In this age of pessimism and skepticism regarding America’s global economic leadership — I have some good news for you.

Last year, America’s patent and trademark office (USPTO) issued its ten millionth patent.

From the beginning, the protection of intellectual property such as patents, trademarks and copyrights has been the driving force behind America’s economic rise.

The patent and copyright clause in our constitution led to the 1790 Patent Act and the first patent board composed of Thomas Jefferson, Henry Knox and Edmund Randolph.

None other than President George Washington signed America’s first patent, for improvements in making potash.

Abraham Lincoln was awarded patent number 6,469 in 1849 for an invention to lift boats over shoals and obstructions in a river, Tesla in 1888 for the technology behind the electric vehicle, Disney in 1940 for the art of animation, Bowerman in 1972 for Nike’s waffle sole, and Steve Jobs in 2007 for the basis of the iPod.

It is not an exaggeration to state that the protection of intellectual property has been the fuel for the engine propelling America to capture the commanding heights of the global economy.

Nowhere is this more evident than in healthcare — one of the fastest growing sectors in America and the entire world.

When you think of healthcare, you probably think first big pharma and then monster health insurance and hospital companies.

The healthcare sector accounts for roughly 18% of the American economy — $3.7 trillion a year.

Sure, the big names like Cigna (NYSE: CI), Abbott (NYSE: ABT), and Novartis (NYSE: NVS) dominate the business headlines but if you take a look at the patents of breakthroughs in medicine, you will see plenty of biotech companies with exotic names addressing health issues you’ve never even heard of.

And while smaller, entrepreneurial, research-intensive firms are leading the revolution, there are new, non-traditional players emerging as well.

For example, in the last five years, Alphabet (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT) and Apple (NASDAQ: AAPL) have filed more than 300 patents related to healthcare.

One important area many of these players are focusing on is Alzheimer's.

About 11% of Americans over the age of 65 are diagnosed with Alzheimer's disease and related dementia.

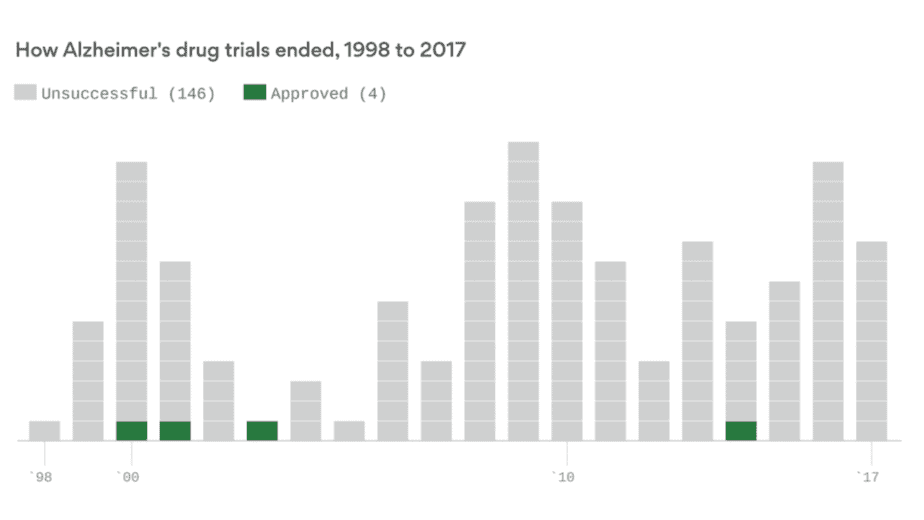

Unfortunately, drug companies have repeatedly struck out in trials looking to prevent or even slow Alzheimer's disease.

Scientists still don't know the cause of the disease, currently affecting 5.7 million Americans but as you see from the below graph, the battle to cure and treat this malady is ongoing.

When there is a breakthrough, you can bet that it will be led by a biotech company and then backed by big pharma.

It will then need to be protected and marketed worldwide.

Let’s address each of these issues while highlighting some companies that should be on the radar screen of savvy investors.

A few examples of patented products and procedures that save countless human lives are insulin, blood transfusions, anti-cancer drugs, and autoimmune drugs.

Biotech companies face some hurdles when applying for patent protection.

Their patent applications face great scrutiny since some argue that a scientist’s invention is merely a creation of nature or an obvious variant of what organically occurs in nature.

Despite these challenges, biotechnology companies continue to jump through the hurdles since the business models of most biotechnology companies rely heavily on intellectual property rights.

Patents and scientists are the most important assets owned by biotech companies because the sector is extremely research-intensive.

They also minimize risk for investors. Investors often use patents as a litmus test in deciding whether to invest in a biotechnology company. Patents demonstrate whether the biotech company has freedom to commercialize its product without infringing on the intellectual property rights of other companies.

Well-supported biotechnology patents also convince investors that a company has a tried and true intellectual property strategy with products that are already generating revenue and profits.

Take Alexion (NASDAQ: ALXN) for example.

Alexion’s Soliris first won Food and Drug Administration (FDA) approval in 2007 as a treatment for paroxysmal nocturnal hemoglobinuria (PNH), an ultra-rare genetic blood disorder.

It was and still is the only drug to receive FDA approval for the condition that reduces hemolysis, the destruction of red blood cells.

Soliris generated more than 86% of Alexion's total revenue of $4.1 billion last year and Alexion followed up by gaining FDA approval for another drug (ultomiris) for treating PNH in December 2018.

Another interesting biotech play is Vertex (NASDAQ: VRTX), which has three approved products on the market — Kalydeco, Orkambi, and Symdeko.

All three drugs treat cystic fibrosis. And they're the only approved drugs that treat the underlying cause of the disease.

The biotech company also expects to file for FDA approval of its first triple-drug cystic fibrosis combo in the third quarter of 2019, followed by submission for European approval by the end of the year.

These two promising biotech plays pose great opportunities for investors but also come with considerable risk as they have competitors from around the world.

This is why protecting their intellectual property rights worldwide is crucial for management and investors.

In these turbulent times when trade disputes dominate the headlines and globalization is under attack, it’s worth pausing to acknowledge that our primary agenda should be promoting the protection of intellectual property at home and abroad.

The U.S. Chamber of Commerce’s Global Intellectual Property Center’s (GIPC) research highlights the high stakes for America. Intellectual property is the foundation of 45 million high-paying U.S. jobs, 74% of our exports, and 38% of our GDP.

But here is a wrinkle that may not have occurred to you...

When a foreign country puts in place a transparent legal framework to protect intellectual property rights, it is not only good for American companies; it is essential for their own economic vitality and progress.

The recently released sixth edition of the U.S. Chamber’s International IP Index ranks 50 countries on the basis of 40 intellectual property protection indicators. The U.S. leads the pack, closely followed by the UK and the European Community. A quick survey of the country rankings shows a close correlation between strong protection of intellectual property and economic development.

For example, a robust IP protection results in a country being 53% more attractive to foreign direct investment, six times more likely to attract highly skilled researchers, 60% more receptive to entrepreneurship, and 42% more likely that an idea will be supported by venture capital and private equity.

This much is clear — a fair and transparent legal framework to protect innovation is the key to unlock capital, talent, creativity and economic growth.

So while trade statistics are important, let’s center our economic diplomacy on the basic building blocks of America’s edge to further America’s leadership of global healthcare.

Progress in the protection of intellectual property by countries such as India and China are painfully slow and incremental.

This important issue should be at the core of our negotiations because many health issues — such as diabetes — are global in nature.

In the United States, healthcare spending has outpaced income growth for almost two decades, and is projected to grow by 57% over the next decade.

In the emerging markets, healthcare spending is on an even steeper growth trajectory, boosted by new demand from a burgeoning middle class.

Healthcare spending accounts for about 10% of gross domestic product in most well developed countries (18% in U.S.) but just half that in emerging markets — implying strong long-term growth over the next 10 to 20 years.

This higher spending is creating better health as well as opportunities in healthcare treatment. For example, the emerging markets are well represented among the estimated 400 million people suffering from diabetes around the world.

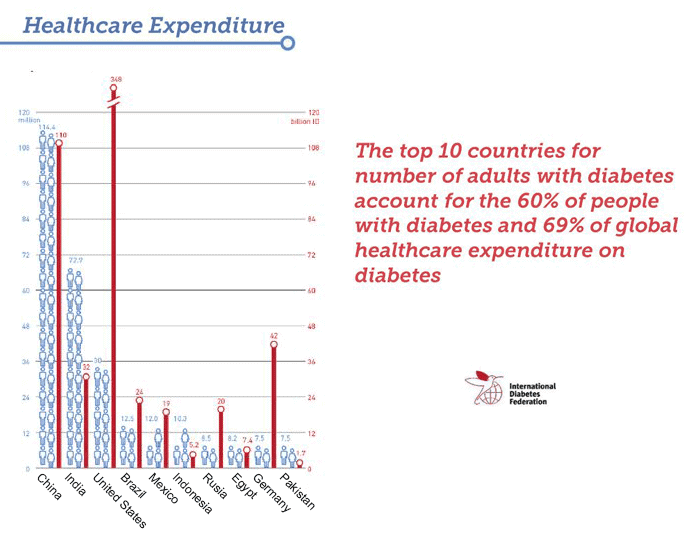

According to data from the International Diabetes Federation, India and China are first and second on the list of countries with the most diabetics. They’re followed by the U.S., which ranks third, and Brazil and Mexico ranked fourth and fifth, respectively.

The chart below highlights the wide gaps in treatment expenditures. For example, America has about one half the number of adults with diabetes but spends more than 1,000% more on treatment.

In India, diabetes has become a raging epidemic, currently afflicting roughly 7% of the population. In fact, India now has more diabetics than any nation in the world.

And a study by researchers from the University of North Carolina found that Chinese teenagers are developing diabetes at a rate nearly four times that of American teenagers.

Diabetes isn’t the only disease that’s becoming increasingly common in the developing world. Income growth has driven increased consumption of tobacco products and alcohol, raising the incidence of lung cancer, cardiovascular illness and liver disease.

In China, healthcare spending is growing at 10% every year from a base of $620 billion — faster than anywhere in the world. With China’s aging population, that is likely to accelerate. India’s healthcare spending is projected to rise by 140% over the next decade.

Pharmaceuticals will likely account for the lion’s share of increased emerging market healthcare spending, with drug sales expected to reach $550 billion annually by 2020.

That equates to about 70% of global drug sales, with China becoming the fastest-growing pharmaceutical market in the world.

Given all these trends and the need to keep prices and costs low, it should be no surprise that branded generic drugs have become a booming business.

A generic drug is simply one that is the bioequivalent of a branded original.

A branded generic is an off-patent drug marketed under a brand name.

Dr. Reddy’s Laboratories (NYSE: RDY) has become one of the biggest players with more than 200 branded generic drugs in the areas of cardiovascular disease, pain management, diabetes medications and oncology, among others.

As one of the largest makers of branded generics in the world, this company is clearly earning emerging blue chip status.

The company offers a growing number of products in the United States, but the majority of its sales are in emerging markets with India and Russia as its most important markets. China comes next and its development work there over the last two decades has paid off with a 12% growth rate in revenue.

The company’s manufacturing base in India allows it to manufacture products at very low cost as it consistently delivers 50% plus gross margins. Dr. Reddy typically allocates about 7% of revenue to R&D and this leads to a strong pipeline.

Dr. Reddy’s Laboratories has already made a nice run so far in 2019 so I would put this stock on your emerging blue chip watch list.

Another good multinational play on this growth trend is Abbott Laboratories (NYSE: ABT).

Abbott has a nice balance in terms of revenue from four areas: nutrition, diagnostics, pharmaceuticals and medical devices. While it has a strong position in the U.S., more than 60% of revenue comes from overseas markets and it is delivering double-digit growth in Latin America and Asia.

Abbott is also at the forefront of cutting-edge research. In an exciting development, a study was just published that showed Abbott's High Sensitive Troponin-I blood test could predict the chance of a heart attack years before it occurs, even in patients with no symptoms.

Abbott and Dr. Reddy are two great conservative core holdings that can complement more aggressive biotech ideas like Alexion and Vertex.

It’s important to take a global approach in building exposure in your healthcare and biotech portfolio to capture this high growth trend. You won’t regret it.

Carl Delfeld, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

“The Complications Around Protecting Biotech, Carly Klein, Labiotech, 2019

The U.S. Patent and Trademark Office

International Diabetes Federation