If the top risks to the world right now are climate change and geo-political conflict, the growth of nuclear energy in both America and China is essential.

Nuclear energy is virtually emissions-free energy. It takes up very little land, consumes very little fuel, greatly contributes to fuel diversification and the stability of the overall energy grid, creates skilled well-paid jobs, and produces very little waste. It‘s the technology that solves both energy poverty and climate change.

Then there is the all-important issue of reliability. Nuclear power plants on average operate at full power on 336 out of 365 days per year.

Hydroelectric systems deliver power on average 138 days per year, wind turbines 127 days per year and solar electricity only 92 days per year. Even plants powered with coal or natural gas only generate electricity about half the time for various reasons.

Nuclear power is a clear leader on reliability. No wonder nuclear power accounts for 70% of France’s electricity mix and 30% for Switzerland, South Korea and Sweden.

In the public’s perception, there are two issues with nuclear power: the risk of accidents, and the question of disposal of nuclear waste. There have been three large-scale accidents involving nuclear power reactors since the onset of commercial nuclear power in the mid-1950s: Three-Mile Island in Pennsylvania (1979), Chernobyl in Ukraine (1986), and Fukushima in Japan (2011). These incidents all represent old technology.

Nuclear waste disposal, although a continuing political problem in the US, is not any longer a technological problem.

More than 90% of spent fuel could be recycled to extend nuclear power production by hundreds of years, and can be stored safely in impenetrable concrete-and-steel dry casks on the grounds of operating reactors, its radiation slowly declining. Price and performance are the key factors, and advanced nuclear energy is cheaper than coal and more dependable than solar or wind.

In addition, the cumulative reductions in CO2 emissions due to nuclear energy are meaningful as the following IEA chart indicates.[1]

The United States has long led the world in developing nuclear energy technologies, providing about 30% of global nuclear energy production and 52% of America’s carbon-free electricity in 2020, according to the Department of Energy, even though American commercial nuclear development has markedly slowed.

China has made significant progress on molten salt reactors, which are powered by liquid thorium rather than uranium. They are safer than traditional reactors because in the event of a leak, the molten thorium would cool and solidify quickly, dispersing less radiation into the environment. Thorium reactors also do not need water for cooling, allowing systems to be built in remote desert regions.

If this progress on the technological front continues, we could face a world where China and Russia become preeminent in nuclear science and technology. Both of these countries have well-financed programs to develop the next generation of advanced, non-light water reactor concepts, many of which were first demonstrated decades ago in American national laboratories. Dominance in new technologies will mean control of the rules and export markets. China plans at least 150 new reactors over the next fifteen years.

There is another angle and that is increased nuclear energy in the world’s electricity mix weakens the hand of China’s de facto ally Russia.

For example, the Ukraine situation would be much easier to handle if Europe, and in particular Germany, had not made the decision to close all of its nuclear reactors by the end of 2022 making it so dependent of Russia’s natural gas.

Throughout most of the 2000s, American nuclear power plants were highly profitable since their capital costs had been largely amortized over previous decades, and their production costs were low compared to the relatively high cost of fossil and renewable alternatives.

The situation changed around 2007, when inexpensive shale natural gas became available, and the global financial crisis led to lower electricity demand and prices. Since then, nuclear power plants in the United States have become less profitable, and the industry has experienced a series of plant closures for older facilities.

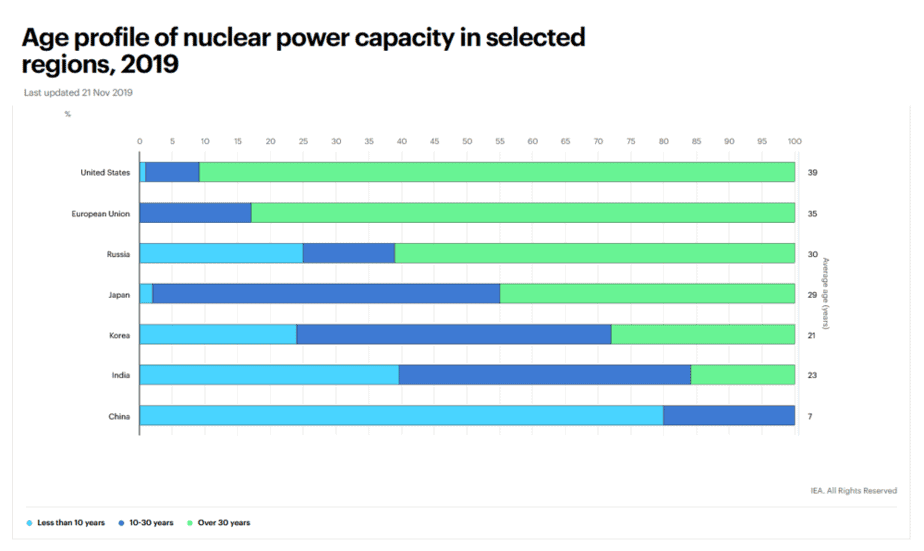

However, the nuclear fleet in advanced economies is 35 years old on average, and many plants are nearing the end of their designed lifetimes. With advancing age, plants are beginning to close. With 25% of existing nuclear capacity in advanced economies, many will probably shut down by 2025. This is coming quickly.

It is considerably cheaper to extend the life of a reactor than build a new plant, and costs of extensions are competitive with other clean energy options, including new solar and wind projects. Nevertheless they still represent a substantial capital investment. The estimated cost of extending the operational life of 1 Gigawatt of nuclear capacity for at least 10 years ranges from $500 million to just over $1 billion depending on the condition of the nuclear site.

America and China are at opposite ends of the spectrum when it comes to average age of nuclear energy facilities. China’s edge in terms of efficiency and cost are highlighted by this IEA graph.[2]

Nevertheless, there are significant American beachheads to support and validate the expansion of nuclear energy. For example, for Duke Energy (NYSE: DUK), 40% of the electricity the company produces comes from nuclear power. America has 94 reactors that generate about 20% of our electricity but we have not built one new plant in the last 25 years.

In the US and Europe, where productivity at construction sites has been low, we need expanded use of factory production to take advantage of the manufacturing sector’s higher productivity when it comes to turning out complex systems, structures, and components. This includes modular construction in factories and shipyards, high-strength reinforcement steel, as well as ultra-high performance concrete. All of these could have positive impacts on the cost and schedule of new nuclear power plant construction.

Jack Devanney is the principal engineer and architect of the ThorCon molten salt reactor power project in Indonesia. Since 2011, he has pursued his idea of using shipyard construction technology to mass-produce safe, inexpensive power plants that can bring the benefits of electricity to the world, with no CO2 emissions. Devanney has married the advanced nuclear technology developed by America’s Oak Ridge Laboratory with his own engineering experience with ships, power plants, and energy.[3]

The US Navy has a long and impressive history with nuclear technology and the future of the nuclear Navy is secure. It has its own design and research laboratories, supports its own extensive computing capabilities, and trains its own operators. While any expansion of nuclear technology in America should be commercially led, the Navy could support the development of human capital in the nuclear field by expanding cooperation with universities and industry.

The Biden Administration included nuclear power in its clean energy plan. The American Nuclear Infrastructure Act, introduced last June, seeks to expand America’s nuclear energy sector, and the US Department of Energy is allocating $61 million in nuclear R&D projects across America.[4]

Now let’s turn to a number of initiatives and investment options for those wanting to capture the potential growth of nuclear energy.

Wyoming Governor Mark Gordon announced in June 2021 that a next-generation nuclear power plant would be built at a soon-to-be-retired coal-fired plant. The project is a joint initiative of PacifiCorp (PPWLM) and Bill Gates’s TerraPower and GE Hitachi.

The project includes a 345-megawatt sodium-cooled fast reactor with a molten salt-based energy storage system, which would produce enough power for roughly 250,000 homes. The storage technology is also able to boost output to 500 megawatts of power for about five and a half hours, which is equivalent to the energy needed to power around 400,000 homes, according to TerraPower.[5]

Governor Gordon said the pilot project, called Natrium, doesn’t mean he is running away from Wyoming’s fossil fuel industry, which he called “the bedrock of our economy.”

Other American companies such as BWX Technologies (NYSE: BWXT), Westinghouse (private), X-energy (private), and UltraSafe Nuclear (private) are all working on new concepts, such as the advanced small modular reactor (SMR) design being marketed by NuScale, a sodium fast reactor, and a modular high temperature gas-cooled reactor.

BWX Technologies, Inc. (NYSE: BWXT) manufactures and sells nuclear components in the United States, Canada, and internationally. Its Nuclear Operations Group segment offers nuclear components, reactors, assemblies, and fuel for the United States Department of Energy/National Nuclear Security Administration's Naval Nuclear Propulsion Program. Its stock trades at about 17 times 2021 earnings with a return on equity of 45%.

NuScale (private) is developing a small reactor that is capable of generating 77 megawatts of electricity and is in the midst of the US Nuclear Regulatory Commission’s licensing process. The first customer for the NuScale design is Utah Associated Municipal Power Systems, which has plans to commission a plant in Idaho by 2027. NuScale has announced plans to go public through a reverse merger with a Special Purpose Acquisition Company or SPAC.

On the exchange-traded fund (ETF) front, take a look at the VanEck Uranium+Nuclear Energy ETF (NYSE: NLR). Launched in 2007, this ETF has 26 holdings and mostly invests in US and Japanese utilities companies. Its top three holdings are Duke Energy (NYSE: DUK), Dominion Energy (NYSE: D), and Exelon Corp (NASDAQ: EXC). Because of its overexposure to utilities, NLR underperformed its peers.

Speaking of Exelon Corp., on February 1, 2022, Exelon split into two companies. One will retain the Exelon name and operate regulated portions of the old company in electricity transmission and distribution. The other company is Constellation Energy Corp. (NASDAQ: CEG), which will be the owner and operator of what used to be Exelon’s generating fleet. The large majority of that fleet is clean nuclear power plants.

Finally, another way to play the growth of nuclear energy is through uranium miners. Cameco (NYSE: CCJ) is the most high-profile and was up a stunning 66% in 2021.

Based in Saskatoon, Saskatchewan, Canada, Cameco is the largest publicly traded uranium company. It owns uranium mines worldwide, including in Canada, Kazakhstan, and Australia. An alternative is NexGen Energy (NYSE: NXE), a stock that was up 59% in 2021.

An interesting alternative that is a bit more speculative is Alpha Lithium Corp, (OTC US: APHLF / TSX-V: ALLI), a lithium and uranium play with properties in Argentina including a $30 million Uranium One investment in the Argentina Tolillar Project.[6]

Uranium One Group, one of an international group of companies all wholly owned subsidiaries of the Russian State Atomic Energy Corporation, better known as Rosatom, manages one of the world's largest uranium mining holdings.

Uranium One's wholly owned subsidiary Uranium One Holding N.V. has agreed to invest $30 million in exchange for a 15% ownership of Alpha One Lithium, with Alpha Lithium holding the balance of 85% and retaining full control of Tolillar, management, and the board and will be responsible for deploying the invested capital.

The transaction, when closed, is expected to leave Alpha Lithium with approximately $45 million in cash, to fund the expansion and development efforts on its nearby Salar del Hombre Muerto, where the company continues to expand its 5,000+ hectare foothold in one of the world's highest quality and longest producing lithium projects.

Aside from investment opportunities, the development of safer nuclear energy projects in America and the rest of the world will be crucial in fighting climate change. Both America and China can create carbon-free electricity by ramping up modern, secure, nuclear energy.

If you are concerned about climate change, you should be a supporter of increasing nuclear power from the current 20% of America’s electricity generation to 30% by 2030.

Carl Delfeld, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.iea.org/data-and-statistics/charts/cumulative-co2-emissions-avoided-by-global-nuclear-power-in-selected-countries-1971-2018

[2] https://www.iea.org/data-and-statistics/charts/age-profile-of-nuclear-power-capacity-in-selected-regions-2019

[3] Why Nuclear Power Has Been a Flop, Jack Devanney, BookBaby, 2020

[4] The Top 4 Uranium ETFs: Invest in Nuclear Power, SustainFi, Updated December 29, 2021, https://sustainfi.com/articles/investing/invest-in-nuclear-power/

[5] Bill Gates' TerraPower to build $4 billion nuclear power plant at Wyoming coal site, https://news.yahoo.com/bill-gates-terrapower-build-4-062833314.html

[6] InvestmentPitch Media Video Discusses Alpha Lithium's Securing of US$30 Million Investment from Uranium One with Right to Invest Additional US$185 Million at Tolillar Salar, Argentina, https://finance.yahoo.com/news/investmentpitch-media-video-discusses-alpha-080500942.html

- Nuclear Power in a Clean Energy System, May, 2019, IEA Report (International Energy Association), https://www.iea.org/reports/nuclear-power-in-a-clean-energy-system

- Investing to Stop Climate Change Is Trickier Than It Seems, Wall Street Journal, James Mackintosh, https://www.wsj.com/articles/investing-to-stop-climate-change-is-trickier-than-it-seems-11643214062?mod=wsjhp_columnists_pos1

https://www.amazon.com/author/powerrivals