I’d like to give everyone a break from the dismal state of the markets and focus on a ray of hope sitting on the horizon: renewable energy commodities.

This covers a variety of commodities such as graphite, lithium, and nickel — essential components of modern battery technologies that will be key to our economy as we continue to transition away from fossil fuel derived energy sources.

Many of you will already have some exposure to this sector through Tesla Inc. (NASDAQ: TSLA) or Toyota Motor Corp (NASDAQ: TM), however, the energy metals market goes beyond electric cars, and there are other ways to gain more direct exposure.

Let’s take a dive into what the energy metals market outlook is and look at some ways you can gain exposure to the supply side of the equation.

We’ve touched on the potential of energy metals before. One of our contributors, MF Williams, noted the lithium trend back in 2021 (read more here), and it’s only been picking up steam since then.

The first trend is most visible — the rise of electric vehicles (EVs). By 2030 EVs are expected to account for 50% of all vehicle sales in the US, between 60–83% in the EU, and 40% in China.[1] This will result in a significant increase in the demand for the commodities essential to lithium-ion battery production, such as graphite and lithium.

The second ingredient in our demand cocktail is renewable energy. Despite a lack of government financing, renewable energy has proven to be incredibly efficient. All renewables are already more affordable than coal, and by certain calculations, renewable energy is currently the world’s cheapest energy source.[2]

This is good news, as many Western nations had already committed to decarbonizing in the Paris Climate Agreement.[3] These efforts to decarbonize saw another significant catalyst in the wake of the tragic Russian invasion of Ukraine in early 2022.

Europe has typically attempted to reduce its carbon impact by focusing on a combination of EVs and a reliance on relatively low-pollution natural gas. Unfortunately, around 41% of the European Union’s natural gas imports came from Russia.[4]

The shock of the Russian invasion, and the extreme violence that followed, has led to increasing calls for the bloc to end its reliance on Russian energy. This has resulted in plans for the EU to wean itself off Russian energy by 2030.[5]

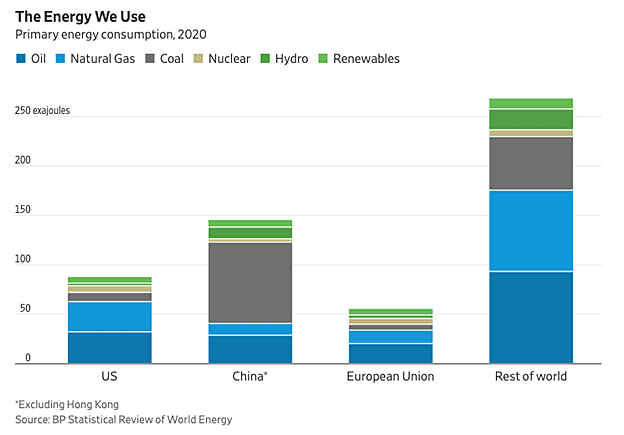

Why is this important for this conversation? Well, the EU’s options for energy generation are limited. Coal is a non-starter if Europe wishes to maintain its position as a leader in the fight against climate change. Nuclear power is an option favored by France, however, Germany is still hesitant to support this option for ethical and practical reasons.[6]

This leaves Europe with one real option: renewables. Europe does produce a lot of energy via renewables, around 22% on average, with some outliers like Sweden producing up to 60% of their energy from renewables.[7] However, renewables have one big problem: They struggle to meet the base-load requirement for energy.

The best way to get around this is battery technology. Batteries can store excess energy and then release it back to the grid when the sun isn’t shining and the wind isn’t blowing. However, that brings us to the big problem here - there is a supply-side bottleneck, for now at least, and it’s going to be exacerbated by electric cars.

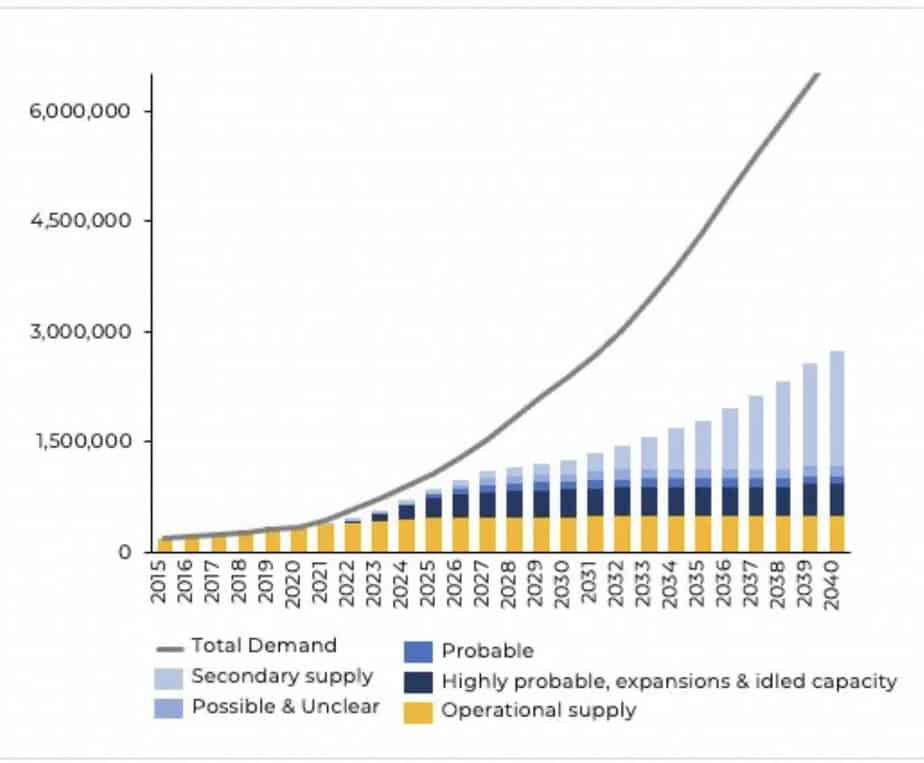

The EV industry alone is set to outstrip demand for key minerals like lithium, with some industry voices worried that we could run out of easily accessible material within the next decade.[8] For context, let’s take a look at graphite which makes up around 50% of the average lithium-ion battery.[9]

The average EV can contain up to 70kg of graphite.[10] So for every 1 million vehicles, you should need around 75,000 tonnes of graphite. By 2030, this means we are looking at a global demand of around 8 million tonnes annually for EVs alone. When you consider that the mining industry could supply just 1.1 million tonnes in 2020, this becomes a little overwhelming.

This has spooked governments around the world who are racing to secure their own national supply of key rare minerals and renewable energy commodities. For example, the Canadian government has already committed around CA$2 billion to secure a supply chain for its EV battery economy.[11] Ottawa (Canada) has gone even further, with pledges of CA$3.8 billion over the next 3 years.

The US has followed suit and has listed graphite, lithium, cobalt and a number of other energy commodities as essential to its natural security. This is particularly problematic in the case of graphite, where the US still imports 100% of its supply from abroad.[12]

This picture isn’t entirely perfect. It should be noted that supply of certain renewable energy commodities, notably lithium, is expected to outstrip demand in the medium term, and Goldman Sachs analysts are actually predicting a fairly aggressive correction in the price of lithium particularly for the next two years.

This brings us to the bit you’ve been waiting for: Which renewable energy commodities are likely to perform well and which should you be avoiding?

Since we can predict that the demand for certain materials, particularly nickel, graphite, and lithium, are likely to increase, then investing in companies that are looking to extract those materials is a good bet. This comes with significant risks of failure if you’re investing at an early stage and reduced rewards for more mature projects.

There are some broad similarities between the different battery metals/mineral mining operations, but the outlook for each individual sector differs — so let’s take a quick dive into three of the big ones: graphite, lithium, and nickel.

There were a number of companies that rushed into graphite when it became clear that demand should rise, but much of that demand has not yet materialized. This has led to a situation where a good deal of graphite mining operations have yet to secure offtake agreements, leaving them stalled.

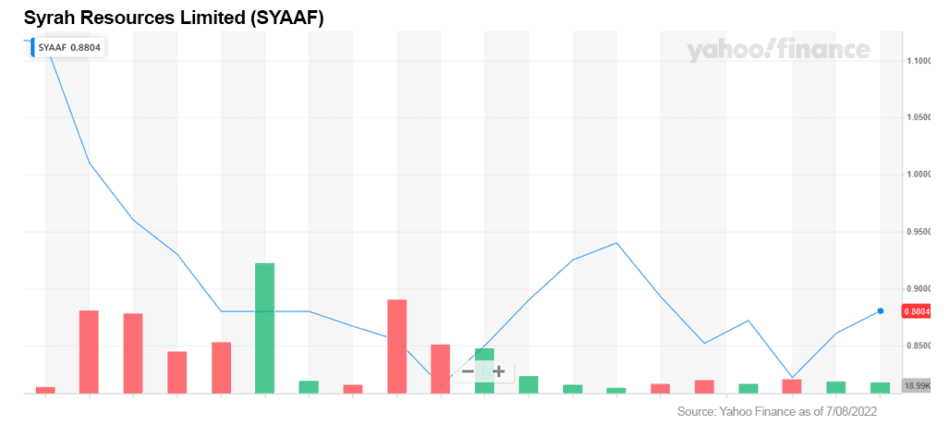

By far the most well known graphite mining stock is Syrah Resources (OTC US: SYAAF / ASX: SYR). Despite securing an offtake deal with Tesla, Syrah Resources is not yet profitable.[13] The company is actually experiencing losses at the moment but it is expected to hit breakeven around 2023, and the company’s revenue forecasts were recently significantly upgraded.

With price targets of around AU$1.58, it is still trading a little under forecast. However, investors should also keep in mind that around 25% of Syrah’s equity is in debt. If the company misses its profit targets, this could cause significant problems down the line.

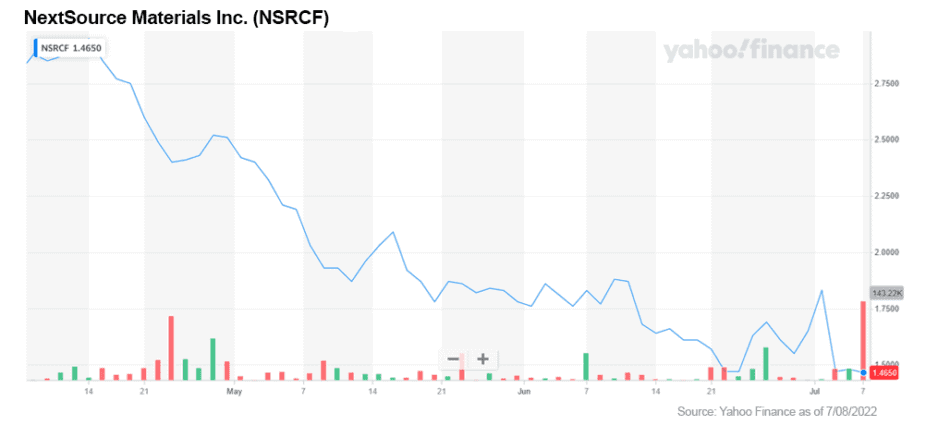

Aside from Syrah, there are a number of smaller graphite projects at the early stage that might make sense for risk tolerant investors. Take NextSource Materials (OTCQB: NSRCF / TSX: NEXT).

The company isn’t yet revenue generating, and it is firmly in the small-cap stage, however, it is one of a handful of companies that has already secured a supply agreement for around 100% of its phase one capacity. It has an agreement with a major Japanese EV product from 2018, and one with the German-based EV battery producer ThyssenKrupp AG.[14]

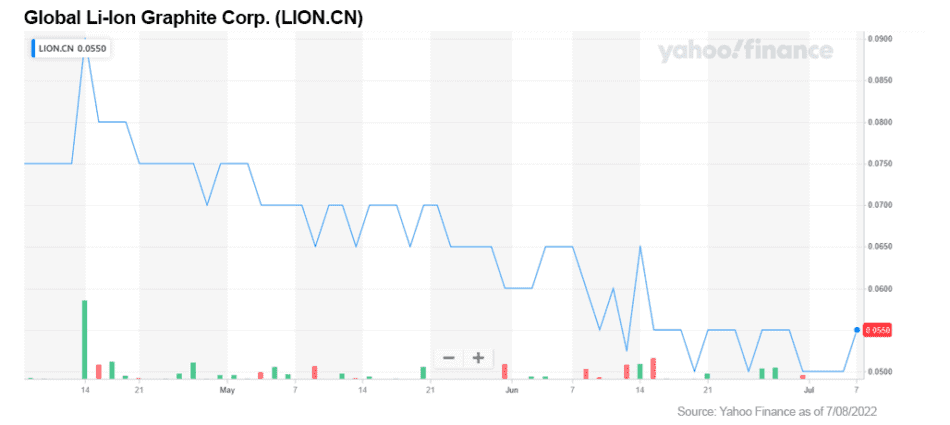

On the extreme end of the scale, we have microcap stocks that are far less along than NextSource or Syrah, adding yet more additional risk. These are stocks that risk-tolerant (or thrill-seeking) investors might want to look at.

For my part, I have made a small bet on Global Li-Ion Graphite Corp. (CSE: LION), another Canadian-based company with a presence in Madagascar. I believe that the company’s properties, combined with a solid management team, have the potential to provide easily accessible high-quality graphite. However, it is too early to give them an outright buy recommendation, but you will be the first to know how my bet turns out! This is a junior market investment punt on my part.

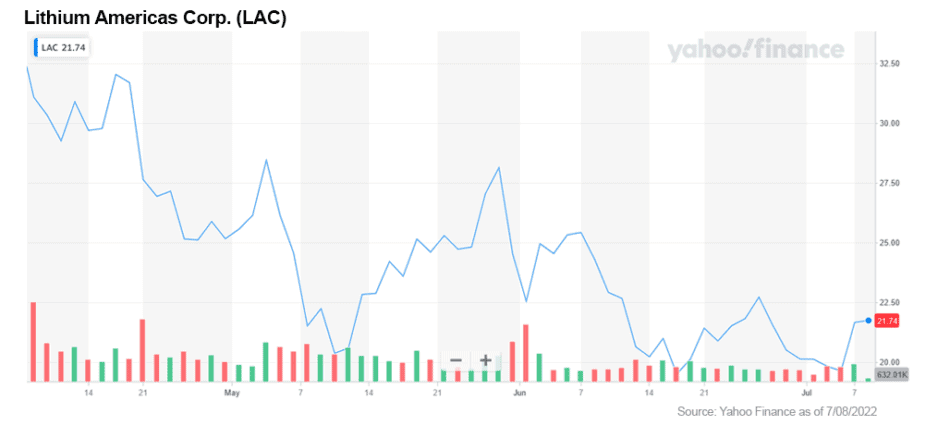

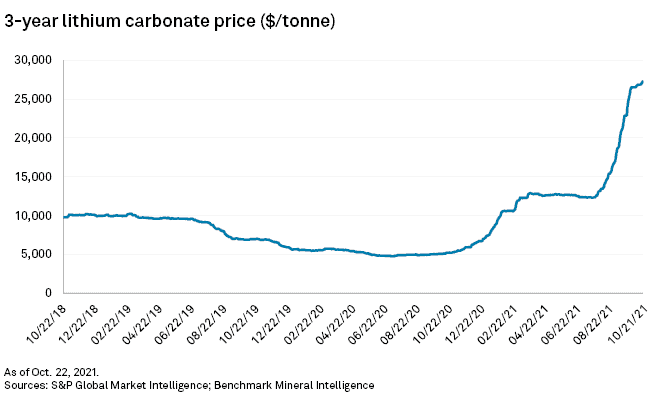

We’ve covered graphite — what about lithium? Until early June, lithium prices were skyrocketing. However, Goldman Sachs poured water on the fire with a report that argued that we will see drops of up to 73% in the price of lithium by next year.[15]

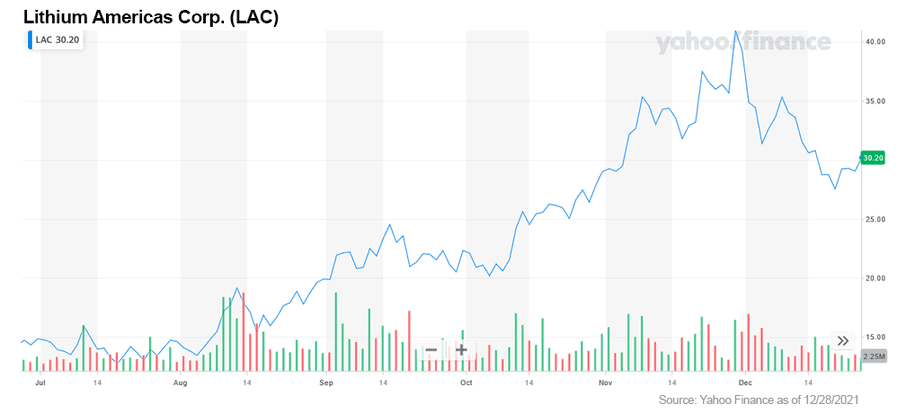

This meant that many major lithium mining stocks, notably Lithium Americas (NYSE: LAC), have since suffered a price correction. This effect is compounded by the large number of Chinese-based lithium mining projects coming to fruition, which will ensure strong supply-side fundamentals.

Now, this isn’t to say that I’m recommending against buying lithium mining stocks. The oversupply of lithium will enable carmakers and battery makers to more effectively operate. This will hopefully lead to a price resurgence in 2025 and beyond.

For my money, the best lithium strategy will be to stagger a number of smaller investments into companies such as Lithium Americas (NYSE: LAC). This will allow investors to benefit from the incoming price shock, while maintaining outsized exposure to stocks that will see a resurgence as the demand side of the lithium market becomes even more robust.

The outlook for nickel is a little more mixed than graphite or lithium. Nickel is a key component for the most common form of battery chemistry for cathodes.

While there is a trend towards nickel-free battery chemistries, there are still some strong fundamentals for nickel. The most important of which being that nickel-based NCM batteries chemistries are easier to recycle, which will become a key decision maker for manufacturers as governments seek to reduce electronic waste and work towards building a cleaner environment.

Another positive for nickel is geography. It will be difficult to scale the supply of nickel anytime soon, which means that it has a much softer tail-off than other energy metals for the next year or so. This does, however, mean that there might not be the same discount on nickel companies that we’ll see on lithium investments in the next 12 months, so possibly fewer opportunities to buy the dip.

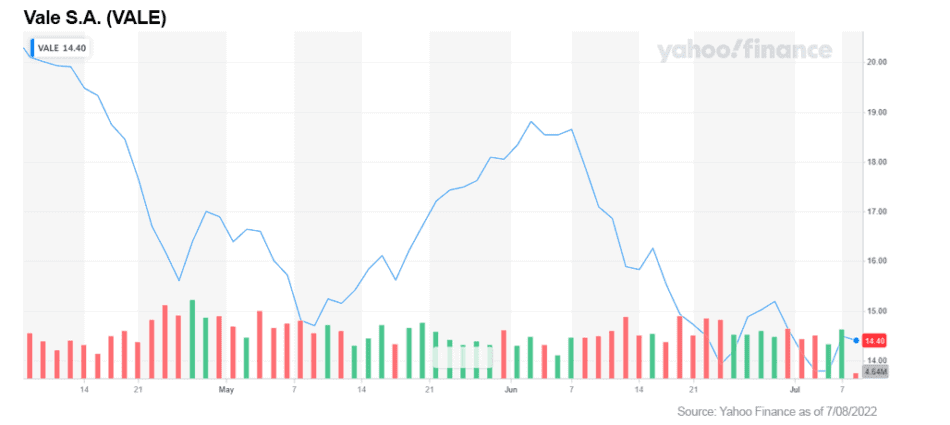

For most FNN readers, Vale SA (NYSE: VALE) is likely our most watched nickel stock... While it is down from highs in June of last year, the stock has been performing well of late, and as the largest producer of nickel is probably a good way to get exposure to this important metal commodity.

So with all that said, are in-demand commodities the best way to gain exposure to the energy (electric) transition? I would say they are a key component of any green or renewable stock portfolio. A healthy combination of lithium, graphite, and nickel stocks will give you broad exposure to three of the most important commodities for battery production.

Once you have supply exposure, then I believe it's time to start looking at demand. As the report from Goldman Sachs highlights, short-term oversupply will reduce prices and give battery technology companies more breathing space to innovate and grow.[16]

This means that in the near future there will be a number of battery stocks, perhaps even fully integrated companies, that could provide even greater upside versus the commodity mining stocks most investors are currently following. I believe we need to look to the future.

I would recommend that you do your own research into the renewable energy commodity mining stocks mentioned, build a personalized investment portfolio plan, and decide how you can best invest and leverage the electric vehicle (EV) commodity opportunities on the horizon.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds LION, LAC, and other commodity stocks.

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://insideevs.com/news/548934/ev-sales-projected-near-6million/

[2] https://www.weforum.org/agenda/2021/07/renewables-cheapest-energy-source/

[3] https://www.nrdc.org/stories/paris-climate-agreement-everything-you-need-know

[4] https://www.bbc.com/news/58888451

[5] https://www.bbc.com/news/science-environment-61497315

[6] https://www.politico.eu/article/politics-behind-germany-refusal-reconsider-nuclear-phaseout/

[7] https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Renewable_energy_statistics

[8]https://www.yicaiglobal.com/news/lithium-battery-raw-materials-to-be-exhausted-in-five-to-10-years-inventor-says

[9] https://www.ecograf.com.au/graphite/

[10] https://industryeurope.com/sectors/metals-mining/vianode-to-open-first-phase-plant-in-norway/

[11]https://www.reuters.com/business/exclusive-canada-spend-c2-bln-mineral-strategy-ev-battery-supply-chain-2022-04-04/

[12] https://www.visualcapitalist.com/the-50-minerals-critical-to-u-s-security/

[13] https://www.afr.com/companies/mining/syrah-signs-offtake-agreement-with-tesla-20211223-p59jr0

[14]https://investingnews.com/daily/resource-investing/battery-metals-investing/graphite-investing/nextsource-materials-signs-offtake-agreement-with-primary-graphite-supplier-to-major-japanese-electric-vehicle-anode-producer/

[15]https://www.goldmansachs.com/insights/pages/gs-research/battery-metals-watch-the-end-of-the-beginning/report.pdf

[16]https://www.goldmansachs.com/insights/pages/gs-research/battery-metals-watch-the-end-of-the-beginning/report.pdf

If the top risks to the world right now are climate change and geo-political conflict, the growth of nuclear energy in both America and China is essential.

Nuclear energy is virtually emissions-free energy. It takes up very little land, consumes very little fuel, greatly contributes to fuel diversification and the stability of the overall energy grid, creates skilled well-paid jobs, and produces very little waste. It‘s the technology that solves both energy poverty and climate change.

Then there is the all-important issue of reliability. Nuclear power plants on average operate at full power on 336 out of 365 days per year.

Hydroelectric systems deliver power on average 138 days per year, wind turbines 127 days per year and solar electricity only 92 days per year. Even plants powered with coal or natural gas only generate electricity about half the time for various reasons.

Nuclear power is a clear leader on reliability. No wonder nuclear power accounts for 70% of France’s electricity mix and 30% for Switzerland, South Korea and Sweden.

In the public’s perception, there are two issues with nuclear power: the risk of accidents, and the question of disposal of nuclear waste. There have been three large-scale accidents involving nuclear power reactors since the onset of commercial nuclear power in the mid-1950s: Three-Mile Island in Pennsylvania (1979), Chernobyl in Ukraine (1986), and Fukushima in Japan (2011). These incidents all represent old technology.

Nuclear waste disposal, although a continuing political problem in the US, is not any longer a technological problem.

More than 90% of spent fuel could be recycled to extend nuclear power production by hundreds of years, and can be stored safely in impenetrable concrete-and-steel dry casks on the grounds of operating reactors, its radiation slowly declining. Price and performance are the key factors, and advanced nuclear energy is cheaper than coal and more dependable than solar or wind.

In addition, the cumulative reductions in CO2 emissions due to nuclear energy are meaningful as the following IEA chart indicates.[1]

The United States has long led the world in developing nuclear energy technologies, providing about 30% of global nuclear energy production and 52% of America’s carbon-free electricity in 2020, according to the Department of Energy, even though American commercial nuclear development has markedly slowed.

China has made significant progress on molten salt reactors, which are powered by liquid thorium rather than uranium. They are safer than traditional reactors because in the event of a leak, the molten thorium would cool and solidify quickly, dispersing less radiation into the environment. Thorium reactors also do not need water for cooling, allowing systems to be built in remote desert regions.

If this progress on the technological front continues, we could face a world where China and Russia become preeminent in nuclear science and technology. Both of these countries have well-financed programs to develop the next generation of advanced, non-light water reactor concepts, many of which were first demonstrated decades ago in American national laboratories. Dominance in new technologies will mean control of the rules and export markets. China plans at least 150 new reactors over the next fifteen years.

There is another angle and that is increased nuclear energy in the world’s electricity mix weakens the hand of China’s de facto ally Russia.

For example, the Ukraine situation would be much easier to handle if Europe, and in particular Germany, had not made the decision to close all of its nuclear reactors by the end of 2022 making it so dependent of Russia’s natural gas.

Throughout most of the 2000s, American nuclear power plants were highly profitable since their capital costs had been largely amortized over previous decades, and their production costs were low compared to the relatively high cost of fossil and renewable alternatives.

The situation changed around 2007, when inexpensive shale natural gas became available, and the global financial crisis led to lower electricity demand and prices. Since then, nuclear power plants in the United States have become less profitable, and the industry has experienced a series of plant closures for older facilities.

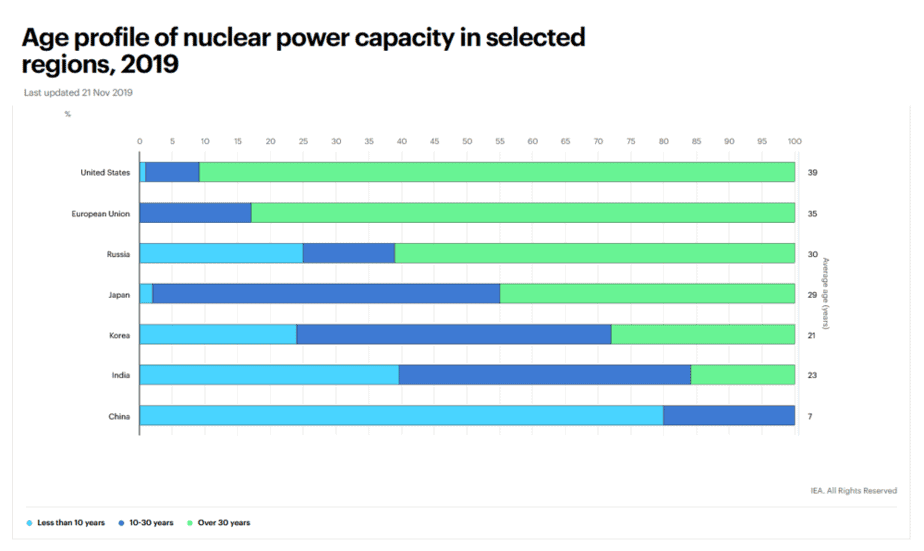

However, the nuclear fleet in advanced economies is 35 years old on average, and many plants are nearing the end of their designed lifetimes. With advancing age, plants are beginning to close. With 25% of existing nuclear capacity in advanced economies, many will probably shut down by 2025. This is coming quickly.

It is considerably cheaper to extend the life of a reactor than build a new plant, and costs of extensions are competitive with other clean energy options, including new solar and wind projects. Nevertheless they still represent a substantial capital investment. The estimated cost of extending the operational life of 1 Gigawatt of nuclear capacity for at least 10 years ranges from $500 million to just over $1 billion depending on the condition of the nuclear site.

America and China are at opposite ends of the spectrum when it comes to average age of nuclear energy facilities. China’s edge in terms of efficiency and cost are highlighted by this IEA graph.[2]

Nevertheless, there are significant American beachheads to support and validate the expansion of nuclear energy. For example, for Duke Energy (NYSE: DUK), 40% of the electricity the company produces comes from nuclear power. America has 94 reactors that generate about 20% of our electricity but we have not built one new plant in the last 25 years.

In the US and Europe, where productivity at construction sites has been low, we need expanded use of factory production to take advantage of the manufacturing sector’s higher productivity when it comes to turning out complex systems, structures, and components. This includes modular construction in factories and shipyards, high-strength reinforcement steel, as well as ultra-high performance concrete. All of these could have positive impacts on the cost and schedule of new nuclear power plant construction.

Jack Devanney is the principal engineer and architect of the ThorCon molten salt reactor power project in Indonesia. Since 2011, he has pursued his idea of using shipyard construction technology to mass-produce safe, inexpensive power plants that can bring the benefits of electricity to the world, with no CO2 emissions. Devanney has married the advanced nuclear technology developed by America’s Oak Ridge Laboratory with his own engineering experience with ships, power plants, and energy.[3]

The US Navy has a long and impressive history with nuclear technology and the future of the nuclear Navy is secure. It has its own design and research laboratories, supports its own extensive computing capabilities, and trains its own operators. While any expansion of nuclear technology in America should be commercially led, the Navy could support the development of human capital in the nuclear field by expanding cooperation with universities and industry.

The Biden Administration included nuclear power in its clean energy plan. The American Nuclear Infrastructure Act, introduced last June, seeks to expand America’s nuclear energy sector, and the US Department of Energy is allocating $61 million in nuclear R&D projects across America.[4]

Now let’s turn to a number of initiatives and investment options for those wanting to capture the potential growth of nuclear energy.

Wyoming Governor Mark Gordon announced in June 2021 that a next-generation nuclear power plant would be built at a soon-to-be-retired coal-fired plant. The project is a joint initiative of PacifiCorp (PPWLM) and Bill Gates’s TerraPower and GE Hitachi.

The project includes a 345-megawatt sodium-cooled fast reactor with a molten salt-based energy storage system, which would produce enough power for roughly 250,000 homes. The storage technology is also able to boost output to 500 megawatts of power for about five and a half hours, which is equivalent to the energy needed to power around 400,000 homes, according to TerraPower.[5]

Governor Gordon said the pilot project, called Natrium, doesn’t mean he is running away from Wyoming’s fossil fuel industry, which he called “the bedrock of our economy.”

Other American companies such as BWX Technologies (NYSE: BWXT), Westinghouse (private), X-energy (private), and UltraSafe Nuclear (private) are all working on new concepts, such as the advanced small modular reactor (SMR) design being marketed by NuScale, a sodium fast reactor, and a modular high temperature gas-cooled reactor.

BWX Technologies, Inc. (NYSE: BWXT) manufactures and sells nuclear components in the United States, Canada, and internationally. Its Nuclear Operations Group segment offers nuclear components, reactors, assemblies, and fuel for the United States Department of Energy/National Nuclear Security Administration's Naval Nuclear Propulsion Program. Its stock trades at about 17 times 2021 earnings with a return on equity of 45%.

NuScale (private) is developing a small reactor that is capable of generating 77 megawatts of electricity and is in the midst of the US Nuclear Regulatory Commission’s licensing process. The first customer for the NuScale design is Utah Associated Municipal Power Systems, which has plans to commission a plant in Idaho by 2027. NuScale has announced plans to go public through a reverse merger with a Special Purpose Acquisition Company or SPAC.

On the exchange-traded fund (ETF) front, take a look at the VanEck Uranium+Nuclear Energy ETF (NYSE: NLR). Launched in 2007, this ETF has 26 holdings and mostly invests in US and Japanese utilities companies. Its top three holdings are Duke Energy (NYSE: DUK), Dominion Energy (NYSE: D), and Exelon Corp (NASDAQ: EXC). Because of its overexposure to utilities, NLR underperformed its peers.

Speaking of Exelon Corp., on February 1, 2022, Exelon split into two companies. One will retain the Exelon name and operate regulated portions of the old company in electricity transmission and distribution. The other company is Constellation Energy Corp. (NASDAQ: CEG), which will be the owner and operator of what used to be Exelon’s generating fleet. The large majority of that fleet is clean nuclear power plants.

Finally, another way to play the growth of nuclear energy is through uranium miners. Cameco (NYSE: CCJ) is the most high-profile and was up a stunning 66% in 2021.

Based in Saskatoon, Saskatchewan, Canada, Cameco is the largest publicly traded uranium company. It owns uranium mines worldwide, including in Canada, Kazakhstan, and Australia. An alternative is NexGen Energy (NYSE: NXE), a stock that was up 59% in 2021.

An interesting alternative that is a bit more speculative is Alpha Lithium Corp, (OTC US: APHLF / TSX-V: ALLI), a lithium and uranium play with properties in Argentina including a $30 million Uranium One investment in the Argentina Tolillar Project.[6]

Uranium One Group, one of an international group of companies all wholly owned subsidiaries of the Russian State Atomic Energy Corporation, better known as Rosatom, manages one of the world's largest uranium mining holdings.

Uranium One's wholly owned subsidiary Uranium One Holding N.V. has agreed to invest $30 million in exchange for a 15% ownership of Alpha One Lithium, with Alpha Lithium holding the balance of 85% and retaining full control of Tolillar, management, and the board and will be responsible for deploying the invested capital.

The transaction, when closed, is expected to leave Alpha Lithium with approximately $45 million in cash, to fund the expansion and development efforts on its nearby Salar del Hombre Muerto, where the company continues to expand its 5,000+ hectare foothold in one of the world's highest quality and longest producing lithium projects.

Aside from investment opportunities, the development of safer nuclear energy projects in America and the rest of the world will be crucial in fighting climate change. Both America and China can create carbon-free electricity by ramping up modern, secure, nuclear energy.

If you are concerned about climate change, you should be a supporter of increasing nuclear power from the current 20% of America’s electricity generation to 30% by 2030.

Carl Delfeld, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.iea.org/data-and-statistics/charts/cumulative-co2-emissions-avoided-by-global-nuclear-power-in-selected-countries-1971-2018

[2] https://www.iea.org/data-and-statistics/charts/age-profile-of-nuclear-power-capacity-in-selected-regions-2019

[3] Why Nuclear Power Has Been a Flop, Jack Devanney, BookBaby, 2020

[4] The Top 4 Uranium ETFs: Invest in Nuclear Power, SustainFi, Updated December 29, 2021, https://sustainfi.com/articles/investing/invest-in-nuclear-power/

[5] Bill Gates' TerraPower to build $4 billion nuclear power plant at Wyoming coal site, https://news.yahoo.com/bill-gates-terrapower-build-4-062833314.html

[6] InvestmentPitch Media Video Discusses Alpha Lithium's Securing of US$30 Million Investment from Uranium One with Right to Invest Additional US$185 Million at Tolillar Salar, Argentina, https://finance.yahoo.com/news/investmentpitch-media-video-discusses-alpha-080500942.html

- Nuclear Power in a Clean Energy System, May, 2019, IEA Report (International Energy Association), https://www.iea.org/reports/nuclear-power-in-a-clean-energy-system

- Investing to Stop Climate Change Is Trickier Than It Seems, Wall Street Journal, James Mackintosh, https://www.wsj.com/articles/investing-to-stop-climate-change-is-trickier-than-it-seems-11643214062?mod=wsjhp_columnists_pos1

https://www.amazon.com/author/powerrivals

The world is a magnificent place, full of wonderful nature providing us with all the resources we need and/or the means to develop them.

Unfortunately, over time mankind has taken for granted these resources and as such, we find ourselves in an environmental crisis. Oceans we admire, the air we breathe, the silence we crave have all been hampered by our own ambitions to develop, develop, develop.

Finally, we are waking up. People are starting to really realize that they need not only to invest financially in their future, but they also need to make decisions that will be an investment in their family’s future well-being.

Across the globe, countries are giving into the pressure and implementing measures to try to, at least in some way, repair the damage caused by centuries of human consumption.

Enter the Paris Agreement, a legally binding international treaty on climate change. On December 12, 2015, it was adopted by 196 parties and entered into force on November 4, 2016. The purpose of the agreement is to limit global warming which would require social and economic transformation. To keep track of countries’ progress, the enhanced transparency framework (ETF) was formed. Under the ETF, starting in 2024, countries will report on actions taken, adaptation measures and progress.[1] This was a giant wake-up call for countries to take action. After all, there is nothing like peer pressure to motivate those involved.

One such measure which is becoming increasingly popular is to advocate for the use of Electric Vehicles (EVs) in a bid to reduce the stress on the environment and in doing so, reduce carbon footprints.

There is no denying that EVs, powered by primarily lithium-ion batteries, are definitely better for the environment for a number of reasons.

As such, countries are jumping on the EV bandwagon. In August 2021, it was announced that President Joe Biden had signed an executive order setting a national goal for zero-emissions vehicles to make up half of the new cars and trucks sold by 2030.[3] This is a very aggressive timeline and order!

Canada’s plan for 2030 Emissions Reduction Plan will be unveiled in 2022, with a target to reduce greenhouse gas emissions by 40% from 2005 levels. It is anticipated that it will include an EV mandate.[4]

The European Union has announced that it will end the sale of polluting vehicles by 2035, including hybrids. In addition, the auto industry will be required to slash the average emissions of new cars by 55% by 2030. In fact, with 2050 as a goal, Europe wants to be the first continent to be climate neutral.[5]

Obviously, with all of this movement towards the future of Electric Vehicles (EVs), companies that produce elements, notably lithium and graphite, that are crucial in the manufacturing of lithium batteries are going to become more and more interesting to investors.

And indeed, to quote Elon Musk on the future of the lithium market, “Our goal here is to fundamentally change the way the world uses energy. We're talking terawatt scale. The goal is complete transformation of the entire energy infrastructure of the world.”[6] Given Musk’s heightened background, he probably knows what he is talking about![7]

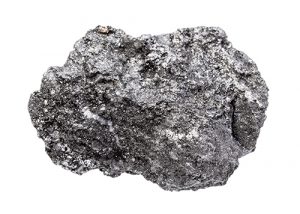

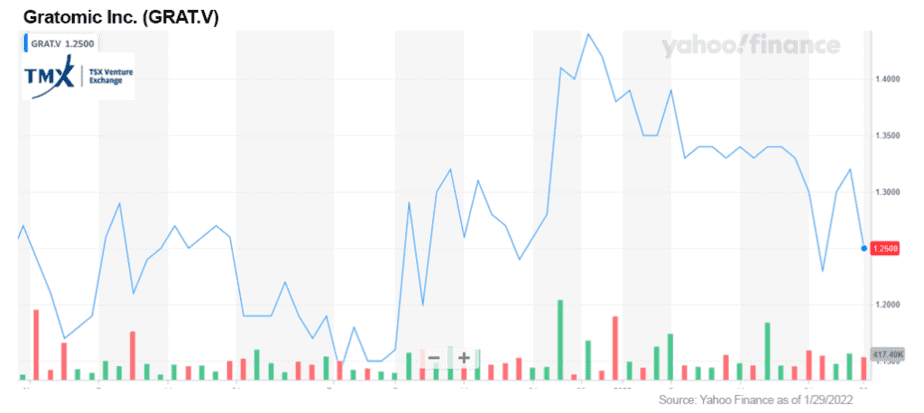

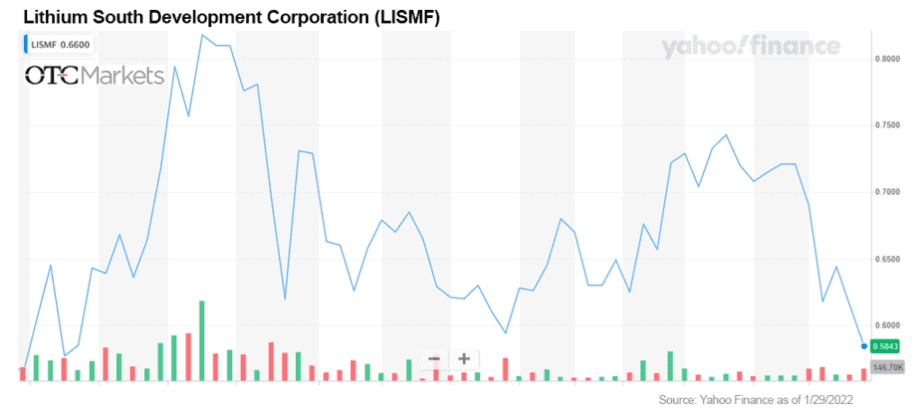

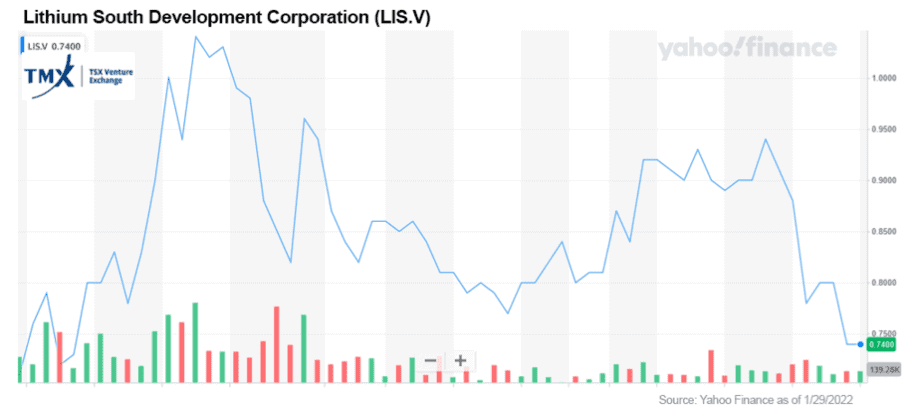

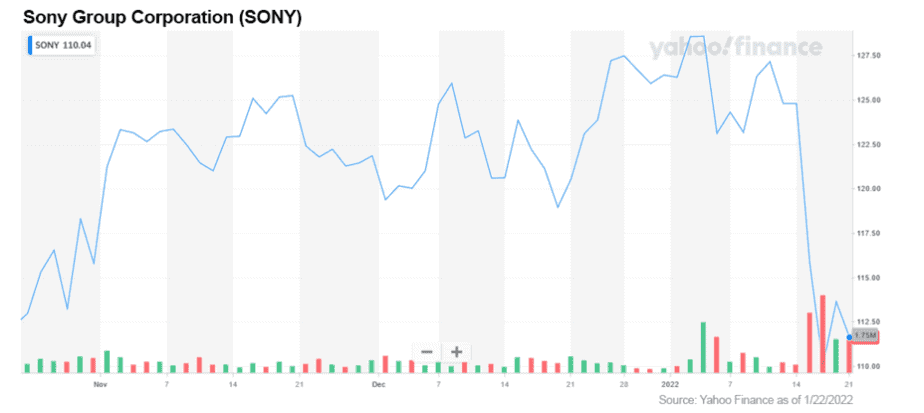

A few companies that are involved in various ways in this market are Gratomic Inc. (OTCQX: CBULF / TSX-V: GRAT / FRANKFURT: CB82), Lithium South (OTCQB: LISMF / TSX-V: LIS / FRANKFURT: OGPQ) and Sony Group Corporation (NYSE: SONY).

It is commonly known that graphite powder is used as an anode material in the majority of lithium-ion batteries.

Gratomic Inc., with a foundation built on being an eco-conscious company, engages in exploration and mining focusing on low-cost mine to carbon-neutral, eco-friendly, naturally high-quality vein graphite. This multinational entity has several projects on the roster in very desirable locales, including in the Karas Region of Namibia (Aukum), the Bahia State of Brazil (Capim Grosso) and Buckingham, Quebec (Buckingham).

So far, the company has been successful in upscaling the naturally pure vein graphite from the Aukam Graphite Project to a battery grade level of 99% + Cg through the addition of air classification, and the commissioning and calibration of its onsite Aukam Vein Graphite Processing Plant remains on schedule as planned.[8][9] From there, it is anticipated that the company will be moving into full operational capabilities within the first quarter of 2022.

I find the Aukam Project very interesting for several reasons. This region, which covers a historical vein graphite mine, is significant. Data obtained over the past 9 years of the project has demonstrated significant potential for expansion. Other variables that contribute to Aukam’s attractiveness are year-round road access as well as nearby power, water, and rail line sources.[10]

At the beginning of 2021, Gratomic provided an update on the commissioning process of several key equipment pieces for the Aukam project in preparation for the final stage of grinding, flotation, and drying circuits. The Product Thickener assembly had been completed, and the vibrating feeder installed in readiness for calibration. This included the process of relocating material from the historical stockpiles to the feed pad.[11]

Clearly, Gratomic is on the move, despite roadblocks faced globally due to the current pandemic.

“Our Aukam construction team has demonstrated resilience in the face of adversity. Even during the holiday period, they never stopped finding ways to push our project forward and keep us ahead of the game.” [12]

— Armando Farhate, COO & Head of Graphite Marketing and Sales

I like to see that determination in a company. I find that it inspires confidence that despite whatever barriers (expected or unexpected) may pop up, determination will supersede difficulties.

With all the positives this unique asset presents, in combination with being one of the only jurisdictions of viable vein graphite outside of Sri Lanka, it may be poised to replace a large part of declining production capacity of vein graphite from Sri Lanka.[13]

In summary, I believe that Gratomic has all the necessary elements to power up success. It is one of my favorite companies.

Based in Salta, Argentina, Lithium South’s focus is the Hombre Muerte North (HMN) Lithium Project, a flagship lithium brine project containing six separate claims and located in the lithium triangle, the nexus for the coveted mineral. In fact, Argentina, Bolivia, and Chile in South America hold more than half of the world’s lithium deposits. It is this huge on a world scale![14]

The company is currently evaluating a Direct Lithium Extraction (DLE) using an absorbent. The exciting part of this is that, if effective, it may have the capability to reduce production time from months to hours and increase recovery from traditional extraction methods of 42% to over 80%. Given how the need for lithium may exponentially increase over the coming years as countries strive to meet their promises, in my opinion, this could be a game changer for the company.

Highlights of the HMN project include:

Two production wells have been drilled and cased, with a 2,000-meter drill program to follow.[16] With everything LIS has in place, in my opinion, this company has strong fundamentals and I am keeping a very close watch on this one.

In my opinion, this is only the tip of the iceberg.

Last but not least, on January 5, 2022, Sony announced that they are launching a new company to explore entry into the electric vehicle market. The company is set to announce the plans to open their subsidiary, to be known as Sony Mobility, at the 2022 Consumer Electronic Show in Las Vegas according to Kenichiro Yoshida, Sony chief executive. The announcement sent Sony’s shares up more than 4.5 percent.[17]

The stock is currently sitting at around $112.50 on the NYSE board.

It will be interesting to see where things go when this tech giant unleashes its’ EV program at full strength.

In summary, I believe that it is an opportune time for investors to look at companies either offering components for the EV market, or the end-products. It is the way the world is heading and more importantly, if we want to help our planet, I feel it is a necessary avenue.

And let’s face it… investing in helping our planet IS investing in our family’s future in the most important way, because if you don’t have a healthy and safe environment, money doesn’t matter so much. We should all be doing our part and, in my opinion, supporting companies that are trying to do theirs is a win-win situation.

Kal Kotecha, PhD

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

DISCLOSURE: Gratomic Inc. and Lithium South are Kal Kotecha portfolio holdings under his Junior Gold Report. Junior Gold Report (Dr. Kotecha) is currently engaged and paid by Gratomic for marketing/consulting services. His relationship with Gratomic and holdings of Gratomic Inc. and Lithium South should be deemed a potential conflict of interest.

[1] United Nations Climate Change : The Paris Agreement : https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement

[2] Caroline Fortuna (March 25, 2019) : EVObsession : Why Electric Cars Are Better : https://evobsession.com/why-electric-cars-are-better/

[3] Josh Lederman : August 5, 2021 : Biden Signs Order Aiming for Half of New Vehicles to be Electric by 2030 : https://www.nbcnews.com/politics/politics-news/biden-sign-order-aiming-half-new-vehicles-be-electric-2030-n1275995

[4] Electric Automony (December 8, 2021) : Canada’s emissions plan for 2030 targets to be released in spring 2022 as strategic consultations begin : https://electricautonomy.ca/2021/12/08/canada-emissions-plan-consultations/

[5] Charles Riley, CNN Business : Europe aims to kill gasoline and diesel cars by 2035 : (https://www.cnn.com/2021/07/14/business/eu-emissions-climate-cars/index.html

[6] Tesla’s Powerful Event: The 11 Most Important Facts https://www.bloomberg.com/news/articles/2015-05-01/tesla-s-powerwall-event-the-11-most-important-facts

[7] Energy & Capital : Why Lithium Investments Are Wall Street’s Hottest Stocks : https://www.energyandcapital.com/report/the-coming-lithium-revolution/1450

[8] Gratomic (September 7, 2021) : Gratomic Provides Update on Pre-Feasibility Study, Independent Lab Results, and the Aukum Vein Graphite Project : https://gratomic.ca/2021/09/07/gratomic-provides-update-on-pre-feasibility-study-independent-lab-results-and-the-aukam-veingraphite-project/

[9] Gratomic (January 11, 2022) : https://gratomic.ca/2022/01/11/gratomic-announces-update-on-the-commissioning-of-its-aukam-graphiteprocessing-plant-in-namibia/

[10] Gratomic : Aukam : https://gratomic.ca/aukam/

[11] Gratomic (January 11, 2021) : Gratomic Announces Update on the Commissioning of its’ Aukum Graphite Processing Plant in Namibia : https://gratomic.ca/2022/01/11/gratomic-announces-update-on-the-commissioning-of-its-aukam-graphite-processing-plant-in-namibia/

[12] Gratomic (January 11, 2021) : Gratomic Announces Update on the Commissioning of its’ Aukum Graphite Processing Plant in Namibia : https://gratomic.ca/2022/01/11/gratomic-announces-update-on-the-commissioning-of-its-aukam-graphite-processing-plant-in-namibia/

[13] Gratomic Inc. Profile : https://agoracom.com/ir/Gratomic/profile

[14] Explainer: Latin America's Lithium Triangle https://www.as-coa.org/articles/explainer-latin-americas-lithium-triangle

[15] Lithium South Development Corporation : www.lithiumsouth.com

[16] Lithium South Development Corporation : www.lithiumsouth.com

[17] Christopher Grimes, Leo Lewis (January 5, 2022) : Sony Launches Electric Vehicle Company to ‘Explore’ entering market. https://www.irishtimes.com/business/manufacturing/sony-launches-electric-vehicle-company-to-explore-entering-market-1.4769241

I always love to look back and review our year-end stats on all the stock picks that FNN contributors have posted within their collective articles over the past 12 months.

It gives me an idea of how our FNN contributors have performed now that 2021 is behind us. In addition, it gives me some sense of where the overall markets are heading in the coming 2022 calendar year.

Current market sentiment has definitely cooled in comparison to the monster year of 2020. It was a year where it seemed you could pick almost any stock and see a double-digit gain right out of the gate.

In 2020, our contributors picked TWO 10-baggers, which is phenomenal in itself. And who can forget Carl Delfeld’s out of the park 24-BAGGER when he discovered Nio (NYSE: NIO) after it first went public at the beginning of 2020.

The market in 2020 defied expectations, especially considering the arrival of the COVID-19 pandemic, and will be a year to be remembered.

2021 looked completely different than 2020, with gains just a fraction of what we saw in the year prior. Many sectors saw a big pullback from their lofty heights posted in 2020.

A repositioning of the market is now taking place, which I pointed out in my article 9 Stocks to Mitigate Stock Shock; Warning Signs Could Be Flashing back in August.

As intelligent investors, we have been forced to tighten our focus and reposition our holdings in a more defensive posture. Investors are happy to take gains in the double-digits when we can. Anytime you are doubling your investment should be celebrated.

Overall, it was hardly a terrible year. Almost all of our contributor picks saw upside. Many recommendations resulted in double-digit gains, and a few were even triples.

Draganfly Inc. (NASDAQ: DPRO), which we first covered as far back as 2019, uplisted to the NASDAQ board from the OTCQB.

2021 also saw FNN begin to broaden its scope and include cryptocurrency and NFT investments in its article lineup.

Blake Finucane introduced us to NFTs as an investment opportunity in her article The NFT Boom: A Technological Breakthrough on the Blockchain That Revolutionizes Digital Ownership for Art, Collectibles and Gaming. It is a good read if you want to get up to speed on NFTs.

Our resident crypto expert Saul Bowden has written a series of articles educating investors on how and where to start their positions in this exciting, volatile and explosive investing space. In fact, four of the top ten picks for FNN in 2021 were crypto investments.

Rumor has it that investors are now taking the crypto space quite seriously and have largely left small and microcap investments in lieu of crypto. Time will tell if this trend continues into 2022 as the crypto space begins to mature, massive short-term gains begin to wane, and as regulation appears to finally be hitting this market segment.

Gains for our Top 10 picks for 2021 were calculated with the starting price at the time of publication to the highest share price realized through the end of the year.

One thing is for sure, FNN contributors continued to prove their salt over the past year and our contributors were able to find some notable investment opportunities for our subscribers.

Below are the Top 10 gainers from our seasoned FNN financial analysts and writers.

Four of the Top 10 gainers for 2021 were cryptocurrency picks.

The crypto space is without a doubt here to stay. While Bitcoin (BTC) tends to get the most media attention, there are loads of other cryptocurrencies to invest in — each with their unique technology and advantages.

FNN contributor Saul Bowden has a deep knowledge of the crypto space, and we are proud to have added him to the team this year. His articles on crypto are thorough and have helped educate our readers on the basics of investing in the space.

You can read our articles on crypto here.

I’ll be honest. I’m a stock guy, and the idea of crypto / NFTs mostly goes over my head. But I have to say that after reading both Saul’s and Blake’s articles, I have a better understanding of these categories and now have a better grasp of some of the investment strategies explained to our FNN readers.

While cryptocurrencies and NFTs are still in their infancy, four out of the Top 10 gainers we saw this year were in the crypto space.

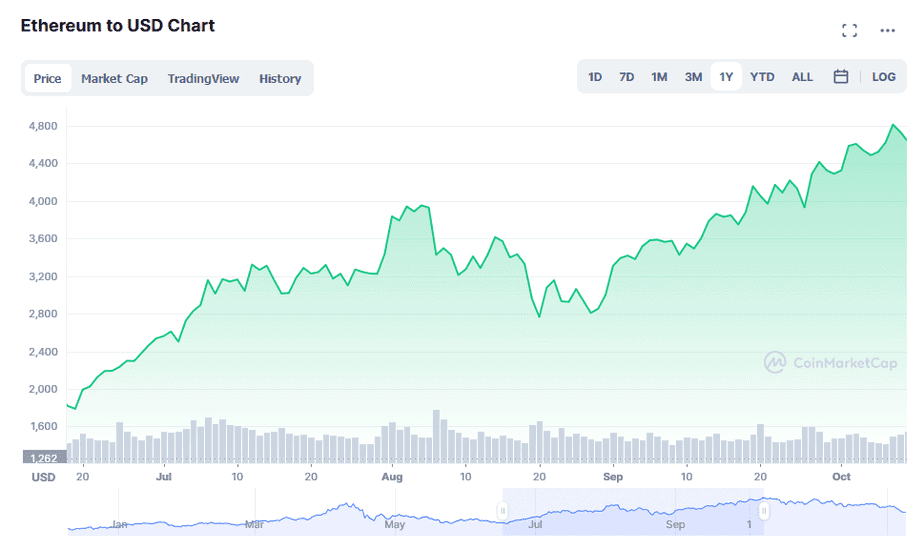

Ethereum (ETH)

Starting price at publication was $2,403.54. The coin reached a high of $4,812.09 on November 7, 2021, giving readers a gain of +100%.

Cardano (ADA)

Saul called Cardano coin at $1.3069. Subsequently, the coin rocketed up to $2.9682 giving up gains of +127%.

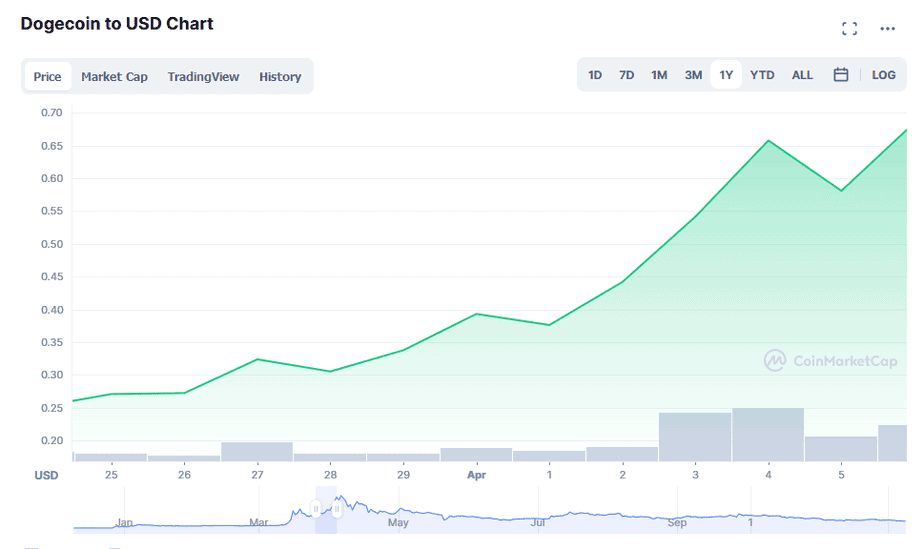

Dogecoin (DOGE)

Dogecoin is an Elon Musk favorite. Saul brought the coin to the attention of our readers when it was at $0.2722. Soon after, the coin reached a high of $0.68. Readers who invested in the coin would have seen gains as high as +152%.

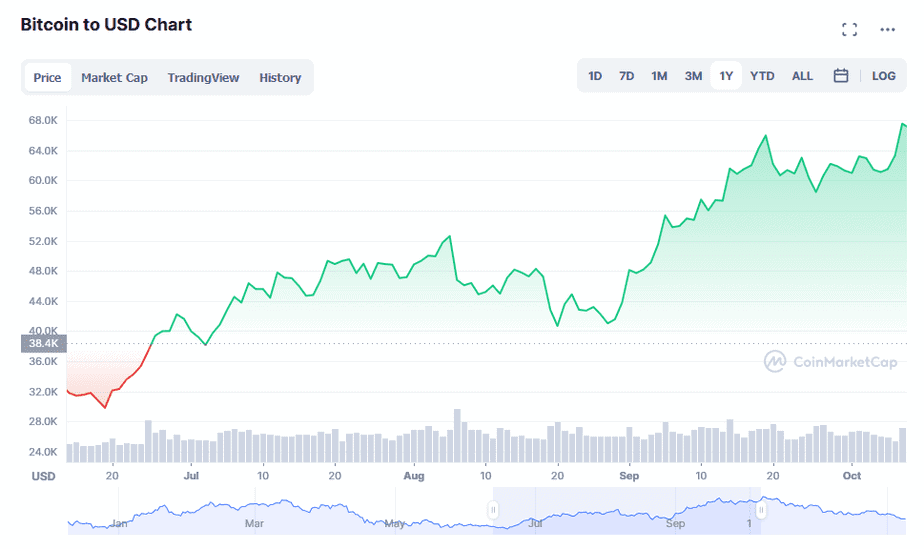

Bitcoin (BTC)

Bitcoin is the most well-known cryptocurrency currently traded and gets the majority of media attention. FNN readers were alerted when it held a price of $32,702.03/coin. Later in the year, Bitcoin reached a high of $67,566.83, with investors seeing gains as high as +107%.

The Green Energy sector covers a wide range of investment opportunities as demonstrated by some our highest gainers in the space.

We are in the very beginning stages of this sector, especially as more countries focus on green energy as the key to fighting climate change. The category has years of unrealized growth ahead as world governments begin to clamp down on fossil fuel emissions and economies begin to transition to renewable energy sources.

I am excited to see where this space will go in the coming years. It has so much growth potential, and on a positive note, could ultimately slow or stop global warming and related climate changes we are now beginning to experience.

In my opinion, this is a smart investment opportunity, as well as a morale and ethical investment in the future of our children.

Renewable Energy:

Aurora Solar Technologies (OTC US: AACTF / TSX-V: ACU)

Sources of renewable energy will continue to see gains as economies transition away from fossil fuels. Solar power has proven itself to be viable and efficient.

Aurora Solar was first noted by FNN contributor Blake Desaulniers at the beginning of 2021 when its share price was at $0.298. Soon after, the stock almost doubled, giving gains to investors of +98%.

Lithium Metal:

Lithium is the white gold of the green energy movement. The metal is literally at the core of energy storage and is used in everything from handheld electronics to the explosive growth of electric vehicles (EVs).

There is currently a resource land grab that is taking place, and countries around the world are positioning themselves to secure this vital resource. Supply is limited and demand is absolutely skyrocketing.

Albemarle Corporation (NYSE: ALB)

Albemarle is one of my favorites in the lithium mining space. They have multiple properties located around the world in both hard rock and brine lithium production. Keep this one on your radar into 2022 as lithium demand continues to outstrip supply and prices continue their parabolic climb.

I first brought Albemarle to you in April 2021 when the share price was $147.71. Readers could have seen gains of up to +92% when the stock reached highs in November.

Neo Lithium (OTCQX: NTTHF)

A junior lithium mining play, Neo Lithium was first noted in an article in July 2021 at a share price of $2.20. By November, the company shares saw a high of $3.00, giving potential gains to our readers of up to an enormous +136%.

Electric Vehicles

I put Ford Motor Company (NYSE: F) under the Green Energy section because of what they are doing with electric vehicles, and more specifically, their new line of electric pickup trucks. It is an exciting time for the auto industry as the transition from gas/diesel to electric (EV) gains ground.

Electric vehicles are seeing explosive growth and are still at the beginning of the upward curve happening now.

Ford Motor Company (NYSE: F)

Ford’s F-150 Lightning electric pickup rocks. Demos of the truck have blown away the competition including anything gas or diesel powered. I’m a big fan of Ford and their new line of electric pickups. They own the historic brand that could sway the minds of reluctant buyers, tipping the multibillion-dollar pickup truck space in their favor.

Ford is already seeing success with both their F-150 Lightning EV truck and the hot Mustang Mach-E EV. In fact, Ford is having a hard time keeping up with demand for the two vehicles.[1] I predict that demand will continue to grow over the coming year.

In my opinion, they are just getting started in the EV space, and I am excited to see what they come out with in 2022/23. Ford will continue to see positive growth over the next year under the direction and restructuring of the company by auto veteran Jim Farley. Since Farley became CEO more than 15 months ago, the stock is up by more than 200%. [2]

Watch out Elon Musk!

I first alerted FNN readers to Ford (NYSE: F) at the beginning of 2021 at a share price of $8.87. In December of this year, shares reached $21.45, giving up triple-digit gains of +142%, making it the top-performing stock in the auto manufacturer space.

Semiconductors are at the core of our modern technology driven civilization. (See my article 7 Stocks in the Red-Hot Semiconductor Space You Need to See Now here.)

I don’t know about you, but if I don’t have my mobile phone on me, I become anxious, panicked and lost all at once. Call it an addiction but I see the devices as more of a second brain — a complement if you will to our biological brains.

This past year, we saw how critical semiconductors are when there was a shortage of the silicon chips. Supply lines ground to a halt and orders went unfulfilled. Factories literally had to shut down waiting for their critical components.

This trend will only continue to grow as 5G, artificial intelligence (AI), machine learning and robotics take on more prominent roles in our lives.

An interesting side note: My son is seven months old and already he is fascinated by our cell phones. He still has not experienced the device, but he knows there is something there that is important. I found this really interesting. How does he know that my mobile device is something he wants to explore? It made me think that it seemed we might be programmed genetically to strive for this technology. It seems to be written into our genes.

NVIDIA (NASDAQ: NVDA)

NVIDIA is one of my favorites in the tech and semiconductor space. They are involved in many, many projects that will flip reality as we know it on its head in the coming 3–5 years. Science fiction is very close to being science reality.

In June, I pointed NVIDIA out to our FNN readers when share prices were at $180.19. By November of this past year, NVIDIA was up to $333.76 per share, giving potential gains of +85%.

The psychedelic space is still in its infancy. The drugs that have been villainized for decades are finally being reexamined for their extraordinary power to help people with debilitating mental health issues.

This is an exciting space for investors… Current mental health drugs that pharmaceutical companies have developed are simply not as effective, based on early data, as potential psychedelic compounds such as ketamine, cannabis, CBDs, psilocybin, MDMA and LSD. Governments are finally letting science speak in terms of efficacy and treatment value. Patients are already benefiting from these novel treatments.

The psychedelic space will continue to mature over the coming years as world governments continue to understand the value of psychedelic compounds and legislate for legalization and controlled distribution.

Allied Corp. (OTCQB: ALID)

Allied Corp. was brought to my attention in March of 2021. After I interviewed the management team, I immediately fell in love with what this company was doing and where they were headed.

I first alerted FNN readers to the company at $1.02/share. By November, the share price had already more than doubled, with readers seeing potential gains of +107%.

Allied is definitely one to have on your radar going into 2022 and beyond.

For me, the Top 10 FNN gainers for 2021 show me what to look out for in 2022.

Here are my takeaways:

I believe markets will continue to tighten as the Fed continues to wind down their loose monetary policies and the COVID handouts MEME stocks craze eventually comes to an end.

In 2022, investors will have to be vigilant and make their investment decisions with care after doing very thorough research.

Amazing investment opportunities will continue to be found, but only for those investors willing to take the time to research and learn in order to make intelligent decisions.

One important way to learn about hot investment opportunities is to follow reputable investment publications such as Financial News Now. Subscribing is free and we have a proven track record of solid investment advice that will surely help guide you in your future investment decisions.

Sign up today and don’t miss the top gainers of 2022.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.forbes.com/sites/alanohnsman/2021/12/27/fords-high-profile-electric-truck-shows-auto-industry-gunning-for-teslas-ev-market-lead/?sh=30bd8a450ddc

[2] https://www.cnbc.com/2022/01/03/ford-beats-tesla-to-become-auto-industrys-top-growth-stock-in-2021.html

Lithium (Li) is used in everything from smart phones to laptops, and is now found in advanced battery technologies that power electric vehicles and store energy generated from renewable sources such as solar and wind.

Lithium producers could be set to reap huge gains in the coming years as the demand for lithium continues to soar, and as we continue to reduce greenhouse emissions and move to an electric powered future.

The lithium investment opportunity currently at hand is huge, and investors should act now to stake their claim in this fast-moving evolving space.

Read on to learn more about lithium and the forces that are driving this metal to record valuations.

Putting Mexico on the Map

Bacanora Minerals (recently taken over by Chinese company Ganfeng) recently discovered what they are calling “the largest lithium deposit” in the world in northwestern Mexico. The deposit has estimated reserves of 243 million tons of lithium embedded in rock and clay.

Bacanora announced a 50-year concession with the Mexican government for mining rights and will pour about $2 billion dollars into developing the reserve. The company is set to commence operations in 2023.[1]

The discovery and subsequent operations could put Mexico on the map as a major world lithium producer. Something to keep an eye on for future investment opportunities.

Lithium is a soft, silver-white metal. It is the lightest known metal and lightest solid element. The metal is highly reactive and flammable when exposed to air.

Lithium is used in several industrial applications such as heat-resistant glass and ceramics, lubricants, flux additives for iron, steel and aluminum production, as a medical supplement to treat various mental illnesses, and, of course, lithium rechargeable batteries.

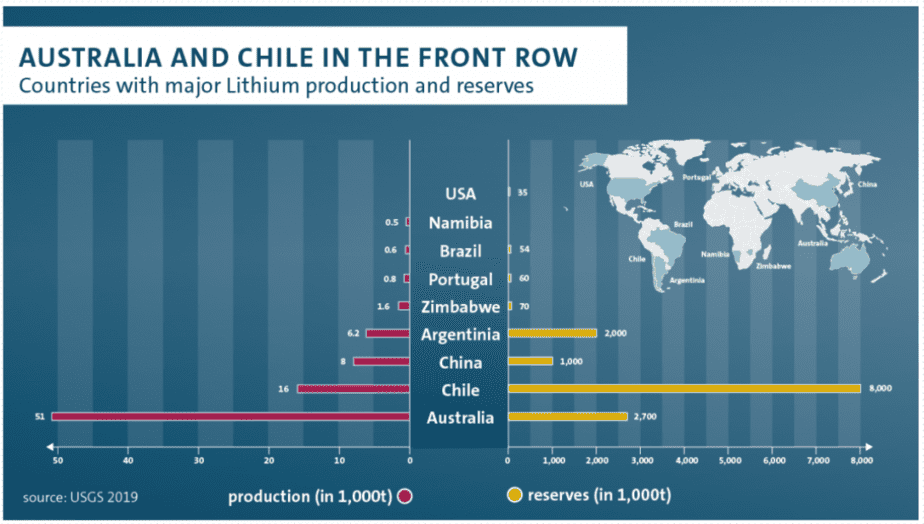

Most of the world’s lithium reserves are concentrated in just a few countries. Chile claims to hold over half of the world’s lithium reserves. Australia, Argentina and China are the next largest holders of lithium reserves.

Currently, the biggest lithium producers in order of production are Australia, Chile, Argentina and China.

The largest lithium importers are China, Japan, South Korea and the United States.[2]

Lithium is mined in three different ways:

Lithium mined from spodumene can be turned into both lithium carbonate and the highly valued lithium hydroxide used in lithium battery production. Australia lithium production is primarily from hard rock spodumene mines.

A second extraction method comes from brine operations which is produced much like sea salt mines. The brine is held in large holding ponds where it is dried out by the sun. Once the water has evaporated the salt is then collected and lithium carbonate salt is extracted from the mixture.

Lithium hydroxide is created from a secondary chemical reaction with the lithium carbonate. Brine production is mainly concentrated in South America.

A third lithium extraction method, geothermal water, is in its early stages of development but promises to be a much more sustainable and commercially viable option. This method uses geothermal wells to extract lithium rich water. The lithium is extracted as both the more valued lithium hydroxide and lithium carbonate.

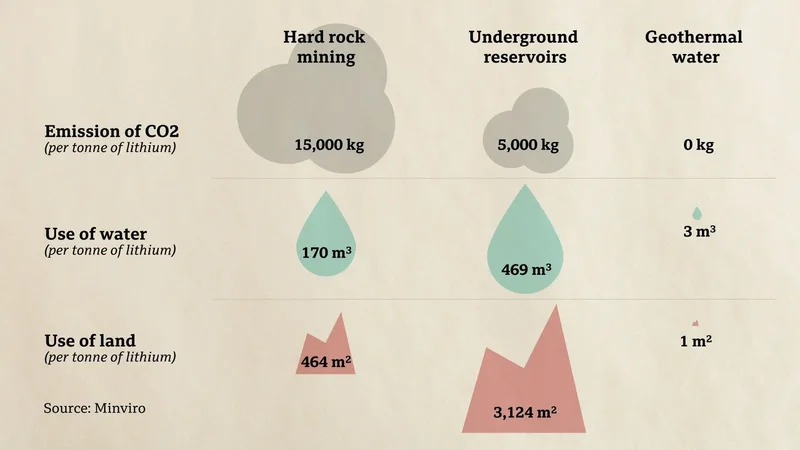

From a green energy perspective, both hard rock mining and brine deposits extraction methods have their drawbacks.

Green Lithium Mining in Germany

Vulcan Energy Resources (OTC US: VULNF / ASX: VUL) is currently exploring the use of geothermal water extraction at its main site located in the Rhine Valley, Germany. They announced significant reserves with lithium concentrations of 181mg/liter of water. Full commercial production is set to commence in 2023–2024.

Vulcan’s chief executive Francis Wedin told an industry conference, “We have a resource which is large enough to satisfy a very substantial amount of the demand in the European markets here for many, many years to come.”[3]

Hard rock lithium is extracted from open pit mines which scars the landscape and uses fossil fuels to heat the rock during the extraction process.

Brine operations use a large of amount of water and are often located where water is scarce, leading to another set of environmental problems.[4]

Of the three extraction methods, geothermal promises to be the greenest as it emits zero carbon and uses very little water and land.

Something to consider as an investor as the world moves to a carbon-free economy and more and more investors demand zero-carbon and environmentally sound lithium investment opportunities.

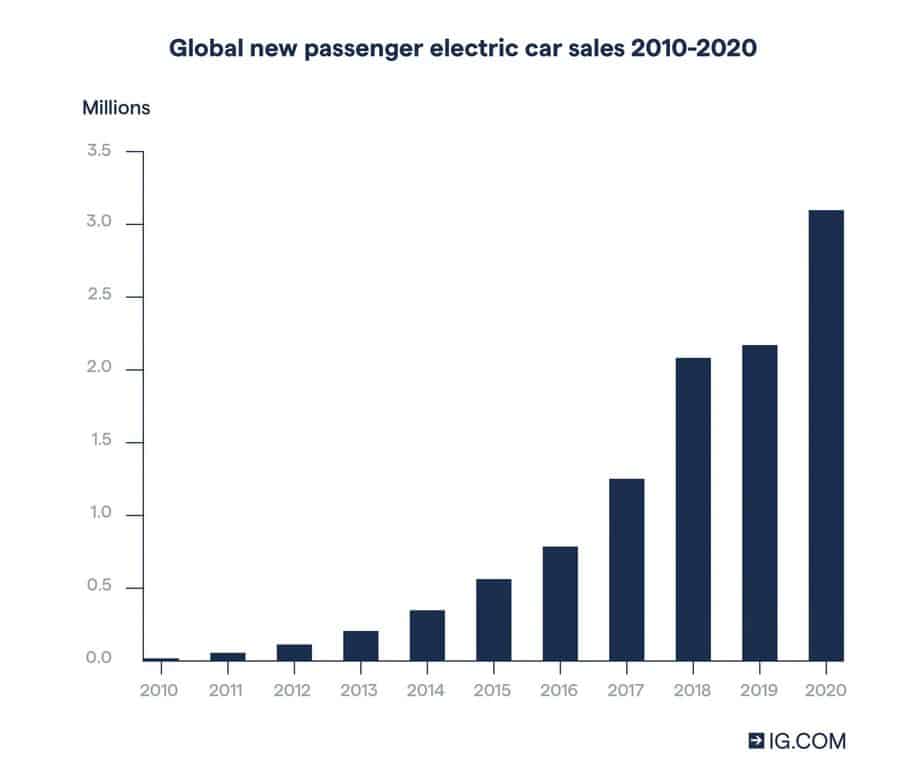

By far, EVs (Electric Vehicles) are the biggest driving force of lithium production bar none.

In 2020, EVs used about 39% of production. Estimates see that demand rising to more than 60% by 2025. The remaining demand comes from consumer demand surrounding electronics batteries, energy storage batteries and other industrial uses.[5]

Sales of EVs will continue to grow rapidly as world governments continue to embrace this EV movement and offer further incentives to consumers.

Sales of new EVs grew significantly leading up to 2019, when the market experienced a temporary slowdown to 2.1 million vehicles due to the COVID pandemic.

— Bloomberg News, October 2021[6]

In 2020, however, existing policies and targeted stimulus responses spurred demand, increasing by 40% to over 3 million vehicles or 4% market share of new car sales.

By early 2021, estimates of passenger EVs around the world was more than 10 million vehicles.[7]

The International Energy Agency (IEA) predicts that by 2030 this number may be a whopping 125 million vehicles as world governments adopt increasingly aggressive policies to curb carbon emissions.

Estimates go as high as 220 million vehicles in this timeframe.[8]

Estimates for growth in lithium demand vary with no clear consensus on a baseline. Needless to say, all the estimates for growth in demand that I found in my research were huge.

My guess why these estimates vary so widely stems from a lack of historical precedent. The world is quite literally at a watershed moment where our entire civilization as we know it is retooling from a fossil fuel-based energy platform to one of solar, wind and other renewable sources of energy that have a low or zero carbon footprint.

Nothing like this has occurred in the course of human history.

This is why I believe that investing in lithium now is a generational investment opportunity. We are in the beginning stages of a new energy era where lithium is central to energy usage & storage.

Current lithium mining operations are insufficient to keep up with expected demand. That means lithium prices will continue to go parabolic, and lithium miners and producers could see their stock prices explode.

Benchmark Mineral Intelligence sees global deficits in lithium supplies surging more than 60 times to 950,000 tons in 2030 driven by increased sales of EVs.[13]

As demand skyrockets, China is snatching up mining rights to lithium reserves around the world, essentially putting a noose on lithium supply.

The effect of this Chinese land grab has exacerbated global lithium shortages and prices have surged for the critical metal.

In 2021 alone, China acquired 6.4 million tons of lithium in reserves and resources. That is about the same amount that was acquired by ALL companies globally in 2020.[14]

Currently, Chinese companies own about 90% of the world’s rare earth mines and manufacture 80% of the lithium batteries.[15]

— Seth Goldstein, senior equity analyst at Morningstar

The lithium market used to be dominated by just three companies — Albemarle (NYSE: ALB), Sociedad Quimica y Minera de Chile (NYSE: SQM) and FMC Corp (NYSE: FMC) — which used to account for 85% of market share.

This has changed dramatically as Chinese companies such as Tianqi Lithium (SZ: 002466) and Ganfeng Lithium (OTC US: GNENF) have become significant players.[17]

Tight supply coupled with intense demand has pushed lithium prices to near-historic levels.

Historically, lithium reached an all-time high of $31,519/ton in November of 2021.

In my research I found three lithium producers that look to be the best in the field. Of course, you will have to do your own research, but this should be a good starting point.

Note: all charts are for the past 6 months from the publishing date of this article.

1. Alpha Lithium Corporation (OTC: APHLF / TSX-V: ALLI)

Alpha Lithium is a junior mining play located in the famed lithium-rich region of the “Lithium Triangle” in Argentina. The company holds 100% ownership of almost 68,000 acres surrounded by other multibillion-dollar lithium assets. They also own over 12,000 acres in the lithium-producing region known as Hombre Muerto, also located in Argentina.

The company is currently testing their proprietary extraction process to increase lithium extraction with a lower impurity ratio.

Alpha Lithium recently announced they secured $30 million dollars in investment from Uranium One. The funds will go to further development of their holdings.[18]

In addition, the company also announced it closed an oversubscribed $25 million bought deal offering conducted by Echelon Markets. The net proceeds will be used to fund strategic acquisitions, exploration and general working capital.[19]

By all indications, this company could be positioned to become a major player in the lithium mining world. Definitely one to keep on the radar.

2. Lithium Americas Corp. (NYSE: LAC / TSX: LAC)

Lithium Americas is currently in the exploration phase and is confirmed to begin production in mid-2022. Their goal is to be producing 40k tons of lithium carbonate equivalent.

The company has holdings in the US and Argentina and has recently partnered with Ganfeng Lithium, working on a brine project in Argentina.

Recently, the company announced that the initial purchasers of convertible senior notes due in 2027 have exercised their option to purchase an additional $33,750,000 aggregate principal amount of notes.

“With the Offering complete and our US$205 million senior secured facility fully repaid, we have significantly enhanced our balance sheet while minimizing potential dilution to shareholders and reducing interest cost.”

— Jon Evans, President and CEO[20]

In addition to repaying the loan, the company intends to use the remainder of the proceeds to repay other indebtedness, further enhancing the company balance sheet.

Lithium Americas currently has a reported $480 million in cash.

Additionally, management is very strong with deep experience in lithium mining and production.

Don’t miss adding this onto your radar and potential trading list.

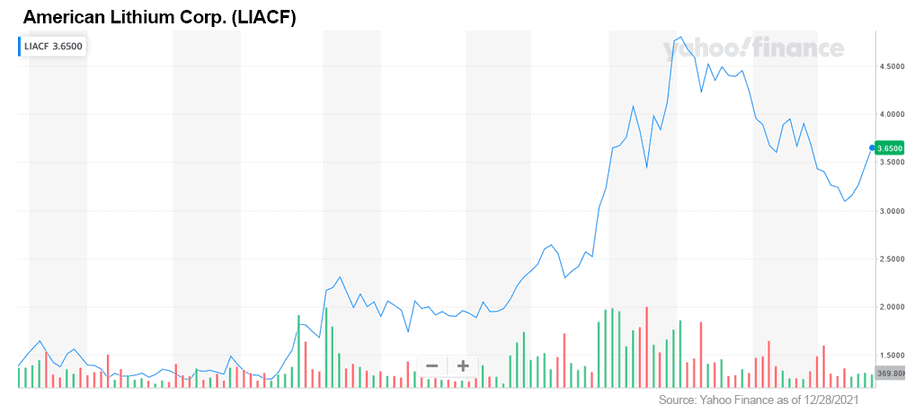

3. American Lithium Corp. (OTCQB: LIACF / TSX-V: LI)

American Lithium is an exploration-stage company currently exploring and developing lithium brine deposits in Nevada and hard rock lithium in Peru. In addition, the company is developing a uranium reserve also located in Peru.

The Nevada property is located in the same region as Albemarle’s (NYSE: ALB) Silver Peak lithium mine and several other advanced-stage lithium projects. It is also located near the Tesla (NASDAQ: TSLA) Gigafactory.

Their Peruvian hard rock lithium deposit is touted as the world’s 6th largest deposit.

Echelon Capital Markets recently initiated coverage of the company with a speculative buy rating and 12-month target price of $6.48/share. Roth Capital has called for $5.93/share and VSA Capital projects $5.50/share.

The stock is deemed a speculative buy and investors should be aware of the risks when investing in any exploration-stage company, however... overall, American Lithium has performed well. I believe there is more to go!

Renewable investments & technology is growing rapidly and the key element to power this tech, right now, is lithium.

Without a doubt, lithium metals should be in every intelligent investor’s portfolio.

Demand is already outstripping supply. Countries like China are putting further pressure on supply by buying up known reserves around the world.

I see a great opportunity in the space for the next few years as world governments continue to move their economies into a carbon free economy.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.reuters.com/article/us-mexico-mining-lithium-exclusive-idUSKCN2E52FN

[2] https://tradingeconomics.com/commodity/lithium

[3] https://www.thinkgeoenergy.com/vulcan-energy-produces-battery-grade-lithium-from-geothermal/

[4] https://www.bbc.com/future/article/20201124-how-geothermal-lithium-could-revolutionise-green-energy

[5] https://investors-corner.bnpparibas-am.com/investing/what-you-need-to-know-about-lithium/

[6] https://www.bloomberg.com/news/articles/2021-10-27/lithium-s-rally-isn-t-slowing-as-costs-rise-for-electric-vehicles-batteries?sref=SAPiUD9B

[7] https://www.ig.com/uk/trading-strategies/what-are-the-best-lithium-stocks-to-watch--200824#information-banner-dismiss

[8] https://www.ig.com/uk/trading-strategies/what-are-the-best-lithium-stocks-to-watch--200824#information-banner-dismiss

[9] https://investors-corner.bnpparibas-am.com/investing/what-you-need-to-know-about-lithium/

[10] https://www.marketwatch.com/story/lithium-demand-to-grow-at-average-annual-rate-of-30-in-2021-23-bacanora-says-commodity-comment-271631179864

[11] https://english.elpais.com/usa/2021-10-21/the-white-gold-dream-why-mexico-wants-to-control-lithium-exploitation.html

[12] https://finance.yahoo.com/news/global-lithium-mining-market-industry-104300637.html

[13] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/china-mining-battery-companies-sweep-up-lithium-supplies-in-acquisition-blitz-67205411

[14] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/china-mining-battery-companies-sweep-up-lithium-supplies-in-acquisition-blitz-67205411

[15] https://www.msn.com/en-gb/money/other/block-chinese-takeover-of-lithium-miner-ministers-told/ar-AARx6a1

[16] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/china-mining-battery-companies-sweep-up-lithium-supplies-in-acquisition-blitz-67205411

[17] https://www.ig.com/uk/trading-strategies/what-are-the-best-lithium-stocks-to-watch--200824#information-banner-dismiss

[18] https://finance.yahoo.com/news/investmentpitch-media-video-discusses-alpha-080500942.html

[19] https://alphalithium.com/alpha-lithium-closes-oversubscribed-25-million-bought-deal-offering/

[20] Ibid.