President Biden’s massive $2.3 TRILLION infrastructure package has its sights on the US energy sector and it does not look particularly good for fossil fuels.

The current administration has set an ambitious goal that mandates all energy produced by 2035 will not produce carbon emissions. [1]

This mandate is a huge windfall for green energy companies that have struggled through the early years of adoption.

The Wall Street Journal points out that, “the infrastructure plan would supercharge an already booming clean-power sector by expanding subsidies and addressing key bottlenecks impeding the shift to a greener grid.”[2]

And CNN points out that, “such a transition would trigger a massive spending boom in wind and solar power — at least doubling the pace of investment now underway.[3]

The transition from a fossil fuel driven energy economy to one that is 100% green is to say the least a massive undertaking. The reality is that it is a goal that is not impossible to achieve and quite frankly is necessary if we are to avert a looming catastrophic global climate crisis.

There really is no time to waste with further discussion and inaction. The Biden administration is taking the lead and charging into the future with massive funding for research and development to replace an aging and obsolete energy infrastructure.

For the savvy investor, the Green Energy Boom is an investment of generational opportunity. The tens of billions of dollars pouring into the sector could take green energy stocks to new heights in the coming years, and now is the time to look at increasing your portfolio exposure to Green Stocks before they really take off.

Stay with me here as I illustrate the current state of green energy stocks and my personal top 5 picks for the coming green energy boom.

Clean energy stocks have come under pressure this year following a record-setting 2020, but supportive policies from the White House could provide big gains across the sector.

“Alt Energy stocks have undergone a correction ... but fundamentals remain very good, and arguably got better with the unveiling of the Biden infrastructure plan, so we think the pullback presents a buying opportunity broadly,” JPMorgan said.[4]

Valuations on these companies are also looking more attractive because of a recent pullback in the sector.

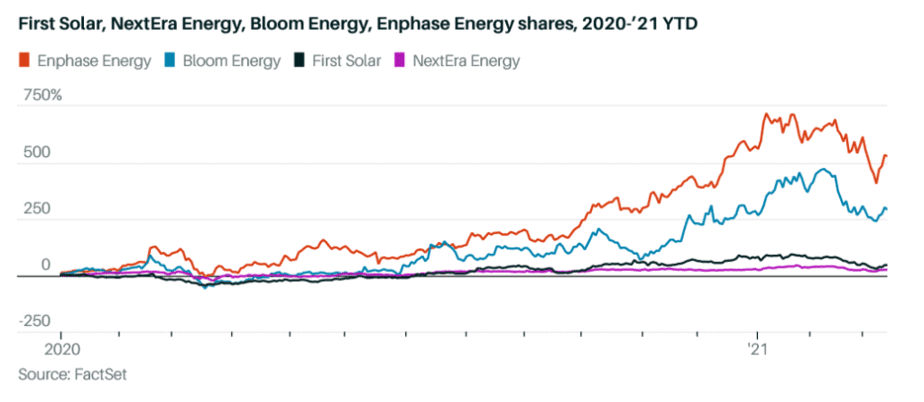

The chart below illustrates four green energy stocks and their respective share prices over the past year. The run-up to Biden’s election set off a flurry of speculative buying and subsequent profit taking in early February of this year.

Two months after the correction, we are now starting to see those stock prices recover as the dream is now becoming reality. We are literally in the midst of a seismic shift of unspeakable proportions.

The retooling of America’s energy grid will be akin to the late 60s and putting the first man on the moon. America is waking up from the COVID nightmare and everything seems possible.

We are in historic times folks!

While doing my research I came across some very powerful quotes and facts from well-known experts in the green energy sector that I wanted to share with you. They clearly illustrate the excitement across the board of where we are going with the upcoming transition to green energy.

Adoption of green energy will continue to gain steam, as solar photovoltaics and onshore wind now are the cheapest ways to add new electricity-generating plants in most countries, according to the International Energy Agency (IEA).

The foundation of President Biden’s green energy plan is to limit fossil fuels from the equation.

For example, in the transportation sector, President Biden has ordered that the federal government develop a plan to make its fleet of 645,000 vehicles go completely electric.

General Motors recently announced that by 2035 it would make only EVs.

"It is a game changer," said Harvard environmental law professor Jody Freeman of GM's plan.

Converting everything to run on electricity requires massive amounts of electricity to be moved across vast distances. This is something our current transmission grid cannot handle and has been a hinderance to adoption of green energy alternatives.

The Biden plan calls for the creation of a new electric transmission tax credit to support the construction of high-voltage transmission lines, a major roadblock for the build-out of renewable energy.[10]

The transmission tax credit, by itself, could drive a 50% increase in renewable energy development.[11]

Battery storage and technology stocks will also see a lift. All that green energy must be stored somewhere as a backup when the sun is not shining, and the wind is not blowing.

To date, grid-scale battery storage hasn’t been eligible for the tax credit unless it is paired with a solar farm. The Biden administration has signaled support for expanding the program to include stand-alone batteries, which are seen as critical in helping to address the intermittency of wind and solar power production.[12]

Lithium-ion battery prices are dropping rapidly creating opportunities that are on par or more economical than current fossil fuel alternatives.

In 2020, the average price of lithium-ion battery packs fell to $137 per kilowatt-hour (kWh) — down 89 percent from 2010, reports BloombergNEF, an energy research organization.

Last year, prices for batteries used in E-buses in China actually broke $100/kWh for the first time — a historic threshold that will allow automakers to create and sell EVs at prices comparable to internal combustion vehicles.

The Green Energy Boom is much more than the production of energy. The movement touches countless sectors across the US economy. When doing your research think of lithium mining, semiconductors, transmission line installations, cables, battery pack technology, electric vehicles, wind turbine production & technology, and solar production & technology.

As I stated before, these massive investment moments are a generational opportunity. We are witnessing what could be an economic paradigm shift that rivals anything seen since the Industrial Revolution.

The time to invest is now!

Below are five companies that I have discovered that appear to be leaders in their respective sectors and what I believe could be solid investment opportunities.

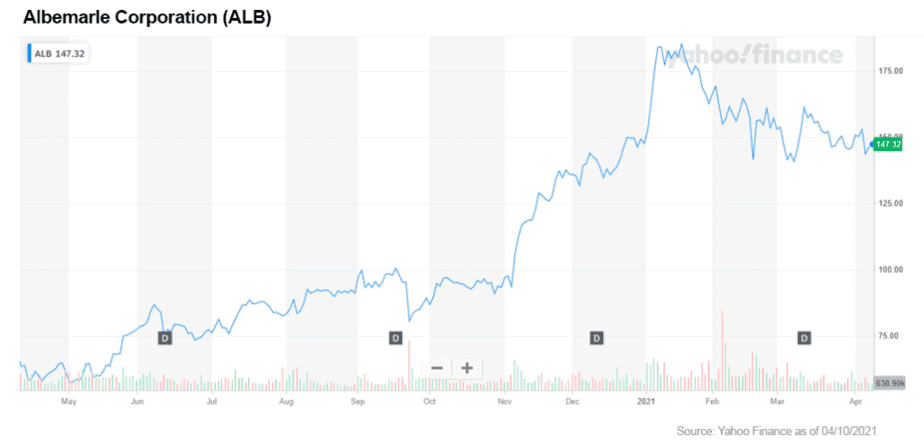

1. Albemarle Corporation (NYSE: ALB)

Albemarle is one of the world's top producers of lithium, which is used in batteries for electric vehicles and mobile devices, among other applications. It produces lithium from its assets in Chile and Nevada, as well as two joint ventures in Australia.

Albemarle plans to nearly double its lithium production by the end of 2021.[13]

2. TPI Composites, Inc. (NASDAQ: TPIC)

This company is a leading manufacturer of composite wind blades. It supplies these blades to wind turbine manufacturers and commands nearly a fifth of all onshore wind blades sold on a megawatt basis globally. Turbine blades are a key input within the wind industry's value chain, and TPI is a top player.

In 2019, the company notched a record $1.4 billion in annual net sales, selling 9,500 wind blades. And despite the economic upheaval of COVID-19, the company finished 2020 with 15% revenue growth to $1.65 billion.[14]

TPI has achieved the rare feat of double-digit organic top line growth every year for the past decade.

Of the 11 analysts that cover TPIC stock, 10 say it's Buy-worthy. That includes Roth Capital analyst Philip Shen, who says TPI will benefit from continued outsourcing of wind blades by wind turbine manufacturers, as well as the potential windfall from the transportation sector.[15]

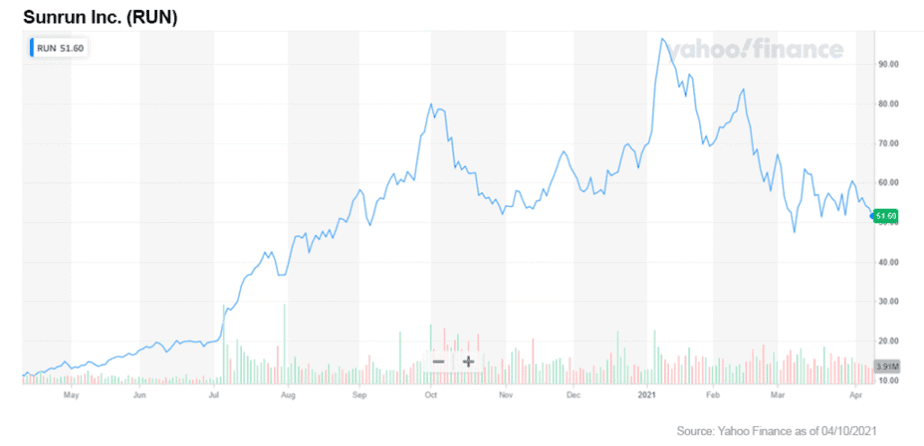

3. Sunrun Inc. (NASDAQ: RUN)

Sunrun recently agreed to buy its rival, Vivint Solar, in a deal worth $1.5 billion. The acquisition, which closed in October, creates a rooftop solar giant that provides 75% of new residential solar leases each quarter.[16]

Sunrun is 'the leading player in the rapidly growing US rooftop solar market,' an RBC analyst says, initiating coverage of the stock at "Outperform."[17]

The market for residential rooftop continues to grow. In 2020, the installed base of residential rooftop solar capacity was more than 19 gigawatts, up from around 16 GW in 2019 and around 13 GW in 2018.[18]

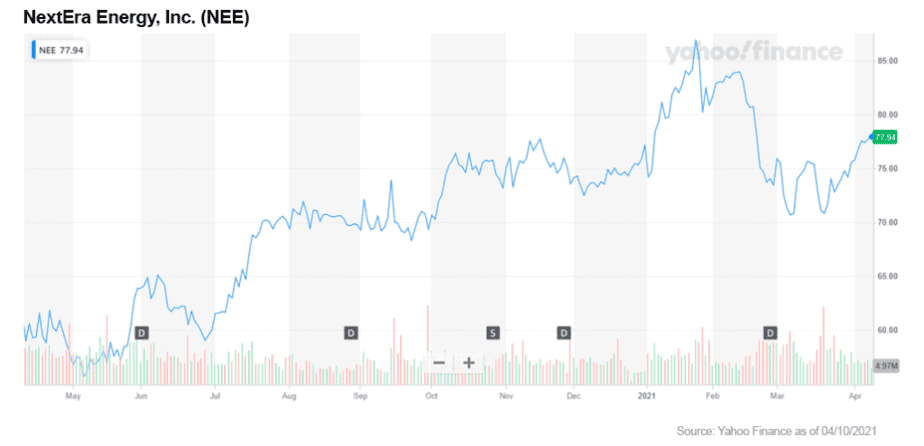

4. NextEra Energy, Inc. (NYSE: NEE)

NextEra Energy isn't just a renewable energy company; it's also a utility. NextEra is the largest electric utility in the United States by retail megawatt-hour (MWh) sales. And its NextEra Energy Resources subsidiary is the world leader in solar and wind power. [19]

For investors, this translates into both income and growth. NextEra estimates that annual earnings growth will average between 6% and 8% through 2023, after growing 10.5% in 2020 compared to 2019.

For income focused investors, the company said it expects to continue to increase its annual dividend by about 10% through 2022 off of 2020s base.[20]

NextEra the largest electric company by market capitalization in the US, is also actively building its transmission development business.

5. Shoals Technologies Group, Inc. (NASDAQ: SHLS)

Shoals provides an array of equipment needed to operate solar energy systems. Moreover, it provides the components needed to carry electric currents from solar panels to solar inverters and ultimately to the power grid.

This includes cable assemblies, wireless monitoring systems, junction boxes, transition enclosures and splice boxes.[21]

A big positive of Shoals is that it's profitable and growing at steady double-digit rates. For the nine months ended Sept. 30, Shoals reported revenue of $136.7 million, up 28% from the year-ago period. Net income was $29.5 million vs. $17.3 million.[22]

The green energy sector is booming, and investors should waste no time in doing their research and adding promising companies to their portfolios.

Think of the early 90s and the beginning of the internet tech companies such as Google, Yahoo, EBay, and Paypal and the explosive gains they all realized in just a few years.

The coming Green Energy Boom holds promise to be the next high return sector for early investors who find a position now.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://edition.cnn.com/2021/03/31/politics/infrastructure-proposal-biden-explainer/index.html

[2] https://www.wsj.com/articles/bidens-big-infrastructure-plan-would-further-boost-renewable-energy-11617276749

[3] https://edition.cnn.com/2021/04/06/politics/infrastructure-plan-biden-green-energy-states/index.html

[4] https://www.cnbc.com/2021/04/05/infrastructure-bidens-proposal-directs-billions-toward-clean-energy.html

[5] https://ieefa.org/ieas-birol-solar-soon-to-be-the-new-king-of-the-worlds-electricity-markets/

[6] https://theweek.com/articles/967613/boom-green-energy

[7] https://www.energy-storage.news/news/fundamental-value-of-batteries-for-the-grid-makes-energy-storage-a-very-exc

[8] https://www.carbonbrief.org/solar-is-now-cheapest-electricity-in-history-confirms-iea

[9] https://www.scientificamerican.com/article/coals-decline-continues-with-13-plant-closures-announced-in-2020/

[10] https://www.wsj.com/articles/bidens-big-infrastructure-plan-would-further-boost-renewable-energy-11617276749

[11] https://www.wsj.com/articles/bidens-big-infrastructure-plan-would-further-boost-renewable-energy-11617276749

[12] https://www.wsj.com/articles/bidens-big-infrastructure-plan-would-further-boost-renewable-energy-11617276749

[13] https://www.albemarle.com/

[14] https://www.tpicomposites.com/

[15] https://www.kiplinger.com/investing/stocks/energy-stocks/601849/green-energy-stocks-that-could-catch-a-2021-tailwind

[16] https://www.sunrun.com/

[17] https://www.thestreet.com/investing/sunrun-beams-as-rbc-starts-coverage-at-outperform?puc=yahoo&cm_ven=YAHOO

[18] https://www.mordorintelligence.com/industry-reports/residential-solar-energy-market

[19] http://www.investor.nexteraenergy.com/

[20] https://www.fool.com/investing/2021/04/01/3-infrastructure-stocks-to-buy-right-now/?source=eptyholnk0000202&utm_source=yahoo-host&utm_medium=feed&utm_campaign=article

[21] investors.shoals.com

[22] https://www.investors.com/research/ibd-stock-of-the-day/shoals-stock-ibd-stock-of-day-sets-up-base-approaches-buy-point/?src=A00220