This is Part 1 of a 2-part series on gold streaming and royalty stocks. For Part 2, click here.

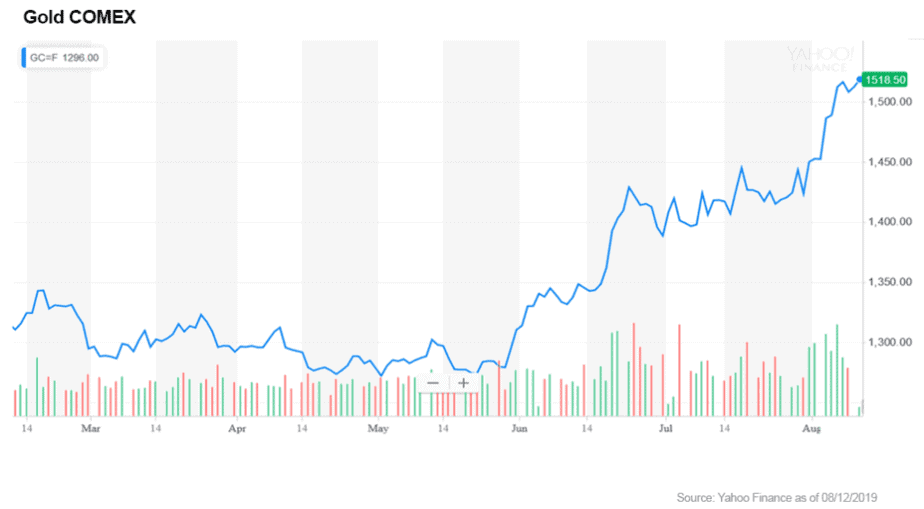

With a long and growing list of danger spots in the global economy, investors are once again turning to all things gold. The price of physical gold has been on an upward tear since May, albeit with a few minor corrections.

Meanwhile, gold mining stocks have roared ahead, returning double the gains of gold. But those aren’t the only two ways to profit from the yellow metal, and they may not even be the best way.

After its multiyear slumber in the shadow of the stock bull market, gold could be set to enter a long-term rally.

Simon Constable, a fellow at the Johns Hopkins Institute for Applied Economics and frequent contributor to Barron’s and The Wall Street Journal, says that “Double-digit increases within the next 18 months may be only the start of the price surge.”[1]

Likewise, Joe Foster, portfolio manager for the VanEck International Investors Gold Fund (NASDAQ: INIVX), says "We believe there is a very good chance that this marks the beginning of a new gold bull market,” adding that it is “likely to last several years.”

Even the normally cautious Swiss Bank UBS says “The macro backdrop has now started moving more convincingly in gold's favor.”

All this optimism for gold is because of the many signs that the world economy is faltering even with high employment, low inflation, and a booming stock market.

The unemployment rate is near a half-century low. The stock market is at record levels. Inflation is low. And even wages, which have been persistently stagnant, are increasing slightly faster than inflation.

But dig deeper and you’ll find some troubling signs that all is not as rosy as it appears at first glance.

Ongoing trade wars and geopolitical tensions are putting a damper on the global economy.

The casualty of escalating trade wars is that trade has slowed significantly, with import and export growth rates at their lowest since the 2008 financial crisis.

Consumer spending, business investment, and GDP growth have all weakened. Aggregate debt is far higher than even pre-crisis levels, and oil prices have fallen off a cliff as the slowing global economy is reducing demand.

India and Australia have already cut interest rates in an effort to pump up their economies. The US Federal Reserve has made one rate cut and signaled that it could make as many as two rate cuts this year. And the European Central Bank says it could even return to printing money if the economy does not improve.

Add it all together and you get nervous investors who see the economic cycle turning away from equity markets and to safer havens like gold.

It’s all just part of…

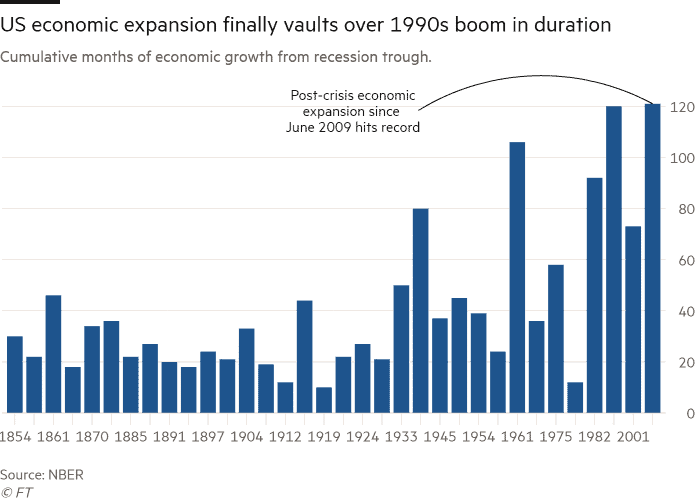

We’ve enjoyed an unprecedented period of economic expansion since the end of the last recession in 2009.

The stock market has pinned its longest bull run in history with the S&P 500 posting a meteoric rise of 352% since the 2009 low, as of August 2019.

But boom times don’t last forever. And with the world economy on a knife’s edge, an external shock – trade war escalation, increased tensions with Iran, a natural disaster – could trigger recession.

That’s when gold starts to shine. When economies struggle, gold thrives. Just like clockwork, it happened in the recessions of 1975, 1980, 1990, 2001, and 2008.

Smart investors aren’t waiting for the boom to fall.

Gold buying is already getting hot. In fact, on one recent day, June 21, holdings in the SPDR Gold Shares ETF (NYSE: GLD) jumped by 34.93 metric tons, or around $1.6 billion worth.

That level of buying isn’t the result of small day traders jumping into the market. Those are the big guns, the multi-billion dollar Wall Street funds.

That’s all convincing evidence that gold is in for a good run.

But what’s the best way to profit from the emerging bull market in gold?

You could buy gold bullion or a gold ETF and profit from rising prices. But that’s a particularly inefficient way to invest.

Smart investors seek to leverage their investments to increase their potential returns. And with gold, that means gold miners.

The reason is because as the price of gold moves higher above a miner’s cost of production, profitability scales up dramatically, dwarfing any gold price increases.

For example, a gold company might be able to mine gold at a cost of, say, $1,000 per ounce.

If the price of gold is $1,000 an an ounce, the mining company is making profits of $200 on each ounce.

If gold is on an upswing and the price goes up by $200, the miner’s profit doubles to $400, even though the price of gold only gained 17%.

That’s leverage! And that’s why so many people are looking at gold mining stocks with the recent boom in gold prices.

During the last gold boom, for instance, starting late in 2015, Barrick Gold (NYSE: GOLD) shot up 277% in 10 months. Meanwhile, HUI, the NYSE Gold Bugs Index, climbed a still-respectable but far lower 149%, about half the gains of GOLD.

Of course, the opposite is true, and when gold prices drop a gold miner’s losses can be magnified. Which is why gold mining stocks are best suited for active investors who can stomach volatility and who watch their portfolios carefully.

But there’s another way to profit from gold’s rise.

A way that is more profitable, safer, less volatile, and often with the added bonus of hefty dividends.

If you want to catch the gold boom but also want to limit your downside potential, gold royalty and streaming companies are just what you’re looking for.

Mining royalty and streaming companies are in the business of financing mines. They provide cash up front to the mining companies, and in exchange they have the right to buy a set amount of gold at far below market prices, or to take physical gold as payment.

Specifically, royalty companies receive a percentage of revenue, while streaming companies are paid in physical gold.

Gold miners generally prefer these financing deals over issuing normal debt because streaming and royalties lever their debt to the price of gold. That means their debt essentially rises and falls with the price of gold and their profits, so it’s less risky.

With normal debt, on the other hand, they’re stuck with the debt regardless of the price of gold.

What’s more, the high costs and unpredictable revenue associated with mining means mining companies often have trouble getting favorable terms from traditional sources such as bank.

It’s a win-win for mining companies and their royalty or streaming partners.

But more than that, it’s a win for investors too, giving you a chance at larger margins, less exposure to risks, and a topping of dividends, to boot.

There are many other benefits too, which we will lay out in Part 2 of this series on gold streaming and royalty companies, including three stocks set to outperform the market…

Click here for Part 2

Cynthia Berryman, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.msn.com/en-us/money/markets/why-the-gold-rally-is-set-to-run/ar-AADHipg