A butterfly flapping its wings might not be able to cause a tornado in Florida, but could a credit crunch in Europe cause financial chaos in North America?

That’s a question that many investors will be asking themselves in the wake of a week that saw a dramatic shotgun wedding between Credit Suisse Group AG (NYSE: CS) and UBS Group AG (NYSE: UBS), Deutsche Bank Aktiengesellschaft’s (NYSE: DB) credit default swaps sharply rising, and the International Monetary Fund (IMF) warning of exceptionally high economic risks.[1]

While things have begun to stabilize as of the 27th of March, there are still some real questions hanging over the European banking system. Specifically, are we looking at the catalyst of another global banking crisis similar to the devastating 2008–2009 collapse? And if so, what can investors do about it?

Given that we’re talking about contamination, it’s worth looking at how high interest rates took down a series of American banks followed by a Swiss institution. It all began with the well-covered failure of Silicon Valley Bank (SVB), which has recently been acquired by First Citizens Bank (NASDAQ: FCNCA) as of March 27.[2]

The reasons for SVB’s demise have become pretty clear — executives at SVB had opted for a high-risk strategy that, when combined with its relatively insecure startup clientele, was not able to weather the Fed’s relentless interest rate rises. This forced the bank to sell a number of government bonds at a loss. This news broke on social media, investors panicked and rushed to withdraw their funds, and SVB ultimately folded.

It soon became clear that SVB was far from the only bank facing difficulties. They were quickly followed by the crypto-centric bank Signature, and then by a Swiss institution, Credit Suisse Group AG (NYSE: CS).

In the grand scheme of things, the SVB collapse was dramatic, but the bank had a highly concentrated depositor base. In comparison, Credit Suisse was a 162-year-old global institution that held almost double the assets of SVB — around 530 billion Swiss Francs (US$575 billion) — with diverse lines of business.[3]

This isn’t to say that Credit Suisse didn’t have its fair share of problems. The bank has struggled since the financial crisis, and actually lost $2.77 per share in 2022.[4] As with SVB, Credit Suisse has long been characterized by poor risk management, an aggressive culture, and questionable decision-making, including a US$5.5 billion loss on Archegos Capital in 2021 — the biggest trading loss in history.[5]

The ultimate collapse of Credit Suisse came about when the Saudi National Bank refused to invest more money in the group.[6] The Saudi National Bank had no choice in this matter as they couldn’t own more than 10% of the bank due to regulations. Unfortunately, the perception in the wider markets didn’t reflect this, and SVB faced the biggest fear of any bank: a bank run.

A bank run is one of the biggest challenges a bank can face. Depositors fear that their funds are under threat so they rush to withdraw money from their accounts. This leads to the bank needing to access liquid capital to give them their money.

If too many depositors do this at once, banks often lack the liquidity necessary to pay them out, and this can force them to take losses on certain assets, leading to a death spiral that ultimately ends in the bank’s failure. Ultimately, bank runs are all about a loss of consumer confidence, and they happen swiftly, often driven by negative news cycles.

To avoid this catastrophic outcome, the Swiss government forced UBS to acquire Credit Suisse for a fraction of its real world value.

While the collapse of Credit Suisse is a dramatic story in its own right, North American investors have been particularly angry about one specific aspect of the deal: the way that AT1 bondholders were wiped out. As part of the deal with UBS, the Swiss government wrote down the value of $17 billion AT1 bonds to zero.[7]

Why does this matter? Well AT1 bonds, also known as contingent convertibles, are designed to provide a shock absorber if a bank faces a capital crunch. These bonds are designed to convert into equity if a bank faces capital challenges in order to support a bank’s balance sheet and helps it to stay afloat. This carries some risk, so banks offer a high coupon to encourage investors to use them.

The key benefit of an AT1 bond is the fact that it is designed to be treated as more important than equity if a bank fails, and bondholders should be paid out before shareholders.

In the case of Credit Suisse, bondholders had the value of their bonds written down to zero, making them the only stakeholders to receive nothing. This has caused significant jitters on the AT1 bond market and has angered US bondholders to the point where legal action is being taken. It has also significantly undermined international perception of European bonds — although it should be noted that the European Central Bank and Bank of England quickly distanced themselves from this approach.

With that in mind, many investors in Europe have begun to look at Deutsche Bank, a company with €1.337 trillion (US$1.439 trillion) in assets, with apprehension. The number of credit default swaps (CDS) rose sharply before calm began to return on March 27 and on the back of a slew of news declaring that Deutsche Bank is “safe.”[8] Despite this, investors have been pouring their capital into money markets, and it seems that trust for the banking sector remains relatively low.

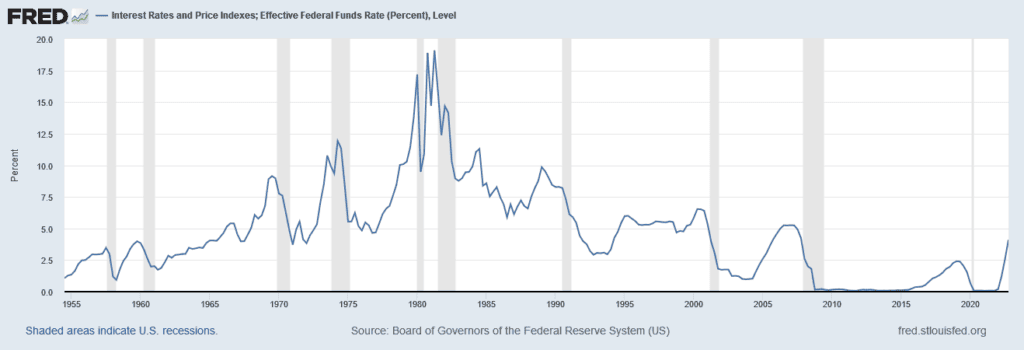

High interest rates are familiar to anyone over the age of 50 who will remember the 15%+ rates of the 80s, but for younger investors this is something new. The 2010s were defined by easy credit, and many younger investors and even companies were thoroughly unprepared for the relatively modest rate rises we’ve seen over the past two years.

This has led to a climate of relative fear that has been exacerbated by a social media led news cycle. While SVB and Credit Suisse may have been two very different beasts, they both fell victim to a bank run sparked by news spread on social media. Bank runs are always fundamentally about a loss of consumer confidence, and in the Twitter age, this can happen far more rapidly than it ever has in the past.

Social media allows news, true or false, to spread much more rapidly. The advent of banking apps also makes it far easier for depositors, particularly those based in more fintech-savvy jurisdictions, to instantly withdraw their deposits if they think something might be wrong.[9]

The main takeaway here is that a banking crisis in North America has already triggered one in Europe, and that the reverse could be just as likely. European banks have a heavy presence in North America, and North American investors should be watching what’s happening over the pond very carefully.

While we’re still in the “wait and see” phase, there are some immediate lessons that can be drawn, and specific things that North American investors can do. And just for the record, no, I don’t think you should be buying Bitcoin during an economic downturn — at least not yet anyway...

The US government’s handling of the SVB collapse was remarkably competent. Insurance schemes were swiftly put in place to guarantee deposits, startups didn’t experience a liquidity crunch, and employee payrolls went through on time. Unfortunately, the same cannot be said for how they handled the aftermath, particularly on March 23.

This particular drama involved two key figures: Jerome Powell, chairman of the Board of Governors of the Federal Reserve System, and Janet Yellen, the first female US Treasury Secretary. Generally both figures are considered to be competent economic stewards, but there was a messaging mismatch on March 23 that led to some market turmoil.

While Powell, to his credit, took an even-handed approach, Yellen threw something of a hand grenade when asked about expanding the federal guarantee for deposits over $250,000.

Yellen’s statement is not exactly unreasonable. [10] It would be madness for the government to agree to cover every deposit in the United States. However, it was not in lockstep with the “wait and see” tone taken by Powell, and it spooked markets who were rightly concerned about the fate of deposits in smaller regional banks in the US.

This, unfortunately, means that investors need to be careful about keeping large sums of money in uninsured accounts. Now might be the right moment to consider moving funds to larger banks or into other kinds of assets.

Which brings us to our next point: Where can you find those assets?

Let’s get the negative out of the way first — startups and startup-focused businesses are high-risk right now. SVB’s fall has left a huge hole in early-stage funding, and this has created big challenges for startup founders — to the point where certain VCs have been quietly suggesting that founders who have not yet identified a product-market fit should consider ending operations and return funding.[11]

This problem is going to be compounded by the fact that startups have doubled their debt-based financing over the last year, and without the likes of SVB and Credit Suisse, they may find it increasingly difficult to actually raise money that they need in today’s investment environment.[12]

So what does this mean? Well, for starters, tech companies may see some short-term struggles. The likes of Alphabet (NASDAQ: GOOG) and Apple (NASDAQ: APPL) will probably be fine, but investors may need to rethink any bets they have made on more risky stocks, particularly fintech.

Given that we’ve been discussing all the problems facing the banking sector, this take may feel a little surprising, but hear me out... Many banks, even those who don’t have the kind of systemic issues we saw at SVB or Credit Suisse, are trading at a discount and have strong long-term prospects.

The reasons for this are simple. While consumers may be concerned about the viability of smaller regional banks, or fintech players, they still have confidence in larger more “reputable” banks, which are well-positioned to receive their deposits. For example, at the height of the SVB collapse, Bank of America Corporation (NYSE: BAC) alone raked in around $15 billion in new deposits.[13]

The Bank of America (BoA) example is a particularly interesting one. Unlike many larger competitors, BoA has suffered the same sort of losses as most US regional banks. This has given it a really attractive price-to-earning ratio of around 8.83, compared to Wells Fargo & Company’s (NYSE: WFC) 11.87 or JPMorgan Chase & Co’s (NYSE: JPM) 10.55. However, investors should approach bank stocks with caution. There is no guarantee that we’ve hit the bottom yet, so you should keep a stop-loss in your back pocket just in case.

If you’re worried that bank stocks are too risky, there’s another option on the table…

While smaller financial institutions are struggling, those operating money market funds are booming. For those of you who don’t know, a money market fund is a type of mutual fund that invests in very liquid, near-term instruments like short-term US treasury bonds, cash, and other low-risk instruments. These are doing very well under a high-interest rate environment, and investors have piled around $286 billion into these funds in March.[14]

Money market funds are a good bet for any investor looking to get minor returns on their cash during periods of uncertainty and saw similar booms during the COVID-19 pandemic. There are a lot of options on the table. Generally, if you’re looking for funds that combine solid 7-day yields (right now anything above 4%) with a good expense ratio.

If you don’t have much to invest, you might look at something with no minimums like the Fidelity Money Market Fund (SPRXX), even if it has a relatively high expense ratio of 0.40%. If you’ve got deeper pockets, you should look at something like the Vanguard Federal Money Market Fund (VMFXX), which has an expense ratio of just 0.11%, or the Gabelli US Treasury Money Market Fund (GABXX), which has an expense ratio of 0.08%.

Whichever fund you choose, keep in mind that money market funds are considered low-risk but are not FDIC insured, so make sure you trust the provider. Big names are usually safer, but as the 2008–2009 financial crisis shows, there are no guarantees.

There’s a lot of conflicting analysis out there right now, and the truth is that the only right approach for the moment is to “wait and see.” Yes, banks are generally in better shape than they were during the 2008–2009 financial crisis; yes, governments seem to be willing to take proactive action; and yes, it seems likely that any continuation of interest rate increases will pause or reverse this year, but there are no guarantees.

I believe investors should begin to look for ways to protect their assets if the situation worsens, and keeping an eye on what is happening in Europe now could help North American investors see early warning signs if things begin to turn sour.

You should keep an eye out for any wobbles in larger European institutions, particularly those with a presence in the United States. If this happens, you will almost certainly see ripples in the North American markets, and it will give you time to put a plan into place to move your assets into safe harbors.

As always, please use my analysis as a jumping-off point for your own research, and subscribe to FNN for further in-depth financial breakdowns about emerging investment topics.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.ft.com/content/a74f05d7-3894-4ca6-88ae-cdedfa8172df

[2] https://www.nytimes.com/2023/03/27/business/silicon-valley-bank-first-citizens.html

[3] https://www.barrons.com/articles/credit-suisse-svb-banking-crisis-3faac588

[4]https://www.barrons.com/articles/credit-suisse-svb-banking-crisis-3faac588

[5] https://www.ft.com/content/ef996142-e5dd-45ae-9008-fc4cbd8c291d

[6] https://www.ft.com/content/0324c5a6-cecd-4fb3-85b3-7cdc99a33e4e

[7] https://www.ft.com/content/e02925dc-26af-4142-88f2-fa8af23d8f08

[8] https://www.bloomberg.com/news/articles/2023-03-24/scholz-says-deutsche-bank-very-profitable-no-need-for-concern

[9] https://www.cnbc.com/2023/03/27/the-first-bank-crisis-of-the-twitter-generation-the-pressure-on-banks-is-very-different-to-2008.html

[10] https://www.ft.com/content/a4ed406e-d0ba-4027-8029-700e94393ac8

[11] https://www.nytimes.com/2023/03/27/business/silicon-valley-bank-first-citizens.html

[12] https://news.crunchbase.com/venture/credit-suisse-startup-investments/

[13]https://www.bloomberg.com/news/articles/2023-03-15/bofa-gets-more-than-15-billion-in-deposits-after-svb-failure

[14] https://www.ft.com/content/032523bc-3b92-4b94-b6b8-ebbe1d606b2c