You might want to take a seat before reading this article. What I am about to share with you will send shivers down your spine.

World economies, and even western civilization itself, are hanging by a thread, and if things do not change fast, we will be in a world of hurt. You thought 8+% inflation was horrible? That number will look very good a year from now if world governments do not get a handle on this vitally important commodity.

What is that commodity?

Chemical fertilizers.

And nobody is talking about this impending tragedy that is slowly unfolding across the globe as I write this article.

It is something that most people don’t even realize is going to be a driving factor behind skyrocketing world inflation numbers.

After doing extensive research on the sector, I believe that food inflation is about to get way worse than anything we have experienced in generations.

Intelligent investors are highly aware of the looming situation and hedging their portfolios with companies that could profit from the fertilizer supply crisis.

In this article I want to share with you the various reasons that have contributed to the fertilizer supply crisis and 7 companies that could help your stock portfolio weather the upcoming storm.

Let’s get started…

I want to stay on topic here and do not want to go too deep into plant chemistry and the myriad of inorganic fertilizers that are used in global food production.

Suffice to say that chemical fertilizers are the backbone of the world’s food supply.

Without them, billions would literally starve.

Several studies have shown that up to 60% of crop yield can be directly attributed to commercial fertilizer inputs.[1]

That is more than half of global food production!

Three-quarters of countries in the world depend on imported fertilizer for 50% or more of their fertilizer use.[2]

Chemical fertilizers and their importance to our existence as a species cannot be overstated. It is a critical commodity equal to the level of water and air we consume. Without quality fertilizer, many billions would perish.

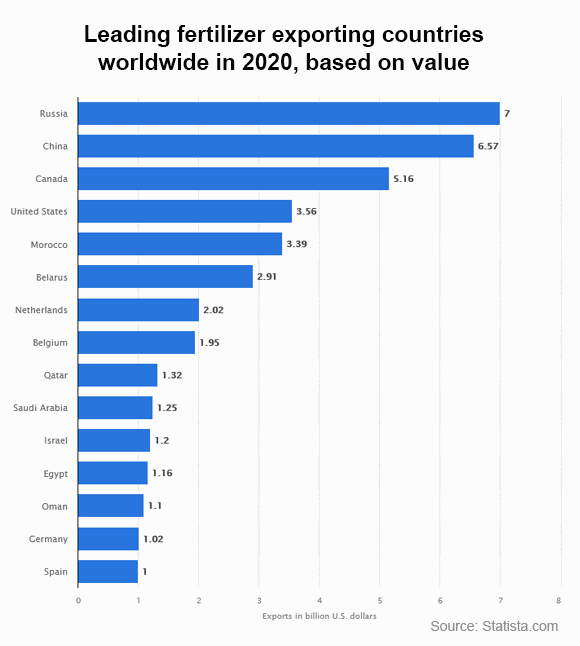

There are literally a handful of countries that produce and export chemical fertilizers, as you can see in the chart below.

Of the top 6, I want you to focus your attention on three of those: Russia, China and Belarus.

Those three countries control a vast majority of the global fertilizer exports. They also are not allies of the Western world…

And the chart below shows the top importers of fertilizers.

The supply and demand of fertilizers has deep geopolitical implications. He who controls the fertilizers, ultimately could control the worldwide food supply.

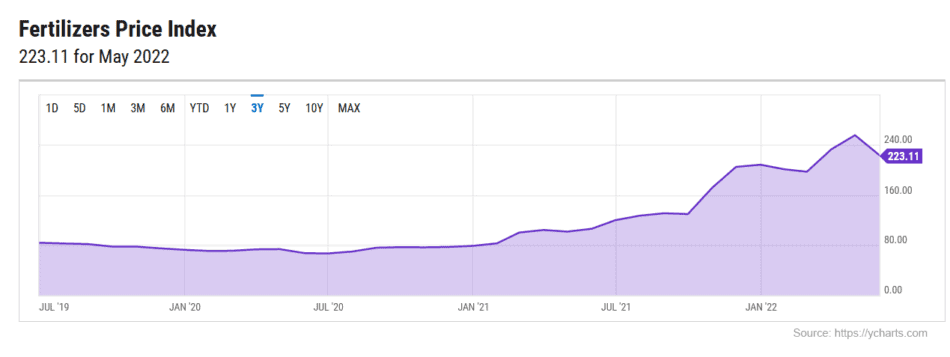

The chart below shows the current spot price for fertilizers. I took a 3-year snapshot so you can see that fertilizer prices have been more or less stable for many years. When Russia began its saber rattling and amassed troops along the Ukrainian border, prices began to rise significantly.

Over the past year, fertilizer prices have shot up +186%!

Soaring prices are driven by a confluence of factors including surging input costs, supply disruptions caused by sanctions (Belarus and Russia), export restrictions (Russia and China) and robust demand.

I will get into these factors in the next section, but what you should know is that any disruption to fertilizer availability directly affects food supply chains around the world sending food prices soaring ever higher.

Just take a look at the recent wheat spot price, up over +88% in the past year!

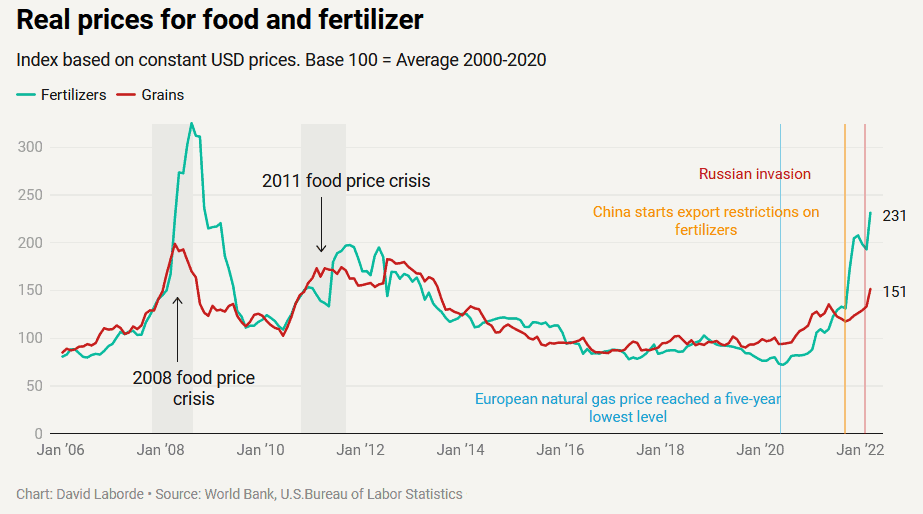

This chart clearly illustrates the correlation between fertilizer prices and food prices almost in lockstep.

Remember the three top producers of fertilizers I mentioned above?

These three key points have directly resulted in almost half of the world’s fertilizer production being taken off the world marketplace.

Add to this the surging costs of manufacturing one of the main sources of nitrogen-based fertilizers. Ammonia gas, derived from natural gas, is used to make ammonium nitrate fertilizer. Ammonia gas is now seeing record high prices in the order of more than +300% due to skyrocketing natural gas prices!

Demand for fertilizers continues to be strong as the US and Brazil have set aside record acreage to fertilizer-intensive soybeans. China is also consuming large amounts of grain crops as it works on rebuilding its hog herd population following the massive cull to control the African swine fever outbreak.

All said, the combined market forces at play will continue to drive fertilizer prices ever higher. Those higher prices will be passed on to consumers at the grocery store, greatly increasing inflationary pressures across the globe.

Fertilizer companies are riding surging demand not seen in years. Supplies are running short due to various market forces including sanctions and hoarding. Customers are looking for reliable sources to fill the supply gap giving US and Canadian firms an obvious advantage.

Fertilizer stock prices will continue to follow this demand surge and could be an excellent hedge against inflation. Currently there is no indication that commodity prices will slow down anytime soon.

In my research I have found the following 7 companies that I feel are well-positioned to live up to the challenge and increase production of critical inorganic fertilizer compounds.

As always, I encourage my readers to use my articles as a starting point in their own research and do their own due diligence before making any investment decisions.

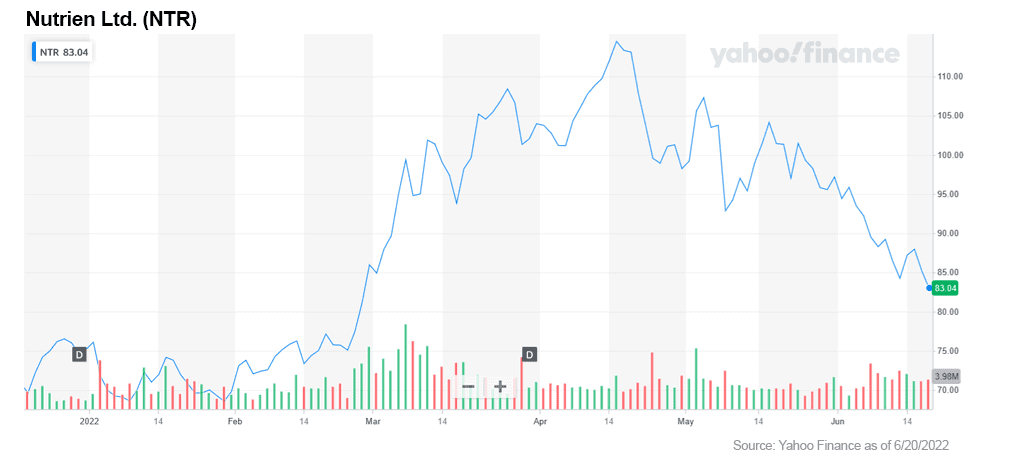

1. Nutrien Ltd. (NYSE: NTR)

Based in Canada, Nutrien Ltd. is a leading global supplier of fertilizers. The company is considering ramping up its potash production to 15 million tons this year amid a global shortfall. This is a one million-ton increase in production from its previous target.

The company could make 18 million tons of the commonly used fertilizer if it increased capacity in increments over a one to three-year period, according to Mark Thompson, Nutrien’s chief strategy officer.[3]

This increase in production will substantially boost revenues in the coming quarters.

4th quarter earnings were up almost +80% year-over-year. Net earnings were up +282% from a year ago.

A solid company in the fertilizer space in my opinion.

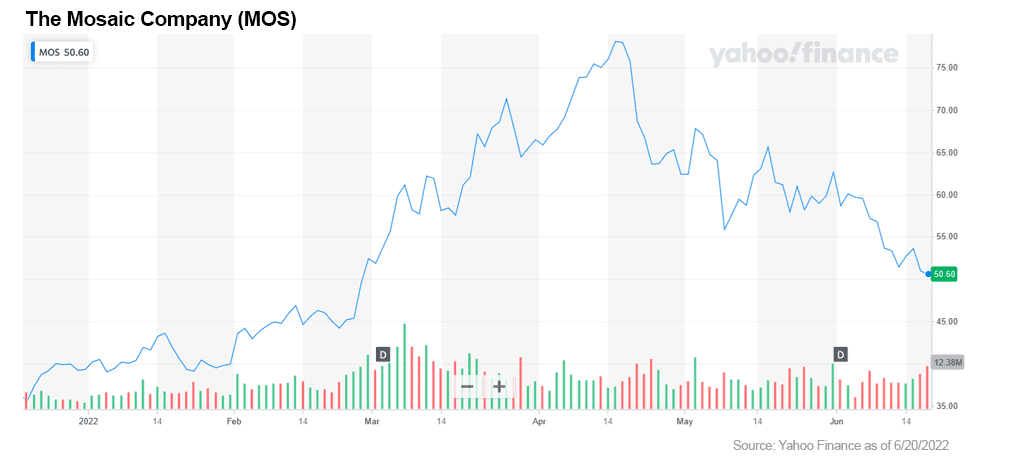

2. The Mosaic Company (NYSE: MOS)

Another beneficiary of the Russia and Belarus sanctions. Mosaic produces both potash and phosphate fertilizers globally.

The company is riding the commodity price surge and the windfall of having Russia, a leading exporter of fertilizer components, knocked off the playing field.

Year-over-year growth was up over +52%. Moving forward the continued demand for potash should create more upside and continue to solidify its financial performance.

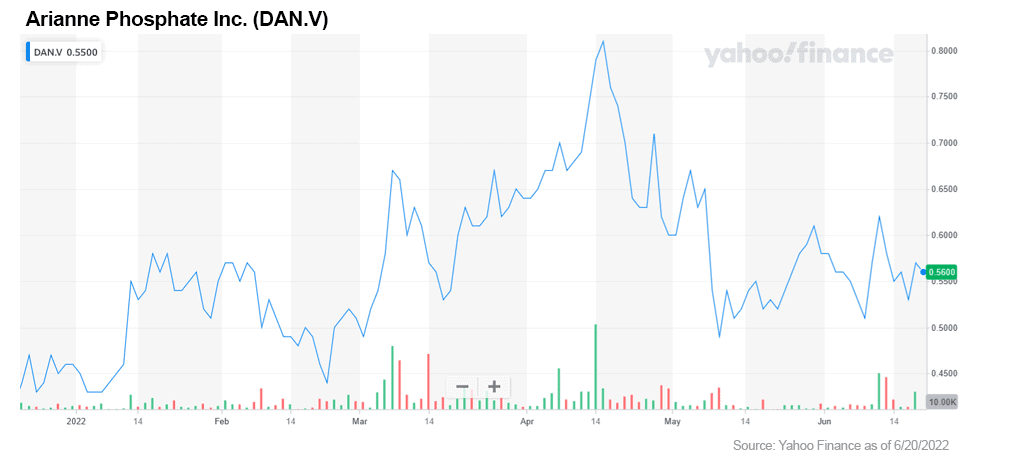

3. Arianne Phosphate Inc. (TSX-V: DAN, OTC US: DRRSF)

Arianne is based in Quebec, Canada, and is a startup junior mining operation.

The company has been working to develop a property rich in phosphate rock reserves for almost a decade. The company claims the reserve is the largest in Canada and is estimated at 590 tons.

Up to now, the project has focused on building out infrastructure in order to get the material out of the ground and to a nearby port for export and processing.

This is a long-shot play in the space. If they can pull this off and start operations, investors will see double- or even triple-digit gains very rapidly.

From my experience these things can go either way, so caution is advised. It’s worth checking out their website for more information: https://www.arianne-inc.com/

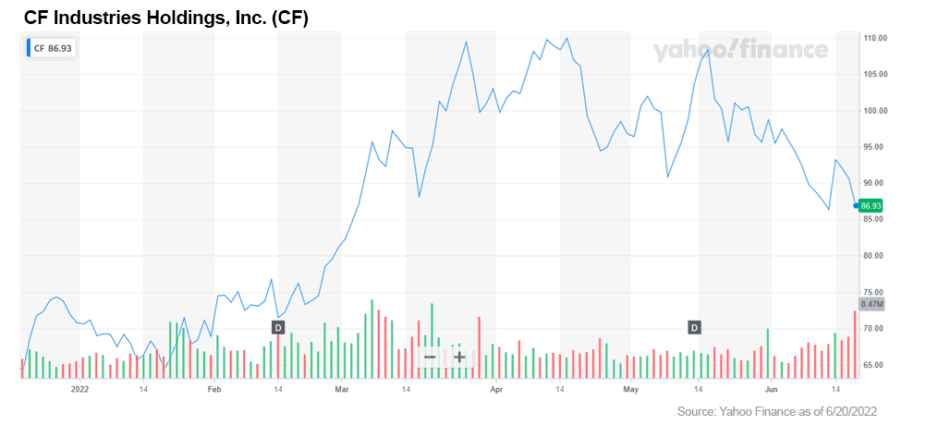

4. CF Industries Holdings, Inc. (NYSE: CF)

Based in the US, CF produces nitrogen-based fertilizers, primarily using natural gas as a base component. This fact does cut into their overall profit margin as its product is directly tied to the price of natural gas.

Russia and Ukraine both produce nitrogen-based fertilizers. With those two competitors removed from the market, CF stands to gain handsomely during this agricultural crisis.

CF plans to expand fertilizer shipments to both US coasts to offset any declines in exports from Russia. These increased shipments should boost CF’s revenues and profit margins in the near-term.

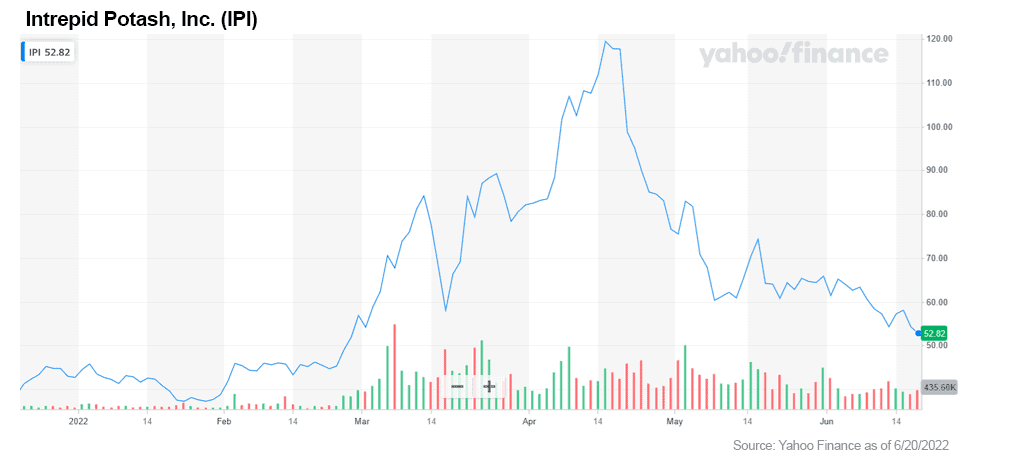

5. Intrepid Potash, Inc. (NYSE: IPI)

Based in Denver, Colorado, this fertilizer manufacturer is one of the largest producers of potassium chloride, specializing in the potassium-rich salt known as potash which is mined from ancient seabeds.

Intrepid is a direct winner of the Belarusian and Russia sanctions on potash exports.

The company topped 1st quarter earnings and revenue estimates fueled by explosive gains in fertilizer commodity prices. The company carries zero debt on its balance sheet and recently announced a $35M share buyback plan.

A solid play in this space in my opinion.

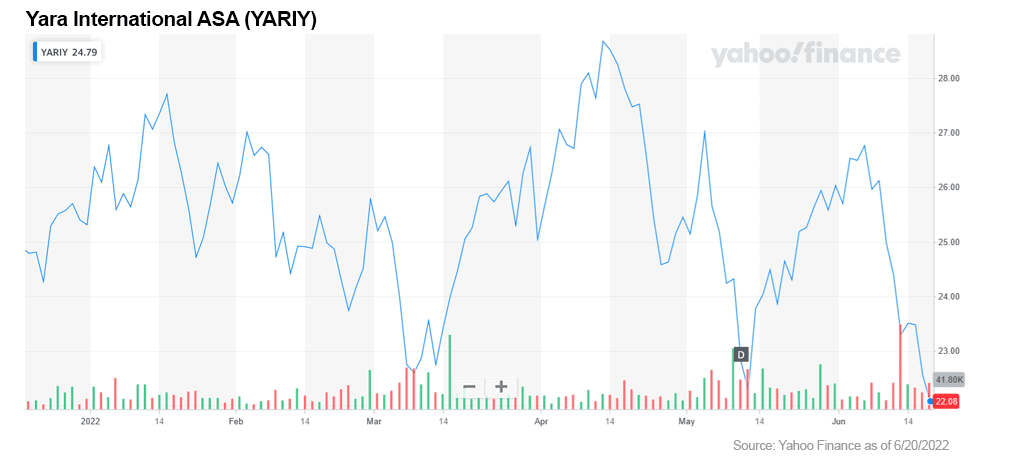

6. Yara International ASA (OTC US: YARIY)

Based in Oslo, Norway, the company produces and distributes nitrogen-based fertilizers.

In January, Yara partnered with Linde Engineering to construct and deliver a 24MV green hydrogen demonstration plant at the company’s ammonia production facility in Norway.

The project aims to supply the first green ammonia products to the market by mid-2023. Producing nitrogen fertilizers that do not rely on fossil fuels is a game changer.

These green fertilizers will have an 80–90% lower carbon footprint than fertilizers produced with natural gas.

The company expects this product to be in high demand as we continue to move in a carbon-free global economy.

Yara’s 4th QTR revenue and other income increased 72% year-over-year to $5.03.

The company boasted a 75.6% growth year-over-year.

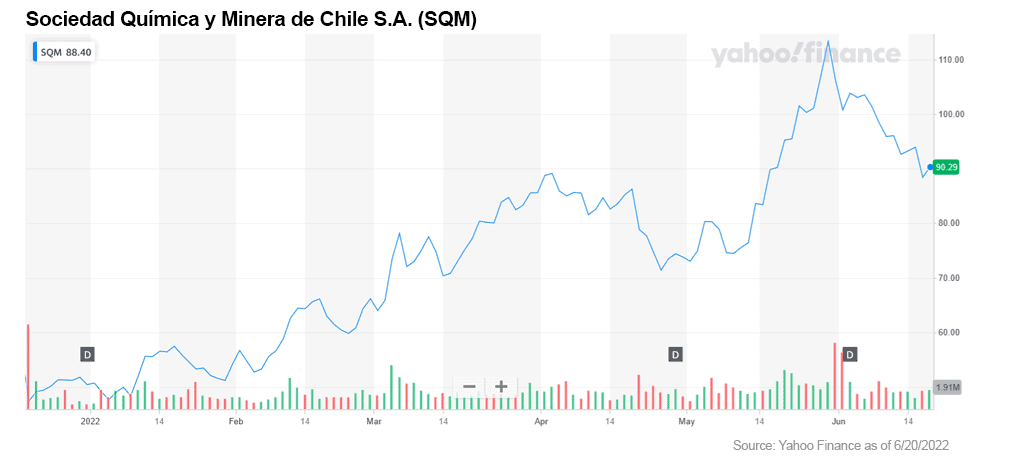

7. Sociedad Química y Minera de Chile S.A. (NYSE: SQM)

I have written about Sociedad Quimica y Minera de Chile in a previous article on lithium. They are a solid player in the lithium production space. They claim to produce up to 20% of the world’s lithium output.

To my surprise they are also involved in the production of chemical fertilizers: iodine, lithium, potassium chloride and potassium sulfate, industrial chemicals, and other commodity fertilizers.

SQM is one of the top producers of potassium nitrate. They hold an astounding 46% market share of this critical fertilizer component.

Revenues for the company in 2021 were up over 57% with net profits up over 300% year-over-year.

This company is one of my favorites in the space given their holdings in both lithium and chemical fertilizer production. A double play!

World economies are intertwined to the point that a single act can send ripples throughout the worldwide markets and put economies into a tailspin. The Ukraine invasion by Russia is a perfect example.

Fertilizers are a world market commodity subject to global supply & demand, resulting in market fluctuations.

We are now directly feeling the effects of rising commodity prices (specifically grains, fertilizers and oil/gas) due to tightened supply caused by a conflict located half a world away.

Intelligent investors know that they cannot sit idly by while their portfolios wither under the heat of high inflation. Investors should act swiftly and with purpose to protect their hard-won gains they have accumulated.

The fertilizer supply crisis is the time and place to move rapidly. Fertilizer prices will continue to go up, driving food prices and inflation to record highs. By investing in those companies that will benefit from this surge in prices, your portfolio will be shielded and could ride the wave as well.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.topcropmanager.com/the-role-of-fertilizer-in-growing-the-worlds-food-10387/

[2] https://www.axios.com/2022/05/06/fertilizer-prices-food-securtiy

[3] https://www.bloomberg.com/news/articles/2022-05-12/nutrien-weighs-increasing-potash-output-amid-fertilizer-crunch