020, which is still highly relevant today.

OK, let’s get started!

A byproduct of the COVID pandemic, millennials and Gen-Z investors piled into stock trading in early 2020. These investors were mostly inexperienced, had some extra cash on hand thanks to federal stimulus checks and a load of free time.

These new investors have been known to ignore company fundamentals at such a basic level such as cash flow, debt, charts or EPS — and instead trade on instinct, emotion and hype primarily driven by mass influencers posting on social media outlets such as Reddit and Twitter.

Meme stock investors flocked to a subreddit called WallStreetBets where they engaged with like-minded investors, learned about trending stocks and how to trade.

At last count, there were just over 11 million followers of this group!

Coupled with this movement was the Robinhood (NASDAQ: HOOD) trading platform. Newly formed by two young Gen-Z entrepreneurs, Robinhood found itself at the right place at the right time and marketed heavily to this group of young and rather inexperienced traders.

The Robinhood app is a perfect marketing case study on how to appeal to a given demographic. The app was built from the ground up to attract younger investors with one-click trading, zero commission fees, slick graphics and emojis, and phone notifications with confetti that make trading feel more like a game.

Inclusivity. Interesting word to use to describe traders.

And that’s the point.

These were not traders as we know them. These were people looking for a cause, something to believe in, something to follow. A group to be a part of, a community or family.

If they made some money along the way, great — but I believe that was never their real intention. Trading was a game for them and making Wall Street and the evil hedge funds the enemy gave them a purpose.

During the pandemic lockdown, it was a reason to wake up in the morning and get out of bed.

COVID had taken their former life away. Being part of a group of other activist traders that was fighting big bad Wall Street gave them a new reason to wake up and live their day.

Hence, the meme trader 'army' was rapidly born.

Jeff Kilburg, Founder and CEO of KKM Financial, made the point that “even though these may be ‘small’ investors, there are over 200 million of them in the marketplace, so when they get herded up, that’s more than just a small impact on the economy.”[2]

So now you know how the meme 'army' was built.

Their enemy was the hedge funds that were shorting failing companies.

These meme investors felt a purpose in 'rescuing' beaten down companies that were being heavily shorted by institutional investors, aka Wall Street.

Their strategy was to use their massive and increasing numbers to move against the heavily shorted hedge funds by driving the stock price to unimaginable and unrealistic levels. This would force the hedge funds to cover or liquidate their short positions, and in turn, take losses in the billions of dollars.

Using Reddit and Twitter as their bullhorn, a call to action was put out to the followers to move on a certain stock.

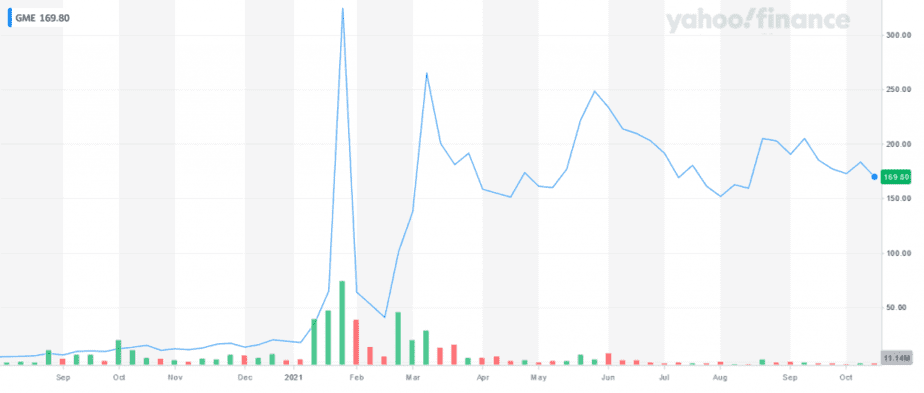

One of the first targets for the meme traders was GameStop Corp (NYSE: GME).

GameStop rents and sells video games at physical locations at a time when games can be downloaded over the internet at home. Obviously, a business model that died years ago but gamers still support it.

The company was in a slow downward trend trading at just over $4/share as late as August 2020. Hedge funds were heavily shorting the stock and profiting on the falling share price.

On January 18, 2021, the short squeeze was launched by the meme traders.

Large-scale retail investors spent $352 million on net purchases of GameStop.[3]

In just a few days, billions were lost by the 'storied Wall Street professionals’ who never saw the sucker punch coming.

This recount of the retail investor bloodbath that followed really says it all:

Driven by the frenzied trading in GameStop Corp. and other stocks that hedge funds have bet against, the losses suffered over the past few days would rank among the worst in some of these money managers’ storied careers. Cohen’s Point72 Asset Management declined 10% to 15% so far this month, while Sundheim’s D1 Capital Partners, one of last year’s top-performing funds, is down about 20%. Melvin Capital, Plotkin’s firm, had lost 30% through Friday.

And it’s not just the big names: Jack Woodruff’s $2.8 billion Candlestick Capital has fallen 10 to 15% in January on its short wagers, while the $3.5 billion Maplelane Capital lost about 33% through Tuesday in part because of a short position on GameStop, according to investors. By end of day Wednesday, Maplelane was down 45%.[4]

— Bloomberg, January 27, 2021

It was a deeply humbling moment for hedge funds and Wall Street in general. Never in their wildest dreams could they have imagined carnage like this coming — and all from retail investors no less.

Take a look at this chart! In one week the share price rocketed from $65/share up to $325/share!!

Wall Street and analysts were left with their jaws on the floor. How could they do this? Who were these people? Who did these commoners think they were? Inflicting this kind of damage on well-respected Wall Street professionals was not right.

The cries! The howls!

There was a sense of powerlessness on how to combat this ‘new force’ of activist meme traders.

As far as the meme traders, they were ecstatic. They had achieved their goal of dealing heavy losses to some of the most powerful hedge funds on Wall Street.

In their celebration, thousands of memes were created, and they flooded social media touting their ‘win’ against the hedge funds and dealing a death blow to evil Wall Street.

Thus the term: Meme Stocks

This video from Trevor Noah at The Daily Show was pretty funny and something you should watch.

And this one I found is hilarious.

Armed with the euphoria of the massive GameStop win, meme traders felt they could take on Wall Street and win.

The army moved on to other downtrodden stocks, looking for companies they felt greedy Wall Street was punishing for pure profit.

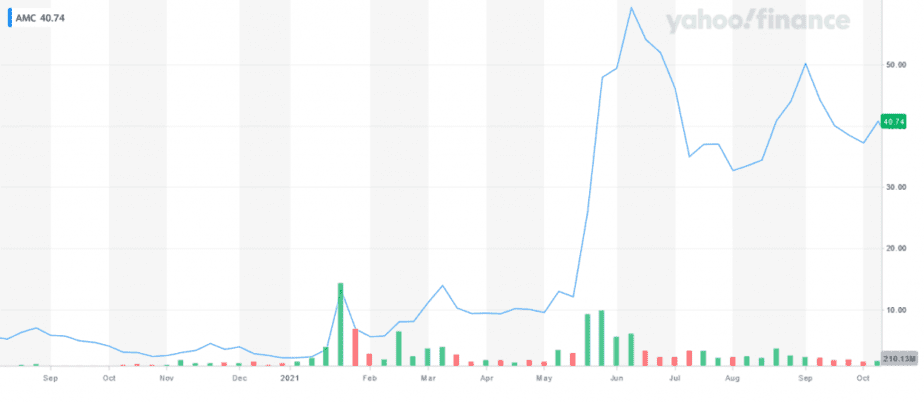

Their next target: AMC Entertainment (NYSE: AMC)

COVID had completely shut down operations of AMC, a national cinema chain. The company had been in a slow downward trend due to the fact that people were watching more movies at home using Netflix (NASDAQ: NFLX), Amazon Prime (NASDAQ: AMZN) or other streaming services. The COVID lockdown was the death knell for the company.

Just before the attention of meme traders, the stock was trading at around $2/share in early January 2021.

By early May, meme traders moved to AMC, and by May 18, 2021, the stock exploded to about $14/share.

In one month, the share price rocketed up to over $72/share!

AMC Entertainment’s subsequent bubble drew $600 million from retail investors at its peak.[5]

Throughout 2021, the meme stock culture continued on its quest to rescue more dying companies being ‘punished’ by evil Wall Street hedge funds.

Some of those companies included:

— Jeff Kilburg, Founder and CEO of KKM Financial

That is the ultimate question.

If you decide to dip your toe in the water of meme trading, you will need to immerse yourself into the culture.

Learn the language and special lingo. Follow the forums (such as WallStreetBets) on Reddit, Twitter, YouTube and TikTok.

Weigh your appetite for risk. These are high-risk investments. Purely speculation. Huge price swings should be anticipated.

All of these trades are short-term or day trades. You would never want to buy into any of these meme stocks and forget about them for a month.

These stocks are strictly for traders who are glued to their screens from market open to market close.

Eat lunch at your desk.

Be proficient in stop loss settings in your trading.

The gains could be huge.

Many people are making money trading meme stocks.

AMC (NYSE: AMC) and GameStop (NYSE: GME) have returned around +1,546% and +788% year-to-date (YTD), respectively.

If you are on the right side of those trades, the gains can be incredible.

One story I ran across was about a young woman called the “Stonk Queen.”

Typical meme trader story. Schools closed due to COVID, she was at home bored, went to a group meetup on stock trading for the free pizza, learned about the Robinhood app and Reddit groups.

She started with $500 in her Robinhood account and now touts she is up to $80k.[6]

She is now giving online classes on trading and has a TikTok channel with over 200k followers.

Her advice to other traders is to go with your gut intuition when it comes to investing.

“I think you have to take a few of those random risks...just go for it,” she says.

Her byline on her TikTok channel is “stonks only go up.”

Reading this makes me laugh. As seasoned traders, we know that her experience is an anomaly. The fabled 10-bagger we are all seeking.

I would say she will probably add to her byline in the near future "Stonks can go up but can also go down."

Dave Maney, Executive Chairman and Co-Founder of Deke Digital, makes a very good point about the meme stock craze:

“None of these influencers are based on performance, they’re all based on popularity. And when you think about the likelihood of GameStop to keep going, that’s the equivalent of the ALS ice bucket challenge or the Harlem shake, you know, those are memes. Now, they’re gone except for brief flickers in our collective memories, so we should all be aware." [7]

It makes me ask the question... whose advice would you follow?

A young college student who has been trading for less than a year or a seasoned Wall Street guru who has over 70 years in the markets with a proven track record of solid gains?

Ummm, I’m going to go with the Wall Street guru, thank you.

The whole meme stock phenomenon is an interesting byproduct of the COVID pandemic era. We will certainly look back on this time with amazement and wonder.

If you do decide to dive into meme stocks, do your homework and be ready for a wild ride.

And be careful out there my friends!

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.cnbc.com/2020/06/17/robinhood-drives-retail-trading-renaissance-during-markets-wild-ride.html

[2] https://www.excelsiorgp.com/resources/the-rise-of-meme-stocks/

[3] https://www.marketwatch.com/story/the-history-of-meme-stocks-suggests-robinhoods-surge-could-still-continue-11628161527

[4] https://www.bloomberg.com/news/articles/2021-01-28/cohen-sundheim-lose-billions-to-reddit-traders-running-amok

[5] https://www.marketwatch.com/story/the-history-of-meme-stocks-suggests-robinhoods-surge-could-still-continue-11628161527

[6] https://www.cnbc.com/select/how-stonk-queen-made-80k-meme-stocks-during-covid/

[7] https://www.excelsiorgp.com/resources/the-rise-of-meme-stocks/