Everything changed on June 18 of this year when Facebook (NASDAQ: FB) announced their cryptocurrency, called Libra. (You can find out more about Libra via my FNN articles here and here.)

This was the day cryptocurrency entered the mainstream, which sent a ripple effect throughout the world.

Facebook – a company with a market cap of over $535 billion – wants to be in control of printing and issuing your money, a role that is traditionally handled by a government’s central bank. This proposed model challenges classical power structures by bestowing enormous influence to a multinational corporation, and by allowing people to easily operate outside of their own country’s economic structure.

In reaction to this announcement, governments all over the world have kicked into high gear in an attempt to launch their own cryptocurrencies, making sure they are not left behind in the global movement to digitize money.

No country has been more proactive since the Libra announcement than China, who officially revealed their plans for their own digital currency, which utilizes blockchain technology, on August 10, 2019.[1]

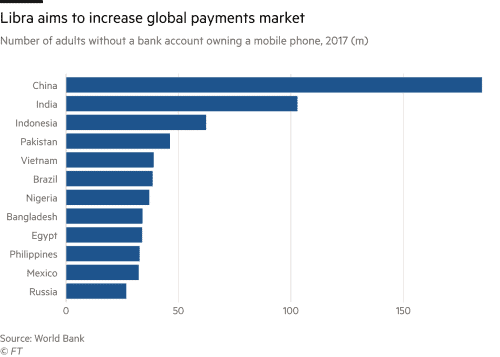

Facebook may have 2.38 billion users (over 30% of the world’s population), but China is home to 1.4 billion people (that’s 18% of the world’s population), so the potential influence of their respective currencies is gigantic.

Let me remind you, whoever has control over how a currency is stored, created and/or traded, whether it’s a corporation or a nation state, has extreme control over the group who uses that currency.

The nature of money is changing, but who will be the leader in the issuance of digital currency is still up for grabs. The race is on.

Keep reading as I explain the latest on the global digital currency race, and all of the risks and benefits associated with it. This technology is on the fast track for global adoption, and I predict it will be available to you sooner than you think.

Both China and Facebook have a lot at stake in their development of a digital currency.

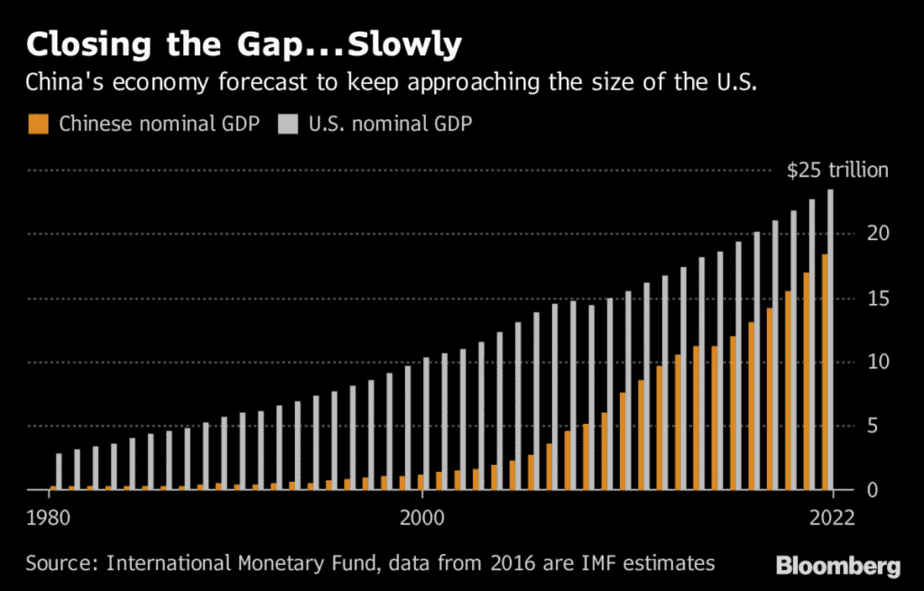

China is the world’s second largest economy behind America, and “beating” Facebook (an American company based in California) to market with their own cryptocurrency can be seen as a signal of China’s impending global dominance.

This rivalry is tremendously symbolic, as each group is fighting to establish their economic and technological superiority.

A top official from the People’s Bank of China (PBoC) explained on September 6 of this year that the main reason for developing their digital currency is to “plan ahead” in order to “protect monetary sovereignty and China’s legal currency.” [2] It is clear that China believes that a digital currency can be a means to not only demonstrate their power on a world stage, but protect themselves from outside economic pressure.

What China hasn't acknowledged, but appears somewhat obvious, is that the digitization of their currency may allow for the Renminbi (the name of China’s official currency) to become the currency of choice for everyday transactions all around the world, which would ultimately allow it to compete with the U.S. dollar!

On the day of China’s cryptocurrency announcement, the PBoC’s deputy director of payments, Mu Changchun, acknowledged that their new currency was “close to being out,” although he refrained from any specific details or timelines.[3]

However, according to a recent article by the respected online crypto news outlet CoinDesk, the creation of China’s cryptocurrency was accelerated in reaction to the Libra whitepaper – as the country wants their project to be released before Libra – which is expected to be launched sometime in 2020. [4]

Even though they expedited the development process, it is important to note that China began working on a blockchain-based national currency in 2014, which has already generated 71 patents.[5] This demonstrates that Bitcoin (and cryptocurrencies in general) have been on China’s radar for several years, and that they saw the value in this form of asset long before they publicly acknowledged it.

China’s digital currency has been shrouded in secrecy, and most of the information available about it comes from official Chinese government-run news sources.

Nevertheless, when looking at patents connected with the project, it appears that “consumers and businesses would download a mobile wallet and swap their physical yuan [a unit of account for China’s official currency, called the Renminbi] for the PBoC’s cryptocurrency, which they can then use to make and receive payments.” [6]

According to Mu (Deputy director of payments), a "two-tier operation system will be used…The PBoC will be the upper-tier operator, facilitating the exchange of the digital currency at banks and other financial institutions,” who will form the “lower-tier” operators.[7] A citizen’s digital wallet will presumably be connected to a bank at the “lower tier” level.

Dovey Wan, partner at crypto-asset investment fund Primitive Ventures and an expert in all things crypto in China, clarifies that “traditionally, central banks directly control base money creation/destruction but have only indirect power over the broader, credit flow-driven monetary supply.” [9] Now, through digitizing their currency, the Chinese government has “the potential to … regain control of currency creation/supply… centralizing their power in policymaking.” [10]

The PBoC can literally code monetary rules and restrictions into their new payment network, dictating where currency can and cannot flow. [11] For example, if the government decides they want to “cool down the housing market…they can simply set a program preventing digital RMB [Renminbi] from entering the real estate sector.” [12]

China’s digital currency will be programmable and easily traceable within the two-tiered operating structure, meaning permissions can be set as to where a citizen’s money can be stored, spent and traded.

China’s digital currency will be issued by the People’s Bank of China (PBoC), so it is classified as a Centralized Bank Digital Currency – also called a CBDC.

The PBoC is China’s central bank and holds over $3 trillion USD in assets, making it the largest holder of assets of any central bank in the world.[13] It is clear that this is an exceptionally influential institution, one that has essentially unlimited assets to build and manage a digital currency exactly to their liking.

Libra, on the other hand, will be pegged to a basket of currencies, the assortment of which has yet to be announced. It is not connected to a central bank, and is designed to be used by any citizen who has an account with any of Facebook’s three messaging apps (Instagram, Facebook Messenger and WhatsApp).

Even with these differences, Chinese officials have been actively proclaiming the superiority of their currency over Libra. So, it seems clear that China is thinking of this as a head-to-head contest.

China has gone on the media offensive with their public relations campaign, as they look to educate non-Chinese citizens about their plans for their CBDC.

The Telegraph – a respected British newspaper publication often associated with conservative political views – published an article paid for by China Daily (a newspaper owned by China’s Communist Party) on September 3, 2019, entitled “Digital currency can help meet new financial challenges,” by Sun Yunchuan.[14]

The content of this advertorial provides insight into how the Chinese government may want the general public outside of China, particularly in the West, to think of their cryptocurrency.

Unsurprising, the article positions China's Centralized Bank Digital Currency (CBDC) as an upgrade from Libra. It questions Libra’s legitimacy as a currency because it is “issued by a non-government entity,” which, Sun claims, means that it has the potential to “seriously undermine global financial services and destabilize the financial market.” [15]

As a counter to this seeming instability, the author explains that China’s digital currency “has the credit guarantee of China’s central bank, which means the solvency of the CBDC will be fully guaranteed.” [16]

Sun continues by arguing that the backing of China’s central bank, the PBoC creates a strong foundation that can help “build a new financial infrastructure” and “upgrade China’s payment system.” [17] He goes on to further advocate that this will make the economy more “efficient” and “transparent,” leading to “better social and economic development.” [18]

The writer diligently positions China's Centralized Bank Digital Currency (CBDC) in contrast to Libra, which further suggests how much is at stake for the Chinese with their new form of currency… it is bigger than technology, it is about global dominance.

It is crucial to highlight that there are other motives at play for China besides asserting their power on a world stage. As hinted at throughout the article, the way that the country has developed their CBDC allows the government to engage in financial surveillance and have tight controls over their citizens.

China’s two most prominent payment apps, Alipay, which is owned by Alibaba (NYSE: BABA) and WeChat Pay which is owned by Tencent Holdings (OTC: TCEHY, SEHK: 700), handle over 90% of mobile payment transactions in China.[19] (If you want to learn more about these apps and how they are used in China, I suggest reading my article here.)

With the majority of digital payments taking place outside the purview of commercial banks, government institutions have been unable to gather significant big data related to Chinese citizens’ payment history and online behavior. [20] A CBDC (Centralized Bank Digital Currency) would permit the central bank to compile their own more complete big data sets all in one place.

China’s CBDC exposes some of the downsides of blockchain technology, as “a person’s spending history and assets balance are immediately evident” through this system.[21] This means it is substantially easier for the government to “accurately assess creditworthiness, detect money laundering, and prevent tax evasion and capital flight.”[22]

This is disconcerting for several reasons, and may cause privacy advocates and critics of China’s social credit score system to be alarmed. (If you are unfamiliar with the social credit score model, you can read more about it in my FNN article here). [23]

Up to this point, I have solely focused on the digital currency race between China and Facebook, but it is essential to highlight that the interest in this technology expands way beyond these two rivals.

Countries that are testing out and/or researching their own Centralized Bank Digital Currency (CBDC) include Canada, Singapore, The Bahamas, Thailand, Uruguay, Sweden, India, Iran, Peru, The Netherlands and Norway. [24]

Outside of larger geopolitical strategies around dominance and control, which appear to be some of the main reasons for China’s (and Facebook’s) development of this technology, a digital currency issued by a central bank can have incredible upsides.

The International Monetary Fund (IMF) declared in a June report that a CBDC can create the conditions for “lowering costs, increasing efficiency of monetary policy implementation, countering competition from cryptocurrencies, ensuring contestability of the payment market, and offering a risk-free payment instrument to the public.” [25]

And, according to research from the Bank of England, “replacing a portion of payments with a digital currency could boost GDP by 3%, lower barriers to financial inclusion and empower consumers.”[26]

These are massive claims that could change the economic state of the world and how people use, store and access currency in their day-to-day lives – possibly providing more economic opportunity and financial freedoms. Even with all the potential issues around privacy and control, there are tremendous advantages to this technology as well.

It is clear the world is trending towards the mass digitization of currency, and this creates both risks and upsides depending on where you live and how you choose to interact with this technology.

Whether it’s Facebook or China, issues around surveillance and tight capital controls will emerge, so it is crucial to keep up to date on how to best participate within this emerging digital currency system and discover how you can make it work for you.

There is a tremendous amount of uncertainty still associated with digital currencies, but I believe that at least one thing is guaranteed: they will affect the global economy and how you personally will spend and store your money in the future.

Keep a close eye on the cash in your wallet…it could be fully digital before you know it.

Blake Finucane, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://medium.com/altcoin-magazine/chinas-cryptocurrency-represents-an-entirely-different-worldview-76ba0544cd4f

[2] https://www.coindesk.com/new-head-of-chinas-digital-currency-says-it-beats-facebook-libra-on-tech-features?utm_source=&utm_medium=&utm_campaign= and https://www.spglobal.com/marketintelligence/en/news-insights/trending/t-38wta5twjgrrqccf4_ca2

[3] https://medium.com/altcoin-magazine/chinas-cryptocurrency-represents-an-entirely-different-worldview-76ba0544cd4f and https://www.scmp.com/economy/china-economy/article/3022441/china-close-launching-its-own-cryptocurrency-says-central

[4] https://www.coindesk.com/chinas-digital-currency-is-being-built-in-a-secret-office-with-restricted-access?utm_source=&utm_medium=&utm_campaign= and http://www.chinadaily.com.cn/a/201908/20/WS5d5b5d1ca310cf3e35566c01.html

[5] https://www.coindesk.com/digital-renminbi-a-fiat-coin-to-make-m0-great-again

[6] Ibid and https://medium.com/altcoin-magazine/chinas-cryptocurrency-represents-an-entirely-different-worldview-76ba0544cd4f

[7] https://www.telegraph.co.uk/china-watch/business/digital-currency-can-help-meet-financial-challenges/

[8] https://www.coindesk.com/digital-renminbi-a-fiat-coin-to-make-m0-great-again

[9] Ibid.

[10] Ibid.

[11] Ibid.

[12] Ibid.

[13] https://www.spglobal.com/marketintelligence/en/news-insights/trending/t-38wta5twjgrrqccf4_ca2

[14] https://www.telegraph.co.uk/china-watch/business/digital-currency-can-help-meet-financial-challenges/

[15] Ibid.

[16] https://www.cbinsights.com/research/report/what-are-stablecoins/

[17] https://www.telegraph.co.uk/china-watch/business/digital-currency-can-help-meet-financial-challenges/

[18] Ibid.

[19] https://www.scmp.com/print/business/banking-finance/article/3023309/chinas-proposed-digital-currency-will-help-banks-bridge

[20] Ibid.

[21] https://www.coindesk.com/digital-renminbi-a-fiat-coin-to-make-m0-great-again

[22] Ibid.

[23] Ibid.

[24] https://news.bitcoin.com/central-banks-testing-digital-currencies/?omhide=true&utm_source=ActiveCampaign&utm_medium=email&utm_content=Central+Banks+Worldwide+Testing+Their+Own+Digital+Currencies&utm_campaign=email-August+15%2C+2019+Daily+Newsletter and https://www.blockdelta.io/cbdc-19-countries-creating-or-researching-the-issuance-of-a-digital-decentralized-currency/

[25] https://news.bitcoin.com/central-banks-testing-digital-currencies/?omhide=true&utm_source=ActiveCampaign&utm_medium=email&utm_content=Central+Banks+Worldwide+Testing+Their+Own+Digital+Currencies&utm_campaign=email-August+15%2C+2019+Daily+Newsletter

[26] https://business.financialpost.com/technology/blockchain/the-future-of-money-is-here-canada-should-take-the-lead-and-launch-our-own-cryptocurrency