The Ethereum Merge has finally happened.[1] Ethereum (ETH) has abandoned Proof of Work and moved towards a Proof of Stake consensus system.

This event has been one of the most anticipated moments in the crypto market in 2022, and its impact will reverberate throughout the market for the foreseeable future.

Understanding the future implications of the success, or failure, of Ethereum’s grand experiment will help savvy investors better take advantage of cryptocurrency.

Are you ready to explore the future of crypto? Then let’s dive in.

The Merge is the term given to the moment where the Ethereum blockchain will move away from Proof of Work (PoW) consensus methods to Proof of Stake (PoS) consensus methods.[2] In a technical sense, it joins the original execution layer of Ethereum with its new Proof of Stake consensus layer, the Beacon Chain.

In layman’s terms: The Merge will change the way Ethereum operates without compromising the history of the blockchain.

AN IMPORTANT NOTE FOR ETH HOLDERS: You don’t need to do anything with your cryptocurrency post-merge. There is no old-ETH or new-ETH — anyone telling you this is trying to scam you.

The reason this moment is so important is because Ethereum is the second largest cryptocurrency and forms the backbone of the decentralized apps (dApps) ecosystem which is worth $24 billion.[3] The Merge was a hugely complicated endeavor — akin to putting an entirely new engine in a car.

Any application that is built using Ethereum’s blockchain needs to process transactions using ETH. Prior to the Merge, this was done using a process called Proof of Work (PoW), also known as mining, that requires vast networks of computers and huge amounts of energy to solve complicated transactions. (Previously covered here.)

This was useful because it offered a decentralized way to secure the Ethereum blockchain and process transactions, but PoW came with a number of major drawbacks.

The most noticeable drawback for the non-crypto public was environmental. Mining requires an enormous amount of computing power, which translates into a massive demand for energy from miners. In a time when energy prices, particularly in Europe, are spiking, this was becoming increasingly problematic, both from an environmental and a cost aspect.

For the blockchain itself, mining pools posed a major scalability challenge.

There are thousands of dApps all using the same blockchain. Under Proof of Work, any sudden spike in network demand would lead to spiraling transaction fees and long wait-times.

This has severely hampered the growth of the dApps ecosystem and has been the main inspiration behind Cardano (ADA) and other so-called “Ethereum Killers.”

Instead of requiring miners to process transactions, Ethereum will now instead use validators. These can either be individuals with 32 ETH (around US$50,000), or “pools” of individuals staking fractions of their ETH. Like miners, they will be rewarded for doing so, with more opportunities for profit for individuals with larger stakes.

The first big benefit of this is energy. Running a Proof of Stake pool is more akin to running an app on your computer than a crypto mining farm. It is estimated that the consumption of the Ethereum blockchain dropped by 99.95% post-merge.[4] Prior to this, Ethereum used around 72 terawatts of energy a year, with a carbon footprint around the same size as that of Switzerland.[5] This major drop will help to dampen some of the environmental concerns that have historically surrounded crypto projects, such as NFTs.

One thing the Merge won’t do is solve scalability and gas price challenges. It puts the infrastructure in place to do so. This means that future updates will be able to focus on the scalability challenges that cause high gas fees.

Interestingly, this may not be entirely bad news. The main reason the Merge didn’t reduce gas fees was because the Ethereum foundation has dropped the idea of introducing Sharding. This solution would have made it possible to run multiple smaller versions of the Ethereum blockchain simultaneously, enabling faster and cheaper transactions running in parallel. Instead, they have decided to focus on supporting community-led 2nd-layer, or roll-up, solutions. (We’ve covered those here).

These community-led solutions have proven effective at reducing the strain on the Ethereum blockchain proper, and the decision to support them has some interesting long-term implications for investors.

On that note, I think it’s time we jumped into the big question…

Let’s start with the obvious. I don’t believe we’re going to see any major spike in the price of Ethereum due to the Merge. It seems like it has already been priced in, and any adjustments in Ethereum’s price seem to be following broader crypto market trends.

Instead, investors should be looking at the long-term implication for what this means for Ethereum as a technology, and how it will impact the ecosystem of dApps that rely upon it.

Interestingly, the Merge does seem to have had a positive impact on the NFT space. Both the price, and volume, for many key NFTs have surged post-merge. OpenSea, a major NFT marketplace, saw sales jump by 70%, and the average price increased by 74%.

Aside from these short-term changes, it is helpful for investors to look at the long-term implication for what this means for Ethereum as a technology, and how it will impact the ecosystem of dApps that rely upon it.

The immediate benefit is that Proof of Stake offers all ETH holders the ability to earn passive income by staking their crypto. For most investors the best way to do this will be through a staking pool, however, it is important to note that you will be unable to withdraw your Ethereum until the 1.5 update, which does not currently have a projected date. You can find details on how to stake here.

For investors who want the best of both worlds, there is another option: liquid staking pools. These solutions allow investors to stake their ETH tokens, while issuing them with an ERC20 derivative token that represents it. These tokens can be traded on any exchange that supports them. This is a little like trading a contract for a physical asset, like oil, rather than trading a physical barrel. The most popular liquid staking solution is Lido, which provides all stakers with sETH (Synthetic Ether), which they can trade.[6]

Most investors will probably want to use a solution like Lido, as there are limited downsides to doing so, however most crypto exchanges also offer some form of Ethereum staking

While there are obvious benefits for individual investors, staking could have another impact on Ethereum as a whole.

The biggest change for Ethereum will be in terms of supply. Pre-merge, there were around 13,000 ETH minted per day in order to reward miners. With the need for a large mining infrastructure removed, it is possible to reward stakers with far less Ethereum, reducing the amount minted daily to approximately 1,600 ETH a day.[7]

Whenever a transaction is conducted on the Ethereum blockchain, a portion of ETH is destroyed or burned. With average gas prices of 16 gwei, at least 1,600 ETH will be burned daily. This will lead to significant deflationary pressure on Ethereum as a whole.

When combined with the fact that 11% of ETH is currently staked and rising, this could lead to a reduction in the amount of liquid Ethereum.[8] This in turn could cause the price of ETH to increase as investors look to take advantage of opportunities offered by the Merge.

For more risk-tolerant investors, now is the moment to take a look at the third-party scalability solutions being developed for Ethereum. In particular, you should keep an eye on 2nd-layer solutions. These solutions “bundle” transactions and process them off-chain, before validating their outcome on-chain in a single transaction.

This has the ability to make extremely complicated dApps, like video games, more viable, and mass use of layer-2 solutions would significantly reduce overall strain on the Ethereum blockchain, limiting the need for capacity increase.[9]

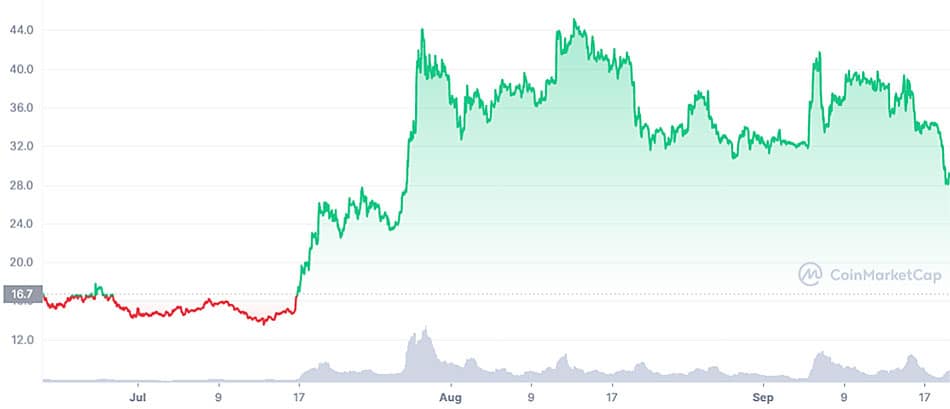

We’ve discussed zero-knowledge-roll-ups before, and I am still a big fan of Polygon (MATIC). It remains one of the most mature layer-2 solutions in the crypto market today and has a high adoption rate. This makes it relatively safe, at least by cryptocurrency standards, and a good bet for investors who are hoping that the dApps space will continue to grow as the crypto markets recover.

The Merge will also generate another major side effect: a large group of disgruntled miners. These are people who have invested thousands of dollars into equipment specifically designed to mine Ethereum and other cryptocurrencies.

Big miners, like an old favorite of mine HIVE Blockchain Technologies Ltd. (NASDAQ: HIVE / TSX-V: HIVE), are looking at diversifying their operations to other Proof of Work coins.[10] Many miners have moved to Ethereum Classic (ETC), and the token has largely seen its gains maintained. I don’t think we’ll see a significant upward movement in ETC’s price based on Ethereum mining in the near-future, and that those gains are already priced in.

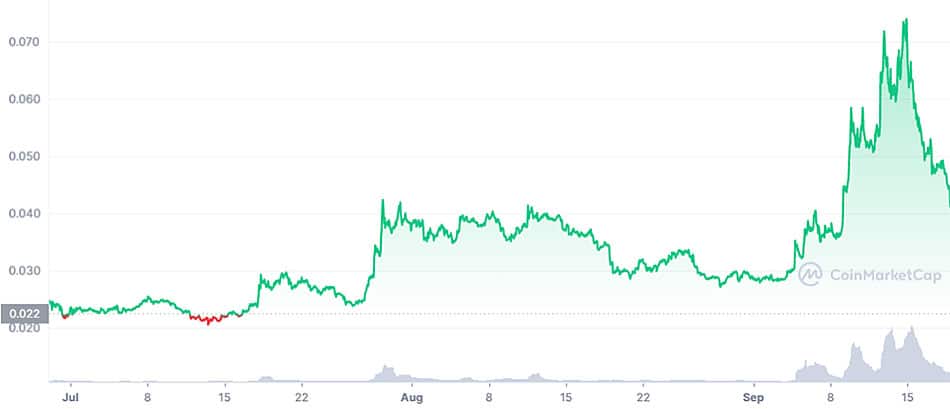

Another popular alternative with miners is Raven Coin (RVN). Its rise came a little closer to the Merge, and as a sub $0.10 token it is prone to sharp price shifts. However, there has been a marked increase in volume over the course of September.

There is a chance that Ravencoin will maintain the support of miners. It’s a fork of Bitcoin, and was designed in 2017 specifically to support the launch of new tokens. It’s a bit of an odd one because it did not conduct an initial coin offering (ICO), and the developers have not opted to take any payment.[11]

The project was set up to provide a more fully decentralized alternative to token issuance that doesn’t rely on smart contracts. Instead, Ravencoin is designed to facilitate the transfer of physical assets, like gold.

It’s a little early to tell whether Ravencoin will be successful, however, I do think the recent burst of media attention might give the project more traction than it has had in the past. I think it’s worth a small portion of your “fun money,” but I wouldn’t bet the house on it just yet.

If Ethereum’s shift to PoS is successful in the long term, then it may cause significant challenges for various Ethereum killers like Cardano (ADA). Specifically, this is because many of these projects have framed themselves in opposition to Ethereum’s perceived sluggishness and the inefficiency of their PoW protocols.

As things stand, Ethereum has a total market dominance of around 20% and gaining. The next biggest smart contracts platform is Binance Coin (BNB) which has 5%. Other platforms are currently barely making a dent, and even promising projects like ADA are sitting at below 1% market share.

Many of these tokens had positioned themselves as Ethereum Killers, and supporters had hoped that Ethereum’s slow progress might have worked to their advantage. Unfortunately, with the Merge successfully going through, we are likely to see Ethereum eating into the market share of smaller platforms.

I’m not selling my ADA today, but the moment when I do might be just on the horizon.

Aside from these specific insights, it is likely that the outcome of the Ethereum PoS experiment will have a significant impact on the overall trajectory of the cryptocurrency space as a whole. If Ethereum is able to successfully navigate the next 12 months, and make good on promises to roll out performance improving updates, then I think that the price will continue to grow.

If this thesis holds true, then we should also see a new renaissance in the dApps space, as lower costs make it possible to build more interesting tools. This could be the catalyst to make jaded investors like Mark Cuban find the space interesting again.[12]

With that said, I don’t think that Proof of Work is going away any time soon. It is unlikely that Bitcoin will ever make that transition, so we may see a proliferation of niche PoW-based coins like RVN. This could represent a good hedging opportunity for investors who want a piece of something a little different from what Ethereum is attempting to do.

One thing is for sure, the Merge has created many new opportunities for investors. Take your time to do some digging of your own, and decide if any of these opportunities are right for you.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds Ethereum, Bitcoin, and other crypto assets.

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.coindesk.com/tech/2022/09/15/the-ethereum-merge-is-done-did-it-work/

[2] https://ethereum.org/en/history/#frontier

[3] https://defillama.com/chain/Ethereum?currency=USD

[4] https://blog.ethereum.org/2021/05/18/country-power-no-more

[5]https://www.theguardian.com/technology/2022/aug/29/cryptocurrency-ethereum-plans-to-cut-carbon-emissions-by-99-per-cent-with-upgrade

[6] https://lido.fi/

[7] https://ethereum.org/en/upgrades/merge/issuance/

[8] https://cointelegraph.com/news/64-of-staked-eth-controlled-by-five-entities-nansen

[9] https://ethereum.org/en/layer-2/

[10]https://cointelegraph.com/news/hive-blockchain-explores-new-mineable-coins-ahead-of-ethereum-merge

[11] https://www.gemini.com/cryptopedia/what-is-ravencoin-mining-rvn-crypto

[12] https://www.thestreet.com/investing/cryptocurrency/billionaire-mark-cuban-says-crypto-is-missing-something

Do you feel like penny stocks and their potential of high returns have lost their allure? You’re not alone. Many investors, drawn in by tales of +1,000% gains, are beginning to overlook high-risk / high-return penny stocks in favor of the hottest new investment: cryptocurrency.

The problem is that many investors don’t know where to start. Buying cryptocurrency is complicated, and the technology backing it is often opaque, adding an additional risk factor that many investors may not be comfortable with. That may be about to change with the rollout of crypto ETFs and stocks operating within the crypto sector.

Longtime readers may be a little surprised that I’m even bothering to talk about crypto stocks. After all, I keep most of my cryptocurrency in wallets that I directly control. Why not just explain the best way to do that?

Well, many of you may own your own physical gold coins or bullion, a hedge or a hard asset. The advantage of this is that you own it and have it on hand should anything truly terrible happen. The disadvantage is that you are forced to store, protect, and care for it yourself. This means you need to take precautions to protect these hard assets from alternative risk factors, such as theft.

The same is true of cryptocurrency, but the risk factors are significantly higher. Your Bitcoin (BTC) or Ethereum (ETH) is not a physical asset, but a digital one, which means you need to take significant effort to secure an attack vector you may not fully understand.[1] To put this in context, around a whopping $10.5 billion worldwide has been lost due to Decentralized Finance (DeFi) fraud and theft in 2021.[2]

For individual investors who lack in-depth knowledge of best practices for cybersecurity (that would be most of us), this can create a level of risk that you can’t control, which puts many investors off investing directly in cryptocurrency.

In addition to these basic risks, effectively investing in cryptocurrency requires highly specialized technical knowledge. An investor needs to be able to understand tokenomics, cryptography, the target market of the cryptocurrency, how smart contracts work, and a plethora of other factors.[3]

All these considerations taken together can be daunting even to a seasoned equity investor. However, all of us understand the growth potential of the crypto sector and want exposure to it. Fortunately, the market is beginning to cater to investors who want exposure to the crypto space through more traditional means.

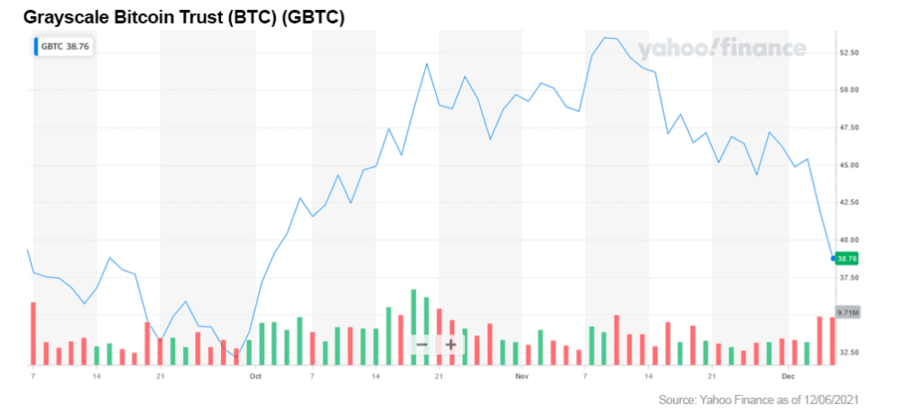

Exchange Traded Funds (ETFs) might not be sexy, but they are still one of the easiest ways to gain exposure to any asset — cryptocurrency included. These ETFs are even causing troubles for the most well-known crypto investment vehicle, the Grayscale Bitcoin Trust (OTC US: GBTC). For some time, this was the best way for investors to gain exposure to Bitcoin without having to open a cryptocurrency wallet.

However, returns for GBTC have not been as stellar as some had hoped. The fund is currently trending just 5% higher than the S&P 500. Additionally, it is facing significant pressure from more affordable ETFs that are able to take advantage of attractive fee structures and better ways of tracking BTC. The end result is that GBTC is now trading at a -15% discount compared to the value of its underlying assets.[4]

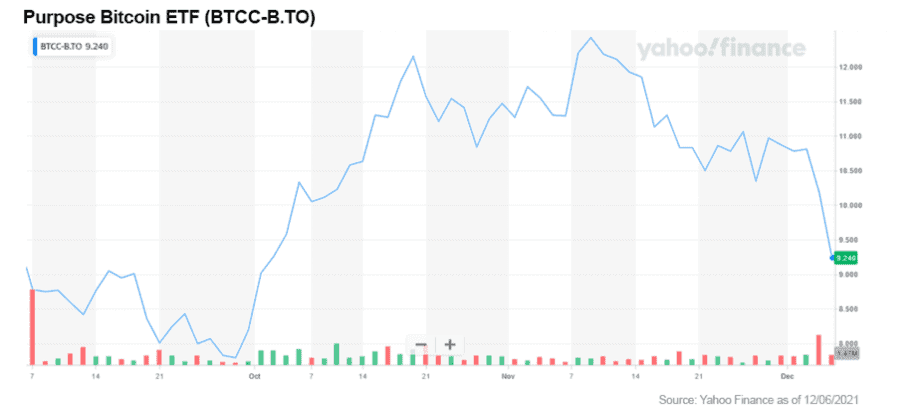

There are a few cryptocurrency ETFs available at the moment, however, the trend began with Canadian company Purpose back in February 2021.[5] The Purpose Bitcoin ETF (TSX: BTCC) has heavily outperformed the S&P 500, but there are other better choices available.

There are also newer ETFs on the block such as ProShares Trust — ProShares Bitcoin Strategy ETF (NYSE: BITO). However, these are a little younger and it’s tougher to say how they will perform over the long term. For me, the Purpose Bitcoin ETF (TSX: BTCC), or its Ethereum (ETH) based cousin, are still the safest bets for new equity investors looking for exposure to the crypto market.

Interestingly, in late November, Purpose also announced that it was creating a Bitcoin and Ethereum fund that pays a monthly yield.[6] The funds use a covered-call strategy to ensure that investors are able to gain a trickle of income — even if the price is trending negative.

This would enable investors to take advantage of upswings with the potential to significantly outperform traditional dividend yield investment vehicles.

Aside from ETFs, there are also three other key equity growth areas in the cryptocurrency space that I see right now...

In the cryptocurrency space, everyone requires one tool: an onramp. This onramp is typically called a stablecoin. These special coins are tied to a currency, for example the US dollar (USD), and provide a low-volatility way for investors to get fiat currency in and out of the cryptocurrency ecosystem.

The way they work is simple. Whenever an investor buys a stablecoin, they “lock” an equal amount of USD into that stablecoin’s ecosystem. If they want to convert it back to USD, they simply need to redeem their stablecoin, and they will receive their money back. So far, so simple.

The most popular stablecoin today is Tether (USDT). However, Tether’s days may soon be numbered. The stablecoin currency has a market cap of around $74,128,810,187. As Tether is supposed to be backed 1:1 by USD, this would make it the 42nd largest bank in the US, just below City National Bank.[7]

The problem is that it is unclear whether Tether actually has the ability to cover all these assets. If enough people were to try to redeem their Tether simultaneously, it could lead to a currency crisis as Tether attempts to hoover up assets in order to cover its withdrawals. This would have a knock-on effect on the currency markets.[8]

The source of this fear is the complete lack of transparency surrounding Tether’s holdings. It might have enough money to be a bank, but it certainly isn’t regulated like one. In fact, Tether is decidedly unregulated. The majority of Tether’s holdings are currently in offshore banks, where regulators can’t confirm or deny their statements about how much money is actually backing their token.

Somewhat worryingly, a report by Bloomberg revealed that the company’s accounts include billions of dollars in short-term loans to large Chinese companies, other crypto companies, and other high-risk investments.[9] If even some of these loans were to default, it could lead to Tether becoming worth less than one US dollar, which could have disastrous effects on the cryptocurrency and currency markets alike.

This fear has led to regulators placing stablecoins under increasing scrutiny. The most comprehensive legislation to date has come from the European Union in the form of two pieces of legislation: ‘Regulation on Markets in Crypto Assets' (MiCA) and the ‘Digital Operational Resilience Act' (DORA).[10] These regulations will require stablecoins to be regulated as financial service providers, and due to the Brussels Effect, are likely to be adopted globally.[11]

This will be a huge problem for Tether, which is unlikely to be able to comply, but it could be hugely beneficial for other stablecoin companies. There are few companies better placed to do this than Circle Internet Financial, the company behind USD Coin.

I have talked about Circle before here, and I still strongly feel that this stock is set to be a ‘strong performer.’ Circle is in the process of going public via the Special Purpose Acquisition Vehicle (SPAC) route via Concord Acquisition Corp. (NYSE: CND). The purpose of this deal is to enable Circle to become a fully regulated financial services provider and provide true transparency to its operations.

This would position Circle to displace Tether as the key onramp / offramp to the cryptocurrency space. This means that any potential investment into Concord Acquisition Corp. would be positioned to benefit from capital flowing into and out of the cryptocurrency sector without needing to own a single cryptocurrency.

Additionally, Circle has launched a $50 million venture capital fund, with a planned expansion into the Singapore market. This fund is designed to support Circle’s attempts to drive innovation in the digital finance space.

During the gold rush of the 19th century, the smartest money wasn’t out there prospecting — it was setting up shops to sell the tools and supplies people needed when they headed out west in hopes of hitting the jackpot. The same is true of the cryptocurrency world.

An obvious way to do this is to invest in the companies that are actually mining cryptocurrency. Crypto miners process transactions for many cryptocurrencies, notably Bitcoin, and are rewarded with cryptocurrency for doing so. By investing in these companies, investors gain access to not only the “tools” to produce more cryptocurrency, but also the value in the cryptocurrency that they are holding.

One of the most promising examples of a publicly trading mining company is HIVE Blockchain Technologies Ltd. (NASDAQ: HIVE / TSX-V: HIVE). HIVE was the first publicly traded crypto mining company, and it avoids environmental concerns by using 100% renewable energy in order to mine Bitcoin and Ethereum.

The company uses a HODL strategy that will be familiar to any crypto investor. (HODL is slang in the cryptocurrency community for holding a cryptocurrency rather than selling it.) In just November, the company announced that it has produced 218 BTC (approx. $12.2 million) and 2,334 ETH (approx. $10.8 million).[12]

The company’s most recent financials also show a company that is making a profit, and despite significant investments in its operations, still has around $4.7 million in liquid cash as of the six-month period ended September 30 2021.[13] This figure should now be even healthier following the closure of a bought-deal private placement financing to the tune of $115 million.[14]

There is one major risk factor for HIVE, and that is Ethereum’s transition to a Proof of Stake protocol. HIVE’s business relies heavily upon Ethereum, with around 48% of the tokens it generates coming from ETH. This means that there is a risk that a certain percentage of HIVE’s hardware could become obsolete.

There is one major and positive caveat here. It will be possible for HIVE to stake its already mined Ethereum in order to continue to generate profits. Additionally, it will be able to use its Ethereum mining hardware to target other coins that still use Proof of Work.

That being said, there is one more aspect of the cryptocurrency sector that all investors should be keeping an eye on. In my opinion, it’s the future of cryptocurrency: Decentralized Finance (DeFi).

Decentralized Finance (DeFi) uses the power of the blockchain to create faster, cheaper, and more accessible money without the need for 3rd party intervention.

DeFi is set to be the next big evolution in the world's financial systems.

There are many DeFi projects, however, many require you to buy their actual token to participate. The most promising projects are rarely listed on major cryptocurrency exchanges but are instead on decentralized exchanges (DEXs). These are difficult to navigate and hard to gain exposure to for traditional investors.

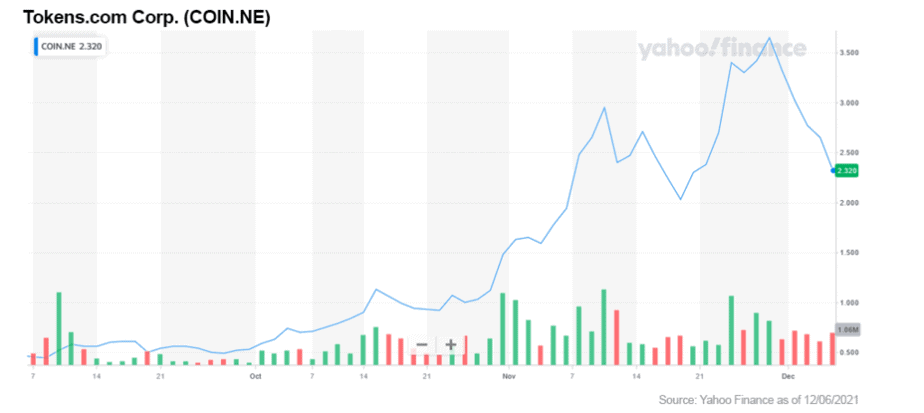

There are a few publicly traded stock options that investors can look at in the DeFi space. One that caught my eye as a risk capital option is Tokens.com Corp., trading in the US (OTCQB: SMURF) and in Canada (NEO: COIN). This company has positioned itself as benefiting from both DeFi and the metaverse. This is important as a true metaverse, built outside of Meta Platforms, Inc.’s (NASDAQ: FB) (formerly Facebook) closed garden, will likely require DeFi instruments in order to function properly.

The metaverse is being billed as the next evolution of the online world. It will enable humans to interact in virtual spaces through avatars. People can hold meetings, attend gigs, play games, and do just about anything else you can imagine. A key component of the metaverse is the ability to take digital objects from one “world” and transplant them to another.

Token.com Corp’s purpose is to provide better access to DeFi assets, specifically metaverse assets, through the public markets. The company invests in DeFi tokens and NFTs (non-fungible tokens), and then attempts to bring shareholder value by staking them. This process enables them to build a recurrent revenue stream.

To help combine DeFi and the metaverse, the company has majority ownership of a private company, Metaverse Group, which focuses upon buying digital “real estate” that is predicted to become valuable as the metaverse grows. This includes non-fungible token assets (NFTs) and space on virtual worlds. (For example, Roblox (NYSE: RBLX). This will then enable them to connect leading brands with already developed metaverse assets.

In addition, the company’s finances appear to be healthy. In its Q3 highlights, the company confirmed a net income of $4.1 million ($0.05 a share). The company earned staking rewards of around $719,051 during the 3 months ended September 30th.[15]

The Metaverse Group, a Tokens.com affiliated company, also recently closed the largest metaverse land acquisition in history.[16] In addition, on November 16, 2021, the company completed a private placement for a sizable CAD$16 million.[17]

There are some risk factors with Tokens.com Corp. — specifically its reliance on underlying crypto assets which are famously volatile. However, I believe that the combination of its newly acquired Metaverse Group asset and cryptocurrency is a big enough selling point to overcome these trends in the long term.

The key takeaway here is that there are plenty of great ways for investors to gain exposure to cryptocurrency without ever using a crypto exchange — decentralized or otherwise. These are all still high-risk, high-volatility investments, so investors should focus upon using their risk tolerance capital — not money destined for safer harbors.

In my view, cryptocurrency is still in its early days. There is room for explosive growth, particularly in the DeFi space, and even well-established cryptocurrencies like Bitcoin and Ethereum have plenty of space to grow.

Serious investors can benefit from gaining exposure to the space today, and for many of us, these ETF suggestions and recommended stocks are a much more convenient or early entry path to do so rather than seeking direct ownership.

That being said, the crypto space is high-risk, so always remember to do your own research and decide if these opportunities are right for you!

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds Ethereum, Bitcoin, and other crypto assets. He also holds shares in Concord Acquisition Corp. (NYSE: CND).

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] An attack vector is a route that a hacker can use to compromise your device

[2] https://www.cnbc.com/2021/11/19/over-10-billion-lost-to-defi-scams-and-thefts-in-2021.html

[3] Tokenomics is the study of the supply and demand characteristics of cryptocurrencies, for example hard caps, mining/distribution methodologies, or the practice of burning (destroying) fixed amounts of cryptocurrency to reduce supply

[4] https://www.ft.com/content/9fc7b034-7659-439f-a991-169662815883

[5]https://www.globenewswire.com/en/news-release/2021/02/18/2177751/0/en/Purpose-Investments-Launches-World-s-First-Bitcoin-ETF-Invested-Directly-in-the-Digital-Asset.html

[6] https://www.cbc.ca/news/business/bitcoin-ether-etf-purpose-1.6266783

[7] https://www.mx.com/moneysummit/biggest-banks-by-asset-size-united-states/

[8]https://www.bloomberg.com/news/features/2021-10-07/crypto-mystery-where-s-the-69-billion-backing-the-stablecoin-tether

[9]https://www.bloomberg.com/news/features/2021-10-07/crypto-mystery-where-s-the-69-billion-backing-the-stablecoin-tether

[10]https://www.consilium.europa.eu/en/press/press-releases/2021/11/24/digital-finance-package-council-reaches-agreement-on-mica-and-dora/

[11] The European Union is one of the world’s largest market, so organizations that wish to trade in that market will often adopt European standards, resulting in Brussels having an outsized effect on global regulations.

[12] https://finance.yahoo.com/news/retransmission-hive-presents-record-november-110000453.html

[13] https://www.hiveblockchain.com/medias/uploads/2021_09-30_HIVE_FS_FINAL.pdf

[14] https://finance.yahoo.com/news/hive-blockchain-announces-closing-115-214000903.html

[15] https://ca.finance.yahoo.com/news/tokens-com-announces-q3-2021-113000942.html

[16] https://ca.finance.yahoo.com/news/tokens-com-subsidiary-closes-largest-133800811.html

[17] https://ca.finance.yahoo.com/news/tokens-com-announces-closing-16-144200259.html