Since Canada legalized recreational cannabis in October of 2018, and the signing of the 2018 Farm Bill in the US which saw a rescheduling of CBD and Hemp, the cannabis sector has been hot on everyone’s mind.

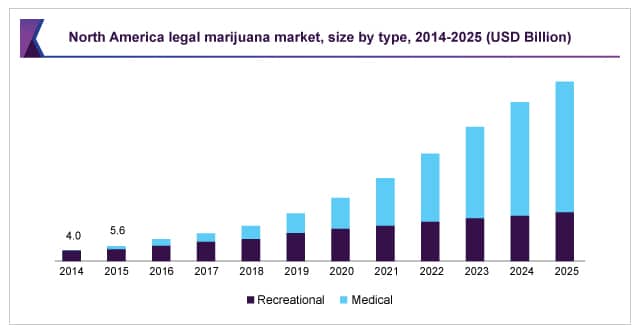

Having seen massive growth over the past 6 months, the global legal marijuana market is expected to reach US $146.4 billion by the end of 2025, according to a new report by Grand View Research, Inc. — with the CBD sector alone expected to reach US $20 billion by 2022.[1]

While this market has been filled with huge speculation, moving into 2019 analysts and investors have more tangible data to work with when it comes to evaluating multiple cannabis companies.

As we’ve been witnessing over the last 6 months, legal regulations are ever-changing, which is allowing for rapid market expansion. But this makes the focus on multi-state operations and a global footprint a necessity for any long-term sustainability.

Operators unfamiliar with each country and state’s unique legal framework will be at a significant disadvantage to those who are already positioned, and thinking long term, even more so internationally.

As reported in Forbes,[2] the UN Commission on Narcotic Drugs still has yet to vote on the recommendation from the World Health Organization on rescheduling cannabis and cannabis extracts, but global cannabis legalization is gaining momentum.

#1 SENIOR STOCK

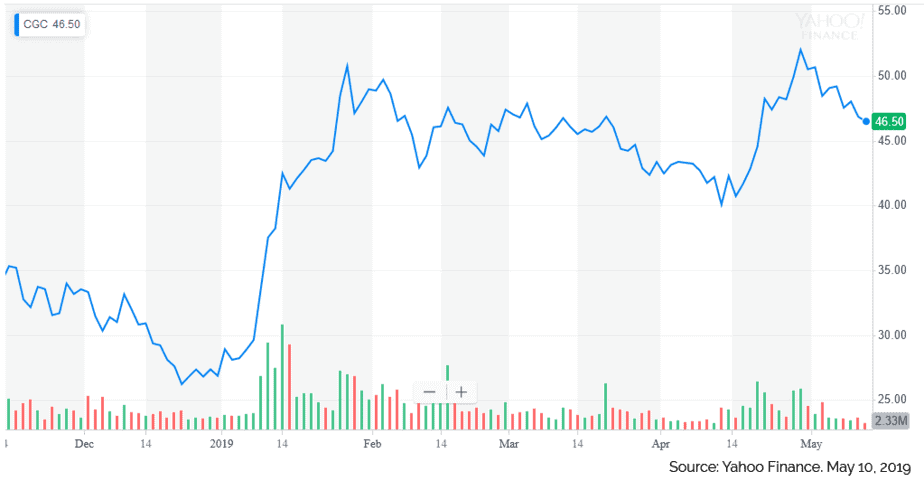

Canopy Growth (NYSE: CGC, TSX: WEED), one of the leading Canadian cannabis companies, has shown through acquisitions and partnerships that it is focused on the global future of cannabis.

Its Canadian medical marijuana market share exceeds 30%, and investments that are boosting its grow capacity are positioning the company to capture a similarly large share of Canada's beverage and edibles market. This is particularly pertinent following drink maker Constellation Brands’ decision to pay US $4 billion for a 38% equity ownership stake in the company in 2018.[3]

Canopy Growth can't participate in the US recreational market until marijuana is legal federally, but it has shipped medical marijuana for use in medical research to the US. It recently acquired AgriNextUSA, as part of its plans to build the first Hemp Industrial Park in the Southern Tier of New York state after receiving a state license to produce and process hemp, investing US $100M to US $150M into the hemp operation.

In addition, on April 18, Canopy Growth announced a forward plan to acquire leading US multi-state cannabis operator, Acreage Holdings. The proposed layered deal complements Canopy Growth’s US CBD strategy with an accelerated pathway into US cannabis markets, once federally legal / permissible. The company continues to construct deals, while staying on the right side of the law with respect to cannabis.

In Australia, Canopy’s Spectrum Australia subsidiary is working with the Victoria state government to cultivate marijuana domestically for medical use. The company and the Victoria state government’s plans include programs focusing on cannabis as medicine, including the development of new types of marijuana.

At the end of 2017, there were 158 approved medicinal cannabis patients in Australia. By the end of January of this year, there were 2,800 according to the Therapeutic Goods Administration’s (TGA) figures. Now, after the TGA moved to streamline the application process for medicinal cannabis patients last year, the industry is preparing for a boom.

The situation is different in Germany where the medical marijuana market has grown more quickly. Canopy Growth's Spektrum Cannabis GmbH is approved to import medical marijuana in Germany and it's distributing it to over 1,200 pharmacies. This is a substantial entry in such an early market opportunity.

As a result, Germany accounts for 10% of Canopy Growth's sales as of Q3 2018 — up from 1% the prior year. Take notice, since Germany's population is double that of Canada, the opportunity there could be much bigger than Canada over time.

#2 SENIOR STOCK

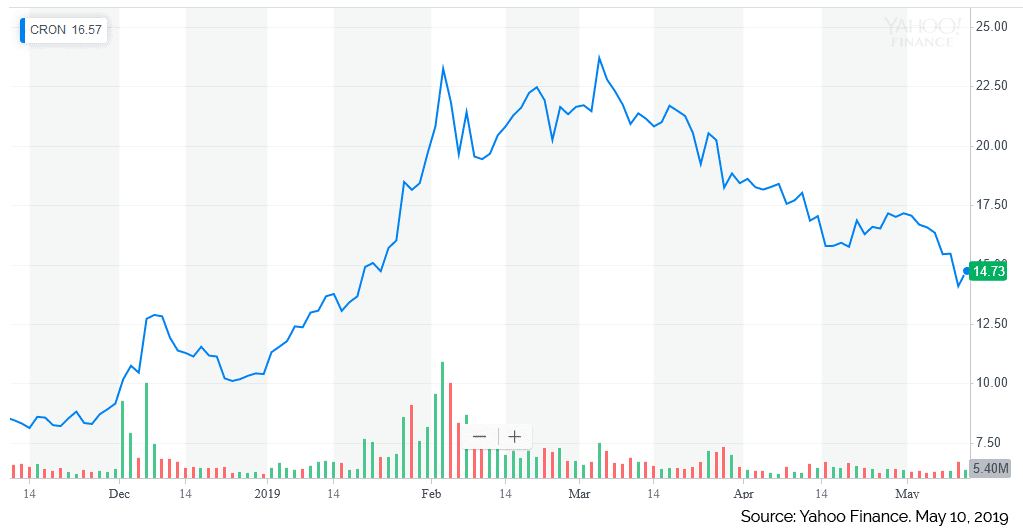

Cronos Group (Nasdaq: CRON, TSX: CRON) managed to secure a major investment from tobacco-giant Altria Group (NYSE: MO) in December 2018 of $1.8 billion for a 45% equity stake. Like Canopy Growth, they are working to establish a large global footprint.[4]

Through the company’s many subsidiaries and division branches such as MedMen Canada, OGBC and Cronos Grow Co. focused on the Canadian market, Pohl Boskamp focused on Germany, Delfarma in Poland, NatuEra in Colombia, Cronos Australia and Cronos Israel, the company is primed and well positioned for international distribution and production.

#3 SENIOR STOCK

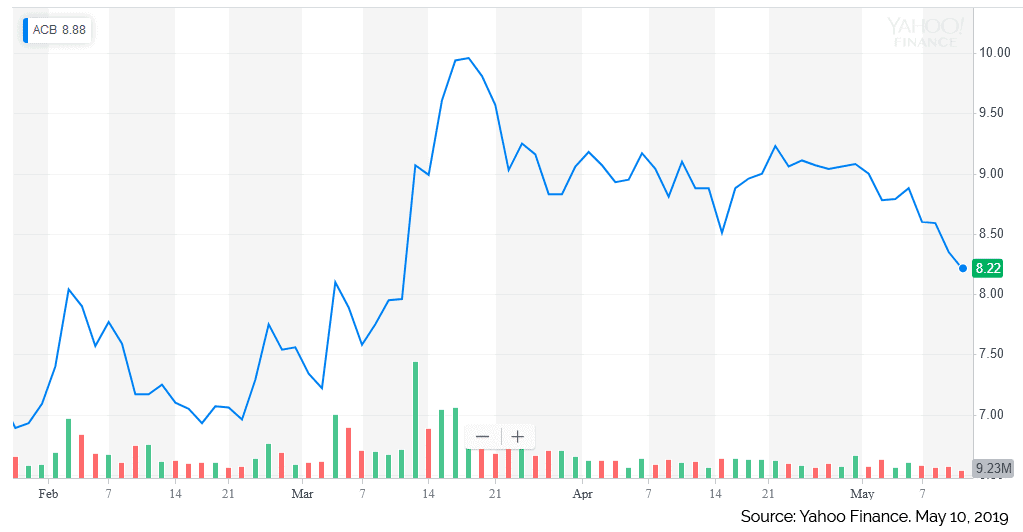

Aurora Cannabis Inc. (NYSE: ACB, TSX: ACB), another Canadian producer with its eyes on the worldwide market, recently completed its first commercial export of cannabis oil to the United Kingdom (UK). Authorities granted the Company approval for its first shipment of medical cannabis into the UK from Canada under its new legal framework that came into effect on November 1, 2018.

"Being one of the first Canadian companies to commercially supply cannabis-based medicines into the UK under the new legal framework reflects Aurora's ability to do business in international markets that have complex and evolving regulatory systems," said Neil Belot, Chief Global Business Development Officer.

"Aurora continues to grow its international footprint, which now includes the UK, a country with a population of approximately 66 million people. Regardless of the barriers we may be faced with, we are focused on helping patients around the world get access to the medicine they need."

Aurora’s strategy for global markets currently sees the company with sales and operations in over 24 countries, across five continents. This foothold and worldwide expansion have not gone unnoticed by many in the financial community.

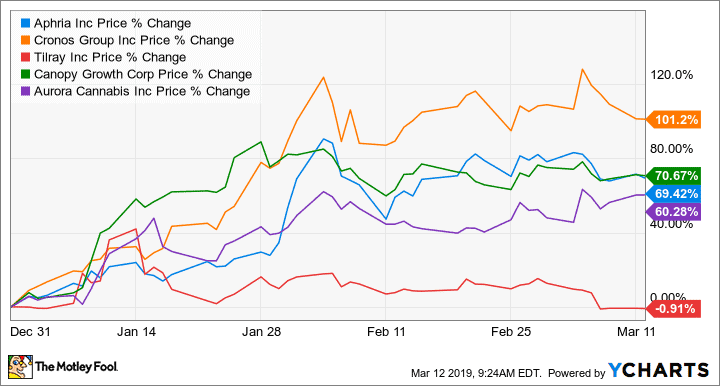

What else makes these three the top senior companies in the cannabis space? There are other companies with strong international footprints so what other factors need to be considered? When comparing these 3 companies with competitors Tilray and Aphria, Motley Fool analysts noticed key differences in trading activity and stock price change since January.

And according to MarketRealist, “The overall recommendation for Tilray (Nasdaq: TLRY) was a “hold in March, as was Cronos Group (NasdaqGM: CRON), while Canopy Growth (TSX: WEED) and Aurora Cannabis (NYSE: ACB) both have a “buy” as of the time of this writing.”[5]

All 5 companies are included on the Horizons Marijuana Life Sciences Index (TSX: HMMJ) with Canopy representing 11%, Aurora 10.76%, and Cronos at 8.19%. Even though Tilray comes in 3rd at 9.8%, many analysts are still giving this stock a hold, due partially to the stagnancy of the stocks trading as well as corporate inactivity.

One issue that can plague an emerging market going through rapid growth like the cannabis industry is the ability to stay relevant. As things are changing ever so rapidly, the companies unable to keep pace with a rapidly growing market can fall behind to the point of irrelevance to investors and the market.

Appearing stagnant in a growth market can be the kiss of death to some companies and that is another reason Cronos, Canopy and Aurora have remained on top.

Canopy was one of the first companies to act following the signing of the 2018 US Farm Bill, announcing their investment into the US hemp industry as well as riding the CBD buzz by partnering with Martha Stewart to create a line of CBD wellness products.

These types of announcements may seem trivial to some, but with so many products and brands expected to come to market in the next year or many years into the future, staying out in front and building brand awareness early could prove to have significant value. It’s what current investors are betting on.

Aurora has been keeping busy ensuring it is at the forefront of the industry by making acquisitions into Mexico, and exporting cannabis into the UK and EU. There are still the much-anticipated completions of their state-of-the-art facilities throughout Canada, which are expected later this summer.[6]

Cronos’ large investment from Altria has kept investors interested in the company, especially for their financial results which the company released May 9, 2019 during a conference call.[7] CEO Mike Gorenstein has established key tenets for Cronos to follow, and he believes that working with Altria should help the cannabis company on all of those fronts.[8]

An efficient global production footprint will require the expertise that Altria has in sourcing and distributing tobacco. Although Altria currently has only domestic cigarette distribution networks, its history is indeed global in scope. The strength of the Marlboro brand is also the kind of brand power that Cronos is ultimately seeking.

Striving for innovation in producing valuable intellectual property will be vital for Cronos to distinguish itself from its marijuana rivals. It is a valuable component to any top tier cannabis company right now as this industry is still heavily defined by “quality,” “effectivity” and “uniqueness” from a consumer standpoint, as medicinal cannabis still accounts for the majority of the market.

Though the Altria deal may be the largest for Cronos so far, the company has been equally active with smaller acquisitions and partnerships in recent months. They have put out a string of press releases each month ensuring the company stays at the forefront of consumer and investor minds.[9]

This is where we get into some of our junior stocks who may not have the budget or capital depth of their larger competitors but are making up for it by focusing on standing out and catering to the craft or specialized side of the market.

#1 JUNIOR STOCK

Zenabis Global Inc. (OTC: ZBISF, TSX: ZENA) has been the first company to go out of its way to recognize the craft element through its Zen Craft Grow program.

Through this program, Zenabis provides its regulatory, compliance and quality control expertise to facilitate the licensing of small-scale craft growers, leveraging its existing supply agreements with provincial liquor authorities, wholesalers and licensed retailers in nine Canadian jurisdictions, and provides consumers across the country with access to high-quality, compliant and quality assured cannabis products from passionate and committed micro-cultivators.[10]

Zenabis’ commitment to craft even goes into their partnerships — their most recent being the Kombucha producer TrueBuch.[11]

Like the big players above, Zenabis has also put a focus on international expansion having recently entered into the EU marketplace. The company was also recently included on the Horizons Marijuana Life Sciences Index (TSX: HMMJ) ETF, along with The Flowr Corporation.[12]

And in June 2019, Zenabis was uplisted from the Junior TSX Venture Exchange to the Senior Toronto Stock Exchange (the big board “TSX”) in Canada.[13]

#2 JUNIOR STOCK

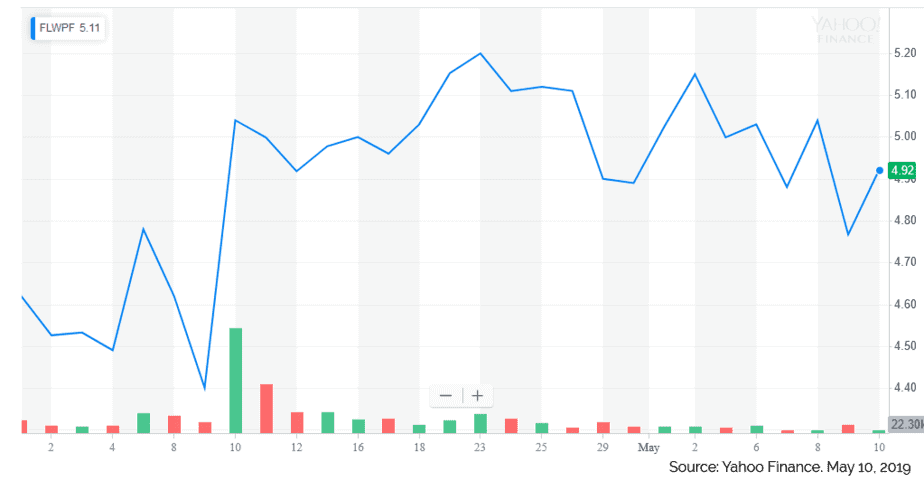

The Flowr Corporation (OTC: FLWPF, TSX.V: FLWR) recently found itself on Jefferies buy list from analyst Owen Bennett, and is on track for about 60,000 kg of dried flower in peak production by 2021 at its Kelowna, BC facility.[14] Whereas most growers are focusing on production numbers, Flowr is all about quality.[15]

This is a company, like Zenabis, that's looking to carve itself a sizable chunk of the ultra-premium cannabis market, targeting more affluent clientele who may be far less perturbed by economic fluctuations than the average consumer.

Additionally, with projected yields of 300 to 450 grams per square foot, Flowr might top all growers in terms of efficient production. This ultimately still needs to prove itself out, but the company’s ambitions are what is intriguing to investors.

The company is not only focused on craft flower but also edibles, as well partnering with Canadian Chef Ryan Reed to develop signature edible cannabis products for the Flowr brand.

Chef Reed, a past winner of Iron Chef and Chopped as well as Victoria, Canada's 2011 Chef of the Year, will collaborate closely with Flowr's R&D Team to research and develop high-quality edibles. The edibles and beverage market has been garnering a lot of attention lately.

The company’s most recent partnership with Shoppers Drug Mart, who was purchased by the Loblaw Companies (TSX: L) in 2013 for CA $12.4 billion and has over 1,300 locations in Canada, speaks to the company’s quality as well as to the de-stigmatization of medical cannabis’ place in mainstream medicine, and in simplifying cannabis delivery in Canada.[16]

#3 JUNIOR STOCK

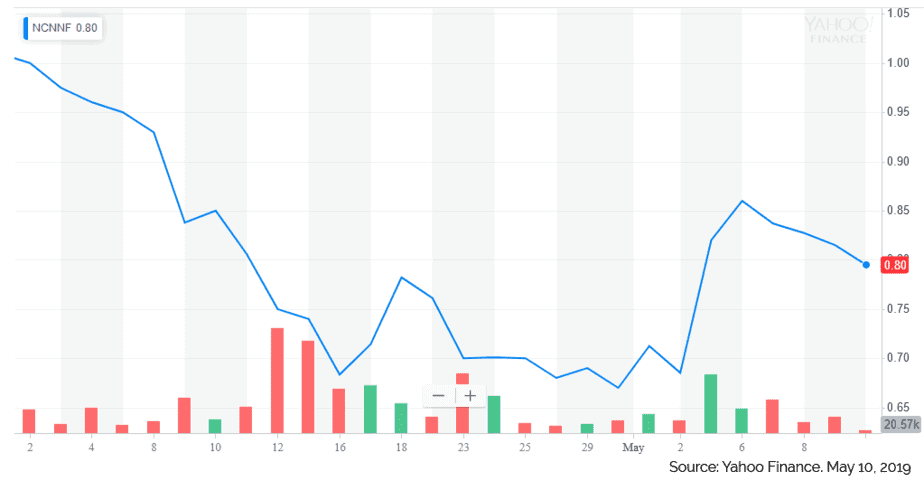

This brings us to 48North Cannabis Corp. (OTC: NCNNF, TSX.V: NRTH), who is bringing its craft brand to market. The company recently announced an exclusive licensing agreement with US-based Arbor Pacific Inc. to bring its premium brand of vaporizers, Avitas, to Canadian consumers.

Avitas, available in over 500 stores in Washington, Oregon and Colorado is one of the best-selling single-strain vaporizer cartridges in the United States and completes 48North's vape strategy.

48North is focused on delivering next-generation cannabis products to Canadian consumers anticipated in Fall 2019. The agreement with Arbor Pacific, on the heels of its previously announced agreement with Mother & Clone, positions the Company to deliver on this commitment. 48North has also entered into a strategic partnership and supply agreement with Canopy and is also listed and included in the Horizons Marijuana Life Sciences Index (TSX: HMMJ) ETF.

When we look at the growing cannabis sector, speculation is the largest factor affecting the market today. This is a sector filled with volatility due to legislation changes, consumer demand fluctuations and the sheer number of unknown variables surrounding the industry. Will future cannabis products overtake the alcohol industry or work in tandem? What will be the social, and future agricultural impacts be as global legislation moves forward?

The potential for this industry can sometimes make investment decisions foggy but as the industry begins to mature and stabilize, we start to see common themes appear which is likely to give the financial community good indicators moving forward.

This cannot be thought of as just a US or Canadian market anymore — companies focused on worldwide growth and with knowledge and experience in international regulatory markets stand a much better chance of success long term.

This is the same for companies with strong vertical integration as this is a multi-layered sector, and to ignore the ancillary sections as well as different product possibilities risks stagnation and a general lack of interest.

This is a very fast-moving market, so it will be essential for companies to stay out ahead whether through acquisitions, intellectual property, or unique branding opportunities in order to stand out from the rest of the crowd. And there is quite a large crowd growing.

A crowd is not a bad thing for the already established companies in the market, as with growing numbers comes a much faster rate of change and adoption. Worldwide, bills are being pushed through and legislation is being adjusted on a global scale at an unprecedented rate compared to any other newly formed regulated market right now.

Just recently, “The House Financial Services Committee cleared a bill to provide a safe harbor for banks that work with the legal cannabis industry. The 45-15 vote allows the Secure and Fair Enforcement (SAFE) Banking Act to go to the House floor.”[17]

Most recent US polls show a consistent rise in support of legalization in some form whether Republican or Democrat, Canadian or German.[18] The mostly shared benefits found towards research and medicine are the main drivers of global support as more and more people find themselves knowing someone benefiting from these advancements and cannabis products.[19]

The global legal cannabis sector seems a maybe at times for investors — slow inevitability and a wait-and-see approach is what many investors are comfortable with. But the companies who really buy into the idea of worldwide forward legal acceptance are pushing forward with their business, and stand the best chance for future success as other companies struggle to adapt to different regulatory environments.

As for the smaller companies wishing to grow, focusing on craft and innovation will be the best path to follow as the true value of intellectual properties and branding opportunities have the potential to be as valuable as a Coke, Nike or Budweiser brands in the future.

Dawn Van Zant, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] Grand View Research https://www.grandviewresearch.com/industry-analysis/legal-marijuana-market

[2] Forbes https://www.forbes.com/sites/sarabrittanysomerset/2019/02/26/as-expected-the-un-delays-voting-on-cannabis/#2b81155014e0

[3] Motley Fool https://www.fool.com/investing/2018/12/10/7-events-that-shaped-canopy-growths-2018.aspxhttps://www.fool.com/investing/2018/08/15/corona-and-cannabis-the-perfect-match.aspx

[4] Motley Fool https://www.fool.com/investing/2018/12/07/its-official-altria-invests-18-billion-in-this-top.aspx

[5] Market Realist https://articles.marketrealist.com/2019/03/tilray-analysts-are-more-bearish-in-march/

[6] Aurora Cannabis https://investor.auroramj.com/#press_release_section

[7] Cronos Group https://ca.finance.yahoo.com/news/cronos-group-inc-announces-first-110000902.html

[8] Motley Fool https://www.fool.com/investing/2019/02/03/altria-just-gave-3-great-reasons-you-should-buy-cr.aspx

[9] Cronos Group https://ir.thecronosgroup.com/press-room/news-releases

[10] Yahoo Finance https://finance.yahoo.com/news/zenabis-launches-zen-craft-grow-100000669.htmlhttps://finance.yahoo.com/news/zenabis-enters-european-pharmaceutical-cannabis-100000164.html

[11] Yahoo Finance https://finance.yahoo.com/news/corrected-zenabis-acquires-51-stake-004900239.html

[12] HMMJ ETF https://www.horizonsetfs.com/hmmj

[13] https://finance.yahoo.com/news/zenabis-announces-graduation-toronto-stock-100000118.html

[14] Jeffries https://www.tipranks.com/analysts/owen-bennett?ref=AR_EXPERThttps://www.analystratings.com/articles/the-flowr-corporation-flwr-initiated-with-a-buy-at-jefferies/, https://www.jefferies.com/OurFirm/Investment-Banking-Firm/Pages/69

[15] Motley Fool https://www.fool.com/investing/2018/12/16/this-tiny-marijuana-stock-could-be-better-prepared.aspx

[16] Yahoo Finance https://finance.yahoo.com/news/flowr-medical-cannabis-now-available-103000278.html

[17] Yahoo Finance https://finance.yahoo.com/m/7b90a1e1-c1bb-3572-8581-4f7daa7e6843/cannabis-banking-bill-easily.html

[18] MySanAntonio.com https://www.mysanantonio.com/news/article/New-Poll-Finds-Highest-Support-Ever-for-Weed-13723998.php, https://www.mysanantonio.com/news/article/The-UN-Is-Moving-Toward-Ending-Decades-of-13714844.php

[19] InvestingNews.com https://investingnews.com/innspired/medical-cannabis-research-programs/