This is Part 2 of a 2-part series on gold streaming and royalty stocks. For Part 1, click here.

In Part 1 of this series, we explained the gold streaming and royalty business model and laid out the reasons why the changing market cycle makes this the perfect time to invest in these stocks.

In this article, we provide you with the numerous ways why the stocks of these companies could give you the opportunity to leverage the rising price of gold in the newly-forming gold bull market for bigger and safer returns.

With economic indicators signaling an imminent end to the stock bull market and turn of the business cycle to safer assets such as gold, royalty and streaming companies offer investors a way to leverage the rising price of gold for even greater gains.

Gold streaming and royalty companies do not own mines, and therefore they do not carry the risk of overhead related to gold mining operations. Instead, they provide capital to gold miners, and take their repayment in the form of greatly discounted gold or cash equivalent, which they either turn around and sell at significant profit or reap the benefit of profiting in the sale of gold and other metals.

These companies have tremendous margins, partly because they are not overhead-intensive, and generally have fewer than 40 employees. They are among the most scalable businesses, as well.

That means these companies can add far more revenue without having to scale-up and add hundreds of new employees to their business in order to grow.

That translates to the highest level of revenue per employee and market cap per employee of any S&P 500 sector.[1] Including the three top revenue per employee generators, Wheaton Precious Metals (NYSE: WPM), Franco-Nevada (NYSE: FNV), and Royal Gold (NASDAQ: RGLD).

What’s more, when you look at revenue on market cap per employee, you see that Franco-Nevada is in a league of their own with more than $400 million per employee. This is almost twice as much as the nearest competitor, Wheaton Precious Metals.

As streaming and royalty companies continue to add more contracts to their portfolios, and as these mines continue to come on-line in greater scale, revenue is increased, which in turn reduces volatility.

The reason is because each new revenue-generating project reduces the impact that other projects have on total revenue.

The low volatility these companies enjoy is why portfolio managers like their stocks, since their clients do not like volatility, but still want exposure to rising gold prices.

What’s more, even if the price of gold stayed the same, new streaming or royalty contracts translate to revenue growth.

There are quite a few royalty and streaming companies, but most of them are private. Here are 11 that trade on US exchanges.

| Company | Symbol | Market Cap (B) |

| Franco-Nevada | NYSE: FNV | 15,890 |

| Wheaton Precious Metals | NYSE: WPM | 10,780 |

| Royal Gold | NASDAQ: RGLD | 6,720 |

| Osisko Gold Royalties | NYSE: OR | 1,620 |

| Sandstorm Gold | NYSE: SAND | 991 |

| Maverix Metals | NYSE: MMX | 475 |

| Abitibi Royalties | OTC: ABTYF | 120 |

| Metalla Royalty and Streaming | OTC: MTAFF | 105 |

| EMX Royalty Corporation | NYSE: EMX | 100 |

| Sailfish Royalty Corp | OTC: SROYF | 41 |

| ELY Gold Royalties | OTC: ELYGF | 13 |

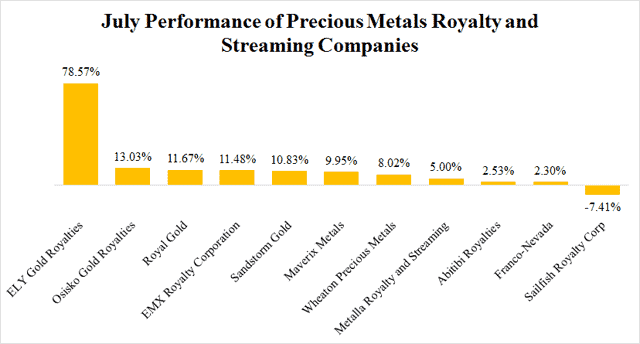

In just the month of June, these streaming and royalty stocks put in a stellar performance, with most outperforming the S&P 500.

Of course, some streaming and royalty stocks are better investments than others, the same as in any sector.

Because of their large number of holdings in every stage of development and production, which tends to even out revenue generation and lower risk, this is one sector where the largest companies tend to also be the most consistent, safest investments.

Here’s a look at the three largest streaming and royalty companies, all of which give investors an opportunity at oversized returns.

1. Franco Nevada (NYSE: FNV)

Franco Nevada is the “big boy” of the group, and it is one of the best performing gold streaming stocks in history.

Since their IPO 12 years ago, they have returned around 474% to investors while significantly outperforming the price of gold. And that’s not even counting their steady dividends, which they have increased every year for 11 years.

In 2018, FNV sold nearly 350,000 ounces of gold, along with around 100,000 ounces of silver, platinum, and other metals, generating $653 million in revenue and $139 million in net income. The company consistently has little or no debt.

With over 300 mining projects, FNV has a robust portfolio that includes mines at every stage of development and production. Many of their holdings are seeing big production increases including their Stillwater mine holding, which is expected to increase production by more than 50% to around 850,000 ounces by 2021, and their Kirkland Lake mine, which just increased production by 35% from Q1/2018.[3]

Increases like these are reflected in increased earnings, share price, and dividends.

2. Wheaton Precious Metals (NYSE: WPM / TSX: WPM)

Wheaton Precious Metals boasts a portfolio of some of the lowest cost producers in the mining world. Over two-thirds of the company’s production comes from assets in the lowest cost quartile.

What’s more, Wheaton’s portfolio has over 30 years of built-in production, based on reserves.

WPM has outperformed both gold and gold miners on just about any timeframe, including more than double the 1-year, 3-year, 5-year, and 10-year performance.

Still, the stock took a big hit in 2012 when they found themselves heavily weighted in silver at a time when the price of silver crashed 47%.

They have since corrected that, contracting with mining giant Vale (NYSE: VALE) in 2016 to purchase a total of 75% of the gold from Vale’s Salobo mine.

Institutional investors have shown their approval of the strategy realignment, and now hold 60% of the stock.

Q1/2019 revenues of $225.1 million are 12.9% over Q1/2018, driven by a 64% increase in gold ounces sold, And a 32% decrease in silver ounces sold.

Besides profiting from share price growth, investors have been doubly rewarded with steadily increasing dividends, which have grown by 200% since 2011.

3. Royal Gold (NASDAQ: RGLD)

When the last recession hit, stock markets tumbled. But as the chart below shows, RGLD (along with other gold streamers) provided investors with some of their only gains for that period.

With recessionary drums beating, filings show that last quarter ten top investment companies each bought up two million or more shares of RGLD.

The Denver-based company owns 191 properties worldwide.

Dividends have increased every year for the past 17 years, and the company’s revenue has grown a healthy 93.51% since 2014 (through 2018).

The company’s current portfolio mines have an average remaining life of 14 years, which means they will be generating revenue far into the future, regardless of what new mines are added to their holdings.[4]

RGLD has performed in both bull and bear markets. Since 2000, in fact, the stock has outperformed the S&P 500 by a whopping +3,500%.

With 145 development and exploration stage properties in their portfolio, a steady stream of new revenue should keep pushing up share value long into the future.

After a 10-year economic expansion and the longest stock market bull run in history, signs point to a turn of the economic cycle.

Investors who see what’s coming are moving to safe assets like gold. But you don’t have to limit yourself to the potential volatility of the precious metal. Mining royalty and streaming stocks give you the opportunity to profit from the gold boom with larger margins, less exposure to risk, and a tasty topping of dividends.

Consider adding mining royalty and streaming stocks to your portfolio. But remember – always perform your own due diligence!

Cynthia Berryman, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://firstmacrocapital.com/research/which-companies-generate-more-revenue-per-employee-than-every-sp-500-stock/

[2] Ibid

[3] https://www.barrons.com/press-release/PR-CO-20181105-913226?tesla=y

[4] https://www.fool.com/investing/2017/08/02/heres-why-the-best-is-yet-to-come-for-royal-gold-i.aspx