It’s been a crazy year in 2020. Tough both from a health perspective and an economic one. But what makes it even more unusual is that while society at large has struggled, overall it’s been a good year for people investing in the stock market and a particularly good last few months for investors focusing on Canadian small caps.

In the early part of the year, gold stocks took charge along with vaccine and COVID-19 test kit developers. Electric vehicles, battery metals and technology thrived throughout the summer and fall. Finally, psilocybin stocks have taken off in the new year as society focuses on the mental health aspect of the pandemic and lockdown.

While I have my reservations over the amount of time we have left in this bull market, there are a few individual stocks that I think will stand out as potential winners in 2021. Here are my top three picks for 2021.

There has always been a desire to detect cancers as early as possible, as early detection greatly increases the chances of beating the disease. The ability to detect tumors early has been a dream of oncologists and patients alike, but it’s easier said than done.

The existing two-dimensional detection methods require lengthy and invasive exams. Sometimes they come back with false positives, which can lead to undue stress for the patient. But even worse are the instances of false negatives. However, as 3D detection technology improves, we may be on the verge of being able to reduce or eliminate these issues. This is why Izotropic is my favorite stock right now.

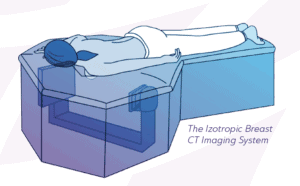

The Izotropic Breast CT Imaging System provides a disruptive solution to the shortcomings and inefficacies of current imaging modalities and care paths to breast cancer diagnosis.[1]

It was the brainchild of Dr. John Boone, a medical physicist with 32 years of experience in academia with broad interests in medical imaging, computed tomography, and breast computed tomography.[2] Dr. Boone led the development of Breast CT at UC Davis Medical Center prior to joining Izotropic.

The company’s system offers high-resolution, true 3D imaging with fast results in a painless procedure. The procedure is completed with the patient lying face down while the scanner underneath takes images of the breast.

Ongoing clinical trials show that the system can capture images of suspicious lesions or tumors as small as 3-5 millimeters. Standard of care mammography typically detects abnormalities at an average of 11 millimeters.[3] The ability to detect abnormalities of this size could mean that Izotropic’s system may be able to detect the threat of breast cancer a year or more before existing methods.

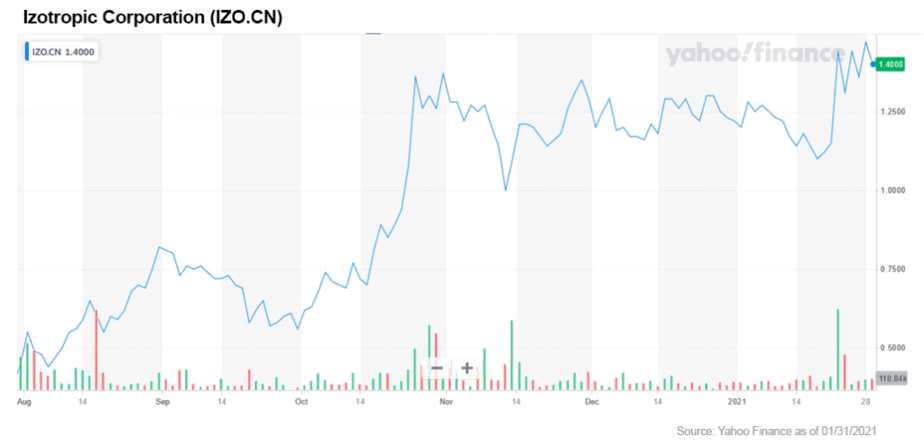

Commercialization efforts began when Izotropic obtained the exclusive global licensing rights to the technology back in 2017. The company went public on the CSE the following June. The stock was fairly under the radar, trading below CAD$0.20 as recently as this past July. Things started to take off when the company filed its Pre-Submission Application with the FDA for marketing of Breast CT in the United States.[4]

This is a huge milestone that was in the works going back to 2004 when the first scan was taken, and from what I understand, many millions have been invested since its development. The chance to get in this investment opportunity right before commercialization when twenty years of the inventors’ blood, sweat and tears was put into it was one that I could not pass up.

Some people might be familiar with the FDA Clinical Trial process for drugs which requires three trials and significant study into the safety profile, along with a marketing and manufacturing plan after proving Stage 3 Trial efficacy. This process can take many years.

As Breast CT is a scanner and not something the patients must ingest, I most likely expect the FDA process to move faster than it would for a drug. The company estimates a timeline of Q4 2022 for approval,[5] less than two years away. COVID may pose a factor on the timeline but I believe it’s still near term in the medical world.

Getting insurers on board will be the bigger challenge. However, if Izotropic can show that its system detects breast cancers early, and therefore increases survival rates and reduces medical costs, I can’t see any reason why insurers wouldn’t prefer this detection system — but many questions remain to be answered including costs, training and adaptability of the technology and unit.

Update on Insurance Payers

As an update in regards to insurance payers, as per the company’s news release on January 5, 2021, “Izotropic is active in participating in the FDA’s Center for Devices & Radiological Health Payor Communication Task Force program, and initial progress will be reported before the end of Q1 2021.

“Approximately $20M in U.S. government grants has been invested in Breast CT product development and clinical trials at UC Davis. The Company is in a unique position to use this trial data in discussions with insurance payers to demonstrate patient benefits for insurance coverage of breast CT.”[6]

Dr. John McGraw, Executive Vice-President of Commercial Operations, stated, “I am pleased to report that the meeting with the FDA was very beneficial for Izotropic and the comments received have validated our clinical study plan and development efforts to date. The initial indication for use of breast CT as a diagnostic device has been confirmed, and we have come away from the meeting with a high degree of confidence in our U.S. market approval plan moving forward."[7]

Izotropic has engaged Starfish Medical in order to complete the final design and development Breast CT.[8] Starfish will build on Dr. Boone’s four prototypes, leveraging its own expertise as Canada's largest medical device design, development and contract manufacturing company, to optimize the potential of the system.

The FDA approval process, marketing and manufacturing will all obviously take money. The company was prudent to raise cash into strength of the stock price while still being mindful of dilution. It raised $4 million at the end of October[9] and an additional $1.7 million in December.[10]

Assuming the exercise of all warrants, that would bring in an additional $9.8 million and would still lead to a fully diluted float of only 59 million shares. At a CAD$1.30 stock price, this would lead to an approximate $77 million valuation. This compares favorably to life sciences companies trading on the NASDAQ, many of which do not have the near-term revenue prospects at Izotropic does.

The reason why I’m such a fan of Royal Helium is built right into its name. Helium.

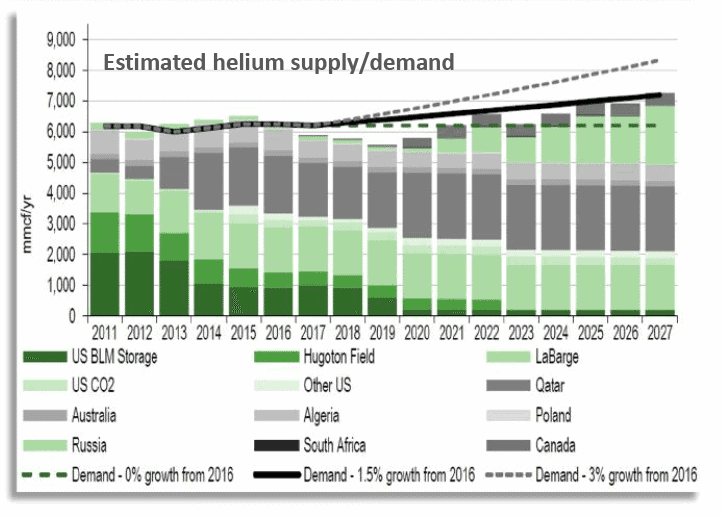

Helium exists on earth as a gas rather than a metal, but in all other aspects of resource investing, it’s subject to the same simple supply-demand dynamics. While it’s the second most common element in the universe, it’s the only element that’s non-renewable on earth.[11] Why? Because it’s so light that it escapes the atmosphere, never to return.

Humanity has treated helium as an afterthought, likely because of its relative abundance off of this planet. But until space resource extraction becomes an economic endeavor, the earth’s remaining reserves are all that we have.

The helium supply in the United States is drying up, and global reserves are estimated to only have a few decades worth left at current rates of use. The demand for the gas will grow as helium has expanded from its primary function of propelling balloons into high-powered computing.

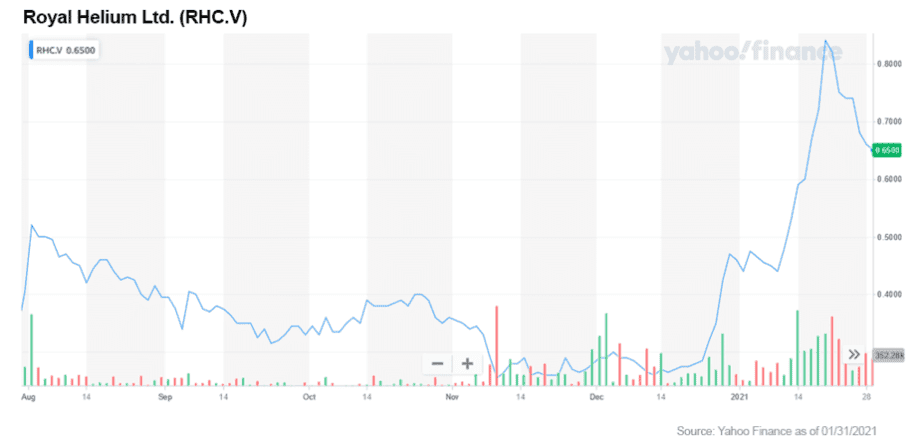

Knowing the supply-demand dynamics of helium is all one really needs to know when assessing Royal Helium. The fact that the company is searching for helium in southern Saskatchewan makes me three times as happy.

The company has about 400,000 hectares of permits, leases and applications to helium and inert gas rights including its Bengough and Climax projects.[12]

The economics of the projects are particularly good based on helium’s robust price. The method of production is the same as drilling a conventional, vertical natural gas well. The projects are also unique in that the helium is produced with nitrogen rather than hydrocarbons.

Royal Helium recently raised $6.15 million, which was upsized twice from an initial $4 million.[13] This indicates strong demand from sophisticated investors. Including the recent raise, there are 88 million shares outstanding and 140 million fully diluted when considering the exercise of all warrants and options. The exercise of all the warrants would bring in an additional $11.2 million on top of the $6.15 million just raised, so the company is well cashed up for drilling and exploration.

Royal Helium has identified five drill targets on its Bengough property and seven at Climax.[14] So, I expect 2021 to be a busy and lucrative time for the company.

As a long time gold bull, naturally one of my picks is going to be a gold stock. My favorite one right now is TomaGold (LOT), an exploration company with multiple projects near the Chibougamau mining camp in northern Quebec. It also holds a 24.5% interest in the Baird property, near the Red Lake mining camp in Ontario.[15]

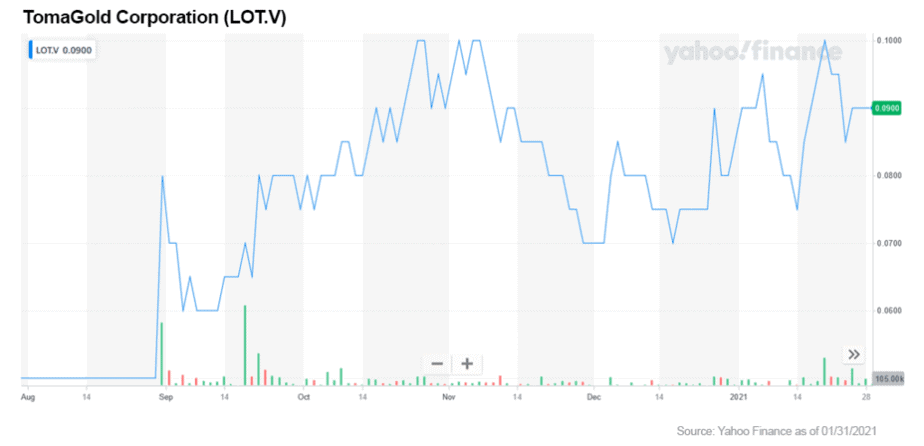

LOT has been a quiet stock in 2020. It sits at CAD$0.09 and has spent the entire year in a tight range between CAD$0.05 and CAD$0.11. It was halted for about 18 months earlier in the year for a transaction that was eventually cancelled in favor of a possibly more lucrative path.

While TomaGold has generally been overlooked by the market, the company has had a busy year. Last month it closed a deal to sell its 25% undivided interest in the Monster Lake project and the related mineral rights to IAMGOLD (NYSE: IAG / TSX: IMG). It received $500,000 and was issued 1,464,377 common shares of IMG.[16] At a CAD$4.59 price for IMG, the current market value of this deal is CAD$7.2 million.

LOT also sold up to 80% of its interest in the Lac Doda property to Goliath Resources Limited (OTCQB: GOTRF / TSX-V: GOT). To earn a 65% interest, Goliath Resources (GOT) issued 625,000 shares and 625,000 warrants with a strike price of CAD$0.24 to LOT. At the time of this writing, GOT is trading at approximately CAD$0.40, the value of these shares and warrants is approximately $350,000. A $25,000 payment is due in 2021 and to earn the final 15%, GOT must issue another $500,000 payment to LOT by 2025.[17]

Finally, LOT sold a 39.5% interest in the Sidace Lake property to Pacton Gold Inc. (OTC US: PACXF / TSX-V: PAC). This resulted in LOT owning 950,000 shares of PAC with PAC paying $250,000 and another $800,000 worth of shares and $250,000 in cash six months after the closing date.

If an NI43-101 report on the property shows a gold resource estimate of at least 750,000 ounces, PAC will issue 416,666 common shares or pay $500,000 to LOT.[18]

The combined market value of the guaranteed portion of these three deals is approximately CAD$8–10 million, comprising the majority of LOT’s market cap of approximately CAD$13 million. So you can understand why I might be monitoring this situation with great interest. People buying at this valuation ‘theoretically’ get the rest of TomaGold for about $3 million, and the company is drilling on its leading asset as we speak.

The receipt of $500,000 from IMG provides the company with sufficient liquidity to develop its remaining assets without the need to raise cash.

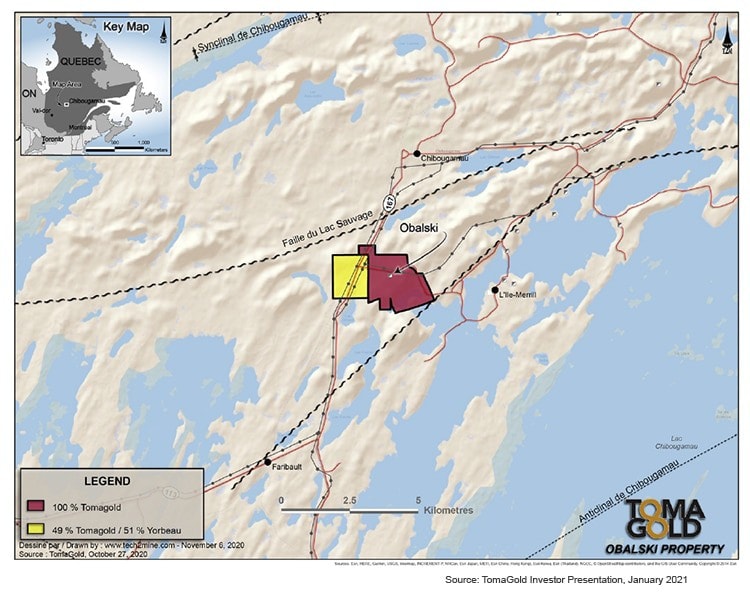

Earlier this month it announced the start of a seven-hole, 2,500-metre drilling program on its flagship Obalski project.[19] The company owns a 100% stake in this 345 hectare property, a former gold-copper producer that hosts seven currently known mineralized zones.

The property is 2 km south of Chibougamau, Quebec, in the heart of the Chibougamau mining camp.[20] It produced 100,273 tonnes at grades of 1.14% Cu, 2.08 g/t Au and 6.04 g/t Ag between 1964 to 1972 and around 9,000 tonnes at a reported grade of 8.5 g/t Au in 1984. This is a mature mine that very likely has substantial economic value remaining.

Not only should gold and silver remain robust, but the price of copper has been very bullish as the expectations of demand for the metal should significantly increase in a greener economy going forward.

I suggest that investors do your own due diligence and take a close look at these diversified segmented companies as potential opportunities to add to your watchlist today.

Kal Kotecha, PhD

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

DISCLOSURE: Izotropic Corporation, Royal Helium, and TomaGold are Junior Gold Report (operated by Kal Kotecha) portfolio holdings. Dr. Kotecha is currently engaged and paid by Izotropic, Royal Helium and TomaGold for marketing services. His relationship with these companies should be deemed a potential conflict of interest.

[1] December 2020. “Izotropic Corporate Presentation” Pg.5,

https://izocorp.com/wp-content/uploads/2020/12/December-9-2020_Investor-Presentation.pdf

[2] December 2020. “Izotropic Corporate Presentation” Pg.15,

https://izocorp.com/wp-content/uploads/2020/12/December-9-2020_Investor-Presentation.pdf

[3] December 2020. “Izotropic Corporate Presentation” Pg.6,

https://izocorp.com/wp-content/uploads/2020/12/December-9-2020_Investor-Presentation.pdf

[4] August 2020. “Izotropic Files Pre-Submission Application with U.S. FDA”,

https://money.tmx.com/en/quote/IZO:CNX/news/4793525365308317

/Izotropic_Files_PreSubmission_Application_with_US_FDA

[5] December 2020. “Izotropic Corporate Presentation” Pg.13,

https://izocorp.com/wp-content/uploads/2020/12/December-9-2020_

Investor-Presentation.pdf

[6] December 2020. “Izotropic Reports High Degree of Confidence after Pre-Submission Meeting with FDA”, https://money.tmx.com/en/quote/IZO:CNX/news/6656933078210660

/Izotropic_Reports_High_Degree_of_Confidence_after_PreSubmission_Meeting_with_FDA

[7] May 2020. “Izotropic Engages StarFish Medical for Design and Development of Commercial Breast CT Model”, https://money.tmx.com/en/quote/IZO:CNX/news/7013459373483192

/Izotropic_Engages_StarFish_Medical_for_Design_and_Development_of_Commercial_Breast_CT_Model

[8] October 2020. “Izotropic Corporation Announces Closing of Second Tranche of Non-Brokered Private Placement”, https://money.tmx.com/en/quote/IZO:CNX/news/7358258466407489

/Izotropic_Corporation_Announces_Closing_of_Second_Tranche_of_

NonBrokered_Private_Placement

[9] December 2020. “Izotropic Corporation Announces Closing of Non-Brokered Private Placement”, https://money.tmx.com/en/quote/IZO:CNX/news/5210242680268390

/Izotropic_Corporation_Announces_Closing_of_NonBrokered_Private_Placement

[10] November 2019. “The World Is Constantly Running Out Of Helium. Here's Why It Matters”, https://www.npr.org/2019/11/01/775554343/the-world-is-constantly-running-out-

of-helium-heres-why-it-matters#:~:text=Helium%20is%20the%20only%20element,such%20as%20uranium%20and

%20thorium.&text=Like%20hydrogen%2C%20its%20immediate%20predecessor,periodic%20table%2C

%20helium%20is%20lightweight.

[11] November 2020. “Royal Helium Corporate Presentation”, https://royalheliumltd.com/site/assets/files/4705/rhc-presentation-nov-2020.pdf

[12] December 2020. “Royal Helium Increases & Closes $6.15 Million On Oversubscribed Brokered Private Placement Financing”, https://money.tmx.com/en/quote/RHC/news/8648517747003242

/Royal_Helium_Increases_Closes_615_Million_On_Oversubscribed_

Brokered_Private_Placement_Financing

[13] July 2020. “Royal Identifies Five Additional Drill Targets In Southeast Saskatchewan”, https://money.tmx.com/en/quote/RHC/news/5275777933494611/Royal_Identifies_Five_Additional_Drill_Targets_In_Southeast_Saskatchewan

[14] “Our Company”, http://www.tomagoldcorp.com/en/#.html

[15] November 2020. “TomaGold announces the closing of the transaction with IAMGOLD”, http://www.tomagoldcorp.com/en/investors/news-releases/

tomagold-announces-the-closing-of-the-transaction-with-iamgold-2020-11-11.html

[16] July 2020. “TomaGold announces the sale of up to an 80% interest in the Lac Doda property to Goliath Resources”, http://www.tomagoldcorp.com/en/investors/

news-releases/tomagold-announces-the-sale-of-up-to-an-80-interest-in-the-lac-doda-property-to-

goliath-resources-2020-08-17.html

[17] January 2020. “TomaGold announces binding LOI for the sale of its stake in the Sidace Lake property to Pacton Gold”, http://www.tomagoldcorp.com/en/investors/news-releases/

tomagold-announces-binding-loi-for-the-sale-of-its-stake-in-the-sidace-lake-

property-to-pacton-gold-2020-01-31.html

[18] December 2020. “TomaGold announces the start of drilling at Obalski”, http://www.tomagoldcorp.com/en/investors/news-releases/

tomagold-announces-the-start-of-drilling-at-obalski-2020-12-08.html

[19] “Obalski”, http://Obalski