When you think of making money, you probably think of people day trading crypto or getting lucky and timing the market. In reality, there are a large number of ways to make money in cryptocurrency, especially since the proliferation of Decentralized Finance (DeFi) apps and Proof of Stake (PoS) consensus methods. These have opened up unique ways for crypto investors to make money — with some risks.

Decentralized Finance, more commonly abbreviated as DeFi, is a special class of cryptocurrency. DeFi tokens are generally based on another blockchain, such as Ethereum (ETH) or Binance Smart Chain (BSC), and mimic the services offered by traditional centralized institutions.

These apps leverage smart contracts, which are lines of code designed to execute when specific parameters are met. This makes it possible to exchange tokens, receive and give out loans, and even offer insurance. All of this can be done without requiring the oversight of a third party. If one participant in a transaction is unable to follow through on their end, the transaction is considered void, and it is not recorded on the blockchain.

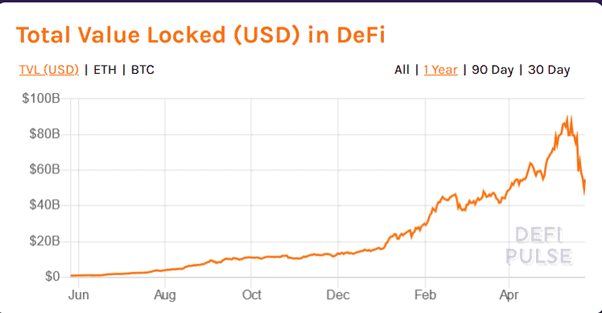

This concept has proven to be enormously popular. Just 12 months ago, there was less than US$1 billion locked into the DeFi ecosystem. At its peak, just prior to the crash in late May 2021, there was almost US$90 billion. This incredible growth was driven by a proliferation of DeFi apps that offered users a way to make money without being forced to liquidate their cryptocurrency.

There are a lot of different DeFi products, touching everything from real estate to insurance, but there are two main varieties that are useful tools for crypto traders to make money:

One of the big drivers of DeFi growth in 2021 is the proliferation of cryptocurrency lending platforms. These platforms offer users the opportunity to stake a portion of their cryptocurrency in order to offer liquidity to a lending platform. They are unable to use this cryptocurrency so long as it is staked, but are given outsized interest rates, sometimes as high as 30% APR.[2]

DeFi platforms do not typically conduct ‘Know Your Customer’ (KYC) or other due diligence requirements that burden traditional financial providers. This is an incredible change as it broadens access to loans, particularly for individuals in troublesome juridictions. It also means that there is still a large demand, and competition for liquidity providers between platforms is fierce, hence the large interest rates.

A common use of DeFi loans is flash loans. These are hyper-short-term loans where individuals borrow money to arbitrage differences between exchanges. In order for the transaction to take place, the borrowers need to be able to pay the loan back within a single “block.” If they are unable to make enough profit to cover the loan and interest, the transaction doesn’t take place and the money is returned without being entered on the blockchain.

There are a large number of crypto lending platforms but the most popular are Maker, AAVE, and Compound. All of these also offer crypto savings services, which are lower-risk versions of their crypto lending offerings.

Crypto lending platforms are broadly considered safe, but there are longstanding concerns that the practice of rate farming (offering high interest rates to attract lenders) is unsustainable.

In many ways this is similar to the used car market where customers with questionable financial ratings are able to secure a loan at a much higher rate, even if they cannot realistically pay it off. In both cases, a sudden change in the loan conditions could lead to a flash crash, significantly damaging the market.

Aside from the risks of a crash, there are more specific risks concerning the smart contracts that power the lending platform. For example, in May 2021, hackers exploited a vulnerability in the Pancake Bunny (BUNNY) lending platform in order to steal $45 million in a matter of seconds.[3] Users without their own insurance will most-likely be unable to recover lost funds.

Decentralized Exchanges are peer-to-peer alternatives to centralized exchanges. These are popular because they combine the ease-of-use and high liquidity of something like Coinbase, with the flexibility of more traditional P2P exchanges.

These work by allowing any user to specify a pair of tokens they would like to buy, for example Ethereum (ETH) and Dogecoin (DOGE). Typically, any user is able to request a pair. Once the pair has been created, large numbers of users can lock their assets together into a liquidity pool and act as a group of many small market makers.

If someone wants to buy Dogecoin or Ethereum, then these users, or market makers, will provide the liquidity in order to do so. In exchange for providing liquidity, these users are typically given a commission in the form of a percentage of all transactions that go through their liquidity pool.

Decentralized exchanges are inherently unregulated. This means that there is a much higher risk that a user will inadvertently purchase a fake copycat cryptocurrency. For example, Uniswap (UNI) has had a long-standing problem with fake cryptocurrencies that use very similar ticker symbols to the legitimate cryptocurrency.[4]

Additionally, at time of writing, most DeXs do not conduct KYC (Know Your Customer). This puts them in direct violation of Financial Crimes Enforcement Network (FinCEN) guidelines.[5] This means that there is a risk that cryptocurrency coming from a DeX may not be possible to use on a centralized exchange. There are some efforts by the cryptocurrency community to solve this problem, but it will take time.

Additionally, many DeX’s are unsuitable for users trading small amounts due to large transaction fees, particularly for Ethereum-based projects. Even a small transaction can cost as much as $30 due to high demand and network congestion.[6]

There are a large number of DeXs but the most popular by volume are the Ethereum-based Uniswap (UNI) and the BSC-based PancakeSwap (CAKE). Many exchanges are functionally similar but most traders will probably be happy with either of these two exchanges.

While Proof of Stake (PoS) isn’t technically a DeFi product, it does share some similarities in how it operates. All cryptocurrencies require a consensus method in order to function. Traditionally this has been done using a process called Proof of Work (PoW), more commonly known as cryptocurrency mining. This involves computers competing to find the solution to complicated problems.

When one computer finds the solution, it earns the right to process a “block” of transactions and receives some cryptocurrency as a reward. This prevents the network from being flooded with fraudulent transactions, and makes it difficult for malevolent operators to compromise the blockchain.

The problem with this approach is that it is slow, and environmentally damaging to the point that Elon Musk announced that Tesla was no longer accepting Bitcoin.[7] PoW is also the source behind Ethereum's scalability problems, which has prompted a shift towards Proof of Stake.

Instead of using computers to process transactions, PoS relies on users “locking” a portion of their cryptocurrency in order to process transactions. Typically this involves a handful of “nodes” that users are able to delegate their cryptocurrency to. In exchange for locking their cryptocurrency, users are able to earn between 6.5

This helps to reduce the amount of selling pressure on a cryptocurrency, while also providing a less energy-intensive way to process blocks.

PoS is generally considered to be low risk, but it will vary from token to token. The primary risk typically comes from the choice of validator node when users are staking cryptocurrency. If the node acts poorly, there is a risk that the user will lose some or all of their stake.

Most projects have fail-safes to limit a user’s risk, but there have been a number of high profile incidents where staking pools have been breached. In May 2021, hackers were able to steal over $30 million in BNB from a staking pool.[8]

There is also a risk that by staking your Ethereum, you will open yourself up to taxation. The rules surrounding cryptocurrency are typically poorly defined and fail to take into account the dilutive nature of staking.[9] Make sure you consult your accountant or financial advisor before staking any cryptocurrency to avoid nasty surprises come tax time.

This will depend on what tokens you are investing in. In order to stake a token, you need to own some of it. The most common tokens to stake at the moment are Ethereum (ETH) and Cardano (ADA), but there are other projects that use Proof of Stake consensus methods. Keep in mind that any cryptocurrency you stake will be locked up for a certain amount of time, so you may be vulnerable to flash-crashes.

The problem with all of these solutions is that they are new, poorly regulated, and generally high-risk — even by cryptocurrency standards. Fortunately, there are a number of similar solutions offered by regulated exchanges, and other providers.

Regulated cryptocurrency exchanges, for example Coinbase, which is fully regulated in the United States and as a money services business with FinCEN,[10] offer staking services for both DeFi projects and cryptocurrencies using PoS. This is lower risk on the part of the investor, however, it also means that the interest rates on offer are lower—typically between 2–6% APY. In exchange for this cost, investors are able to access a technologically simpler, and regulatory compliant, service.

The risk here is similar to the risks of using an exchange generally. Most experienced cryptocurrency investors prefer to hold their assets in cold storage. In order to take advantage of staking on an exchange, you will need to keep your cryptocurrency in their wallets. This means that your cryptocurrency is at risk if the exchange is compromised in a hack—something that wouldn’t happen if you had stored it offline. However, many exchanges have an insurance policy which may provide some protection.

Another alternative is cryptocurrency-backed collateral loans. This involves providing cryptocurrency as collateral for a loan in fiat or a stablecoin. The collateral will typically need to be larger than the amount you need in fiat in order to account for any price swings. Borrowers need to pay the fiat back with interest.

Collateralized loans are popular because they provide a way for investors to access their crypto capital without liquidating it. This can then be used to purchase a property, or engage in another kind of investing. Additionally, when handled correctly, they are typically not considered a taxable event.[11] However, they can be problematic in the case of extreme market swings, which could result in the lender liquidating part of your investment in order to protect themselves.

Anybody considering taking advantage of these opportunities needs to remember that there is risk. Before trying to leverage your crypto holdings to make more money you should ensure that you do your due diligence on your platform of choice. You should ask yourself the following questions:

If anything about the platform seems wrong to you, it is almost certainly not worth the risk. Cryptocurrency scams are commonplace, and since October 2021, there have been more than $80 million in reported losses.[12] This is why it’s critical you conduct your due diligence before sending your hard earned cryptocurrency.

You also need to make sure that you fully understand any regulatory risks. Cryptocurrency regulations are constantly evolving, and you may be inadvertently opening yourself up to a taxable event by using these platforms. If you are not certain how this will affect you, it is best to engage a specialist in cryptocurrency finances in order to avoid an unexpected expense come tax time.

Assuming that you understand both the regulatory risk and the technology, there are very few compelling reasons not to try to make your cryptocurrency investment work for you. These tools can be particularly useful for investors looking to hold long term, and can help you weather any bear markets.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds Ethereum, Bitcoin, Uniswap and other crypto assets.

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://defipulse.com/

[2] https://defirate.com/lend/

[3] https://www.cryptoninjas.net/2021/05/20/45m-gone-in-a-flash-loan-attack-how-scammers-exploited-vulnerabilities-in-pancake-bunnys-smart-contract-code/

[4] https://personal-financial.com/2020/09/04/decentralized-finance-defi-uniswap-is-crawling-with-fake-tokens-cryptocurrencies/

[5] https://www.jdsupra.com/legalnews/the-anti-money-laundering-act-and-3117511/

[6] https://crypto.com/defi/dashboard/gas-fees

[7] https://www.bbc.com/news/business-57096305

[8] https://coinquora.com/hackers-steal-30-million-from-staking-pool-using-bnb/

[9] https://blockchainassoc.medium.com/why-staking-rewards-need-better-tax-treatment-81ea4d542ebd

[10] https://www.coinbase.com/legal/faq

[11] https://www.forbes.com/sites/shehanchandrasekera/2021/03/17/how-are-crypto-loans-taxed/?sh=68103a8f135e

[12] https://www.ftc.gov/news-events/blogs/data-spotlight/2021/05/cryptocurrency-buzz-drives-record-investment-scam-losses#end2