As encouraging as the recent market gains have been for investors with the S&P 500 up 30% from lows on March 23 as of today, big dramatic moves both up and down are a hallmark of stressed markets.

From mid-March to mid-April, the Dow Jones Industrial Average had 28 swings — higher or lower — of at least 0.5%.

Putting the Fed stimulus aside, Congress has already approved new virus-related spending that, together with this year's pre-virus budget deficit projection of +$1 trillion, puts our budget deficit on a path to reach 20% of America’s GDP in one year.

This is big stuff.

My read is that the huge Fed stimulus and emergency appropriation measures by Congress have overpowered concerns about the real economy.

To some, drawing attention to the jump in Federal spending, exploding budget deficits, or our skyrocketing national debt burden seems inappropriate.

Besides, our country’s finances have been off the tracks for some time. But the above numbers make the Reagan budget deficits look like petty cash.

We are indeed a long way from fulfilling Thomas Jefferson’s call for a “wise and frugal government.”

Who would have believed an America with a Republican U.S. Senate and Republican president would — prior to the coronavirus stimulus and bailout initiatives — deliver annual budget deficits of $1 trillion in a strong full employment economy with total national debt already at more than 100% of GDP?

That is more than all private investment expenditures in 2019.

Congress has proved once again that consensus can almost always be found in a crisis to spend huge sums of taxpayer money.

Businesses are also drawing down bank credit lines and issuing corporate bonds at knock-down interest rates to raise cash. Many households are tapping existing or new credit lines or credit cards for funds, too.

I’ve heard many people ask recently, “How are we going to pay for all this government spending?”

The first consequence is, of course, piles of debt.

But then what?

Some believe that in the next few years we’ll have the biggest tax increase since the end of World War II, regardless of who becomes president.

Charlie Munger, Warren Buffet’s partner, puts his 96 years of experience to good use with a common sense view of the economy and markets.

He sees us like a captain of a ship in a stormy sea with no idea when we will come out on the other side.

“Of course we’re having a recession,” said Mr. Munger. “The only question is how big it’s going to be and how long it’s going to last. I think we do know that this will pass. But how much damage, and how much recession, and how long it will last, nobody knows,” according to a recent interview with him by the Wall Street Journal.

He added, “I don’t think we’ll have a long-lasting Great Depression. I think government will be so active that we won’t have one like that. But we may have a different kind of a mess. All this money-printing may start bothering us.”

The other potential side effects of COVID-19 range from escalating generational tension and conflicts over debt and spending priorities, the implications of turning the Federal Reserve into an extension of the U.S. Treasury, the possibility of igniting the cruelest tax of all, inflation, and finally, the outside chance of the return of miserable 1970's stagflation.

Let’s take a look at some of these and then look at a strategy for investors to cope with these unwelcome potential outcomes.

My tattered and torn college textbook defines inflation as “a persistent increase in the level of consumer prices or a persistent decline in the purchasing power of money, caused by an increase in available currency and credit beyond the proportion of available goods and services.”

Inflation is an upward movement in the average level of prices. Its opposite is deflation, a downward movement in the average level of prices.

Inflation is the expansion of money and credit. Deflation is the contraction of money and credit. The boundary between inflation and deflation is price stability and the most common situation is a low level of inflation in the 1% to 3% range.

There you have it, the jaws of high inflation can squeeze your purchasing power and nest egg while the claws of deflation usually pull both an economy’s growth rate and stock markets down to earth.

Now, in a healthy economy, there will always be a modest inflation since it serves as sort of a lubricant to the wheels of commerce and keeps economic momentum moving forward.

Price stability leads to all actors in an economy being able to make sound economic decisions and fosters a virtuous cycle of growth and progress.

But high inflation discourages investment and savings — the fuel for both growth and productivity.

Let’s just look at the probabilities of each occurring and how they will affect your financial well-being and, most importantly, what you can do to hedge your bets and protect your portfolio.

It is important to note that price levels reflect, to a large degree, psychological leanings. They try to look around the corner and anticipate what’s next.

For example, if most people expect prices to rise sharply, producers will raise prices to protect themselves, workers will negotiate higher pay increases, and the cycle continues and accelerates.

The same is true with deflation, if consumers believe that overall prices will fall, they will delay large purchases, companies will reduce costs to maintain margins, and economic growth will suffer.

Most financial pundits dwell on only the likelihood and risks of high inflation. I will try to be evenhanded and look evenly at the twin risks of deflation and inflation.

Since the explosion in government debt and spending makes deflation very improbable, let’s focus on inflation. I’ll also offer you some investment ideas and strategies to cope with inflation and also introduce another less welcome possibility — stagflation.

Before getting into your investments, let’s briefly look at how rising and falling price levels impact your financial situation. Normally, rising inflation is coupled with a rising cost of money — better known as interest rates.

These higher interest rates and the decline in your real spending power are like a one-two punch to your real purchasing power and your standard of living.

During high inflationary periods, the American economy is not as productive since borrowing, capital spending and productivity all tend to decline.

In an economy where inflation is rising quickly, interest rates rarely keep up, causing savers' hard-earned dollars to lose some buying power.

Retirees are especially hard hit since high inflation rates often mean wage increases, but that won't benefit those who are retired.

Homeowners with variable mortgage rates and people with credit card balances see their borrowing costs climb with the broader inflation in the economy, leading to larger payments and weaker cash flows.

The real estate and construction business is particularly hard hit since high inflation leads to sharply rising home prices, high interest rates for mortgages and a relentless slide in the value of any money people have put away for a down payments.

The strongest case for a coming period of high inflation is not the Fed pumping of enormous amounts of liquidity into our economy but rather that inflation is perhaps the only way out of America’s incredible debt problem.

We now face $1 trillion plus annual budget deficits as far as the eye can see. And high inflation is the government’s best strategy to reduce the impact of high debt.

Michael Lewis writes in The Atlantic how in 1979, for example, the government ran a deficit of more than $40 billion — equivalent to about $118 billion in today’s money.

The national debt stood at about $830 billion as of 1980.

But because of 13.3% inflation, that $830 billion was worth what only $732 billion would have been worth at the beginning of the year.

So, in effect, the government ran up $40 billion in new debts but inflated away almost $100 billion and ended up with a national debt smaller in real terms than what it started with.

Now, the U.S. national debt is over $22 trillion ($700,000 for each American) with a trillion dollar plus budget deficits forecast for the next five years. The coronavirus could double the annual deficits for the next several years, or even worse.

This is why I think the probability of a high inflationary environment going forward is about 80%.

In short, you should be concerned about inflation and your investments.

What should be your investment strategy if you expect inflation to not just go up a notch but get entirely of control?

Just the word "inflation" strikes fear into the hearts of many Americans worried about rising prices, a falling dollar and an income that just can't keep up with the cost of living.

But while a high inflation rate hurts many Americans financially, it also presents opportunities for smart investors.

Stock investors get some protection from inflation because the same factors that raise the price of goods also raise the values of companies. But coping with the fear of high inflation is not easy because of uncertainty — the goal posts and the rules both keep moving.

While some companies can react to inflation by raising their prices, others who compete in a global market may find it difficult to stay competitive with foreign producers who don’t have to raise prices due to inflation.

More importantly, inflation robs investors by raising prices with no corresponding increase in value.

Adding some gold to your portfolio and nest egg is a great way to hedge this risk and protect your purchasing power.

Now let's get to some ideas on ways to invest in gold.

Exchange-traded funds (ETFs) represent the easiest way to get exposure to a diversified basket of gold stocks.

VanEck Merk Gold Trust (NYSE: OUNZ)

Some investors may want to invest directly in physical gold rather than in gold stocks. Gold in a vault is one thing but this ETF takes this preference for physical gold to another level by allowing investors to redeem their funds as a deposit back to their investment account or actually shipping the gold to your door.

With $200 million or so under management, this fund clearly has found a path to the heart of any gold bug. Delivery comes with an added fee, but the minimum shipment size is just 1 ounce and the base expense ratio of 0.4% annually is more than reasonable.

That means you can invest in this fund at a competitive price and simply retain the option for physical delivery if and when you want it.

The SPDR Gold Shares (NYSE: GLD) exchange-traded fund is also a good play on the price of gold and seeks to replicate the performance of the price of gold bullion on a one-to-ten ratio. The shares trade on the NYSE and may be bought and sold like any other securities.

If you are a more aggressive investor and feel more venturesome, the VanEck Market Vectors Junior Gold Miners ETF (NYSE: GDXJ) offers a more indirect exposure to gold through ownership in a portfolio of small and medium sized gold miner equities that generate at least 50% of their revenues from gold and/or silver mining.

Keep in mind that these smaller mining companies can be volatile so you need to be comfortable with this more aggressive option. Recently, GDXJ has outperformed its large cap rivals and has more than $1 billion in assets.

You could also invest directly in gold mining stocks.

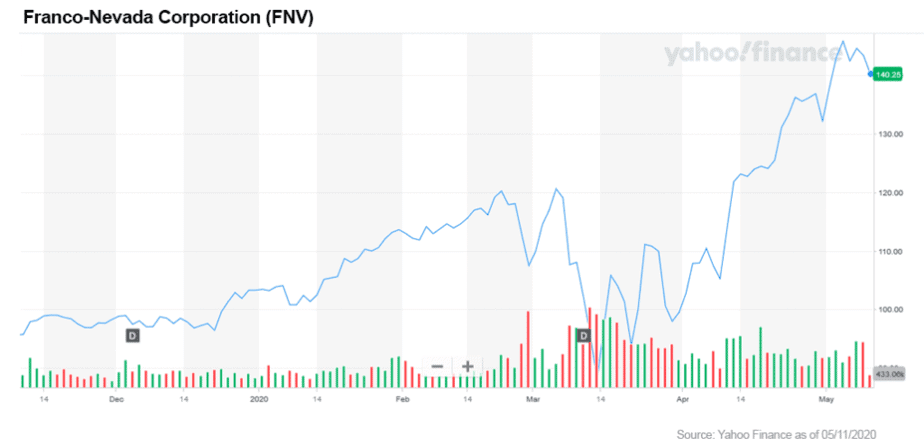

But I have a better idea. Take a look at the Franco-Nevada Corporation (NYSE: FNV).

FNV is not a gold mining company but rather a gold-streaming and royalty company. Franco-Nevada buys gold from third-party miners at pre-determined percentages in exchange for funding them up front.

This means that Franco-Nevada doesn't have to bear costs and risks associated with the business of mining, and also gets to acquire gold at rates much below spot prices.

For example, Franco-Nevada's cost of stream sales was only $135.1 million in 2019 but it generated revenue worth $844.1 million.

Now, let’s take a quick look at one other potential scenario — stagflation.

Stagflation is the awful combination of lack of growth (stagnation) and persistent, substantial increase in prices (inflation).

Remember the 1970s or still trying to forget?

All through the 1970s (during the Nixon, Ford, and Carter administrations) the Fed would stumble between stimulating the economy, trying to head off a recession, and then restraining the economy, trying to keep inflation from spinning out of control.

In the end, Nixon tried to spend his way out of it (not an option now) before Carter and Volcker finally crushed inflation by sharply increasing interest rates to cause a recession thereby wringing inflationary expectations out of the economy like a wet rag.

I put the probability of America following the stagflation model at about 20%. The best place to be in this scenario is out of equities and into fixed income such as bonds or preferred stock.

I hope this discussion of inflation and deflation, debt, currency, and geopolitical competition has been helpful and should underscore the high level of uncertainty in today’s markets.

One thing should be clear — no one knows precisely how events will unfold and leaning against the winds of conventional wisdom is oftentimes a smart strategy.

Now is the time to add some gold to your investment strategy since it serves as an effective hedge and shock absorber in this age of uncertainty.

Carl Delfeld, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

Guide to Investing in Gold & Silver, by Michael Maloney

The Black Swan: The Impact of the Highly Improbable by Nassim Nicholas Taleb

Inflation & Deflation, Their Causes and Effects by Kimberly Amadeo, The Balance, November 9, 2018

https://www.cnbc.com/2020/03/27/the-feds-balance-sheet-just-passed-5-trillion-for-the-first-time-ever.html

https://www.cnbc.com/2020/03/23/fed-announces-a-slew-of-new-programs-to-help-markets-including-open-ended-asset-purchases.html

https://www.federalreserve.gov/monetarypolicy.htm

https://www.wsj.com/articles/charlie-munger-the-phone-is-not-ringing-off-the-hook-11587132006

WSJ, April 13, 2020