Observers who witnessed the questionable demise of the cannabis space will likely view psychedelics with a skeptical eye, but they could not be more wrong.

America is facing a mounting mental health crisis, and more studies are showing that psychedelics therapies could be the solution.

And this means this could be the ultimate entry point for investors looking to enter the psychedelics space. To understand why, let’s take a look at the state of mental health in America, and what is happening in psychedelics in general.

2020 was a difficult year for many of us, with nearly 1 in 5 adults confirming that their mental health is worse now compared to 2019 — and the main reason appears to be stress.[1]

The American Psychological Association is concerned that the U.S. is "facing a national mental health crisis that could yield serious health and social consequences for years to come."

With 46% of Americans exhibiting signs of at least one mental illness, we need to take this warning very seriously.[2]

Traditional mental health solutions aren’t enough. There is still a phenomenon of patients being “diagnosed, drugged, and discarded.” This is particularly true for difficult-to-treat mental illnesses such as schizophrenia or treatment-resistant depression.[3],[4]

Poor understanding of these illnesses often leads to doctors prescribing generic treatments which may not be suited or based on an individual patient's needs.

Indeed the shift for treatment by what could be previously classified as traditional drugs has led to a 400% increase in the rate of antidepressant use, despite there being very real concerns about the actual utility of drugs like prozac and the long list of side effects.[5],[6]

To make matters worse, many major pharmaceutical companies have pulled out of the psychiatric medical field following the release of Prozac findings. This lack of innovation has left a huge gap in the market.[7]

The lack of interest from big pharma has opened up room for smaller biotech and key medical or health-focused companies. The most promising advancements are in the field of psychedelics. A number of these studies are full-blown clinical trials and are typically focused around three varieties of psychedelics:

Clinical trials into psychedelic based treatments are still in their infancy but the results so far are promising. For example a study with John Hopkins University has found that administration of psilocybin (colloquially known as magic mushrooms) combined with supportive psychotherapy was able to help significantly reduce major depression.[9]

The study was a follow-up of an earlier study showing that psilocybin could help treat anxiety and depression for people with cancer diagnosis. These findings are so important, with many Americans suffering during this unprecedented COVID time.

One of the big problems for the recreational cannabis sector was the regulations themselves. Canada was an early mover but the roll-out was plagued by supply problems that forced users back into the black and grey markets.[10]

In addition, over-investment in production meant that companies were forced to sell their cannabis for significantly less than hoped for, creating an unpleasant problem for many producers.

Psychedelics are different. Governments have begun to abandon the war on drugs, and the medical evidence behind the efficacy of psychedelics in various treatments is arguably stronger than it was for cannabis. This is part of the reason that Health Canada has announced its intention to adjust the Special Access Programme (SAP) to allow certain authorized uses of psilocybin-assisted psycho-therapeutic treatments.[11]

That being said, there are still barriers. Outside of Oregon, which has legalized many varieties of drugs, it is illegal to receive most forms of psychedelics, with the notable exception of ketamine. This means that the available space for companies to operate is necessarily limited, but companies are still jockeying to establish an early foothold.

Private companies innovate faster than governments can legislate, and there is already significant movement in the psychedelics space.[12] For the moment, the bulk of this is focused on either treatment using ketamine, which is legal, or on the race to patent psychedelic treatments prior to their legalization.

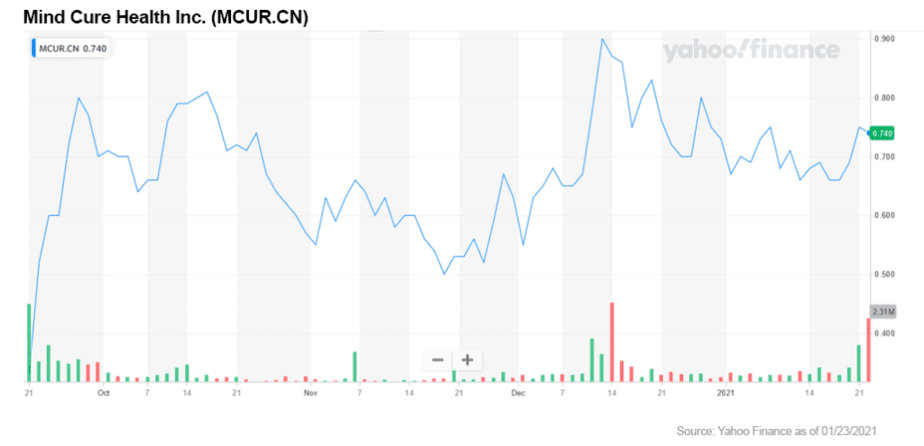

One of the interesting companies in the latter camp is Mind Cure Health, Inc. (OTCQB: MCURF / CSE: MCUR). The company’s self proclaimed aim is to identify, develop, and commercialize products that enhance mental wellness.

The company has announced a number of deals in December, including the roll-out of its nootropic product lines.[13]

Recently, they announced a CAD$20 million (approx US$15 million) bought deal financing, which demonstrates the early enthusiasm surrounding the psychedelics space. This, even as a potential breakout in science or business has not yet materialized. The stock continues to trade volume under a dollar.[14]

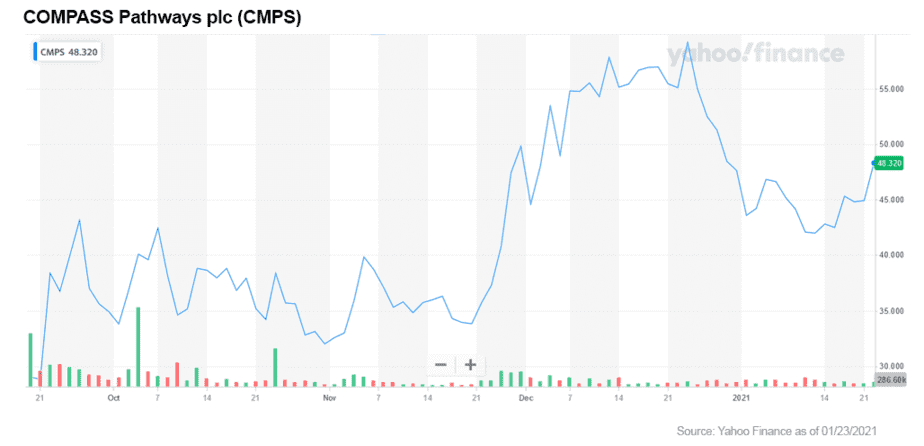

This stands in sharp contrast to one of the high flyers in the psychedelics space, COMPASS Pathways plc (NASDAQ: CMPS). The company completed its IPO in November 2020 and has gone from $17 to an impressive $48, with a market cap of approximately $1.599 billion. The company has done well enough that it landed on numerous stock watch lists — but is it justified?

The company’s financial results announced in November 2020 can help to shed some light.[15] In the positive, it is continuing with its phase IIb clinical trial of COMP360 psilocybin therapy for treatment-resistant depression, and has opened a new site in Berlin, bringing their research to a total of 21 sites in 10 countries. COMPASS was additionally able to secure a handful of patents in Britain and Germany.[16]

The company has also been able to increase its cash holdings to $196.5 million but there’s just one problem — it's not making money. The company’s losses in the 3rd quarter were $16.7 million, or $1.30 per share once share-based compensation was accounted for.

Admittedly the bulk of these outflows were down to R&D expenses, but it becomes difficult to justify the stock’s value without some kind of immediate incoming cash or dealflow. This same problem can be seen with a variety of other companies in the psychedelics sector, and it should concern investors.

However, as someone with an overstacked crypto portfolio, I fully appreciate the appeal of a moonshot. For psychedelics investors, there is the rarest of opportunities — a sustainable shot at a stock with a chance of going to the moon.

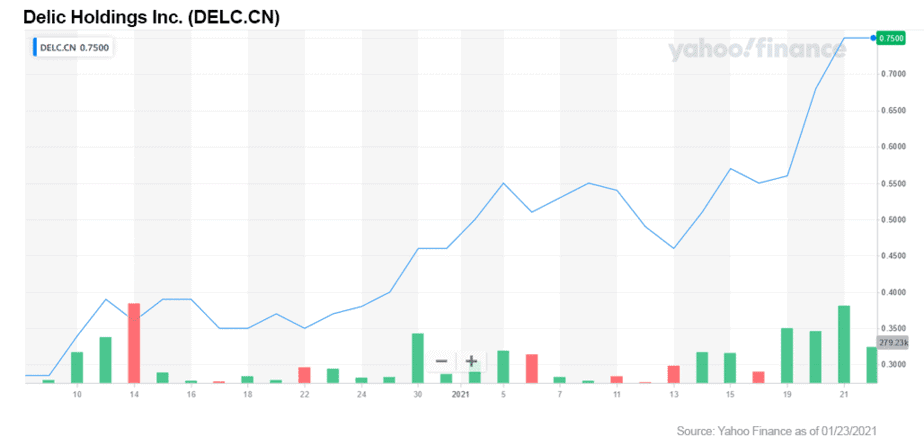

I think it's time to properly introduce you to Delic Holdings Inc (OTCQB: DELCF / CSE: DELC). Delic is the only publicly traded company focusing on psychedelics education with what I believe to be a meaningful roll-up strategy moving forward.

There is one common denominator between all psychedelics: the uninformed public perception is negatively associated with recreational use, not medical. This is a major potential barrier for adoption. Thankfully the cannabis market has helped to build a blueprint for how we can normalize potentially helpful medicinal drugs, and Delic (OTCQB: DELCF / CSE: DELC) could hold the key to unlocking the industry.

Rather than focusing on building out early stage treatments, DELC is laying the foundation of public information necessary for the psychedelics sector to thrive. The cornerstone of this effort is education of consumers and regulators alike.

The company has founded 3 platforms with a combined reach of more than 100 thousand active users each month, and one flagship event:

Delic’s media assets will form the foundation of the company’s push into the psychedelics space, but they are just the first piece of the puzzle. The company’s real strength lies in its highly experienced team.

WATCH VIDEO: First Glance with Jody Vance talks to Delic’s management team

The founders, Matt and Jackee Stang, both come from the leadership team of High Times. They understand how to build a brand that appeals to the same demographic that is interested in participating in the psychedelics space. This also explains the company’s strong presence in social media and the high quality of their media assets.

In terms of directors, the company has the former President and CEO of Cronos Group (NASDAQ: CRON / TSX: CRON) and has a varied advisory board. Why does a media company need this kind of talent? Because Delic is much more than just a media company.

As the company builds out its media presence, it will simultaneously curate a basket of acquisitions and investments in the psychedelics space. These assets will benefit from Delic’s considerable media and marketing presence, and it will enable Delic to leave its own stamp on the direction of the space.

The only thing Delic is missing is deals, and those will come. Acquisitions will come! This has been mandated by the Delic team.

With all this in mind, how does Delic (OTCQB: DELCF / CSE: DELC) compare to say, COMPASS Pathways plc (NASDAQ: CMPS)? With a market cap of just over $20 million, it looks like a battle between David and Goliath. I am comfortable saying that Delic may turn out to be the stronger of the two, at least when it comes to investor returns when looking at the future investment cycle of newly emerging investment cycles.

The main reason I say this is that Delic hasn’t had the same rush of capital that COMPASS Pathways has. This means that the stock price is still undervalued enough that retail investors can get involved without the risk of being left holding the bag down the line.

As the company announces more deals, and eventual acquisitions, this will help to provide impetus that will increase the stock's price and overall value to the market.

Most importantly, Delic’s hands aren’t tied by government regulations. While COMPASS Pathways or Mind Cure Health will have to wait for new treatments to be legalized before making money, Delic can do it now.

It is possible for Delic to immediately begin monetizing its media assets, while simultaneously building a solid platform to support and grow the acquisition of psychedelics companies, and Delic’s future valuation, once legislation catches up with the science.

In short, Delic Holdings Inc (OTCQB: DELCF / CSE: DELC) is a unique opportunity for investors interested in the psychedelics sector. It is an undervalued company, capable of immediately monetizing its existing assets. In addition it has a highly talented team with experience from the early days of the cannabis market and significant media experience. This all positions it to be possibly one of the best ways to gain exposure to what will undoubtedly become a dynamic investment sector.

Summary:

To my eye it seems that psychedelics is still an overlooked sector. This means that there is a small window of opportunity for investors to get in before everyone else catches on. This is the right moment to start doing your own due diligence and looking deeper into Delic and other offerings in the field to see if the psychedelics space, and Delic, is an opportunity you want to grab.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.apa.org/news/press/releases/2020/10/stress-mental-health-crisis

[2] https://pubmed.ncbi.nlm.nih.gov/15939837/

[3] https://www.ted.com/talks/eleanor_longden_the_voices_in_my_head

[4] https://www.mayoclinic.org/diseases-conditions/depression/in-depth/treatment-resistant-depression/art-20044324

[5] https://www.nybooks.com/articles/2011/06/23/epidemic-mental-illness-why/

[6] https://www.webmd.com/depression/features/coping-with-side-effects-of-depression-treatment#1

[7] https://www.theguardian.com/society/2016/jan/27/prozac-next-psychiatric-wonder-drug-research-medicine-mental-illness

[8] https://www.livescience.com/psilocybin-depression-breakthrough-therapy.html

[9] https://www.hopkinsmedicine.org/news/newsroom/news-releases/psychedelic-treatment-with-psilocybin-relieves-major-depression-study-shows

[10] https://www.bbc.com/news/world-us-canada-46200873

[11] https://www.lexology.com/library/detail.aspx?g=de954df3-cd8d-4282-907c-f523d381ad10

[12] https://www.psyindex.com

[13] https://finance.yahoo.com/news/mind-cure-announces-retail-roll-083000012.html

[14] https://www.stockwatch.com/News/Item?bid=Z-C:MCUR-3020677&symbol=MCUR®ion=C

[15] https://ir.compasspathways.com/news-releases/news-release-details/compass-pathways-plc-announces-financial-results-third-quarter

[16] https://compasspathways.com/compass-pathways-news-december-2020-issue/

[17] https://realitysandwich.com/about/

[18] https://finance.yahoo.com/news/tmx-group-last-mile-holdings-222400376.html

[19] https://podcasts.apple.com/us/podcast/delic-radio/id1349473577

[20] https://thedelic.com/

[21] https://meetdelic.com/