In February, I discussed the role of China, rare metals and rare earths. You can read my article here.

Since then, one of the stocks I profiled, Lynas Corporation (OTC: LYSCF, ASX: LYC), has soared.

But that’s not all that’s changed.

The China-US high-tech cold war has moved into overdrive.

Finally, what I’ve been writing about for the past two years is hitting most investors. That what many thought was just a trade dispute, is something much larger and more enduring.

It is a full-blown US-China economic cold war.

President Trump and his team are focusing in on technology, with China’s Huawei with a target on its back.

And recently, 40 world leaders joined Chinese President Xi Jinping for the second international gathering on Belt and Road Initiative to build a massive network of ports, roads and railways across some 65 countries.

China clearly is digging in, and has signaled it will play a powerful card that could put U.S. negotiators on their heels.

For America, the stakes are high — whether its leadership position and influence in the world will be renewed or upended.

The United States and China are increasingly competing for the commanding heights of global technology markets. China has already made clear in its “Made in China 2025” plan that it intends to be the global leader in technology.

China accounts for 85% of global rare earth production and 95% of the refining of materials that are vital to the production of permanent magnets for EV motors.

China is also the #1, #2, or #3 supplier for 85% of America’s supply of 35 critical, strategic metals.

China will use this leverage to keep more of these materials at home and may cut back production or limit these exports to gain a strategic edge.

China is also becoming a net importer of these materials. All this will put upward pressure on prices.

Let’s take a step back and learn more before getting to some ideas to profit from these dramatic events.

One of my favorite books is Daniel Yergin’s riveting tale of the major role oil played in the 20th century, The Prize: The Epic Quest for Oil, Money & Power.

Oil not only powered the economy, it also played a pivotal role in the century’s statecraft. But the following sentence in the book’s prologue really caught my eye.

“As we look toward the 21st century, it is clear that mastery will certainly come as much from a computer chip as from a barrel of oil.”

But what’s behind the computer chip and advanced technology that forms the backbone for so much that we take for granted in modern life? The answer is rare metals and, in particular, an important subset called rare earths.

These vital ingredients are critical to economic growth and advancement of technology.

They are also invisibly intertwined with national economic strategies, geo-politics, wealth and power.

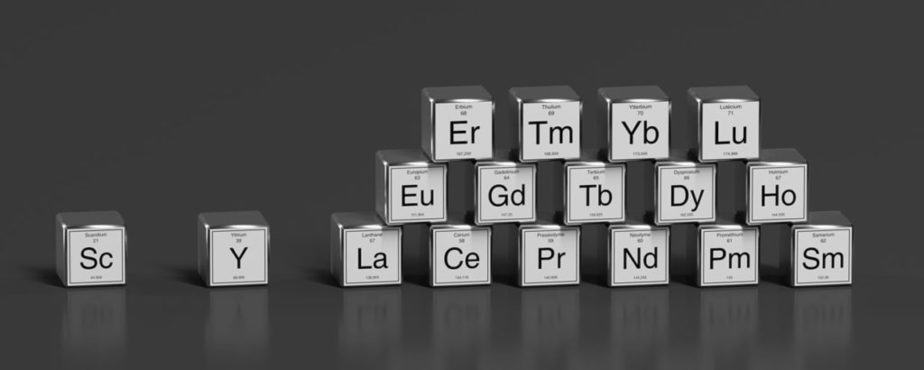

Beginning with atomic number 51, rare earths include lanthanum, cerium, praseodymium, neodymium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, and lutetium. Two additional non-lanthanide metals, yttrium and scandium, are related.

These 17 elements are grouped together as rare earths because they exhibit similar chemical and physical properties.

Rare earths are the special ingredients in the age of industry and technology. Like yeast in making bread and wine, they are required in small quantities in all sorts of products from cell phones to advanced weapons systems, aircraft engines, robots and hybrid batteries.

Rare earth elements, although not particularly rare, are very difficult to find in economic quantities and are time consuming and expensive to extract and process.

The real value of these metals is their unique thermal, electrical, optical and magnetic properties, for which there are no substitutes. This allows for miniaturization and much lighter, stronger, resilient, and efficient components.

Since the 1990s, China has become the Saudi Arabia of rare earths as the country’s favorable geology, low cost labor and lax environmental standards allowed it to produce about 85% the world’s production. While China’s near monopoly is reason alone to raise concern, China has used its power to influence international affairs.

After a long period of weak pricing and being off the front page, rare metals and rare earth are now back in the news with prices and headlines on an upward trajectory.

What has changed? In short, the momentum behind clean energy, wind power, robotics and, in particular, electric vehicles (EV) and the entire infrastructure that supports these trends.

Backing these developments is a confluence of trends and events.

There has been significant progress in materials science regarding batteries and motors.

The numbers show that we are very close in reaching a point of critical mass — an inflection point when all the benefits of scale start kicking in.

In addition, government emission targets and consumer subsidies for hybrid and electric vehicles are driving markets forward. While EV batteries, cobalt and lithium have garnered most investor and media attention, we believe that EV motors have been overlooked and offer significant upside potential.

EV motors are dependent on rare earth permanent magnets, which are 5–10 times stronger than regular magnets. This leads to lighter and more efficient motors. For example, the Chevy Bolt motor weighs only 38 kg, or just over 83 pounds.

Let’s now turn to some investment ideas to capitalize on these trends.

Largo Resources (OTC: LGORF, TSX: LGO.TO)

Largo Resources is a natural resource development and exploration company, engaging in the acquisition, exploration, and development of mining and exploration properties in Brazil and Canada.

The company primarily explores for vanadium along with iron, tungsten, molybdenum, chromite, palladium, and platinum group metals.

Its flagship project is the Maracás Menchen Mine that consists of 18 concessions covering an area of 17,690 hectares located in Bahia State, Brazil. Largo Resources Ltd. was incorporated in 1988 and is headquartered in Toronto, Canada.

Largo produces vanadium that turns ordinary steel into “super steel,” and is playing an increasingly important role in electrifying the grid.

In addition, titanium-vanadium super alloys are widely used in the aerospace industry.

Largo is a strategic mineral company focused on the production of vanadium flake, high-purity vanadium flake and high-purity vanadium powder.

Vanadium prices soared in 2018, briefly peaking in November before coming back sharply to the current levels of $10 a pound.

This presents investors with a very attractive and timely price entry point. And this is, by far, the most important factor in delivering big gains.

Here is an overview backing up my Largo immediate investor research recommendation:

Largo represents one of the highest-grade deposits of vanadium in the world. It is the lowest-cost producer of vanadium in the world estimated by H. C. Wainwright to be about $3.50 per pound.

Finally, Largo is expanding capacity, improving its balance sheet and has a strong off-take partner in Glencore with a contract to purchase 100% of production through May of 2020.

Delrey Metals (OTC: DLRYF, CSE: DLRY, FRA: 1OZ)

Now let’s move on to a promising, more aggressive play on vanadium.

Delrey Metals is a mineral exploration company focused on the acquisition, exploration and development of mineral resource properties, specifically in the strategic energy metals space — with a focus on vanadium.

The Company owns and is developing the Star, Porcher, Peneece and Blackie iron-titanium-vanadium properties located in Northwest British Columbia.

In addition, the company recently announced an agreement to acquire an 80% interest in the Four Corners Project in Newfoundland and Labrador, Canada.

This iron-titanium-vanadium project is backed by previous exploration, drilling and metallurgical work, all showing positive results.

Delrey Metals is very interesting for the following two reasons:

Complementing the Four Corners project is Delrey Metals’ four other vanadium properties on Northern British Columbia’s Pacific coast.

Each of these is located at tidewater, within reach of a large shipping port, and come with ideal mine-to-market geography.

Delrey Metals is an attractive speculative play on vanadium and, in particular, on vanadium prices which will very likely rise sharply over the next few years.

Now let’s move to a company at the heart of developing the first rare earths supply chain in North America.

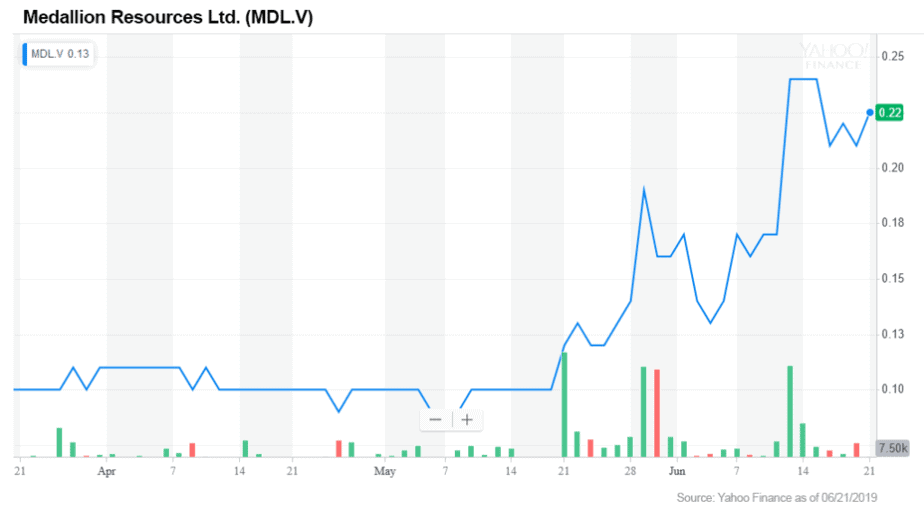

Medallion Resources (OTC: MLLOF, TSX.V: MDL, FRA: MLDN)

This is one company I have written up in the past and continue to have my eye on, having found through intensive research and are at the forefront of helping to solve America’s dependency on China for supply of rare earths.

Medallion Resources is a Canadian company with a simple low cost strategy to produce neodymium and praseodymium (NdPr) through basic, proven technology and smart partnerships, all the while keeping the whole rare earth production chain in North America.

Medallion Resources is pursuing near-term magnet metal production, firstly in North America, by exploiting by-product monazite. Monazite is a rare earth element (REE) phosphate mineral containing significant amounts of the key magnet metals neodymium and praseodymium (NdPr).

NdPr is the key input material for the high-powered permanent rare earth magnets required for growing demands of vehicle electrification, wind power generation and robotics.

Monazite is widely available as a by-product from heavy mineral sand mining operations and has a history as a commercial REE resource and well-understood metallurgy.

Medallion is committed to following best practices and accepted international standards in all aspects of mineral transportation, processing and the safe management of waste materials.

This is a welcome development that we expect will attract significant media attention.

It all starts in the Southeastern region of the United States where heavy mineral sands are plentiful. Medallion arranges to source monazite from heavy mineral sand producers and then to extract a rare earths concentrate from this monazite sand.

The rare earths concentrate produced by Medallion is then shipped to a private company — Rare Earth Salts — a Nebraska company that has signed an agreement with Medallion to separate the rare earth concentrate into the high-quality rare earth oxides.

It is a great example of what I’m always looking for — a company with a proven and experienced management team that limits risk through a low-cost, low-capital expenditure strategy, presenting the company and investors with upside potential.

Medallion Resources is an innovator among rare earth companies. As a microcap development stage company, it is off the radar screen of institutional analysts and investors, and therefore presents sizable discovery potential as investors increasingly look for rare earth opportunities.

In my opinion, Medallion Resources is on the right track.

Consider taking action to get some rare earths exposure into your portfolio for potential profits in 2019.

Carl Delfeld, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

Inside China’s Plan to Create a Modern Silk Road, Morgan Stanley, January 2018

The Elements of Power, David S. Abraham, Yale Press

United States Geological Survey, 2019

Mining the Future: How China is Set to Dominate the Next Industrial Revolution, FP Analytics, May, 2019

Roskill Information Services Ltd., "The World Market for Vanadium to 2025: Premium Edition," 14th edition, 2015

Frost & Sullivan, Emerging Technologies in the Energy Storage Market”, 2016.