Most people can’t scroll through Twitter or open their inbox without being inundated with think pieces and “hot takes” about Facebook’s (NASDAQ: FB) new cryptocurrency announcement, Libra. (If you haven’t kept up, you can read my breaking news story about Libra published on FNN here.)

The sheer volume of coverage on Facebook’s coin is overwhelming — often times, the thoughtful content is overshadowed by non-experts weighing in...

In this article, I will take the initiative to cut out the noise and zoom in on what I anticipate to be the most meaningful outcome from the FB announcement: the release of Libra will drive a significant increase in Bitcoin usage and adoption globally.

Dissecting Libra and how it is organized will illuminate just how useful a decentralized cryptocurrency (like Bitcoin!) really is.

My hope is that when you are finished reading this article, you will know everything you need to about Libra, and be convinced that Bitcoin is the ultimate beneficiary of Facebook’s breakthrough crypto launch.

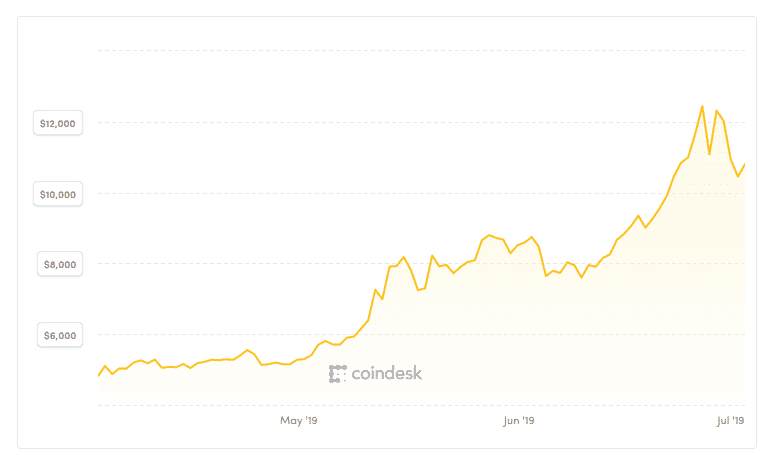

Cointelegraph, the online crypto news site, identified April 1, 2019, as the official beginning of Bitcoin’s latest bull run —reversing Bitcoin’s previous downward trend, which hit its lowest point on December 15, 2018, at $3,130.[1]

Although the downtrend was reversed much before the Libra whitepaper was released on June 18, this day still marks a clear turning point for Bitcoin’s mainstream acceptance.

Facebook, the 6th largest public company in the world by market cap, and whose user base encompasses over 30% of the global population (2.38 billion), is going all in on crypto technology. They are replicating the model that Bitcoin pioneered, creating digital money that is not controlled by a nation state and that can facilitate instant transactions across the world.

This is the endorsement the market was looking for, as evidenced by Bitcoin reaching $13,700 a week after the announcement on June 26, 2019 — its highest price in 18 months.[2]

It is crucial to note that there are many ways in which Libra falls short on Bitcoin’s promises of a self-sovereign, censorship-resistant, portable form of money, and examining these limitations are where the value proposition for Bitcoin adoption is proven.

To more clearly illustrate why I predict that Libra will end up spurring on Bitcoin usage, it is helpful first to dig into why, in fact, Facebook has chosen this moment — mid-2019 — to declare a new initiative and announce their cryptocurrency project.

Examining mobile payment technology in China tells us all we need to know.

China has a population of 1.4 billion people (that’s 18% of the world’s population!) and is the world’s second largest economy behind America.[3] These statistics make it obvious that China is a dominant international force, both demographically and economically, so understanding how the country uses technology can provide pivotal insights into global digital trends.

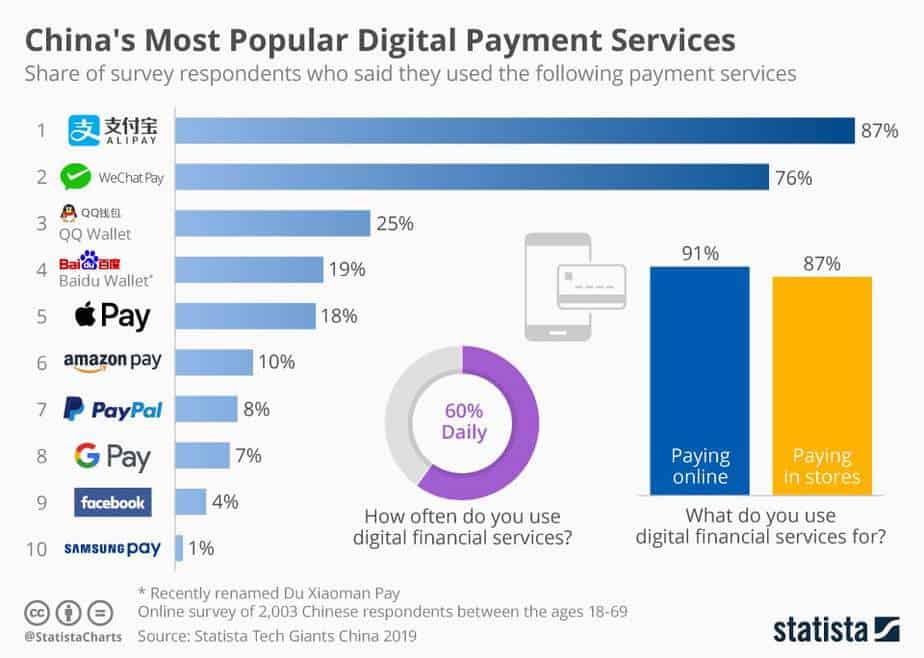

In 2017, $15.4 trillion worth of mobile payments were handled by third-party platforms in China — more than 40 times the amount processed in the U.S.[4] In China, you pay for basically everything through your smartphone: restaurants, taxis, house bills, etc.[5]

It is also worth noting that 8 out of the 10 countries with the highest mobile payment adoption are in Asia.[6] Of course, China is number 1, with Thailand and Hong Kong rounding out the top 3.[7]

The two most prominent mobile payment apps are WeChat Pay, owned by Tencent (SEHK: 700) and Alipay, owned by Alibaba (NYSE: BABA).

WeChat Pay has over 900 million monthly users, with about 85% of them living in China; and Alipay has about 1 billion users worldwide, with about 70% of them living in China.[8] For comparison, there are 127 million users of Apple Pay… globally.[9]

I believe this speaks to how advanced Chinese consumers are when it comes to mobile payment technology — and the direction that North Americans and Europeans will be headed in the next few years as these apps gain greater popularity.

WeChat Pay was introduced in 2014 and is part of WeChat — which is sometimes called a “super app,” acting as Uber, Tinder, Facebook, Messenger and Doordash all in one. Alipay was developed in 2004 as a simple way to pay for products on Alibaba, the Amazon-like ecommerce giant, and is now used in China in most situations that require a payment.

Although the Western world may not be accustomed to engaging with payment apps in this way, the colossal success of WeChat Pay and Alipay in China signals that consumers are willing to adopt such processes. Facebook must evolve to be more than just a social network to keep up.

There is another app that has emerged as a key competitor to Facebook called TikTok, a social platform where users share 15-second videos of themselves. It was launched inside of China in 2016 and outside of China in 2017.

Developed by the Chinese company ByteDance, it has been the most downloaded app in the American Apple App Store (NASDAQ: AAPL) for 5 quarters in a row (January 2018–March 2019).

In India (where it has over 120 million monthly active users), it overtook Facebook as the most downloaded social networking app in the first quarter of 2019.[10] This is important to note because India is home to Facebook’s largest user segment, and the U.S. is second.[11]

Facebook is now competing with TikTok for advertising dollars, as the fight for users’ attention is becoming more fraught.[12]

The Libra coin adds new functionality to Facebook’s ecosystem, hopefully luring in new users, or at least preventing users from switching over to other payment apps like WeChat Pay and Alipay. But Libra will also allow Facebook to monetize its user base more efficiently to better serve ads (and better compete with rival apps for marketing dollars).

If you want to transact with Libra, it is anticipated that you will have to hand over personal and financial information to fulfill compliance requirements.[13] Through this method, Facebook will be able to gather an unprecedented amount of detailed data on its user base — information that will be invaluable to potential advertisers.

Although Facebook vows to keep their users’ identities private and not share them with advertisers, they have a tremendously shaky track record (look no further than the Cambridge Analytica scandal).

The head of the Libra project, David Marcus, even insinuated that privacy is only a tool that criminals want to use, during an interview with Bloomberg on the day of Libra’s whitepaper release.[14]

So, it is no wonder that there is growing fear (chronicled in WIRED, CNBC, The Independent and the New York Times, among others) that Facebook and Libra will not be concerned with protecting their users’ payment information.[15]

Facebook has taken drastic measures, instituting its own currency to further compete with the popular Chinese apps mentioned above. However, there are major privacy issues that emerge with this type of strategy, and this is where Bitcoin’s use cases really shine.

To illustrate this point, I want to look at how WeChat Pay and Alipay are used in China as surveillance tools, helping to gather data for China’s Social Credit Score system.[16]

Under this regime, a Chinese citizen is given a score based on their “social behavior — from their spending habits and how regularly they pay bills, to their social interactions — and it’ll become the basis of that person’s trustworthiness, which would also be publicly ranked.”[17]

These scores affect someone’s “eligibility for a number of services, including the kinds of jobs or mortgages they can get, and it also impacts what schools their children qualify for.”[18]

Through the implementation of Libra, Facebook is putting a system in place where this type of all-encompassing surveillance is possible. Not only will Facebook have data on your social connections, likes, and communication patterns, it will also be able to more tightly control and gather information on your spending habits.

And remember, Facebook has a user base of 2.38 billion people! Gathering such extensive data could create an international network for the comprehensive supervision and tracking of its users.

Facebook is architecting a system where a user’s every move (no matter where they are in the world) can be easily monitored. Bitcoin provides an answer to this, as it is censorship resistant and there can be no controls put in place on how you spend, store or transfer it — it is out of reach of government and corporate control.

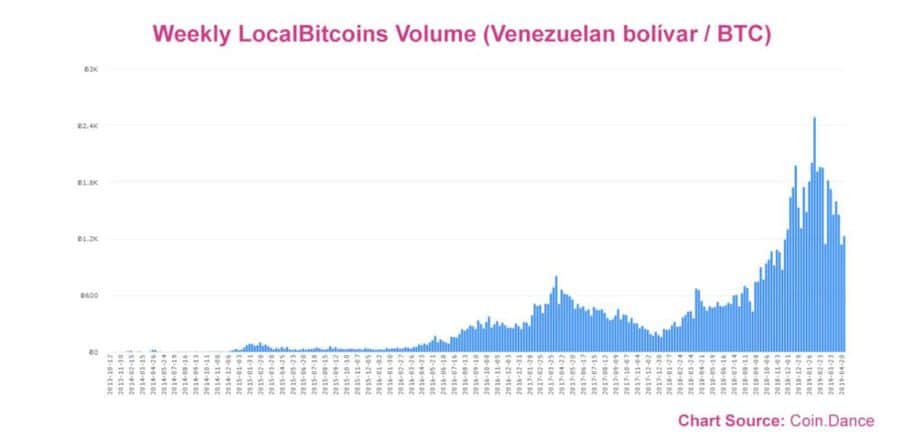

This relationship between increasing economic surveillance and Bitcoin adoption has precedent. Citizens in Venezuela were forced to use their own state-sponsored cryptocurrency called “the petro” under President Nicolas Maduro, who is often considered a dictator due to his human rights violations and oppressive policies.[19]

After citizens learned how to use this government-instituted cryptocurrency, there was a notable increase in Bitcoin usage in the country, as Venezuelans looked to subvert national economic controls.[20]

The Libra whitepaper lays out a system where The Libra Association (if you are not familiar with this group, read my recap, here) is able to create new Libra tokens and control how they circulate — basically acting like a central bank.[21]

Regulators around the world have taken note of what this could mean for Facebook’s global economic influence.

Maxine Waters, chair of the Financial Services Committee (FSC), which is part of the United States House of Representatives that oversees the financial services industry, explained to CNBC on June 20 that “We just can’t allow them [Facebook]… to compete with the [U.S.] dollar.”[22]

As a result, the FSC will hold a hearing on Project Libra on July 17. The Senate Banking Committee, part of the standing committee of the U.S. Senate, will hold its own hearing the next day, in order to gain more clarity from Facebook on its plans.[23]

Internationally, regulators are also on the offensive. The governor of The Bank of France, Francois Villeroy de Galhau, stated that he “vehemently opposes Libra becoming a sovereign currency.”[24]

Markus Ferber, a German member of the European Parliament, cautioned that Facebook could become a “shadow bank.”[25]

In response to the uproar, France is creating a G7 task force led by a board member of the European Central Bank “to examine how central banks can regulate cryptocurrencies.”[26]

The reactions from regulators not only affirms the large scale international influence that Facebook wants to accrue but also how little confidence government authorities around the world have in Facebook to carry out this process ethically.

Again, I believe this is positive for Bitcoin (BTC) as it operates outside of government and corporate purview, allowing users to be in full control of the storage, transfer and spending of their cryptocurrency.

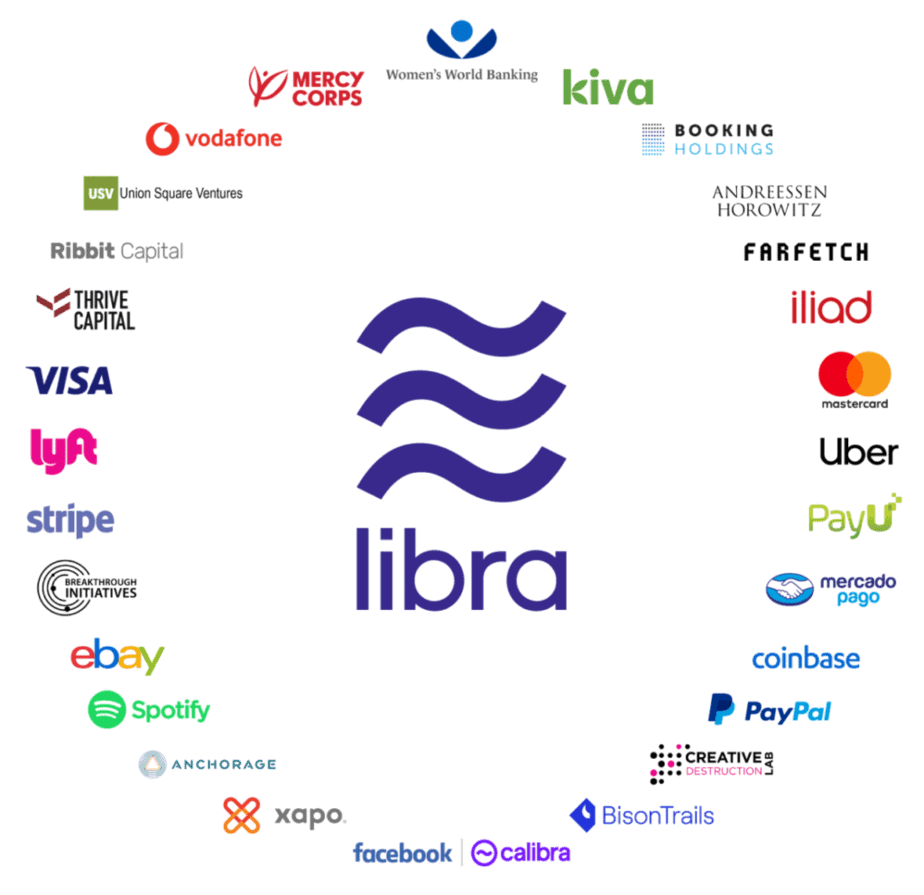

The lack of faith in Facebook to maintain user privacy and generally “do the right thing” is further demonstrated by the relationship between the social media giant and the other members of the Libra Association (members are pictured below, if you need some refreshing).

Facebook announced that it had partnered with 27 firms to run The Libra Association, with each company paying $10 million to be a part of it.

At the time of the Libra whitepaper release, it was assumed that Facebook had received payments of $10 million from each of the members, but as the New York Times revealed on June 25, no money has actually been paid to Facebook.[27]

Instead, each company “signed a nonbinding agreement, so they are not obliged to use or promote the digital token and could easily back out.”[28] Some partners (including Uber, NYSE: UBER and eBay, NASDAQ: EBAY) even declined Facebook’s requests to put out news releases and speak with media outlets about Libra.[29]

The significance of this report cannot be understated, as it demonstrates the tremendous trepidation that companies have in partnering with a corporation with such an abysmal privacy track record.

However, I think that members of the Libra Association have, through their participation in the consortium, declared their interest in being part of an ecosystem that replicates Bitcoin — highlighting growing corporate interest in how cryptocurrency can be used to support commerce and explore other use cases.

I believe that Bitcoin, and cryptocurrency more generally, has been legitimized by Facebook’s entry into the space.

And as I dig deeper into Libra — and compare it to how large Chinese payment apps operate — it is clear that the token will run into major issues around privacy and regulation. And, as these threats become more visible to Libra’s users, I believe we will see a mass migration to Bitcoin.

Facebook has opened up the Bitcoin floodgates, demonstrating how valuable the original cryptocurrency really is, and there is no turning back…my Bitcoin price sentiment for the rest of 2019 can be summed up in one word: bullish.

Blake Finucane, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://cointelegraph.com/news/no-its-not-facebook-bitcoin-price-already-up-200-in-2019-before-libra?utm_source=newsletter1&utm_medium=email

[2] https://www.reuters.com/article/us-crypto-currencies/bitcoin-reaches-18-month-high-as-facebooks-libra-spurs-interest-idUSKCN1TR10L

[3] https://www.worldometers.info/world-population/china-population/

[4] https://www.technologyreview.com/f/611491/tencent-and-alibabas-mobile-payment-war-shows-how-far-china-is-ahead-of-the-us/

[5] https://technode.com/2019/03/15/wechat-alipay-qq-top-ranking-apps-in-february/ and https://www.businessinsider.com/alipay-wechat-pay- china-mobile-payments-street-vendors-musicians-2018-5?r=US&IR=T

[6] https://www.zdnet.com/article/asia-driving-global-mobile-payments-with-eight-in-top-10-markets/

[7] Ibid.

[8] https://www.mobilepaymentstoday.com/news/allied-wallet-adds-wechat-pay-with-900-million-active-users/ and https://technode.com/2019/01/10/alipay-1-billion-users/

[9] https://www.businessofapps.com/data/wechat-statistics/ and https://www.mobilepaymentstoday.com/news/allied-wallet-adds-wechat-pay-with-900-million-active-users/

[10] https://medium.com/utopiapress/tiktok-is-making-money-with-in-app-purchase-ceec78297331

[11] Ibid and https://www.statista.com/statistics/268136/top-15-countries-based-on-number-of-facebook-users/

[12] https://medium.com/utopiapress/tiktok-is-making-money-with-in-app-purchase-ceec78297331

[13] https://medium.com/coinshares/calibra-ask-not-what-but-why-f3591fff2218

[14] https://www.bloomberg.com/news/videos/2019-06-18/facebook-s-new-libra-cryptocurrency-to-have-over-100-launch-partners-video and https://twitter.com/udiWertheimer/status/1142083827063504898

[15] https://www.wired.com/story/facebooks-libra-cryptocurrency-betrays-companys-true-ambitions/, https://www.wired.com/story/facebooks-libra-reveals-silicon-valleys-naked-ambition/, https://www.cnbc.com/2019/06/18/finance-privacy-experts-skeptical-of-facebooks-libra-cryptocurrency.html and https://www.nytimes.com/2019/06/25/technology/facebook-libra-cryptocurrency.html and https://www.independent.co.uk/life-style/gadgets-and-tech/news/facebook-libra-cryptocurrency-privacy-data-collection-a8963381.html

[16] https://futurism.com/china-social-credit-system-rate-human-value

[17] Ibid.

[18] Ibid.

[19] https://www.forbes.com/sites/caitlinlong/2019/06/09/what-facebooks-cryptocurrency-means-6-predictions/#770c50d97022

[20] https://www.forbes.com/sites/caitlinlong/2019/06/09/what-facebooks-cryptocurrency-means-6-predictions/#770c50d97022 and https://cointelegraph.com/news/bitcoin-trading-reaches-all-time-high-in-venezuela-amidst-ongoing-economic-collapse

[21] https://medium.com/@TrustlessState/libra-forking-the-fed-67dcc376d7fc

[22] https://www.coindesk.com/second-us-congressional-hearing-is-scheduled-on-facebooks-libra-crypto

[23] https://thehill.com/policy/finance/450074-house-panel-to-hold-hearing-on-facebook-cryptocurrency-project

[24] https://cointelegraph.com/news/france-creates-g7-taskforce-to-examine-facebooks-libra-crypto-regulation

[25] https://www.theblockcrypto.com/tiny/bank-for-international-settlements-warns-facebooks-libra-crypto-project-could-pose-risks-to-banks/

[26] Ibid and https://finance.yahoo.com/news/france-creates-g7-taskforce-examine-110100646.html

[27] https://www.nytimes.com/2019/06/25/technology/facebook-libra-cryptocurrency.html

[28] Ibid.

[29] Ibid.