With the recent market correction taking some of the air out of Bitcoin’s bull run, it's a good moment to take a step back and take a look at the wider cryptocurrency market.

While it monopolizes mainstream media attention, Bitcoin (BTC) is far from the only opportunity out there, and many other cryptocurrencies, termed altcoins, offer potentially better gains.

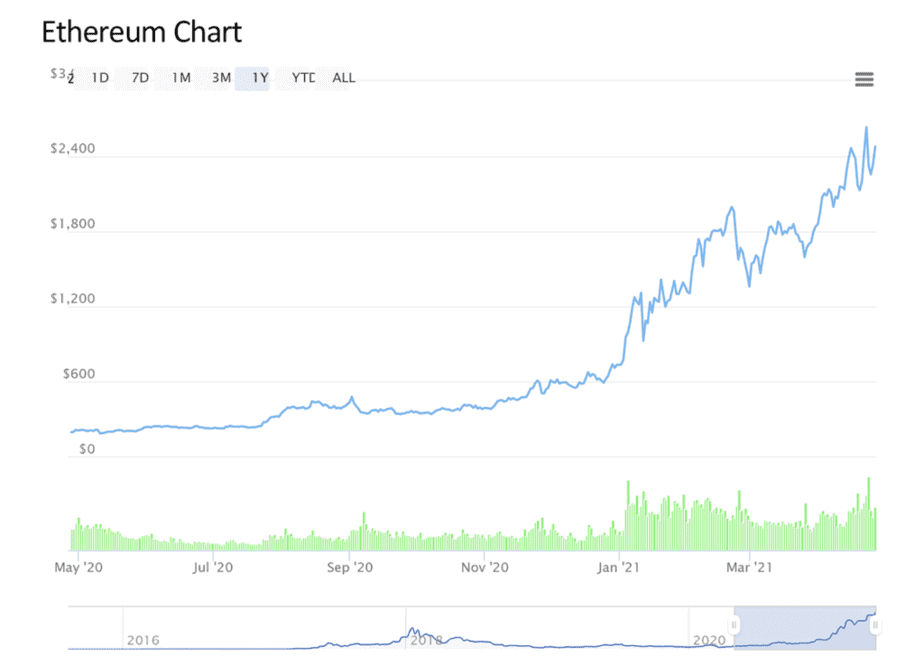

For example, in one year, the value of the second largest cryptocurrency, Ethereum (ETH), has grown by a staggering 1,200% compared to Bitcoin’s 702%.[1] The challenge for many newcomers to the crypto market is understanding what drives the value of an altcoin, compared to Bitcoin. To understand that let’s first take a look at how Bitcoin drives the cryptocurrency market.

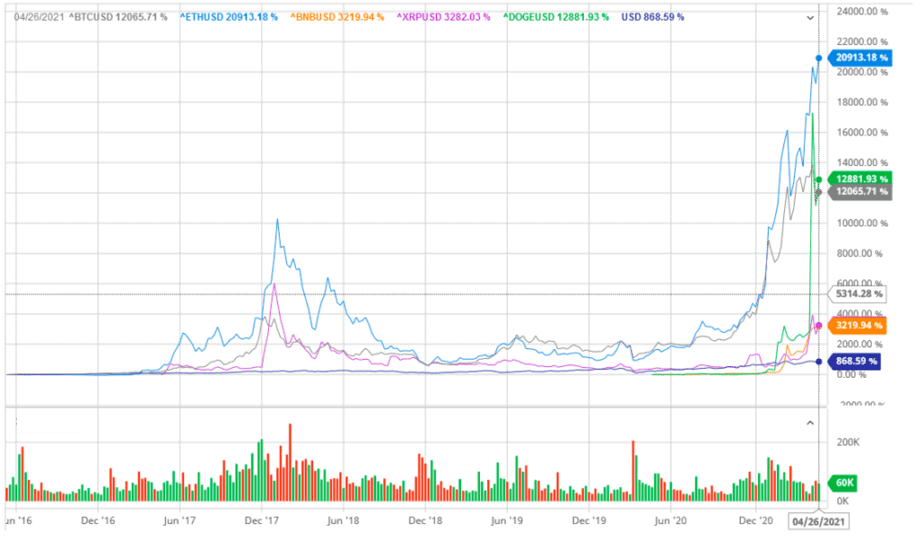

The easiest way to understand the cryptocurrency market is to view Bitcoin as a bellwether. When Bitcoin is bullish, so is the crypto market — when Bitcoin is bearish, most of the market will decrease with it. There are exceptions to this, but as the chart below demonstrates, this is typically how it works.

This chart is interesting because it demonstrates two key points. The first is that the market does tend to correlate strongly with Bitcoin. The second is that specific cryptocurrencies have been able to massively outperform Bitcoin during bull runs, and in some cases continue to maintain their price for some time after Bitcoin experiences a bearish period.

The reason for this is that not all cryptocurrencies are designed for the same purpose. Many of the earliest cryptocurrencies, notably Bitcoin (BTC) and Litecoin (LTC), were designed to act as digital gold and silver respectively. This meant that they were largely designed to function as digital stores of value.

As the cryptocurrency ecosystem grew, people began to experiment with blockchain technology. This has led to the proliferation of a number of specific kinds of cryptocurrencies. These are generally called alternative coins, or altcoins, and they serve a number of different purposes.

Some, such as Monero (XMR), are designed to build on perceived shortcomings of Bitcoin. Others, like Ethereum (ETH), were designed to be the foundation for the future infrastructure of a more decentralized internet.

In general, Bitcoin will continue to control the overall direction of the crypto sector, and remains a (comparatively) safe harbor asset. However, specific crypto projects often have significant value of their own, and can significantly outperform (or underperform!) the crypto market generally.

To understand how it works, let’s take a dive into a handful of high performing altcoin projects.

Ethereum (ETH) is the second largest cryptocurrency by market cap and with good reason. In 2019, 18%[3] of all open-source crypto developers use the Ethereum ecosystem, and there are over 3,000 decentralized apps (DApps) running on the Ethereum blockchain.[4] These apps rely on Smart Contracts, which form the basis of Ethereum's platform.

The explosive growth of Ethereum in 2021 has been driven not just by Bitcoin, but by the explosion of decentralized finance (DeFi) applications. These are dApps that replicate many of the same instruments used in the traditional finance world. They typically offer significantly higher interest rates than other options, and have attracted over $55.6 billion in locked capital.[6]

This rise hasn’t come without its teething problems. The sheer number of applications competing for space on Ethereum’s blockchain has led to rising transaction prices. The project is hoping to resolve this with the roll-out of Ethereum 2.0, which will introduce Proof of Stake (PoS) consensus methods, eliminating the need for miners.

Ethereum 2.0 will be the largest test for Ethereum within the next 12 months. This update is designed to make major changes to the way Ethereum works in order to allow the project to properly scale. We’ll be going more into this in a future article.

If the project is able to successfully complete important milestones of this roll-out, the cryptocurrency will likely continue to experience positive growth. If there are problems with the roll-out, there will be a window of opportunity for so-called “Ethereum killers” such as Cardano (ADA) or Binance Coin (BNB) to cannibalize its market share.

For as long as Ethereum has existed, there have been claims that other projects are about to take its crown. At the moment there are two main competitors to Ethereum: Cardano (ADA) and Binance Coin (BNB).

Both these projects are very different, and have been posed as potential alternatives to Ethereum if the project is unable to follow-through on its update roadmap.

Binance Coin (BNB) — A Centralized Smart Contract Provider

Binance Coin (BNB) is an oddity in the crypto world. It is a fully centralized smart contractor provider, designed to provide a more scalable alternative to Ethereum’s own smart contract platform.

Despite the fact that it is centralized, Binance Coin has performed extraordinarily well and grown by more than 3,787.6% in the past year.[8] This is significantly higher performance than both Ethereum and Bitcoin.

Despite the fact that the token confers no equity in Binance, BNB appears to be closely tied to the success of the Binance exchange. Binance’s decision to launch its own smart contract environment, the Binance Smart Chain, is one of the main reasons that BNB skyrocketed this year.

This could also pose a challenge for BNB. 80% of the token’s total supply is owned by the Binance team. This means that unlike Ethereum, there is a team, and owners, that regulators can come after. The SEC has already targeted Ripple (XRP) for operating an unregulated security offering unregulated securities, and this level of centralization could leave Binance open to similar problems, which is a major potential risk for BNB investors.[9]

Cardano (ADA) — A Proof of Stake Trailblazer

Like Binance Coin, Cardano (ADA) has experienced stellar growth. In the last year, ADA grew by 3,558.6%, just behind BNB.[10] Unlike BNB, Cardano is a heavily decentralized project and consists of early-stage Ethereum founders, scientists and academics.

The project was one of the earliest examples of a functional Proof of Stake blockchain. The Cardano project is still in its early stages but is currently undergoing a series of updates in order to implement smart contracts as part of its ecosystem.

The challenge for Cardano is that it is largely untested. Investors backing the project are basing it on the potential of the project, rather than past results. This means that it could share the same troubles as Ethereum if it fails to make good on its promises. This is likely why the project is looking to hire new developers ahead of its potential smart contract roll-out.

What Is the Outlook for Ethereum Killers?

Cryptocurrency is not necessarily a zero sum game. It is theoretically possible for ETH, BNB, ADA and others to coexist and thrive together. However, in the short term, a lot will depend upon the roll-out of Ethereum 2.0. Investors should treat ADA and BNB as a hedge against Ethereum, and invest accordingly.

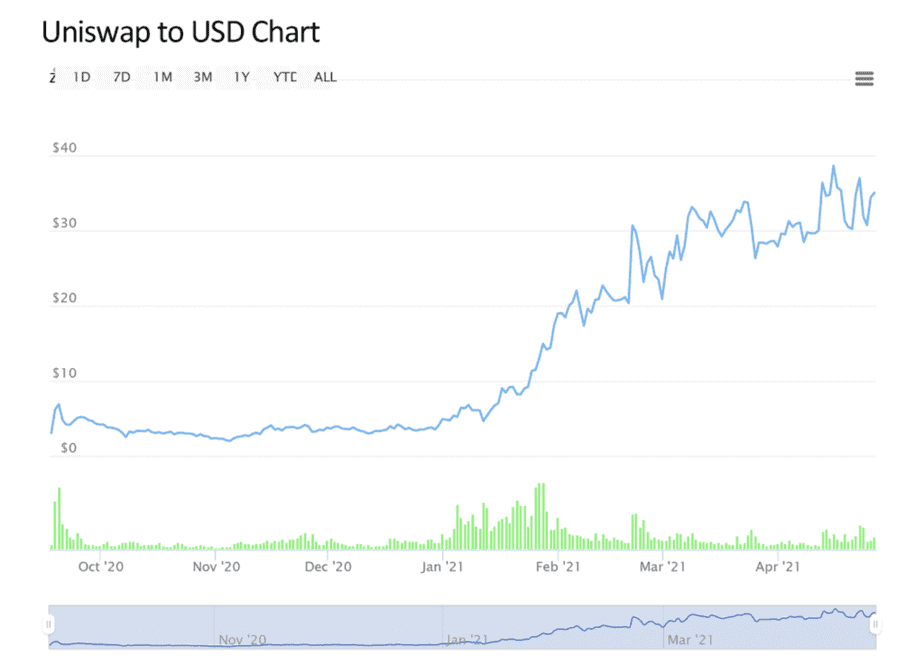

The growth of cryptocurrency smart contract platforms has been driven primarily by decentralized finance apps. There are thousands of different DeFi projects but one of the best known is the decentralized exchange, Uniswap (UNI). UNI is the youngest project here, but since its inception in September 2020, it has grown by 918%.[12] It is also the largest DeFi project by market cap at the moment.

The premise behind Uniswap is simple. It is designed to offer a decentralized alternative to exchanges like Binance or Coinbase, and makes it possible for users to trade any pair of cryptocurrency they want to. There is no Know Your Customer (KYC) check, and no login. All you need to do to trade is link your metamask wallet to Uniswap.

Uniswap is one of the most seamless trading experiences available and it has proven popular. In April 2021, the exchange saw over $10 billion in weekly volume pass through it.[14]

Unfortunately, UNI has become a victim of its own success. The project is based on Ethereum, which means that transaction fees have begun to rise, and it now faces stiff competition from the Binance Smart Chain based PancakeSwap (CAKE), which fulfills a similar function at lower fees.

What Is the Outlook for Uniswap?

Uniswap’s fate is tied closely to that of Ethereum. While the project is attempting to resolve some of the transaction fee problems itself with its own V3 update, this alone won’t be enough. For Uniswap (UNI) to become more scalable, it needs Ethereum to do well. This means that an investment in UNI is a bet on the success of Ethereum 2.0.

Now we get to an example of the problems with altcoins. Dogecoin (DOGE), named after that eponymous Doge meme, is one of the oldest members of the crypto community. It has no supply cap, very little that distinguishes it technically, and a dedicated community following. None of this seems to justify its 6th spot by market cap and astounding 15,843%(!!!) growth in the past 12 months.

Dogecoin has often been used as an entry-level cryptocurrency. It is simple to understand, its community is typically welcoming to newcomers, and it's affordable. In the past, I have used Dogecoin as a way to demonstrate how crypto wallets work. Aside from its role as a crypto gateway, the token has had little in the way of fundamentals to recommend it, until Elon Musk became involved.

Over the course of 2021, Elon Musk has repeatedly referenced Dogecoin in his tweets. The example above led to a 75% spike in the price of Dogecoin.[16] This spike was further sustained by users seeking to piggy-back onto the Gamestop (NYSE: GME) drama and replicate it with Dogecoin.

This is where the rise of Dogecoin is fundamentally different from the success of Ethereum or BNB. It isn’t driven by any unique technological features, or any features at all really. It is almost entirely the result of FOMO and hype.

What Is the Outlook for DOGE?

It is difficult to make any reasonable estimate for Dogecoin (DOGE) in the medium term. So long as Elon Musk continues to tweet about it, and the hype surrounding the coin continues to grow, we could well see continued growth. However, there will probably be a point in the near future when the satoshi (the smallest unit of the Bitcoin currency recorded on the blockchain) drops, and many DOGE holders are left with some very heavy bags.

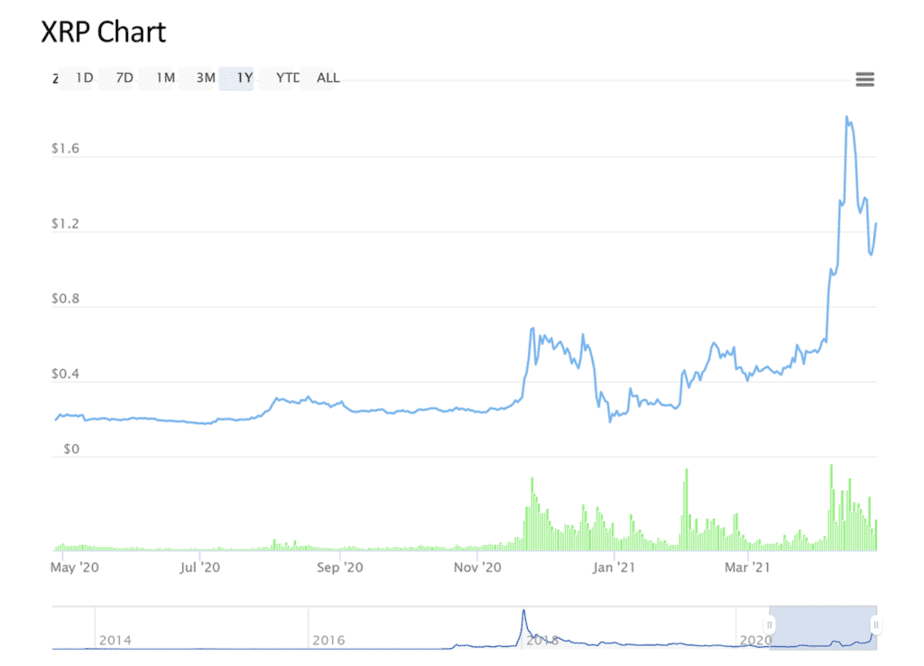

It is also important to remember that projects can underperform compared to Bitcoin, and we need look no further than Ripple (XRP). Ripple was an example of a semi-centralized project that consistently performed well. It was typically listed among the top five projects by market cap, and experienced consistent growth.

That was until December 22, 2020, when the Securities and Exchange Commission charged Ripple and two executives with conducting an unregistered securities offering to the tune of $1.3 billion.[17] This downturn has hampered Ripple’s growth, and the cryptocurrency has “just” grown by 666.5% in the last year.[18]

The token experienced a significant drop after the SEC’s announcement as investors panicked. This led to the usual series of dead cat bounces before the price of Ripple began to slowly stabilize.

Recently the company has had a number of major wins by its legal team which have helped to improve the price of XRP. The most recent example was the ruling by United States District Court Judge Sarah Netburn of the Southern District of New York. Neubern noted that the SEC’s request that Ripple executives provide their personal financial records was not “relevant or proportional to the needs of the case.”[19]

What’s the Outlook For Ripple (XRP)?

Ripple (XRP) is an excellent example of the impact external forces can have on a cryptocurrency project. If their legal team is able to keep racking up wins, then the price of XRP will slowly begin to recover. If, however, the SEC is able to prosecute its case, then investors should expect to see the price of XRP decline significantly.

Altcoins have the potential to provide investors with absolutely incredible returns. I will freely admit that the bulk of my cryptocurrency portfolio is in altcoins, not in Bitcoin. However this approach comes with significant risks compared to betting on Bitcoin.

Bitcoin’s most recent bull-run was largely powered by a vanguard of institutional capital. This significantly improved the staying power of BTC as an asset class, and has made it much “safer” to invest in the cryptocurrency. There are limited reports that institutional capital is moving into larger altcoins, like Ethereum, but the volume is nowhere near as significant as that which has flowed into Bitcoin.

This means that investments into altcoin projects, even mature ones, are largely speculative in nature.This is particularly true when looking at easily manipulated assets like Dogecoin. These investments can be easily lost by technological or regulatory changes, and should be considered very high risk.

That being said, in my opinion (and for my money), altcoins still represent one of the best opportunities on offer for risk-averse investors today. I strongly encourage you to do your due diligence, look at some of the larger altcoin projects, and consider whether it is right for you.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds Ethereum, Bitcoin, Uniswap and other crypto assets.

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.coingecko.com

[2] https://www.barchart.com/crypto/quotes/%5EBTCUSD/interactive-chart

[3] https://consensys.net/blog/developers/ethereum-has-4x-more-developers-than-any-other-crypto-ecosystem/

[4] https://finance.yahoo.com/news/crypto-projects-based-ethereum-145710336.html

[5] Chart via coinmarketcap.com

[6] https://defipulse.com/

[7] Chart via coinmarketcap.com

[8] https://www.coingecko.com/en/coins/binance-coin

[9] https://www.sec.gov/news/press-release/2020-338

[10] https://www.coingecko.com/en/coins/cardano

[11] Screengrab via Coinmarketcap.com

[12] https://www.coingecko.com/en/coins/uniswap

[13] Chart via coinmarketcap.com

[14] https://decrypt.co/68562/uniswap-hits-record-10-billion-weekly-trading-volume

[15] Chart via coinmarketcap.com

[16] https://www.ndtv.com/offbeat/elon-musk-shares-cryptic-tweet-on-dogecoin-read-details-2414177

[17] https://www.sec.gov/news/press-release/2020-338

[18] https://www.coingecko.com/en/coins/xrp

[19] https://www.courtlistener.com/recap/gov.uscourts.nysd.551082/gov.uscourts.nysd.551082.103.0.pdf