This is Part 1 of a 2-part series on the streaming video revolution and streaming video stocks. For Part 2, click here.

Broadcast and cable TV are rapidly sinking toward extinction as media marches toward an all-digital future.

At the same time, consumer choice is replacing the forced channel “bundling” that has been the model of cable providers. Instead of expensive bundled packages, consumers are being given more choice about what they watch and pay for.

By the end of 2018, more than one billion people were subscribed to streaming video services. By the end of 2019, another 600 million will have joined the streaming revolution.[1]

Yet only 14.5% of the global market has been penetrated.[2]

That means there’s a whole lot of opportunity for both streaming service providers and their investors.

“There are going to be explosive opportunities for investors,” says James McDonald, CEO of investment firm Hercules Investments on November 12.[3]

Market intelligence powerhouse Boston Consulting Group writes in their comprehensive state-of-the-industry report:

And it has created an industry that didn’t even exist a little more than a decade ago which has already become a $36 billion market, and growing at a 25% annual pace.[5]

The industry is streaming video on demand, or SVOD. With streaming, the content, be it a movie, show, song, or game, is stored on a remote server and “streamed” over the internet to your media device of choice.

Market trends group Deloitte writes:

That disruption is creating opportunity for investors as some of the world’s largest media companies battle for dominance.

Savvy investors who back the right companies have already pocketed profits of up to 95,000%.[6]

And yet unbelievably, it’s all just getting started...

When Netflix (NASDAQ: NFLX) became a publicly traded stock in May of 2002, few investors had a clue that the company would forever change the way we watch TV.

At the time, Blockbuster was the home entertainment juggernaut, with 9,000 stores and 84,000 employees around the world.[7] The Saturday afternoon ritual for countless millions of Americans was to drive to the neighborhood Blockbuster store to rent the latest Hollywood releases.

High-speed Internet was rare, which made downloading video a slow and error-fraught endeavor. So few bothered. And no company was foolish enough to build a business model around video over Internet.

Yet Netflix founder Reed Hastings had a hunch that things would soon change. He had an idea, and was waiting patiently until its time would come.[8]

And it did. By 2007, 70% of Americans had high-speed broadband Internet in their homes.[9] And so Hastings launched the revolution we now call streaming video on demand, or SVOD.

Investors savvy enough to see Netflix’s potential back in 2002 rolled in the dough, raking in profits of almost 95,000%.[10]

Netflix profited from early adopters to SVOD. It has now become mainstream with plenty of room to grow.

Media consumers around the world are “cutting the cord,” abandoning traditional cable and broadcast television in favor of Internet-delivered services.

Netflix has grown to become the largest entertainment service in the world, achieving that position in just 10 years.[11]

But Netflix isn’t the only streaming video on demand (SVOD) provider. And despite its 158 million subscribers worldwide, it is being challenged to remain the largest.[12]

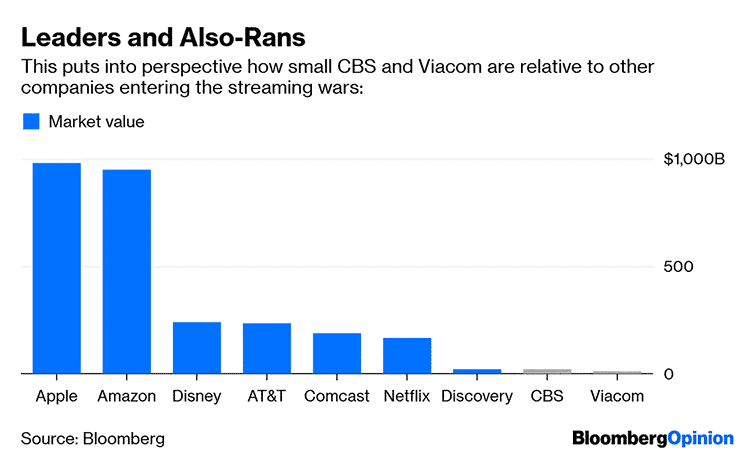

Tech giant Amazon (NASDAQ: AMZN), the world’s third largest company, launched its SVOD service in 2015. While the company does not say how many SVOD users it has, Amazon’s 101 million Prime subscribers have free access to its streaming video content.[13]

To remain top dog, Netflix is spending a reported $15 billion on original content in 2019. Amazon is in line to spend about $6 billion.[14]

But now Disney (NYSE: DIS) and Apple (NASDAQ: AAPL) have entered the market too, with both launching their own SVOD services this fall.

As the world’s largest company, Apple can afford to pour billions into the streaming race. Which is exactly what it’s doing, spending a reported $6 billion on original content this year.

Looking like a cheapskate in comparison, Disney, the world’s second largest media company, is spending $1 billion on original content. While that’s just a fraction of Amazon’s or Apple’s budget, let alone Netflix’s, $1 billion is nothing to sneeze at.

The biggest production studios have been swallowed by mass media conglomerates. Disney owns Pixar, Marvel, Lucasfilm, and 20th Century Fox. AT&T (NYSE: T) owns Warner Brothers. And Viacom (NASDAQ: VIAB) owns Paramount Studios. Netflix bought its first production studio last year, though it has not followed that with other purchases.[15]

So which companies will pay off for investors? Here are a few that are currently getting investor love.

You don’t have to worry whether Netflix will be the loser when the really big guns begin their assault on the SVOD market. Netflix will do just fine, thank you. This is not a winner-take-all battle. Most media consumers will likely subscribe to two, three, or four SVOD services. Netflix only needs to be in the top three or four.

Currently Netflix is the world’s biggest SVOD provider, with 149 million subscribers around the world and $15.8 billion in annual revenue. By those measures Netflix is the largest entertainment service in the world, a position it achieved in just 10 short years.[16]

Netflix has more than doubled revenue since 2017, while earnings per share have grown a whopping six times.[17] Compare that to Disney, which has grown revenue by 26% and has decreased earnings per share by 10% in the same time. In fact, Netflix’s earnings have grown at a 58% per year clip for the past five years. And their run isn’t over. Analysts expect Netflix to grow earnings by 477% over the next five years.

Investors have been jittery about Netflix’s prospects now that Apple and Disney are breathing down its neck. The NFLX stock chart looks like the Himalayas with all its peaks and valleys lately, and the stock is down around 24% from its June high. But that’s after having shot up 50% in the last two years, which puts Netflix’s gains over that time two and a half times the S&P 500’s returns.

As for its competition, in the words of Pivotal Research Group analyst Jeffrey Wlodarczak:

Nearly half of all US households now subscribe to Netflix. While there will continue to be some growth here, the most robust growth now lies abroad. Netflix began an aggressive international expansion campaign in 2016, entering 130 new countries. International subscribers have skyrocketed from 27.4 million to 91.5 million in just over three years.

Although you’d be wise to not count Netflix out, many analysts feel the stock is currently overvalued and can stand to pull-back a little closer to Earth. Let it be known, it’s been on fire the past couple years.

Disney’s new streaming service, Disney+, signed up more than 10 million people on its first day.[19] And that’s just a hint of the many millions more who will make Disney+ one of the most successful streaming services. The company estimates it will have 60 to 90 million subscribers by 2024.[20]

After seeing the success of the Disney+ launch, Bernstein Research analyst Todd Jeunger upped his estimate, saying the service will reach 120 million subscribers in five years.[21]

Disney is charging just $6.99 per month for nearly its entire back catalog of Star Wars movies and related series, Marvel movies and series, Pixar movies, old Disney movies, 30 seasons of “The Simpsons,” and Disney Channel shows.

At the same time, the company is pulling all its content from other media platforms, which will make Disney+ the only place a family can tune in to watch Disney’s high-demand content.

Disney will benefit from owning both content producers and Disney+. But since announcing its entry into the streaming space last spring, DIS has rocketed 40%, including a 10% pop in two days since news hit that Disney+ has already reached 10 million sign-ups in the new service’s first three days of sales.[22]

DIS is still a solid investment, with steady growth in both earnings per share and revenue. But with the stock at a record high, and current price only 1.78% beneath analyst consensus price target, it might be best to wait for a pullback before buying DIS. Investors need to closely watch Disney moving forward.

AT&T is coming late to the party, but don’t count it out. Next year it will launch the highly anticipated HBO Max, as well as a new streaming service called simply AT&T TV.

The company is no doubt nervous after losing a record number of subscribers to its various pay TV services in Q3 2019. They attribute 225,000 of the 195,000 losses to blackouts from Nexstar and CBS, and believe those losses have now peaked and will subside going forward.

AT&T is another one that has its hands in both content production and SVOD. The company showed off HBO Max to Wall Street analysts on October 30. But while shares of Netflix and Amazon fell after both Disney and Apple announced their SVOD market entry in the spring, investor knees did not quake with AT&T’s news.

In fact, after some initial investor optimism on the announcement, the eagerness turned to caution, and the stock lost a hairsbreadth of value. Part of the reason may be the hefty price the company will be charging for its streaming subscription. While Netflix charges $12.99 a month, HBO Max will launch at $14.99. More significantly, Disney+ is a value at $6.99 a month, and Apple TV+ is in downright bargain basement territory at $4.99.

There is also trouble elsewhere at AT&T. Investors are questioning the company’s purchase of DirectTV and TimeWarner, which flies in the face of the long-term downward trend of pay TV. After losing three quarters of a million subscribers of its pay TV services in Q2 2019, the company advised that it expects to lose more than a million more subscribers in Q4.[23]

Investors would be cautious to watch and wait before jumping into any AT&T investment based on streaming position.

Viacom’s strategy is a little different. Instead of jumping into the swelling streaming market with one all-encompassing service, the company has a hodgepodge of small, vertical services, including Showtime, BET+, ET Live, Noggin, and CBS services All Access and Sports HQ, which Viacom is getting as part of its purchase of CBS in December 2019.[24]

How those services will fare in the shadow of streaming’s giants remains to be seen. Sticker shock may be an issue for consumers who have already covered the basics with Netflix, Amazon, Disney, or Apple.

Viacom’s more interesting venture might be its partnership with Facebook (NASDAQ: FB), announced on October 29, for Viacom to create original programming for Facebook’s streaming service.[25]

With Facebook now boasting an eye-popping 2.37 billion active users, including 1.56 billion who log on every day, the potential is enormous.[26] While Viacom will initially be producing only short-form videos, the arrangement could morph into something much more, given Facebook’s ambition to conquer the world and I mean all in it.

For now, though, Viacom may not be the best way to find big streaming profits. I do recommend following the Facebook relationship closely to discover where this leads.

Amazon is a powerhouse, to be sure. Its Prime subscription service has more than 100 million subscribers who deliver an average of $1,400 in revenue to the company each year, compared to an average $600 for non-Prime subscribers.[27]

Membership to Prime costs $12.99 a month, or $119 for an annual membership, which translates to $9.92 a month. The streaming video-only option is $8.99 a month, which is hardly a bargain compared to all the benefits Amazon offers for full membership. This pricing gives you an idea of how Amazon views Prime video, as simply one of the benefits of a full Prime membership.

Still, the company is shelling out about $7 billion this year on new content. But Amazon’s vast and expanding video library is mainly used as a free perk for Prime members, and they do not track how many subscribers actually use the streaming service.

There are plenty of reasons why AMZN is a good investment. While the company is a serious contender in streaming services, those reasons do not include Amazon as a top contender in the streaming video revolution.

Today is the best time to profit from the streaming revolution since Netflix’s IPO in 1992.

In October 2019, Forbes wrote that “the streaming wars are intensifying.”[28]

The following month, The New York Times said “the long-promised streaming revolution is here.”[29]

The same month, Parks Associates senior analyst Brett Sappington advised, “I get asked all the time, ‘When does it stop?’ The truth is that it is only getting started.”[30]

The biggest profits always go to those who are early to recognize opportunity. That time is now, as the streaming video revolution changes the essential landscape of the $2 trillion media and entertainment industries.

Click here for Part 2 of my streaming video revolution series.

Cynthia Berryman, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.ig.com/en/news-and-trade-ideas/streaming-wars--will-netflix--amazon--disney-or-apple-come-out-o-191120

[2] Ibid

[3] https://finance.yahoo.com/news/streaming-revolution-may-bring-an-even-bigger-disrupter-soon-194804647.html

[4] https://www.bcg.com/en-us/publications/2016/media-entertainment-technology-digital-future-television-impact-ott-video-production.aspx

[5] https://www.mediaplaynews.com/report-global-svod-revenue-to-increase-25-to-36-billion-this-year/

[6] Split-adjusted $0.45 9/30/02 - $423.21 6/18/18 93,947%

[7] https://en.wikipedia.org/wiki/Blockbuster_LLC

[8] http://www.bbc.co.uk/newsbeat/article/42787047/netflixs-history-from-dvd-rentals-to-streaming-success

[9] https://www.pewresearch.org/internet/2007/07/03/home-broadband-adoption-2007/

[10] Split-adjusted $0.45 9/30/02 – $423.21 6/18/18 93,947%

[11] http://go.ooyala.com/rs/447-EQK-225/images/Ooyala-State-Of-The-Broadcast-Industry-2019.pdf

[12] https://www.statista.com/statistics/250934/quarterly-number-of-netflix-streaming-subscribers-worldwide/

[13] https://fortune.com/2019/01/17/amazon-prime-subscribers/

[14] https://www.fool.com/investing/2019/09/08/how-much-are-streaming-giants-spending-on-content.aspx

[15] https://www.cnn.com/2018/10/08/media/netflix-albuquerque-production-studio/index.html

[16] http://go.ooyala.com/rs/447-EQK-225/images/Ooyala-State-Of-The-Broadcast-Industry-2019.pdf

[17] https://www.fool.com/investing/2019/11/14/forget-disney-netflix-is-a-better-growth-stock.aspx

[18] https://www.investors.com/news/technology/click/netflix-stock-gets-reprieve-ahead-of-streaming-wars/

[19] https://www.cnbc.com/2019/11/16/disney-plus-streaming-wars-just-warming-up.html

[20] https://www.fool.com/investing/2019/11/27/disney-plus-could-reach-126-million-subscribers.aspx

[21] Ibid

[22] https://www.investors.com/market-trend/stock-market-today/dow-jones-climbs-powell-speech-china-trade-worries-disney-stock-buy-range/?src=A00220&yptr=yahoo

[23] https://arstechnica.com/information-technology/2019/09/att-expects-to-lose-another-1-1-million-tv-subscribers-this-quarter/

[24] https://www.hollywoodreporter.com/news/viacom-cbs-close-merger-dec-4-1255617

[25] https://www.cordcuttersnews.com/viacom-facebook-agree-to-a-new-streaming-partnership/

[26] https://www.socialmediatoday.com/news/facebook-reaches-238-billion-users-beats-revenue-estimates-in-latest-upda/553403/

[27] https://fortune.com/2017/10/18/amazon-prime-customer-spending/

[28] https://www.forbes.com/sites/danafeldman/2019/10/15/the-streaming-wars-who-will-win-your-subscription/#45d6c304a2ae

[29] https://twitter.com/nytimes/status/1196453016913793025

[30] Ibid