One can debate the political tactics but the idea of purchasing Greenland may be just the kind of big thinking America needs in this new age of US-China rivalry.

But the mass media makes light of the idea just as it seems to think that the US-China rivalry began last month or last year...

We need a sense of history to realize that the rivalry actually goes back 235 years to the very beginning of the American story when China was the largest economy in the world and America was at best a frontier market.

Just five months after the Treaty of Paris was inked formally ending the Revolutionary War, the Empress of China set sail from New York heading to Canton, China with a cargo of 2,000 animal skins, $20,000 silver dollars and 250 casks of ginseng.

Eighteen months later it returned to America laden with silk, tea, and porcelain table sets — one of which was purchased by none other than George Washington.

Robert Morris — a wealthy and influential trader and merchant who played a key role as the financier of the American Revolution — led a syndicate of intrepid investors that backed this venture.

As America moved with confidence into the 19th century, it became one of the most successful emerging markets of all time.

In the four decades from 1860 to 1900, its share of global manufacturing went from 7% to over 25%, as it became the world’s largest manufacturer.

In 1870, the size of the American economy eclipsed China and by 1890, America became the largest economy in the world

While America’s drive to the Far East began with the lucrative China trade in the 1780s, it was President Lincoln’s Secretary of State — William Henry Seward — who began a chain of events that enabled America to become a Pacific power.

Seward purchased Alaska as a gateway to Asia from tsarist Russia for $7.2 million, negotiated a commercial reciprocity treaty with Hawaii, built a transcontinental railway across the Rockies, and gained access to the Pacific by completing the Panama Canal.

Keep in mind that for most of American history, US foreign policy has been centered on economics. “Our plan is commerce,” declared Thomas Paine, the revolution’s leading pamphleteer.

Seward strived to build a global infrastructure for American commerce and to secure control of maritime bases from which our commercial influence could be projected. Economic diplomacy and statecraft, rather than conflict, was the preferred strategy.

Throughout his distinguished career, Seward argued and acted to support an energetic economic diplomacy to promote American interests in the Pacific — and that commerce was the key to global influence.

From Alexander Hamilton to William Seward to John Hay to James A. Baker III, our best chief diplomats and Treasury Secretaries have understood that economic statecraft — commercial, financial, humanitarian — should be at the center of our foreign policy agenda of safeguarding and advancing American interests.

Unfortunately, in the last three decades, American economic diplomacy has been at best, reactive, naïve and almost always subordinate to perceived security interests.

Policymakers have yielded to near-term corporate interests embracing free markets without any sort of comprehensive blueprint to protect and advance American national interests.

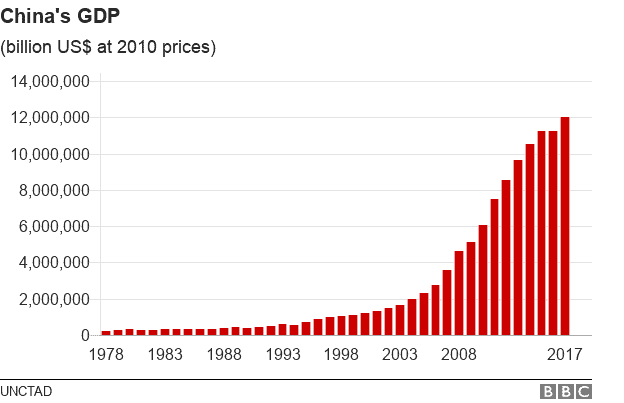

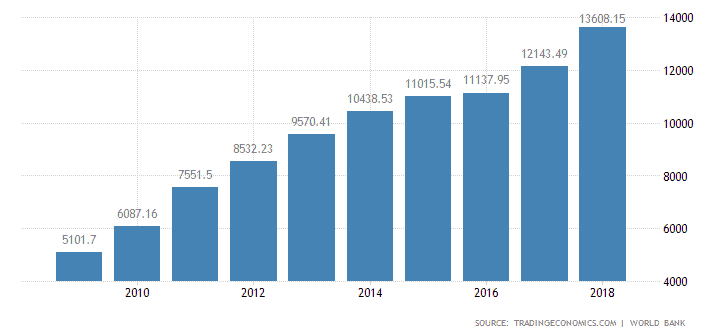

Meanwhile, in the last four decades since China opened up to the world in 1979, China has become the most successful emerging market in history.

In 1979, China’s economy represented just 10% of America’s GDP but its awakening led to China’s remarkable resurgence as it followed the top down mercantilist Asia model of development established by Japan, Taiwan, Hong Kong and South Korea.

The size of China’s economy is now approaching parity with America.

China’s total exports for the year in 1979 are now equal to China’s exports in one day.

And China became the world’s largest manufacturer in 2010 — ending America’s 110-year reign.

China, for all its weaknesses, is clearly now a peer competitor to America on the economic front and beyond...

America’s complacency in the wake of this challenge has to change since the 21st century - oftentimes referred to as the Pacific century — is one of immense opportunity if America centers its attention and resources on the Indo Pacific region.

The stakes could not be higher since the region reaching across the Indian Ocean through the Straits of Malacca all the way to the Sea of Japan is now home to several rising, contending powers such as China and India.

New strategic balances are emerging creating friction, tension and disputes as well as opportunities. American diplomacy and business can play a critical role as leader, balancer and mediator in the age of US-China rivalry.

This is where the world’s center of economic and innovation is shifting, where our strongest partners and competitors are based amidst rising “state capitalism,” and where our destiny as the world’s leading power will be either confirmed or upended.

And make no mistake, China is taking dead aim at becoming the hegemonic power in Asia, and is displacing America as the leading economic power in the world.

Investors need to be alert to new risks and at the same time, giant opportunities as America and China both use hardball tactics to protect their interests.

First, let’s take a look at China’s goals.

China’s strategy to outcompete America has three arrows.

1) Disrupt America’s stock market and financial system

China’s Mandarins often refer to America’s political and economic system with the phrase “moneybags democracy.”

They realize that they can create leverage and pain by disrupting the flow and value of money into stocks and other investments.

This is why since 2016, Chinese direct investment into the US has plummeted and why they time announcements for maximum impact on our stock market.

They also understand that they can deliver a devastating blow to America if they are able to disrupt and undermine US stock markets.

2) Leverage dominant position in rare metals and rare earths to capture global technology markets

The United States and China are increasingly competing for the commanding heights of global technology markets.

And it has a secret weapon that it has cultivated over the past three decades.

Let me explain…

One of my favorite books is Daniel Yergin’s riveting tale of the major role oil played in the 20th century, The Prize: The Epic Quest for Oil, Money & Power.

Oil not only powered the economy, it also played a pivotal role in the century’s statecraft. But the following sentence in the book’s prologue really caught my eye.

“As we look toward the 21st century, it is clear that mastery will certainly come as much from a computer chip as from a barrel of oil.”

But what’s behind the computer chip and advanced technology that forms the backbone for so much that we take for granted in modern life?

The answer is rare strategic metals and, in particular, an important subset called rare earths. These vital ingredients are critical to economic growth and advancement of technology.

They are also invisibly intertwined with national economic strategies, geo-politics, wealth and power. Today’s investors are not paying attention this.

Rare earths are the special ingredients in the age of industry and technology. Like yeast in making bread and wine, they are required in small quantities in all sorts of products from cell phones to advanced weapons systems, aircraft engines, robots and hybrid batteries.

The real value of these metals is their unique thermal, electrical, optical and magnetic properties for which there are no substitutes. This allows for miniaturization and much lighter, stronger, resilient, and efficient components. Advancements in making anything smaller, faster and better depends on these materials.

Since the 1990s, China has become the Saudi Arabia of rare earths as the country’s favorable geology, low cost labor and lax environmental standards allowed it to produce about 85% of the world’s production. While China’s near monopoly is reason alone to raise concern, believe it when I say… China has used its power to influence international affairs.

China accounts for 85% of global rare earth production and is using this leverage to keep more of these rare earths at home and may cut back production or limit these exports to gain a strategic edge.

To discover more about rare earths, click here to read my article.

3) Displace the US Dollar as the World’s Reserve Currency

China’s third goal is much more ambitious but more difficult to execute — weakening the value of the US dollar and ending the dollar’s reign as the reserve currency of the world.

Given that the value of the US dollar has been historically strong, this might seem to be an impossible task — but the Chinese are looking ahead and seeing $1 trillion annual budget deficits and sense an opportunity.

Let’s begin by looking at what characteristics makes a durable reserve currency:

Strong, Stable Currency with Ample Liquidity

Its currency should demonstrate deep liquidity so that investors can move in and out of it without sharp movements in price. It needs to be widely recognized as a reserve currency.

Financial & Political Stability

The fiscal discipline and political stability of the country needs to be unquestioned. Countries with large fiscal deficits are unable to be dependable safe havens since the path of least resistance is to devalue the currency to make debt loads more manageable.

Market-Based, Rules-Driven, Open Economy

Investors and trading partners thrive best in a market-oriented economy where the rules are clear and transparent. Faith in the fairness of the judicial system and institutions is vitally important.

Looking at the above characteristics of a reserve currency report card, you’re probably thinking that the US dollar looks pretty good with the glaring and important exception of fiscal discipline.

But China may be thinking they have a way to leapfrog ahead by going back in time — to GOLD.

China has always valued cold, hard precious metals as a store of value and medium of exchange.

According to Bloomberg, China bought nearly 10 tons of gold in July 2019, marking the eighth consecutive month the country increased its reserves.

The purchase is another signal from China that it's gearing up for a prolonged trade conflict with the US.

Gold serves as a historic safe-haven investment, and its price typically rises when markets and other currencies see increased volatility or prolonged weakness. China is likely buying gold to diversify its holdings away from the US dollar and hedge against harm from the trade war.

China now holds about 1,945 tons of gold, according to data from the People's Bank of China. The sum is worth approximately $93.4 billion at current prices. The country has added about 94 tons of gold to its reserves in the past eight months!

While it would take some time, a real blockbuster killer move by China would be to somehow back its currency with gold or silver.

Either way, the recent uptrend in gold prices is no accident and should attract investors serious attention and action.

Gold bullion or coins are a good way to go but the next best thing are ETFs that are backed by physical bullion like the Sprott Physical Gold Trust (NYSE: PHYS) and the VanEck Merk Gold Trust (NYSE: OUNZ).

For gold stocks, I would start with the leading Barrick Corporation (NYSE: GOLD / TSX: ABX).

Barrick is the king as the world’s most profitable gold company, with five of the ten largest gold mines in the world. Its stock is in a strong uptrend, supported by a strong balance sheet and increases in production in part due to its acquisition of Randgold and a joint venture with Newmont in Nevada.

Newmont Goldcorp (NYSE: NEM / TSX: NGT) is another solid idea that has lagged the market a bit since two of the world’s largest gold companies merged earlier this year, creating Newmont Goldcorp.

This is a longer-term play since it will take some time for the two companies to reap cost savings and bring production and shipments up to expectations.

Bottom line: investors right now can profit from the age of US-China rivalry by following the Chinese to… GOLD!

Carl Delfeld, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

Bloomberg, Robert Morris: Financier of the American Revolution, Charles Rappleye, Yahoo Finance, The Prize: The Epic Quest for Oil, Money & Power, Daniel Yergin, China & Buying Gold, Armstrong Economics.