Warren Buffett doesn’t seem like a man who would have regrets. He’s considered the greatest investor alive, the fourth richest person in the world, and is revered for his wisdom as much as his success.

But sometimes Buffett regrets his success…

Everyone wants to invest like Buffett. But the truth is even Buffett can’t invest like Buffett anymore.

Like the adolescent whose growth spurt means he can’t fit into his favorite ripped jeans anymore, the sheer size of Buffett’s investment fund means he can no longer fit into the kind of investments that made him rich in the first place.

When he first began his investing career in the 1950s, Buffett regularly pulled in gains of 50% or more.[1]

He did it by buying undiscovered companies that are small and nimble enough to grow fast without large capital demands.

And he likes to get them at bargain prices.

Those are the early investments that built his fortune and made him a legend.

If he could still buy small cap (or microcap) companies today, he says, “I could make you 50% a year.”[2]

But running a fund of $720 billion means he can invest only in the largest companies, which is why he owns stakes in Apple (NASDAQ: AAPL), Bank of America (NYSE: BAC), Coca-Cola (NYSE: KO), and other giants.

That means he has to be satisfied with beating the market by only several points at best in most years.

Even if he bought controlling interest in a small cap company, it wouldn’t be enough to budge the performance of a fund the size of Buffett’s Berkshire Hathaway (NYSE: BRK-A).

Fortunately or unfortunately, most investors don’t have the problem of having too much money, and that means there are countless opportunities to find profits that would make the young Warren Buffett proud.

“There are thousands of times as many options if you’re investing $10,000 rather than $100 billion,” he says.[3]

And as it turns out, now is a perfect time to buy Buffett-style stocks.

You can’t argue against the facts, and the fact is that historically, small cap stocks are the best performing asset class.

When Paul Merriman, founder of The Merriman Financial Education Foundation, analyzed data from 1928 to 2014, he found that small cap value stocks had a compound annual return of 13.6%, compared with 9.8% for the S&P 500.

That means an investment of $100 would have grown to more than $6.5 million in small caps – compared with just under $350,000 for the larger-cap S&P stocks.[4]

In more recent decades the outperformance of small caps has only intensified. A review of data since 1966 shows that large caps returned 14.4% annually compared to 28.4% for small caps – almost exactly double.[5]

So it’s no wonder Warren Buffett focused on small companies when building his fortune.

And right now small caps are undervalued relative to their larger-cap peers.

When the stock market plummeted after reaching its all-time high in August of 2018, all size companies were affected.

But since the market hit its low in December of 2018, small caps have lagged larger-caps in recovering.

That is likely because money that was taken out of stocks that could be hurt by the ongoing trade wars has come rushing back in since trade negotiations and trade deals have shown some progress.

Small caps, though, are seldom international in nature, and so they have not benefited.

While the Dow is up 6.64% from its August 2018 high, the Russell 2000 is still down 5.35% – which means small caps are a great bargain right now.

Research by the $13 billion Royce Fund shows that it is extremely rare for large caps to be positive while small caps are negative over any 12-month period.[6]

It has happened only 8% of the time in the last 20 years – only 19 out of the last 229 periods since 1999.

What’s even more interesting is that in more than 90% of the cases when that has happened, small caps outperformed large caps in the following 12 months by an average of more than 400 basis points.

If that pattern holds true, it means small caps could likely rocket in value over the next 12 months.

For big profit potential at bargain prices, it’s hard to beat these three small cap value stocks.

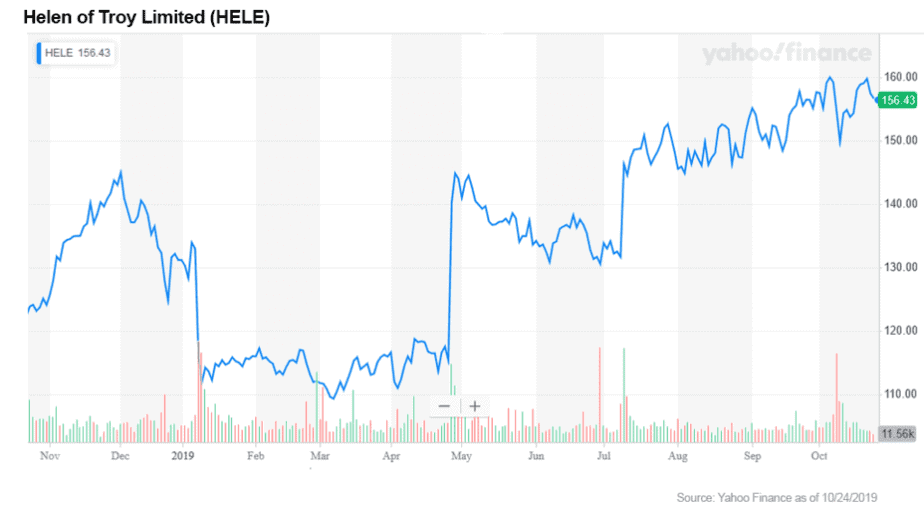

Helen of Troy (NASDAQ: HELE)

Warren Buffett likes companies that lead their categories, and that’s what Helen of Troy delivers.

The company had its origins as a beauty supply store in El Paso, Texas. The store owner’s son, Gerald Rubin, found he had a knack for sales, and after graduating from the University of Texas with a science degree, he came back to work in the store.[7]

Rubin’s break came when he pitched the Vidal Sassoon Company to put its brand on his products. It was a bold move for a tiny $6 million company to go up against Clairol and Gillette to convince Sassoon to take the deal.

But take it he did, and within several years Helen of Troy’s sales jumped to $68 million.[8]

Today the $3.9 billion global housewares and personal care products company brings in revenue of $1.6 billion per year with market-leading brands like Braun, Pur, OXO, Honeywell, and Revlon, to name a few.

What ties all those brands together is an emphasis on quality at a high price point.

The company’s emphasis on excellence extends beyond its products to its operations, as well. HELE has embraced e-commerce, and 19% of all sales are now from online sources, growing at an annualized rate of 43%.[9]

HELE increased its guidance on 2020 sales and earnings, highlighting its initiation of Phase Two of a multi-year plan to continue investment in leadership brands and to expand and acquire internationally.[10]

Newly imposed China tariffs have led to increased prices to offset the margin impact of their increased costs, and it is still unclear how those higher prices will impact sales.[11]

The company is well-insulated against potential price shocks, though. Revenue is up nearly 20% over the past five years. Income is up just over 30%. And with a nod to investor value, EPS has grown a whopping 79% in the same period.

Compared to its consumer staples industry P/E average of 30.2,[12] or the household products sector P/E of 37,[13] Helen of Troy’s P/E is a value investor’s dream at 20.2.[14]

The P/E ratio is a measure of a company’s share price relative to its earnings per share. If a company’s P/E is high compared to its industry or peers, it can mean the stock is overvalued.

On the other hand, if a company’s P/E is low, it can mean the stock is a bargain. And that’s exactly what you’re seeing with Helen of Troy – a bargain at just over half the price of its household products industry peers.

HELE stock is underfollowed and undervalued by the investment community. But with numbers like these, it won’t be for long.

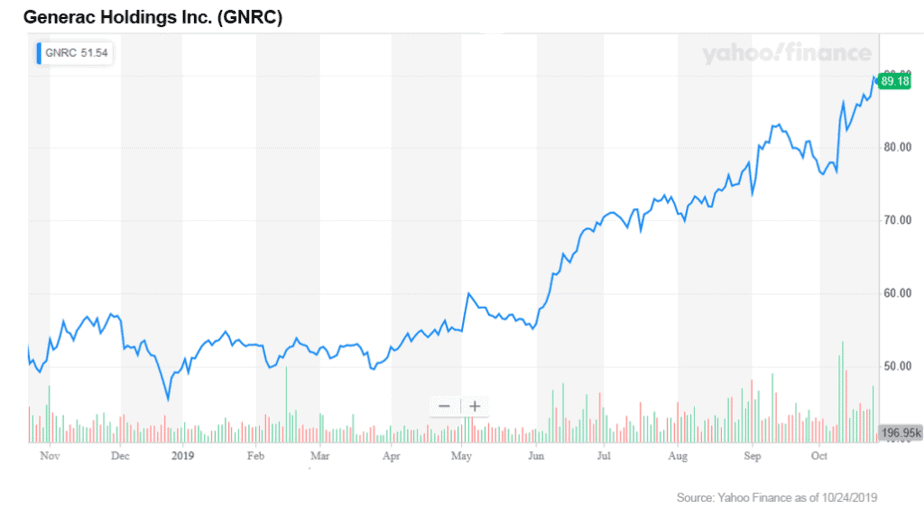

Generac Holdings (NYSE: GNRC)

Generac Holdings might not be a household name, but it is North America’s leading producer of portable power generators, outselling heavyweights like Honda, Yamaha, Hyundai, and Briggs and Stratton here as well as in other areas of the globe.

While sales in all regions are growing, the US portable generator market is set to explode by nearly 50% in just the next four years.[15]

With Generac controlling more than 75% of the North American market for home generators,[16] and penetration still at only 5% of the market, that gives the company a lot of potential upside.[17]

Much of the market growth is due to severe weather events and an aging power grid.

Since 2000 there has been a disturbing 454% increase in power grid outages in the US, with 80% of all outages caused by weather.[18][19]

Generac sells its products in more than 150 countries, and has manufacturing facilities in the US, Italy, Spain, Germany, Poland, Brazil, Mexico and China.

Nor are power generators their only products. Generac’s product line includes a wide range of “chore” products – power washers, brush mowers and trimmers, mobile lighting towers, and portable pumps and heaters.

In 2018 Generac became the first company to offer home standby generators with Wi-Fi capability, a feature that is increasingly important in our connected world.

The company is also committing major resources to clean energy products. In March of 2019 Generac bought Neurio, a leading maker of metering technology to optimize energy use.

The following month Generac bought Pika Energy, a leading manufacturer of smart storage solutions and smart batteries.

Sales for 2018 topped $2 billion, and are expected to increase by close to $115 million to $2.14 billion in 2019. Sales have grown at a brisk compounded rate of 10% per year since the company’s 2010 IPO.

Generac is the closest thing to a pure play in the booming portable power generation market that you’ll find. With the company’s market dominance and the increasing number of severe weather events today, big growth is all but guaranteed.

Merrill Lynch analyst Ross Gilardi says Generac provides the “best growth outlook in US machinery by a country mile.”[20]

And investment strategist Bryan Bottarelli wrote on October 14 that “Generac Holdings has been one of the steadiest names you’ll find on Wall Street right now.”[21]

GNRC isn’t cheap. The stock had a big run-up with the recent massive power shut-down in California, but has since pulled back part of the way.

It will no doubt enjoy another jump up when the next severe weather event happens. Before that occurs, channel your inner Warren Buffett and consider whether an investment in Generac Holdings makes sense for you.

Ulta Beauty (NASDAQ: ULTA)

Warren Buffett famously once said, "Whether socks or stocks, I like buying quality merchandise when it is marked down."

Which is why now is the perfect time to look at Ulta Beauty.

Ulta is one of the nation’s premiere beauty retailers, offering everything from cosmetic and skincare products to salon hair and makeup services.

And while many analysts are reporting on the “retail apocalypse,” Ulta and its rival Sephora are doing just fine, thank you very much.

Ulta has long been a Wall Street favorite, with shares up more than 2,500% since the financial crisis through this past August.

But when the company posted a rare quarterly earnings miss and slashed its targets, the fickle Wall Street crowd bailed ship.

Shares plunged a whopping 30%, making the still-strong company the buy of the decade.

Ulta’s total sales have more than doubled since 2014, which is so good that it is almost unbelievable for a $14.6 billion company.

Surprisingly, even with Ulta’s downward-revised guidance, analysts still have earnings per share rising from the current $11.80 to over $20 by 2024.[22]

ULTA currently trades for just 20.6 times this year’s earnings, which makes the stock as cheap as it’s been since the aftermath of the financial crisis in 2009.

With five-year and ten-year average P/E ratios averaging about 29, ULTA is trading at just half that value.[23]

And with next year’s EPS estimate of $13.47, should the company get to 28 times earnings, shares would trade 50% higher than where they are today.[24]

A recent consumer survey by Cowen & Company found that of the “Big Three” beauty retailers – Ulta, Sephora, and Amazon – Ulta is not only the consumer preference, it is pulling away from the other two.[25]

Ulta has initiated a newly expanded rewards and credit card program that is actually building loyalty, with a whopping 38.1 million members so far.

The company’s mobile app efficiently supports customers in the different ways they choose to shop, and that is helping to increase Ulta’s e-commerce sales, which grew 25% in Q4 2018.

Total sales are expected to rise about 10%, and the company is opening new stores at a rapid pace, adding to their 1,200-location map.

For all these reasons, ULTA is an exceptional company trading now at an exceptional price.

Warren Buffett focuses on value and business quality.

He likes companies in industries that are easy to understand and that are not capital-intensive or require a lot of funding up front.

He looks for a competitive edge and market leadership that will provide consistent results.

That’s what you get in all three of the above profiled companies, Helen of Troy (NASDAQ: HELE), Generac Holdings (NYSE: GNRC), and Ulta Beauty (NASDAQ: ULTA).

He also likes the companies he invests in to be relatively small. Those are the kind of companies that have built his fortune.

But he’s a victim of his own success, growing his investment fund so large that he can no longer invest in the small companies he loves.

But you can… You can invest like the young Warren Buffett whose fortune would be made in small, well-run companies at a value price.

In the immortal words of Buffett himself, “there are thousands of times as many options if you're investing $10,000 rather than $100 billion.”

These are just three choices. And remember: Before you invest in any stock, be sure to do your own due diligence.

Cynthia Berryman, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://boards.fool.com/buffettjayhawk-qa-22736469.aspx?sort=whole

[2] http://valuevista.blogspot.com/2007/06/warren-buffett-50-returns.html

[3] http://valuevista.blogspot.com/2007/06/warren-buffett-50-returns.html

[4] https://paulmerriman.com/buy-best-performing-stock-sector-87-years/

[5] https://www.thestreet.com/markets/it-may-be-time-to-show-some-love-to-the-russell-2000-14996447

[6] https://www.roycefunds.com/insights/small-cap-interview

[7] https://www.jpost.com/Business/Business-Features/Your-business-A-Jewish-boy-builds-an-empire-in-a-faraway-city-341006

[8] https://www.inc.com/magazine/19881201/6322.html

[9] http://s22.q4cdn.com/745654544/files/doc_presentations/2019/07/19/Helen-of-Troy-Investor-Presentation-July-2019-Final.pdf

[10] https://www.eagleasset.com/-/media/rj/affiliate-sites/eagle/insights-and-commentary/quarterly-commentary/eam_insight_smidcap.pdf?la=en

[11] http://www.congressasset.com/assets/small-cap-growth-commentary-1q19.pdf

[12]https://eresearch.fidelity.com/eresearch/markets_sectors/sectors/sectors_in_market.jhtml?tab=learn§or=30

[13] http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/pedata.html

[14]https://eresearch.fidelity.com/eresearch/markets_sectors/sectors/sectors_in_market.jhtml?tab=learn§or=30

[15] https://www.power-eng.com/2019/02/14/u-s-portable-gensets-markets-predicted-to-grow-to-819m-by-2024/#gref

[16] https://www.barrons.com/articles/generac-stock-generators-pacific-gas-and-electric-california-power-51570647392

[17] http://www.annualreports.com/HostedData/AnnualReports/PDF/NYSE_GNRC_2018.pdf

[18] https://www.generacpowerproducts.com/pages/content/why-home-backup

[19] https://www.ourenergypolicy.org/wp-content/uploads/2014/04/climate-central.pdf

[20] https://www.foxbusiness.com/industrials/generac-stock-surges-as-it-helps-california-deal-with-power-outages

[21] https://mtatradeoftheday.com/how-to-play-the-washington-risk-with-generac-holdings/

[22] https://seekingalpha.com/article/4296506-ultas-exceptional-value

[23] https://seekingalpha.com/article/4296506-ultas-exceptional-value

[24] https://seekingalpha.com/article/4296506-ultas-exceptional-value

[25] https://www.forbes.com/sites/pamdanziger/2019/03/19/ulta-puts-more-distance-from-sephora-and-amazon-in-the-number-of-people-who-prefer-to-shop-there/#756c433836f4

CHART SOURCE: https://www.cnbc.com/2019/05/02/warren-buffett-heads-into-berkshires-big-weekend-with-stock-underperforming-over-long-term.html