There is no denying that Bitcoin had a rocky year last year. The price was $9,800 in May of 2018, and dropped to $3,900 ten months later.[1]

What was once euphoria about cryptocurrency and its infinite promise… has turned to general dread, or so it seems.

But price doesn’t tell the whole story, and let me explain why.

Right below the surface of mostly negative headlines lies a vibrant crypto ecosystem, undeterred by pejorative mainstream news coverage.

At this very moment, major institutions are investing in cryptocurrency and blockchain technology, companies are releasing innovative crypto products, and users are still flooding into the market.

The crypto revolution hasn’t slowed down just because some people have stopped paying attention. Quite the contrary.

There are countless reasons why cryptocurrency and blockchain technology are thriving at this very moment, and I have narrowed it down to what I believe are the top 10 indicators proving crypto isn’t dead.

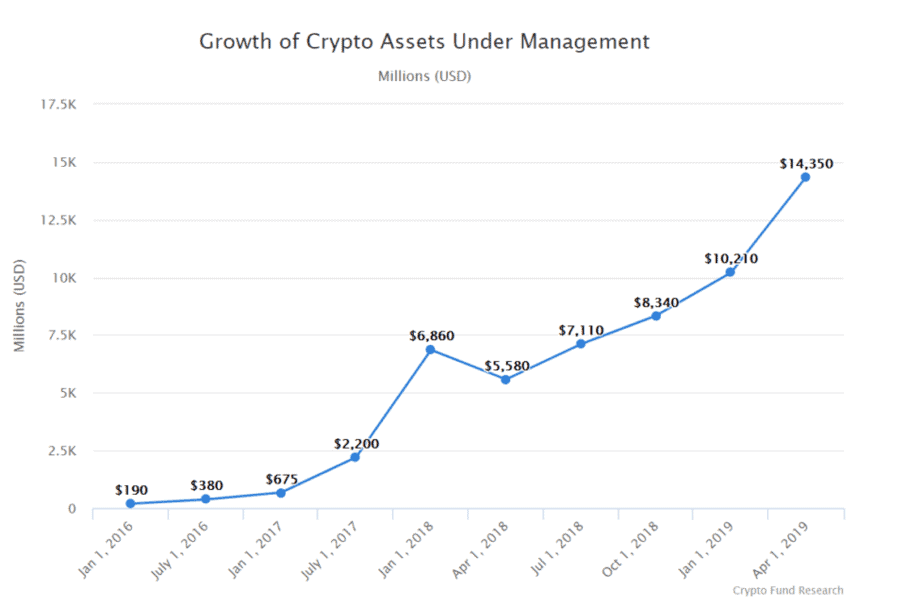

Some of the world’s largest funds and banks have begun to invest in, or employ, crypto technology.

These massive institutions possess tremendous influence across the world, and their involvement in crypto signals that the industry has long-term viability, lending credibility to the space.

Fidelity Investments Inc.

Fidelity Investments Inc. is a private, multinational financial services company based in Boston, Massachusetts. They are the 5th largest asset manager in the world and according to Fidelity’s website, they administer over $6.7 trillion in total customer assets and have over 30 million individual clients.[2]

They launched their crypto custody and trading platform on March 8, 2019, as they prepare to address growing customer demand for cryptocurrency.[3] With such massive scope and scale, the adoption of crypto by Fidelity is a huge boost for mainstream credibility.

Endowment Funds

Endowment funds at Harvard, Yale, Stanford, Massachusetts Institute of Technology (MIT) and the University of Michigan have all invested into funds and/or projects relating to cryptocurrency.[4]

There are several others, but I included these particular institutions because they all rank in the top 10 largest endowment funds in America, with Harvard being number 1, holding over $38 billion in assets.

JPMorgan Chase & Co.

Jamie Dimon, the CEO of JPMorgan Chase & Co. (NYSE: JPM), was perhaps the most famous crypto critic calling Bitcoin a “fraud” on September 12, 2017. [5] But now his company is leading the banking push for crypto adoption.

Despite Dimon’s tirades, the bank launched its own blockchain product just a month later on October 16, 2017, called the Interbank Information Network (INN).[6] It is designed to be “ a peer-to-peer network powered by blockchain technology” in order to minimize “friction in the cross-border payments process” as well as enable “payments to reach beneficiaries faster and with fewer steps.” [7]

There are now more than 220 banks in the network including Royal Bank of Canada (NYSE: RY) and Australian-based ANZ (ASX: ANZ).[8]

JPMorgan Chase & Co. also announced in February of 2019 that it will be the first major bank to release its own cryptocurrency called the “JPM Coin,” which is designed “to settle a small portion of its transactions between clients of its wholesale payments business in real time.”[9]

The International Data Corporation reports that “total corporate and government spending on blockchain should hit $2.9 billion by the end of 2019, an increase of 89% over the previous year, and reach $12.4 billion by 2022.”[10]

The list of companies actively exploring and/or instituting blockchain technology is endless and includes basically all of the world’s most powerful companies: Amazon (NASDAQ: AMZN), Alibaba (NASDAQ: BABA), Comcast (NASDAQ: CMCSA), Google (NASDAQ: GOOG), IBM (NYSE: IBM), Intel (NASDAQ: INTC), Microsoft (NASDAQ: MSFT), Nike (NYSE: NKE), PayPal (NASDAQ: PYPL), Oracle (NYSE: ORCL) and Samsung (KSE: 005930.KS).[11]

I believe this is a predictor of what is to come in the next few years — blockchain will be deemed essential technology for any large corporation (as evidenced by the multi-billion-dollar companies listed above) because it acts as an immutable database that can track countless numbers of goods, services and payments.

Facebook (NASDAQ: FB) is set to become the most notable corporate adopter. The social media giant is releasing its own cryptocurrency called “GlobalCoin,” which will officially be announced in mid-June 2019.[12]

Users will be able to exchange these coins through Facebook-owned messaging platforms, and it is rumored that “employees who are working on the project” can opt-in to be paid with the coin as well.[13]

The company wants to conglomerate its three major messaging services — Messenger, WhatsApp and Instagram — which would “extend the reach of Facebook’s digital currency across the 2.7 billion who use one of the 3 apps each month.”

This integration is a game changer — when Facebook’s coin is released, crypto will become truly mainstream.

Having influential spokespeople and strong advocates is essential for any business or product.

Cryptocurrency and blockchain technology have some of the most powerful investors and entrepreneurs in Silicon Valley singing its praises. This started as early as 2013, when dominant venture capital funds including Union Square Ventures and Andreessen Horowitz took early positions in foundational crypto companies like Coinbase and Ripple. (I’ve included more information on this below.)

Fred Wilson: Co-founder and partner of Union Square Ventures (USV), early backer of Twitter (NYSE: TWTR), Tumblr, Etsy and Kickstarter

Wilson’s Union Square Ventures (USV), which manages assets that total over $1 billion, has backed several blockchain companies, starting in 2013 when they participated in an early private round of Coinbase.[14] Since then, USV has expanded their crypto investments to total 15% of their entire portfolio.[15]

Wilson has also been a long-time evangelist of Bitcoin and its benefits. He wrote on his personal blog in November of 2013, that he had purchased over 175 Bitcoins and that he believes that the cryptocurrency “can be...the financial and transaction protocol for the global internet.”[16]

Mark Andreessen: Co-founder of Mosaic and Netscape, board member at Facebook

Ben Horowitz: Co-founder and CEO of Opsware, VP positions at Hewlett-Packard, AOL and Netscape[17]

Together, Andreessen and Horowitz co-founded the venture capital fund, Andreessen Horowitz, which made early investments in Twitter, Facebook, Skype, Airbnb, Lyft and Medium.

Andreessen Horowitz also made investments in several notable crypto projects starting in 2013, when they participated in financings for Ripple, Earn and Coinbase.[18] They set up a separate $350 million venture fund to invest solely in “crypto companies and protocols” in July of 2018.[19] This launch was during the depths of the crypto bear market, which further underscores their belief in the long-term viability of the space.

In April 2019, Andreessen Horowitz announced that they will cease to be a venture capital firm and pivot to become “a registered investment advisor.” [20] This is seen as a strategic move by industry insiders, made specifically to give them more flexibility to invest in crypto projects and tokens.[21]

Jack Dorsey: Co-founder of Twitter (NYSE: TWTR), co-founder and CEO of Square (NYSE: SQ)

Dorsey revealed on March 4, 2019 that he purchases $10,000 worth of Bitcoin every week, and he predicted last year that “The world ultimately will have a single currency…I personally believe that it will be Bitcoin.” [22]

Square, his mobile payment company with a market cap of over $27 billion, also began allowing merchants to accept Bitcoin in 2014.

Gaming — a $140 billion industry, which includes gaming activity on PCs, mobile devices, virtual reality headsets and consoles like Sony’s PlayStation (NYSE: SNE) and Microsoft’s Xbox (NASDAQ: MSFT) — is centered around micro transactions and acquiring digital assets, requirements that are perfectly suited to blockchain and cryptocurrency’s capabilities.[23]

Tencent (SEHK: 700) — the 8th largest company in the world by market cap — released a blockchain game called “Let’s Hunt Monsters” in April 2019. [24]

Players roam around catching monsters (similar to Pokémon Go), while “rearing and trading digital cats stored on a blockchain” (similar to Cryptokitties).[25] It has ranked in the top 20 most downloaded free games in China’s iOS App Store since its launch.[26]

Crypto-gaming specific funds are also beginning to emerge. Ripple and Tron, which are both decentralized protocols that support cryptocurrency, each announced they were dedicating $100 million to investing in blockchain-based games that are built using their respective protocols.[27]

These types of collaborations will play a major role in bolstering awareness and user adoption of crypto, as well as highlighting its diverse use cases.

To find out more, check out my FNN article here, which includes an in-depth look at gaming’s relationship to all things crypto.

Mainstream media is relatively unfamiliar with crypto technology and its unique culture — often only focusing coverage on the price of Bitcoin.

As a result, crypto enthusiasts have developed distinct online spaces where they congregate, mostly on social media, which has evolved into a committed community of passionate believers.

Nowhere is this sentiment more prominent than on “Crypto Twitter.” It is a real-time news source where you can connect directly with the top crypto developers and executives. I have provided a starter list of who to follow first, here.

For a movement to grow and persevere, even in the face of extreme criticism, a strong community is essential — and crypto has one of the most robust and active social networks I have ever seen. This tight-knit group emphasizes sharing and learning, and should not be underestimated when surveying the staying power of crypto and blockchain technology.

For the unfamiliar, purchasing cryptocurrency has proven to be tremendously difficult, and I believe this is the biggest barrier for widespread adoption. In response to this, several companies have focused on making this process more straightforward.

Coinbase, the most famous American crypto exchange, is now available in 103 countries (in 2018, they were only available in 32 countries) and has reportedly over 25 million users.[28] They have simplified the buying process and continuously expand their currency offerings.

Robinhood, a free stock trading app, has emerged as a competitor to Coinbase, and allows you to make commission-free purchases of Bitcoin, Ethereum and Litecoin (among others) through a few pushes of a button on your smartphone. Their service is constantly growing and is now available in almost 40 states.

Crypto ATMs are another easy way to purchase crypto, and installations of these machines have doubled in the last year — there are about 4,600 around the world and another 6 are installed daily.[29]

The benefits of a decentralized, digital currency are sometimes lost on North Americans.

Through a Bitcoin wallet, which you can easily download onto your smartphone, you are able to store and send cryptocurrency almost instantly without going through an institutional intermediary (like a bank). This can be life changing for citizens in developing nations who want to protect themselves from local currency inflation or bypass inaccessible banking systems.

According to the exchange LocalBitcoins, crypto adoption is on the rise in South American nations that are dealing with unstable governments including Venezuela, Columbia and Brazil.[30]

There are more Brazilian users on crypto exchanges than investors on the largest stock exchange in Brazil (called B3), which has a $1 trillion market cap and is based in Sao Paulo.[31]

Interest is growing in Africa too. South Africa, Ghana, and Nigeria are among the top five countries to search for the keyword “Bitcoin” according to Google Trends. [32] Nigerians are the 3rd largest holders of Bitcoin as a percentage of GDP in the world.[33]

Paxful, a Bitcoin exchange, reported that the volume of transactions it has processed in Africa increased by 130% in 2018, with an average of 17,351 trades per day. [34]

Asia has been the leading continent in crypto adoption. As a result of their underdeveloped banking infrastructure, it is estimated that “about 10% of Filipino adults now use cryptocurrency to make payments.”[35]

Even in developed nations like South Korea, “the average South Korean cryptocurrency trader has increased their crypto holding by 64.2% over the last year.”[36]

The American government is going full speed ahead to nail down regulatory clarity of crypto assets in a way that still leaves the door open for adoption and innovation — which will have positive ripple effects throughout the world.

In March of 2019, SEC Chairman Jay Clayton stated that he believes that Ethereum and other decentralized cryptocurrencies (including Bitcoin) are not securities.

This was a monumental ruling, as Ethereum now falls outside of the agency’s purview. The responsibility shifts “to their sister regulator the CFTC (Commodities and Futures Trading Commission).” [38] This is crucial because the CFTC “has already shown a willingness to approve and open up the institutional market to a number of regulated products in the form of Bitcoin futures...”[39]

There is also a push from Congress to nail down specific rules in regards to how to pay taxes on crypto gains.[40] The IRS has responded by making it a “priority” to “issue guidance” on virtual currency transactions in the near future.[41] This is vital, as it can encourage more Americans to buy and use crypto without fear of governmental repercussions.[42]

At the state level, Ohio and Wyoming have taken lead roles in instituting favorable crypto regulation.

Ohio became the first state to allow businesses to pay their taxes in Bitcoin, as they want to position themselves as “a progressive and business-friendly crypto region.”[43]

Wyoming has enacted 13 “blockchain-enabling laws, creating a welcoming legal framework that enables blockchain technology to flourish both for individuals and companies.”[44]

Certain regions have taken it upon themselves to encourage usership, which bodes well for federal regulatory outcomes, too.

If Bitcoin is to become a widely used currency globally, its throughput needs to be addressed. Bitcoin allows about 7 transactions per second while Visa averages 24,000 per second — this is a major problem.

As an answer to crypto’s scalability issue, the Lightening Network (LN) was launched in January of 2018. It adds a layer to Bitcoin’s blockchain, enabling users to create payment channels between any two parties. This can exist for as long as required, and transactions are almost instant, with extremely low (or non-existent) fees.[45] This means that Bitcoin transactions have the potential to be increased from an average of 7 per second, to an almost infinite amount, greatly exceeding Visa’s capacity.

The Lightening Network is in the early stages of development, meaning that it is still quite difficult to interact with, as payment channels are very challenging to set up for the average person. But there are several start-ups that address the LN user experience including Moon, which announced in April that they have created an LN browser extension that allows you to easily make purchases on e-commerce sites like Amazon (NASDAQ: AMZN).[46]

This same technology is being developed for other cryptocurrencies including Litecoin, Zcash and Ether, so scalability is being addressed across several crypto networks.

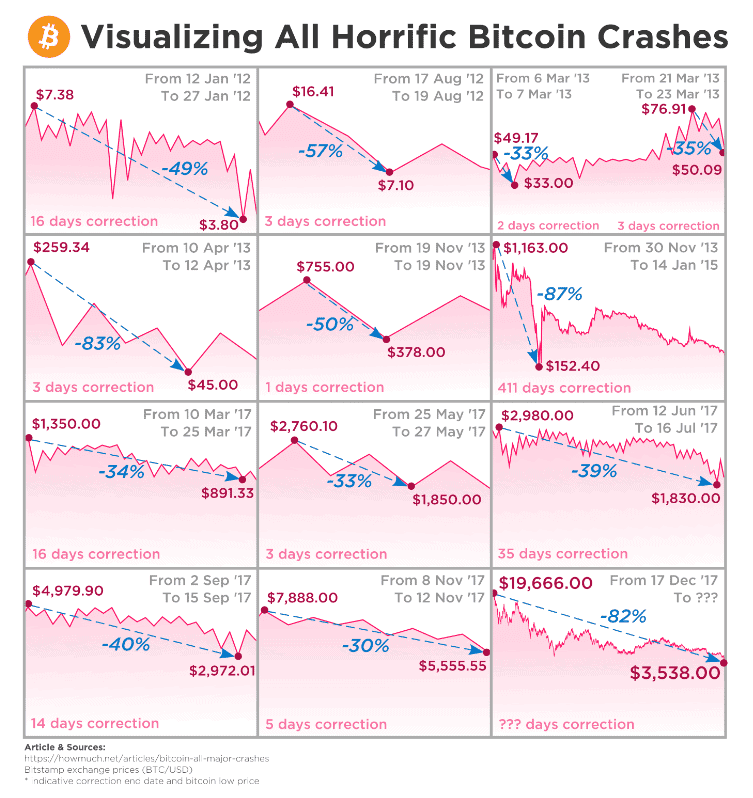

In some circles, depressed crypto prices are used as proof that the technology is a failure. However, when examining the price history of cryptocurrency, it is clear that its boom and busts are actually quite positive — they have encouraged innovation, better user experiences, and have forged a more committed user and developer base.

Dramatic ups and downs are also typical for emerging technologies on the road to mass adoption.

I have provided a more detailed explanation here as to why these price swings are a good thing in the long run.

Low prices also create great buying opportunities!

Corporations and institutions are realizing crypto and digital currency’s benefits, the user base is growing internationally and exciting products are being built.

When considering the vibrant activity in the space, it is obvious that crypto is certainly not dead and in fact, prices are beginning to rise, reflecting the remarkable advancements being made. Bitcoin’s price even peaked above $9,000 on May 30, 2019, for the first time in over a year.

This list does more than simply outline why “crypto isn’t dead” …it highlights why crypto is here to stay for the long run!

The ecosystem is dynamic and ever-evolving, and what is clear is that there are tremendous investment opportunities to take advantage of before the next bull run really takes off. So, the time is now to start following the industry closely because the crypto revolution won’t stop for anyone.

Blake Finucane, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] The price as on May 5, 2018 https://www.coindesk.com/price/bitcoin

[2] https://www.fidelity.com/about-fidelity/fidelity-by-numbers/overview and https://blockmanity.com/news/fidelity-launches-custody-trading-platform-bitcoin-ethereum/

[3] https://www.theblockcrypto.com/2019/03/08/fidelitys-bitcoin-custody-business-is-live-a-conversation-with-fidelity-digital-assets-head-tom-jessop/

[4] https://www.coininsider.com/university-interest/ and https://www.bloomberg.com/news/articles/2018-10-05/yale-is-said-to-invest-in-crypto-fund-that-raised-400-million and https://www.financemagnates.com/cryptocurrency/news/94-percent-endowment-funds-include-crypto-investments-survey-shows/?utm_source=BlockchainBites&utm_medium=Email&utm_campaign=2019-04-16

[5] https://www.bloomberg.com/news/articles/2017-09-12/jpmorgan-s-ceo-says-he-d-fire-traders-who-bet-on-fraud-bitcoin

[6] https://cryptovest.com/news/jpmorgan-launches-blockchain-network-after-jamie-dimon-blasts-bitcoin/

[7] https://www.theblockcrypto.com/tiny/j-p-morgan-continues-development-of-its-interbank-blockchain-network-with-220-banks-signed-up/

[8] https://www.theblockcrypto.com/tiny/j-p-morgan-continues-development-of-its-interbank-blockchain-network-with-220-banks-signed-up/

[9] https://www.coindesk.com/jpmorgan-moving-its-in-house-crypto-to-real-world-trials-report

[10] https://www.forbes.com/sites/michaeldelcastillo/2019/04/16/blockchain-goes-to-work/#2b8ee6362a40

[11] https://www.forbes.com/sites/michaeldelcastillo/2019/04/16/blockchain-goes-to-work/#2b8ee6362a40 and https://cointelegraph.com/news/nike-files-trademark-application-in-the-us-for-cryptokicks?utm_source=newsletter1&utm_medium=email

[12] https://www.cnbc.com/2019/06/05/facebook-cryptocurrency-coming-in-june-report.html

[13] https://www.cnbc.com/2019/06/05/facebook-cryptocurrency-coming-in-june-report.html and https://www.nytimes.com/2019/02/28/technology/cryptocurrency-facebook-telegram.html and https://www.bbc.com/news/business-48383460

[14] https://cryptotraderspro.com/union-square-ventures-a-billion-dollar-vc-firm-is-investing-in-cryptocurrency-long-term/

[15] https://www.theblockcrypto.com/2019/04/15/union-square-ventures-tangled-web-of-crypto-investments/

[16] https://avc.com/2013/11/a-note-about-bitcoin/

[17] https://a16z.com/author/ben-horowitz/

[18] https://s3.amazonaws.com/cbi-research-portal-uploads/2018/04/17124539/180417-AH-OSV-Blockchain-Investments-Timeline-V2d.png

[19] https://a16zcrypto.com/

[20] https://www.cnbc.com/2019/04/02/andreessen-horowitz-says-it-will-no-longer-be-a-venture-capital-firm.html

[21] https://www.cnbc.com/2019/04/02/andreessen-horowitz-says-it-will-no-longer-be-a-venture-capital-firm.html, https://www.forbes.com/sites/alexkonrad/2019/04/02/andreessen-horowitz-is-blowing-up-the-venture-capital-model-again/#1e04d73e7d9f and https://techcrunch.com/2019/04/02/andreessen-horowitz-isnt-alone-in-leaving-behind-vc-as-we-know-it-and-more-company-is-coming/

[22] https://www.cnbc.com/2018/03/21/jack-dorsey-expects-bitcoin-to-become-the-worlds-single-currency-in-about-10-years.html and https://cryptovest.com/news/why-jack-dorsey-is-buying-10k-in-bitcoin-btc-every-week/

[23] https://venturebeat.com/2019/03/12/forte-and-ripple-form-100-million-fund-for-mainstream-blockchain-games/

[24] https://www.statista.com/statistics/263264/top-companies-in-the-world-by-market-value/

[25] https://www.altcoinflow.com/2019/04/17/tencent-releases-new-lets-hunt-monsters-blockchain-game-inspired-by-pokemon-go-cryptokitties/

[26] https://www.appannie.com/en/apps/ios/top/china/games/iphone/

[27] https://news.bitcoin.com/why-the-future-of-esports-is-tied-to-cryptocurrency/?omhide=true&utm_source=ActiveCampaign&utm_medium=email&utm_content=Token+Analyst+Monitors+Exchange+Inflows+to+Help+Predict+Market+Movements&utm_campaign=email-April+16%2C+2019+Daily+Newsletter and https://venturebeat.com/2019/03/12/forte-and-ripple-form-100-million-fund-for-mainstream-blockchain-games/

[28] https://bitsonline.com/coinbase-25-million-users/ and https://www.theblockcrypto.com/2019/05/14/coinbase-expands-usdc-trading-to-85-countries-in-a-bet-to-onboard-more-customers/

[29] https://www.coininsider.com/cryptocurrency-adoption-in-2018-2019/ and https://coinatmradar.com/charts/growth/

[30] https://www.bitcoinmarketjournal.com/how-many-people-use-bitcoin/

[31] https://cointelegraph.com/news/brazilian-tax-regulator-publishes-draft-on-cryptocurrency-taxation, https://www.investopedia.com/terms/s/sao-paolo-stock-exchange-sao-.sa.asp and https://www.stockmarketclock.com/exchanges/bovespa

[32] https://trends.google.com/trends/explore?q=%2Fm%2F05p0rrx

[33] https://hedgetrade.com/cryptocurrency-regulation-global-update-2019/#Malta

[34] https://cointelegraph.com/news/crypto-payment-firm-volume-of-transactions-in-africa-has-risen-130-percent-in-2018

[35] https://www.asiablockchainreview.com/philippines-leads-crypto-adoption/

[36] https://news.bitcoin.com/survey-shows-south-koreans-increased-crypto-holdings-by-64-last-year/?omhide=true&utm_source=ActiveCampaign&utm_medium=email&utm_content=Big+Players+Transforming+Crypto+Exchanges+in+Japan&utm_campaign=email-April+24%2C+2019+Daily+Newsletter

[37] https://www.computerworld.com/article/3269875/sec-decision-on-ethereum-cryptocurrency-could-affect-others-funded-by-icos.html and https://www.newsbtc.com/2018/06/14/ethereum-rebounds-up-nearly-10-as-sec-confirms-its-not-a-security/

[38] https://finance.yahoo.com/news/sec-chairman-confirms-ethereum-isn-144009375.html

[39] https://finance.yahoo.com/news/sec-chairman-confirms-ethereum-isn-144009375.html

[40] https://www.newsbtc.com/2019/04/03/crypto-regulation-sec-staff-publish-guidelines-on-digital-assets/ and https://news.bitcoin.com/how-ambiguous-regulations-complicate-crypto-taxation/?omhide=true&utm_source=ActiveCampaign&utm_medium=email&utm_content=Japan+to+Provide+G20+With+Solution+for+Crypto+Regulation&utm_campaign=email-April+23%2C+2019+Daily+Newsletter

[41] https://www.coindesk.com/fincen-says-some-dapps-are-subject-to-u-s-money-transmitter-rules and https://news.bitcoin.com/irs-plans-to-issue-guidance-on-virtual-currency-taxation/?omhide=true&utm_source=ActiveCampaign&utm_medium=email&utm_content=How+to+Buy+Pizza+With+Bitcoin+Cash&utm_campaign=email-May+22%2C+2019+Daily+Newsletter

[42] https://news.bitcoin.com/how-ambiguous-regulations-complicate-crypto-taxation/?omhide=true&utm_source=ActiveCampaign&utm_medium=email&utm_content=Japan+to+Provide+G20+With+Solution+for+Crypto+Regulation&utm_campaign=email-April+23%2C+2019+Daily+Newsletter

[43] https://hedgetrade.com/cryptocurrency-regulation-global-update-2019/#Malta

[44] https://www.forbes.com/sites/caitlinlong/2019/03/04/what-do-wyomings-new-blockchain-laws-mean/#53bb04415fde

[45] https://cointelegraph.com/lightning-network-101/what-is-lightning-network-and-how-it-works#how-does-it-work

[46] https://www.coindesk.com/you-can-now-shop-with-bitcoin-on-amazon-using-lightning?utm_source=BlockchainBites&utm_medium=Email&utm_campaign=2019-04-22