When looking for a potential 10-bagger stock for 2020, one first has to be willing to stomach some risk and volatility.

You also have to find a company that is a bit controversial. And a company that has plenty of ardent bulls and skeptical bears covering its stock.

And you need the company to be operating in a big, blue ocean market providing a long runway for high-level growth.

I believe that electric vehicles fit that bill nicely.

The first question you have to ask about electric vehicles (EVs) is simple.

Is it for real or just hype? If you have read any of my past FNN articles, I have been an EV skeptic for a long time. But a deep dive throughout the last year has convinced me that the industry is on a growth path that is very likely to accelerate.

Why? The most important reason is staring us right in the face — China!

Electric vehicles are a winning proposition for China because they help solve two big problems. China’s air pollution problem in its severely congested cities is one.

The other is it provides China with a platform to generate tens of millions of jobs and helps the country capture the commanding heights of the global economy – the key goal of its longer-term China 2025 strategic plan.

EVs represent a huge opportunity to take advantage of economies of scale for 1.3 billion consumers, and will create a blend of employment and technology that will drive economic growth for decades to come.

Tesla (NASDAQ: TSLA / FSE: TL0), of course, is already selling EVs in China and is building a substantial factory there. Daimler (DAI:GR – XETRA / OTC US: DDAIF) will begin making electric cars in China in 2019.

There is a reason beyond China’s market potential for automakers like Daimler to come to China – it is the source for many of the materials that go into EV batteries and motors such as rare earths and rare metals.

Let’s look at the rapidly advancing landscape of electric vehicles and the breakthroughs making EVs more efficient, inexpensive and practical.

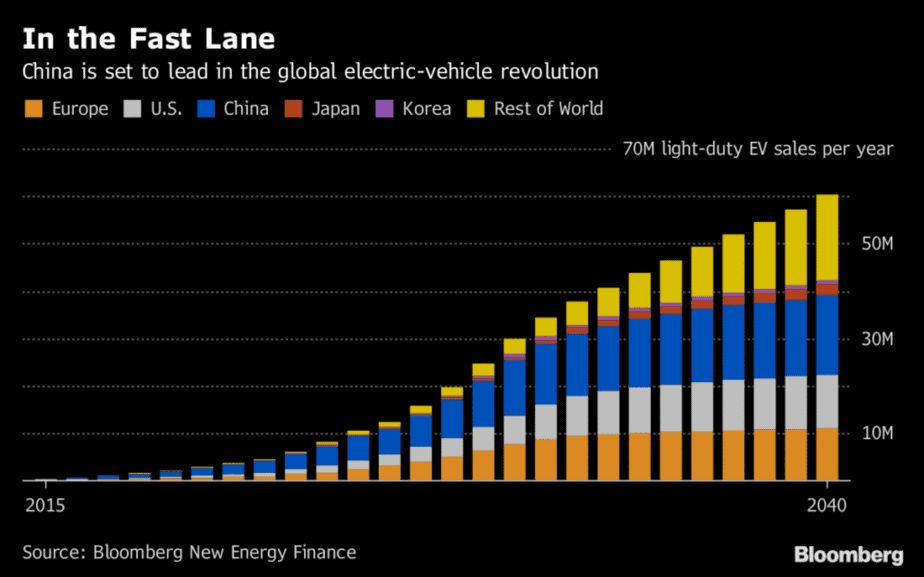

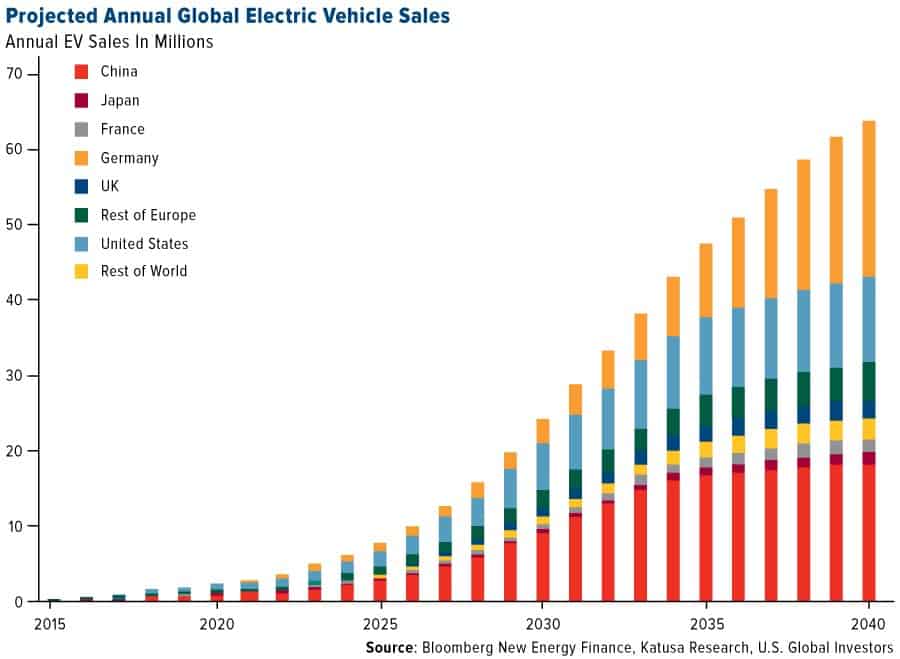

While almost every expert predicts China will be the dominant market for electric vehicles, the momentum is building across the world.

And new technologies and partnerships are driving innovation at an astonishing speed.

The Rivian electric drive platform delivers remarkable power and torque through four independent motors – with 200 horsepower available at each wheel.

And Waymo, the self-driving car business of Google-parent Alphabet (NASDAQ: GOOG), has finally taken the driver out of its self-driving cars launching a service in Phoenix, Arizona.

What all this evidence points to is that we are approaching a takeoff point for sharp growth in the EV markets.

The stakes are high to be sure – the current global auto business generates $2.5 trillion of sales each year.

The world’s automakers are in the beginning stages of a massive transition to electric vehicles and, while the build up often takes more time than expected, the takeoff can oftentimes be absolutely explosive!

America once dominated the world’s auto industry until a complacent Detroit underestimated the determined and now historical threat from you named it… Japan!

Today, China is by far the world’s largest car market, with 28.8 million in unit sales in 2017.

That compares to the U.S. with a smaller 17 million unit sales. These numbers place perspective on overall market size and upcoming gain.

China is determined to be the leader in electric vehicles just as improvements in technology and strict environmental regulations from governments are laying the groundwork for an explosive growth of electric cars.

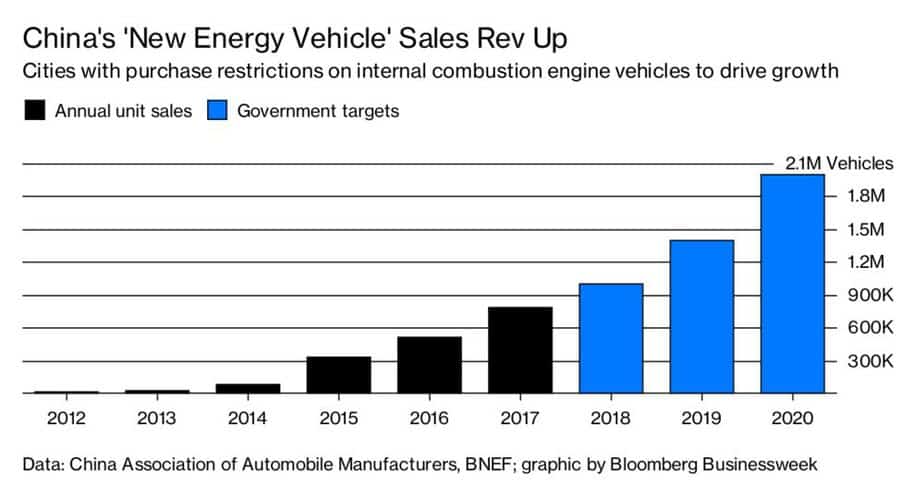

Already electric vehicles (EVs) make up 5% of China’s auto market and are growing at an annual rate of a staggering 120% a year so far.

In January 2019 – EV sales doubled that of the previous year.

In the electric car industry – let this be known, China is playing for keeps.

Bloomberg has recently confirmed that $90 billion is being invested in electric vehicle development by global automakers.

This graph shows the explosive growth of China’s EV market, which is expected to reach 5.8 million sales per year by 2025.

Check this out – China’s share of global electric vehicle production has gone from 1.2% in 2013 to 22.6% in 2017.

And China has a huge advantage over America that Japan never had – tremendous scale due to its population of 1.3 billion people.

Bloomberg has recently confirmed that $90 billion is being invested in electric vehicle development by global automakers and a recent McKinsey report projects that by 2020, two hundred new hybrid electric vehicle models will be launched.

Major auto groups – led by Toyota (NYSE: TM), GM (NYSE: GM) and BMW (BMW.GR – XETRA / OTC US: BAMXF) are now racing to develop a solid state battery that will reduce recharge time from hours to minutes while tripling the EV’s range.

This means that by 2022, the all-in cost of an EV is expected to be lower than a traditional combustion engine vehicle – without subsidies.

All across the globe from America to Japan to China to Germany, the race is on.

General Motors, Volkswagen, Volvo, Ford, Toyota, and BMW all know that the key to the electric vehicle (EV) story really taking off is a battery with much shorter recharging times and much longer range from one charge.

Meet a New Tycoon – William Li

Mr. Li is the Founder, Chairman and CEO of NIO (NYSE: NIO).

In November 2014, Mr. Li founded NIO with the goal of redefining the car ownership experience.

Mr. Li is a serial entrepreneur. In 2000, he established Bitauto Holdings Ltd. (NYSE: BITA), where he still serves as the Chairman of the board of directors today. (Bitauto is one of the largest providers of online content and marketing services for China's automotive industry).

He has co-founded and invested in over 40 companies in the Internet and automotive industries. And while studying at Peking University, he founded Beijing Antarctic Technology Development Co., Ltd, one of the earliest Internet companies in China.

Mr. Li was recognized by Sina Finance and People’s Daily in January 2018 as one of the “2017 Top 10 Economic Players of China.”

In 2017, Mr. Li was named GQ China magazine’s “Entrepreneur of the Year.” The China Automobile Dealers Association recognized Mr. Li in 2008 as one of the top 10 most influential and distinguished people within China’s automobile deal industry in the last three decades.

Mr. Li was born in Anhui, China and received his bachelor’s degree in from Peking University.

NIO is a pioneer in China’s premium electric vehicle market. The company designs, jointly manufactures, and sells smart and connected premium electric vehicles, driving innovations in next generation technologies in connectivity, autonomous driving and artificial intelligence.

Founded in November 2014, NIO went public on the NYSE in 2018.

NIO began deliveries of the ES8, a 7-seater high-performance premium electric SUV in China in June 2018 and officially launched the ES6, a 5-seater high-performance premium electric SUV, in December 2018.

After launch, several companies invested in NIO, including Tencent (HKSE: 007 / OTC US: TCEHY), Temasek (private), Baidu (NASDAQ: BIDU), Sequia (ES: S2658), Lenovo (HKSE: 0922 / OTC US: LNVGY) and TPG Capital.

Its track car debuted the same day the brand was established.

In 2016, NIO was issued an "Autonomous Vehicle Testing Permit" by the California DMV and is beginning testing on public roads under the "Autonomous Vehicle Tester Program" guidelines as it progresses on its path to bring autonomy to market.

In May 2018, NIO opened its first battery swap station in China dubbed the "Power Swap Station." Only ES8 cars would be available for this station.

NIO was named #5 in Fast Company magazine’s prestigious annual list of the Most Innovative Companies in China for 2019.

Nio is a $1.9 billion Shanghai-based electric vehicle company.

The company was founded just four years ago and pulled off a U.S. initial public offering in September 2018, three months after starting deliveries of its first electric model, the ES8 sport utility vehicle.

Currently, the ES8 is this Chinese automaker’s only mass-production automobile that Nio began delivering in June 2018.

Last December, NIO launched its second electric SUV, the ES6.

The ES6 comes with a lower price tag than the ES8, and it’s a five-seat SUV compared to the seven-seat ES8.

The company claims that the ES6 base model can deliver up to 255 miles and the high-end model can deliver 317 miles of range in a single charge.

In January, Nio also announced that its battery swap network along the G2 Expressway in China is now online so Nio vehicle owners can make the trip from Beijing to Shanghai without needing to charge their cars.

And recently, as investors take notice, the stock has come to life, suggesting it’s ready for an uptrend. But it now has a seven-passenger SUV in its lineup and a five-passenger version soon to be released.

What makes Nio interesting is its huge potential likelihood of favorable attention from the Chinese government, and its many influential investors – which means a lot in China.

The lead shareholder is William Li, the founder of Bitauto Holdings (NYSE: BITA), an Internet marketing, content and transaction company for the Chinese auto market.

Tencent (HKSE: 007 / OTC US: TCEHY) holds the second-largest stake, and the third-largest investor is the well-respected investment management firm Baille Gifford. Interestingly, by the way, both have a stake in Tesla.

Let it be known that 2019 has been a volatile and turbulent year for NIO.

But in the more macro view including the past couple of months, NIO has gained its footing and begun what I believe is an uptrend in the stock.

Specifically, NIO delivered the best monthly sales numbers in October, increasing 25.1% from the strong delivery in September. In October, NIO delivered 2,526 vehicles, including 2,220 ES6s and 306 ES8s. This marks October as the best month in 2019.

And NIO entered into a strategic partnership with Intel-owned autonomous driving company Mobileye (NASDAQ: INTC). NIO will engineer and manufacture a self-driving system designed by Mobileye. NIO will mass-produce the system for Mobileye and also integrate the technology into its electric vehicle line.

Importantly, in addition to adding considerable credibility to Nio, it increases its access to capital.

This is a massive and aggressive idea to be sure, but I really like the rapid growth, and the huge potential here. Let’s not forget the potentially strong, if not apparent, support of the Chinese government, influential shareholders, recent partnership with Mobileye and the stock’s recent, while new uptrend.

Investors should start small and I strongly suggest you put in place a 20% trailing stop loss in order to manage your risk versus reward investing profile. While this is NYSE traded, there remains great risk, but what could be really great rewards.

Carl Delfeld, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

NIO website, Rivian website, Bayleaf Capital, Bloomberg, U.S. Global Investors