If I’m Elon Musk, I’m going to keep looking up. Not only to the universe and beyond, but to the competitive tree hanging over my head. Musk, and Tesla, may soon re-learn Newton’s law of gravity—when a proverbial "Apple" drops out of a tree and bonks them on their collective noggin.

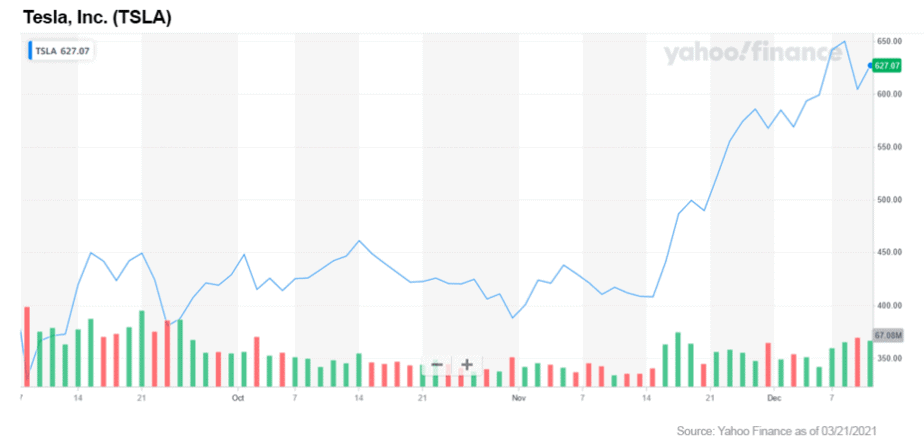

Competition is fast coming to the electric vehicle (EV) market in a big, big way. While Tesla (NASDAQ: TSLA) will surely lose market share, the immense growth in the overall market will guarantee that, as far as actual unit sales go, Tesla will not go away. But there will be real challenges upcoming.

The competitive pressure is real, felt first from traditional automakers. Yet the bigger threat may come from the disruptors—techs and tech startups all grabbing for a piece of the transportation services pie.

Before I go on any further, a full disclaimer is warranted... I drive a Tesla Model 3 Performance, the one rated with just under 500 horsepower. It’s a beast. Fast, powerful, quiet as a ghost, and connected—not to mention being unchained from the hydrocarbon ecosystem. Yet, it’s not without its soft, vulnerable bits.

Still, when it comes to traditional automakers, they themselves face big challenges figuring out that stuffing a battery electric drive-train into any old school internal combustion engine (ICE) vehicle architecture won’t really cut it.[1]

It must be tough for them. With engineering benches, patents, processes, supply chains, and distribution structures all firmly vested in old-school vehicles, and mega-corporate structure, the Fords (NYSE: F) and GMs (NYSE: GM) of the world just can’t turn on a dime—or can they?

Perhaps they don’t have to, given that their resources might buy them some time in transitioning to the battery electric vehicle (BEV) ecosystem. In the meantime, they may find their customers’ loyalty tested as those automakers try to catch up with the curve and produce a few sure-to-be flops.

Tesla’s strength, coming out of the gate, is miles on the road and years of experience. Their weakness (one of them) is manufacturing. Tesla is a tech company, and they’re still learning the auto-making bit. The inexperience here shows up in fit and finish, and in sub-par luxury appointments, most obviously.[2]

Compare a top-of-the-line Tesla with a comparably-priced ICE and there’s a lot to be improved on from Tesla’s end. BMW, Mercedes, Audi... even Infiniti or Lexus, all do an arguably better job on creature comfort and luxury feel.

Yet, the simplicity of Tesla’s design and driver experience reflects an intelligence born out of forward thinking, the idea of connected cars, and a user interface that ultimately buries the old-school dials and buttons approach inherent in traditional automotive. Drive one for a few days and the dash of an ICE looks like a circus act run amok. That having been said...

Tesla is now inherently open to competition, not only from established car manufacturers, but from companies who know how to do interface. Companies like Apple (NASDAQ: AAPL) for instance. It’s no secret that Apple is actively working on car tech.

Not only does Apple know, probably better than any company in the world, how to insert functioning user interfaces, they also know how to manufacture. Maybe not vehicles, but a bunch of their manufacturing chops can be adapted quickly enough. Plus, they know a fair bit about the ever-critical battery game. If they partner up with a traditional automaker, it could spell real success, real fast.

Apple also knows how to produce and manage disruptive products. Just look at the iPhone for starters. Apple transformed cellular from a purely hardware-based game into a software business. Steve Jobs once observed that, when it came to the demise of the Blackberry, that RIM (NYSE: BB) was essentially a hardware company trying to compete in a software market. Will the same transformation happen to vehicles?

Also, Apple has around $200 billion cash hanging around.[3] They can go to war if they want to grow a new division and compete in the EV space.

So, who will the winners and losers turn out to be?

There are a few factors in the battery electric vehicles (BEV) success equation. First of all there is the battery. Relatively slow to charge and limited in terms of range, batteries look to stand a whole lot of improvement in coming years as the global EV fleet grows toward the 100 million mark by 2028.[4]

One goal is to improve charging rates (currently 30 minutes to an hour) to a point that they’re the same as filling up with good old dino juice—about two minutes or so. The charging technology is already there, the batteries—not quite yet.

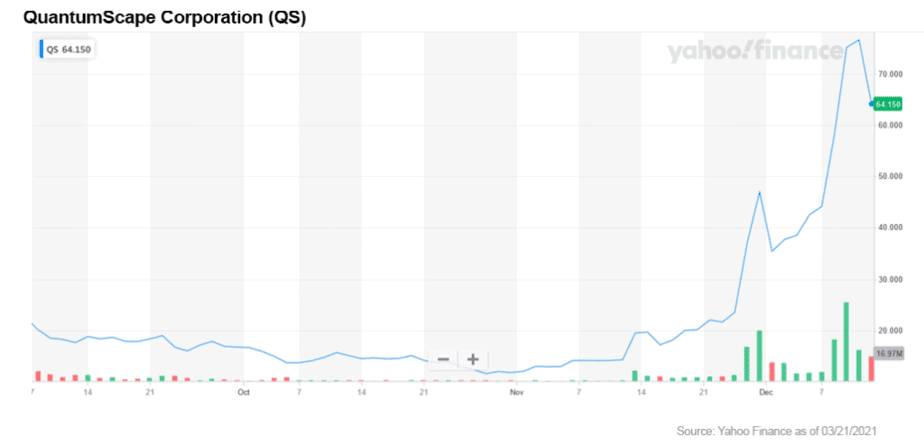

According to Industry Week, “Numerous investments from OEMs such as Volkswagen (OTC US: VWAGY), BMW Group (OTC US: BMWYY), and Daimler (OTC US: DDAIF) have been made in solid-state technology and lithium-silicon technology companies, including QuantumScape (NYSE: QS), Solid Power (Private), Enevate (Private), and Sila Nanotechnologies (Private). These investments highlight how important these technologies will be for the future of EVBs.”

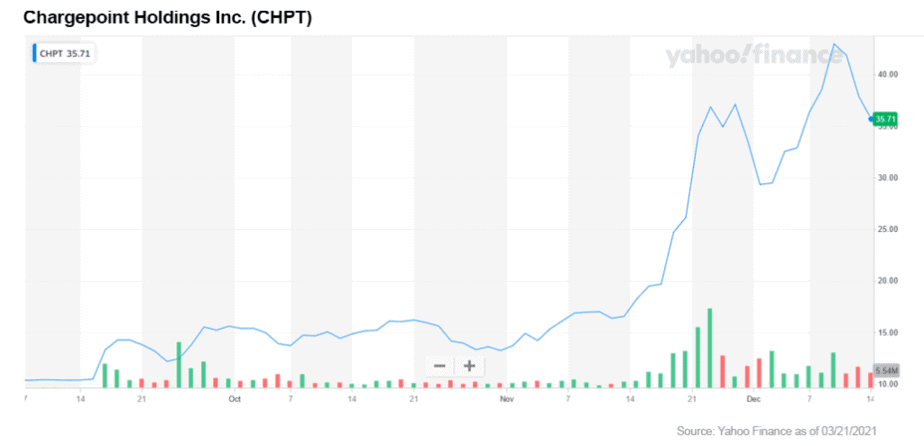

ChargePoint (NYSE: CHPT) fuels all types of vehicles (from passenger vehicles to delivery vans to buses) across use cases (from L2 to DC fast charging) in parking lots, depots, and residential settings. The company bills itself as a “basket for investing in automotive and mobility brands that are making the switch to electric.”

ChargePoint not only charges everything, but claims to be working to integrate into everything. ChargePoint is integrated in-vehicle through native infotainment systems and in Apple CarPlay and Android Auto. ChargePoint is also integrated through payment systems, mobile wallets, fleet fueling cards and with utility programs. At home, ChargePoint is integrated with at-home assistants like Alexa and more.

QuantumScape (NYSE: QS) claims to be a leader in the development of next generation solid-state lithium-metal batteries for use in electric vehicles. Solid-state batteries have long promised to solve the thorniest issues, preventing widespread battery-electric vehicle adoption while providing better performance on many metrics. However, these batteries are not without challenges.

That having been said, confidence in QS and in the future of solid-state batteries may be best illustrated by the fact that VW has invested $300 million of the $1.5 billion in committed capital the company has raised.[5]

So, yeah, energy systems and batteries are a critical part of the game—but only one part...

The emerging crop of new vehicles are more about being computers on wheels, which is something that Tesla, with their current lineup, has barely hinted at. Here’s where I take a shot at Musk.

As much as I love my Tesla, the computerization sucks. Great idea, even a technical triumph, but barely developed in its potential.

As quick as my Model 3 is (and trust me it’s really, really quick), the tragically slow response time on the lovely and brilliantly conceived single screen interface, as well as the limited flexibility offered in its captive ecosystem, often reminds me of working on a 9600 bit modem. I just don’t get jazzed-up over a media-rich interface delivered at 3G speeds. I mean, waiting 60 seconds for Netflix to boot is just the start.

This is a connected car. That connectivity is key in distinguishing it from every other vehicle out there, and it defines Tesla as the way of the future. I question whether traditional automakers will ever really understand or be able to execute the kind of connectivity and interface that buyers will ultimately bite on. But guess who can?

You got it. When it comes to user interface and systems integrations, nobody does it better than Apple. That’s one reason why it’s quite possible that the as yet mysterious Apple car, when it arrives, stands a good chance at kicking Tesla out of its market leadership slot.

There are other reasons why Apple could define the automotive segment as it morphs into transportation services. Apple already has a very rich ecosystem of devices and, more importantly, content and the ability to make content deals by, among other things, leveraging that ecosystem.

Just as cellular communications morphed from selling hardware gizmos to delivering all manner of higher speed data, as Jobs observed regarding Blackberry, a transportation services device could become more or less defined by the data it captures and delivers.

It’s doubtful that the traditional automakers will be great at this, but will Tesla be able to compete against Apple? This remains an unanswered but meaningful question at this point in the EV growth cycle.

The third big factor in the emerging EV market is, of course, vehicle autonomy. One of the obvious ways to play the sector is to invest in the sensor technology critical to self-driving vehicles.

Luminar (NASDAQ: LAZR) has proprietary software designed to unlock full LIDAR capabilities that will enhance automakers’ ability to deliver high-speed highway autonomy in commercial series production scale.

The company has landed huge contracts with Daimler AG (OTC US: DDAIF), Intel Corp.’s INTC Mobileye unit (NASDAQ: INTC), Volvo Group (OTC US: VLVLY) and others, which are likely to solidify its standing in the LIDAR market. Volvo’s vehicles will be equipped with Luminar’s Iris LIDAR sensors beginning 2022. The company expects to generate revenues of $15 million in 2020, which is expected to jump to an enormous $837 million by 2025 based on company forecasts.

ON Semiconductor (NASDAQ: ON) offers various intelligent sensing solutions for automotive and autonomous perception with superior technology targeting image sensors, radar, as well as LIDAR. ON is well positioned to benefit from the solid momentum witnessed in image sensors amid consistent growth in the advanced driver-assistance systems.

Partnership with Velodyne (NASDAQ: VLDR) has bolstered Veoneer Inc.’s (NYSE: VNE) footing in the LIDAR market. Sweden-based Veoneer is manufacturing and commercializing LIDAR systems for automotive usage, utilizing Velodyne's scalable auto-grade LIDAR sensor and core 3D software technology. Veoneer has a proven track record of combining superior sensor technology into automotive modules that automakers can effectively integrate into their cars.

As to the future, well it’s moving fast… One thing you have to say about Tesla, they’re the only vehicle maker to get their DNA from space exploration. Does anybody see Ford or GM getting ready for a mission to Mars? It’s probably a fair bet that Tesla will benefit from the technology devised for the extraordinary demands of space exploration. So there is that!

Still, back here on earth, where the challenges seem comparatively simple, they are still considerable. Putting a lineup of battery-powered EVs on the road—EVs that have long range, quick charging, and long-lived affordable batteries—is tricky enough to deliver today.

While we’re here, by the way, creating a truly self-driving vehicle is amazingly complicated. Just consider all of the thought that goes into an everyday driving experience such as approaching a busy intersection. There may be pedestrians, road work, traffic signage, and intangible factors that you only intuitively understand after years of driving experience.

As a Tesla driver who uses autopilot from time to time, I’ve begun to think about vehicle autonomy in a very different way. Personally, I’ll be quite reluctant to relinquish total control of my car until I know that there’s robust and reliable vehicle-to-vehicle and vehicle-to-infrastructure communications going on. Until then, I’ll call these systems driver-assistance features only.

That doesn’t mean that self-contained systems based purely on cameras and various sensors won’t become increasingly standard in vehicles. They will. They reduce both severity and frequency of accidents and save lives. Nobody will argue with that.

I look forward to the day I can get into a vehicle and tell it to take me to the office while I sit back and read my emails, and let the car do all the rest.

In the meantime, there are huge benefits to be gained through the future electrification of the global vehicle fleet and through developing vehicles with greater (and faster) connectivity, offering a broader range of transportation-related services and a completely new buying and ownership experience.

Volvo, for example, has announced they are following Tesla’s lead in making vehicles available only through online ordering.[6]

“The future of Volvo Cars is defined by three pillars: electric, online and growth,” head of global commercial operations Lex Kerssemakers stated in a press release announcing the new sales strategy. “We want to offer our customers peace of mind and a carefree way of having a Volvo, by taking away complexity while getting and driving the car.”

Tesla absolutely has been regarded as the leader in redefining the automotive EV sector. Now, the rest of the automotive world is playing catch-up. If the trash-laden interior of the new Chevrolet Bolt is any example, they have a long way to go if they ever hope to show that they “get it.”

Tesla may not have much to worry about from the old-school crowd. Or do they? Musk had better remember to keep looking up, lest the automotive majors figure it out and that “Apple” drops on Tesla’s head.

Blake Desaulniers, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.strategy-business.com/article/Facing-up-to-the-automotive-innovation-dilemma?gko=a45a6

[2] https://www.motortrend.com/news/tesla-model-y-ev-safety-quality-issues-problems/

[3] https://www.cnbc.com/2020/07/30/apple-q3-cash-hoard-heres-how-much-apple-has-on-hand.html

[4] https://www.industryweek.com/technology-and-iiot/article/22028055/next-gen-batteries-to-power-up-electric-vehicle-installed-base-to-100-million-by-2028

[5] https://www.motortrend.com/news/technologue-solid-state-battery-frank-markus/

[6] https://driving.ca/volvo/auto-news/news/death-of-a-car-salesman-some-new-volvos-only-for-sale-online