I always love to look back and review our year-end stats on all the stock picks that FNN contributors have posted within their collective articles over the past 12 months.

It gives me an idea of how our FNN contributors have performed now that 2021 is behind us. In addition, it gives me some sense of where the overall markets are heading in the coming 2022 calendar year.

Current market sentiment has definitely cooled in comparison to the monster year of 2020. It was a year where it seemed you could pick almost any stock and see a double-digit gain right out of the gate.

In 2020, our contributors picked TWO 10-baggers, which is phenomenal in itself. And who can forget Carl Delfeld’s out of the park 24-BAGGER when he discovered Nio (NYSE: NIO) after it first went public at the beginning of 2020.

The market in 2020 defied expectations, especially considering the arrival of the COVID-19 pandemic, and will be a year to be remembered.

2021 looked completely different than 2020, with gains just a fraction of what we saw in the year prior. Many sectors saw a big pullback from their lofty heights posted in 2020.

A repositioning of the market is now taking place, which I pointed out in my article 9 Stocks to Mitigate Stock Shock; Warning Signs Could Be Flashing back in August.

As intelligent investors, we have been forced to tighten our focus and reposition our holdings in a more defensive posture. Investors are happy to take gains in the double-digits when we can. Anytime you are doubling your investment should be celebrated.

Overall, it was hardly a terrible year. Almost all of our contributor picks saw upside. Many recommendations resulted in double-digit gains, and a few were even triples.

Draganfly Inc. (NASDAQ: DPRO), which we first covered as far back as 2019, uplisted to the NASDAQ board from the OTCQB.

2021 also saw FNN begin to broaden its scope and include cryptocurrency and NFT investments in its article lineup.

Blake Finucane introduced us to NFTs as an investment opportunity in her article The NFT Boom: A Technological Breakthrough on the Blockchain That Revolutionizes Digital Ownership for Art, Collectibles and Gaming. It is a good read if you want to get up to speed on NFTs.

Our resident crypto expert Saul Bowden has written a series of articles educating investors on how and where to start their positions in this exciting, volatile and explosive investing space. In fact, four of the top ten picks for FNN in 2021 were crypto investments.

Rumor has it that investors are now taking the crypto space quite seriously and have largely left small and microcap investments in lieu of crypto. Time will tell if this trend continues into 2022 as the crypto space begins to mature, massive short-term gains begin to wane, and as regulation appears to finally be hitting this market segment.

Gains for our Top 10 picks for 2021 were calculated with the starting price at the time of publication to the highest share price realized through the end of the year.

One thing is for sure, FNN contributors continued to prove their salt over the past year and our contributors were able to find some notable investment opportunities for our subscribers.

Below are the Top 10 gainers from our seasoned FNN financial analysts and writers.

Four of the Top 10 gainers for 2021 were cryptocurrency picks.

The crypto space is without a doubt here to stay. While Bitcoin (BTC) tends to get the most media attention, there are loads of other cryptocurrencies to invest in — each with their unique technology and advantages.

FNN contributor Saul Bowden has a deep knowledge of the crypto space, and we are proud to have added him to the team this year. His articles on crypto are thorough and have helped educate our readers on the basics of investing in the space.

You can read our articles on crypto here.

I’ll be honest. I’m a stock guy, and the idea of crypto / NFTs mostly goes over my head. But I have to say that after reading both Saul’s and Blake’s articles, I have a better understanding of these categories and now have a better grasp of some of the investment strategies explained to our FNN readers.

While cryptocurrencies and NFTs are still in their infancy, four out of the Top 10 gainers we saw this year were in the crypto space.

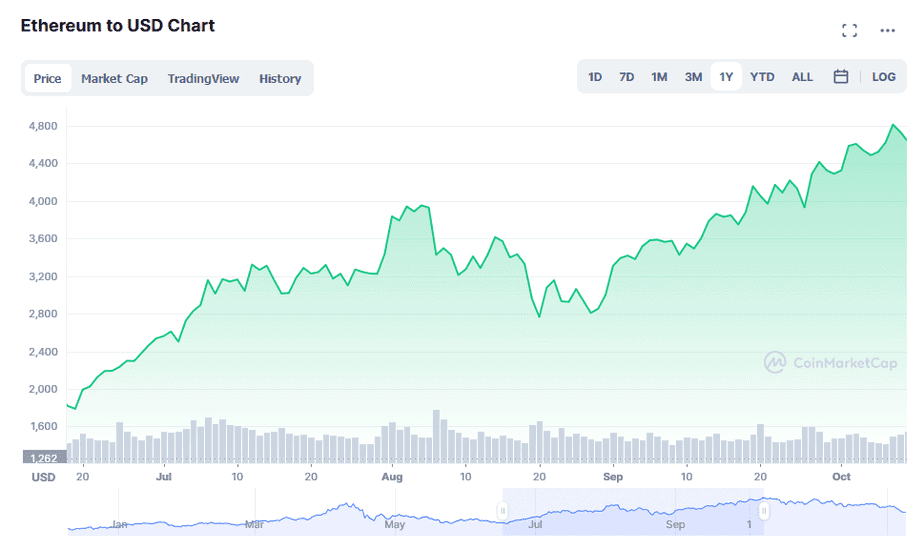

Ethereum (ETH)

Starting price at publication was $2,403.54. The coin reached a high of $4,812.09 on November 7, 2021, giving readers a gain of +100%.

Cardano (ADA)

Saul called Cardano coin at $1.3069. Subsequently, the coin rocketed up to $2.9682 giving up gains of +127%.

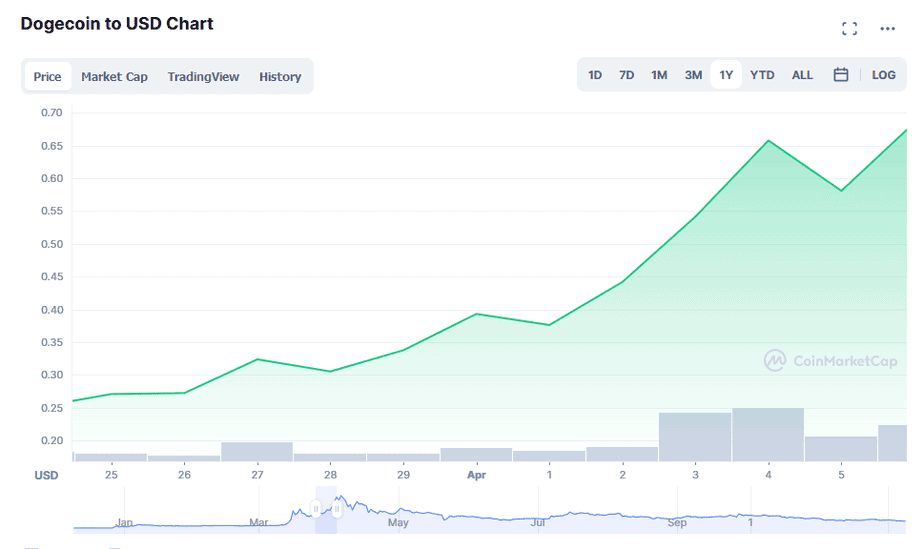

Dogecoin (DOGE)

Dogecoin is an Elon Musk favorite. Saul brought the coin to the attention of our readers when it was at $0.2722. Soon after, the coin reached a high of $0.68. Readers who invested in the coin would have seen gains as high as +152%.

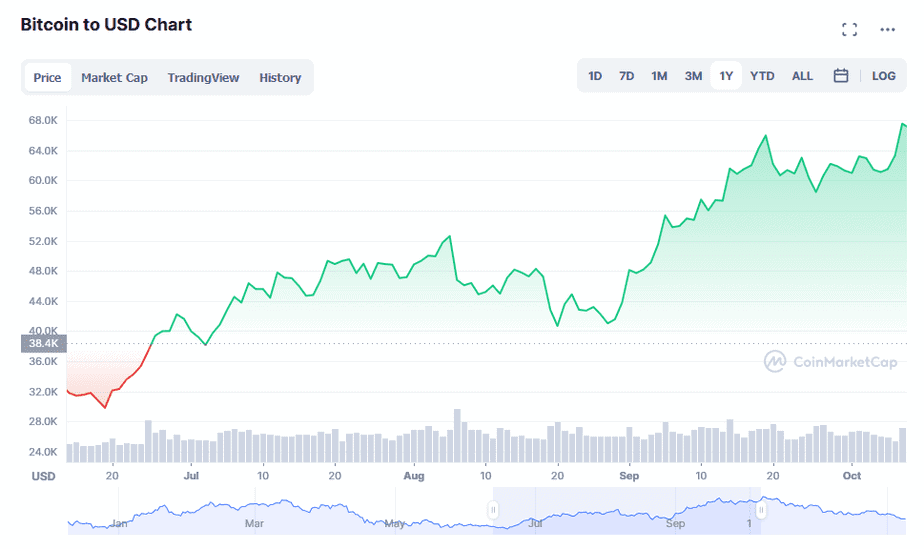

Bitcoin (BTC)

Bitcoin is the most well-known cryptocurrency currently traded and gets the majority of media attention. FNN readers were alerted when it held a price of $32,702.03/coin. Later in the year, Bitcoin reached a high of $67,566.83, with investors seeing gains as high as +107%.

The Green Energy sector covers a wide range of investment opportunities as demonstrated by some our highest gainers in the space.

We are in the very beginning stages of this sector, especially as more countries focus on green energy as the key to fighting climate change. The category has years of unrealized growth ahead as world governments begin to clamp down on fossil fuel emissions and economies begin to transition to renewable energy sources.

I am excited to see where this space will go in the coming years. It has so much growth potential, and on a positive note, could ultimately slow or stop global warming and related climate changes we are now beginning to experience.

In my opinion, this is a smart investment opportunity, as well as a morale and ethical investment in the future of our children.

Renewable Energy:

Aurora Solar Technologies (OTC US: AACTF / TSX-V: ACU)

Sources of renewable energy will continue to see gains as economies transition away from fossil fuels. Solar power has proven itself to be viable and efficient.

Aurora Solar was first noted by FNN contributor Blake Desaulniers at the beginning of 2021 when its share price was at $0.298. Soon after, the stock almost doubled, giving gains to investors of +98%.

Lithium Metal:

Lithium is the white gold of the green energy movement. The metal is literally at the core of energy storage and is used in everything from handheld electronics to the explosive growth of electric vehicles (EVs).

There is currently a resource land grab that is taking place, and countries around the world are positioning themselves to secure this vital resource. Supply is limited and demand is absolutely skyrocketing.

Albemarle Corporation (NYSE: ALB)

Albemarle is one of my favorites in the lithium mining space. They have multiple properties located around the world in both hard rock and brine lithium production. Keep this one on your radar into 2022 as lithium demand continues to outstrip supply and prices continue their parabolic climb.

I first brought Albemarle to you in April 2021 when the share price was $147.71. Readers could have seen gains of up to +92% when the stock reached highs in November.

Neo Lithium (OTCQX: NTTHF)

A junior lithium mining play, Neo Lithium was first noted in an article in July 2021 at a share price of $2.20. By November, the company shares saw a high of $3.00, giving potential gains to our readers of up to an enormous +136%.

Electric Vehicles

I put Ford Motor Company (NYSE: F) under the Green Energy section because of what they are doing with electric vehicles, and more specifically, their new line of electric pickup trucks. It is an exciting time for the auto industry as the transition from gas/diesel to electric (EV) gains ground.

Electric vehicles are seeing explosive growth and are still at the beginning of the upward curve happening now.

Ford Motor Company (NYSE: F)

Ford’s F-150 Lightning electric pickup rocks. Demos of the truck have blown away the competition including anything gas or diesel powered. I’m a big fan of Ford and their new line of electric pickups. They own the historic brand that could sway the minds of reluctant buyers, tipping the multibillion-dollar pickup truck space in their favor.

Ford is already seeing success with both their F-150 Lightning EV truck and the hot Mustang Mach-E EV. In fact, Ford is having a hard time keeping up with demand for the two vehicles.[1] I predict that demand will continue to grow over the coming year.

In my opinion, they are just getting started in the EV space, and I am excited to see what they come out with in 2022/23. Ford will continue to see positive growth over the next year under the direction and restructuring of the company by auto veteran Jim Farley. Since Farley became CEO more than 15 months ago, the stock is up by more than 200%. [2]

Watch out Elon Musk!

I first alerted FNN readers to Ford (NYSE: F) at the beginning of 2021 at a share price of $8.87. In December of this year, shares reached $21.45, giving up triple-digit gains of +142%, making it the top-performing stock in the auto manufacturer space.

Semiconductors are at the core of our modern technology driven civilization. (See my article 7 Stocks in the Red-Hot Semiconductor Space You Need to See Now here.)

I don’t know about you, but if I don’t have my mobile phone on me, I become anxious, panicked and lost all at once. Call it an addiction but I see the devices as more of a second brain — a complement if you will to our biological brains.

This past year, we saw how critical semiconductors are when there was a shortage of the silicon chips. Supply lines ground to a halt and orders went unfulfilled. Factories literally had to shut down waiting for their critical components.

This trend will only continue to grow as 5G, artificial intelligence (AI), machine learning and robotics take on more prominent roles in our lives.

An interesting side note: My son is seven months old and already he is fascinated by our cell phones. He still has not experienced the device, but he knows there is something there that is important. I found this really interesting. How does he know that my mobile device is something he wants to explore? It made me think that it seemed we might be programmed genetically to strive for this technology. It seems to be written into our genes.

NVIDIA (NASDAQ: NVDA)

NVIDIA is one of my favorites in the tech and semiconductor space. They are involved in many, many projects that will flip reality as we know it on its head in the coming 3–5 years. Science fiction is very close to being science reality.

In June, I pointed NVIDIA out to our FNN readers when share prices were at $180.19. By November of this past year, NVIDIA was up to $333.76 per share, giving potential gains of +85%.

The psychedelic space is still in its infancy. The drugs that have been villainized for decades are finally being reexamined for their extraordinary power to help people with debilitating mental health issues.

This is an exciting space for investors… Current mental health drugs that pharmaceutical companies have developed are simply not as effective, based on early data, as potential psychedelic compounds such as ketamine, cannabis, CBDs, psilocybin, MDMA and LSD. Governments are finally letting science speak in terms of efficacy and treatment value. Patients are already benefiting from these novel treatments.

The psychedelic space will continue to mature over the coming years as world governments continue to understand the value of psychedelic compounds and legislate for legalization and controlled distribution.

Allied Corp. (OTCQB: ALID)

Allied Corp. was brought to my attention in March of 2021. After I interviewed the management team, I immediately fell in love with what this company was doing and where they were headed.

I first alerted FNN readers to the company at $1.02/share. By November, the share price had already more than doubled, with readers seeing potential gains of +107%.

Allied is definitely one to have on your radar going into 2022 and beyond.

For me, the Top 10 FNN gainers for 2021 show me what to look out for in 2022.

Here are my takeaways:

I believe markets will continue to tighten as the Fed continues to wind down their loose monetary policies and the COVID handouts MEME stocks craze eventually comes to an end.

In 2022, investors will have to be vigilant and make their investment decisions with care after doing very thorough research.

Amazing investment opportunities will continue to be found, but only for those investors willing to take the time to research and learn in order to make intelligent decisions.

One important way to learn about hot investment opportunities is to follow reputable investment publications such as Financial News Now. Subscribing is free and we have a proven track record of solid investment advice that will surely help guide you in your future investment decisions.

Sign up today and don’t miss the top gainers of 2022.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.forbes.com/sites/alanohnsman/2021/12/27/fords-high-profile-electric-truck-shows-auto-industry-gunning-for-teslas-ev-market-lead/?sh=30bd8a450ddc

[2] https://www.cnbc.com/2022/01/03/ford-beats-tesla-to-become-auto-industrys-top-growth-stock-in-2021.html