As we close the books on 2019, it’s time to take a look back on a record bull market year and consider our investment strategy for 2020.

Investors cashed in big time in 2019. It was a banner year for the stock market!

The U.S. economy’s moderate expansion has held steady: lower interest rates from the Feds, solid consumer spending, a robust labor market, recovery of the housing market and the belief that Trump’s trade war with China is coming to an end all pushed major stock indices to record highs.

While newly introduced market risk has evolved regarding the recent Iran conflict, look at the chart below and the level percentage change for each index. 2019 was nothing short of a stellar year for investors.

But now investors are asking, “Will the bull market continue to soar into 2020?”

The signals are mixed mostly due to conflict in the Middle East and most obvious… trade, but going into 2020, the market appears optimistic as China and the U.S. come closer to a trade agreement, the newly negotiated North America Free Trade Agreement (USMCA) between the U.S., Canada and Mexico has been signed, and the Federal Reserve is on a holding pattern.

But even with all the optimism, there are headwinds looming over the 2020 economy: a presidential election year; potential war with Iran, Brexit is still up in the air; the final U.S.-China trade agreement details are still being hammered out; a rapidly climbing federal debt load; the current administration’s erratic trade policy and ever-increasing hostility to immigration; not to mention signs of a slowdown in global growth that could constrain overall U.S. growth in 2020.

Certainly, all valid points to consider when making your 2020 investment strategy.

From my perspective, I see 2020 being another good year for savvy investors. Maybe not as great as 2019, but still a good year.

Looking for a sector-specific bull market that could be less vulnerable to a potential broader market slowdown is the right strategy.

"Wall Street is likely to get ‘a continuation’ of the not-too-strong, not-too-weak macroeconomic backdrop that has paved the way for stocks to climb for much of 2019." — Dave Donabedian, chief investment officer for CIBC Private Wealth Management[2]

My research has identified 5 ETFs, or exchange-traded funds, in sectors that should be a good way to sidestep volatility in the next year. These are also sectors to use as a starting point in your investment research for individual stocks that could outperform.

An ETF involves a collection of securities—such as stocks—that often tracks an underlying index. ETFs are in many ways similar to mutual funds, however, they are listed on exchanges, and ETF shares trade throughout the day just like ordinary stock.

For the advanced investor, dissecting and researching particular ETFs for top investment pick selection can take half the work out of the equation for finding the best-positioned stocks.

While the risks still remain with this approach, there is also potential for higher gains, because half of the research work has already been accomplished. The latter research work will be dependent on the individual investor to pick their favorites in the space. I would say… this is a good start to any investment strategy.

Without software, nothing much happens in the modern world. Software is everywhere and is present in everything from smartphone to cars. As such, it is not surprising that software is a huge industry on the order of hundreds of billions of dollars.

2019 saw the software subsector become a safe haven from the trade war tariffs. The S&P North American Technology Software Index was up an impressive 37.62% for the year.[3]

Looking ahead to 2020, revenue expectations are expected to continue to be robust across a wide array of software platforms, including cloud, cybersecurity, customer relationship management (CRM), internet applications and video games.

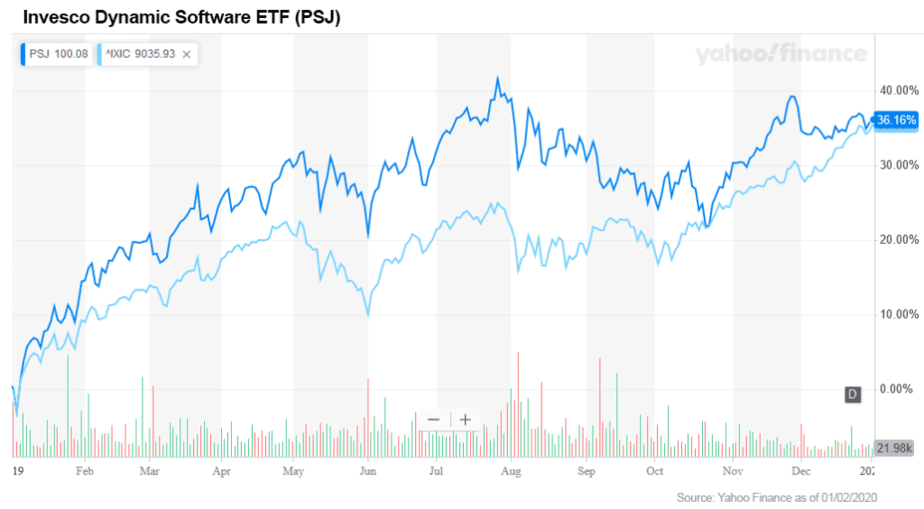

Invesco Dynamic Software ETF (NYSE: PSJ)

PSJ is home to 30 stocks and features exposure to a variety of software companies, including application data software makers, enterprise software firms and increasingly popular video game publishers.

The 30 companies in the ETF holdings are principally engaged in the research, design, production or distribution of products or processes that relate to software applications and systems and information-based services by tracking the Intellidex Index.

PSJ holds its heaviest allocation in the Information Technology sector—about 90% of the portfolio. Looking at individual holdings, VMware Inc (NYSE: VMW) accounts for about 6.12% of total assets, followed by Microsoft Corp (NASDAQ: MSFT) and Oracle Corp (NYSE: ORCL).

The product has a Zacks ETF Rank of 1 (Strong Buy) with a high risk outlook.[4]

The chart below shows the ETF performance over 2019 as compared to the Nasdaq index. The fund closed the year out with over 36% in gains.

Semiconductors underlie virtually everything in technology. It is arguably the axis around which technology spins its wheels.

Semiconductors now make up some of the most essential products and technologies we use every day, such as advanced mobile networks (5G), smartphones and the new generation of artificial intelligence (AI).

The semiconductor subsector-related ETFs have been outperforming, with chipmakers among the top performers of the past decade, as adoption of digital devices proliferates. The sector soared 377% in the past 10 years, more than doubling the S&P 500′s 182% climb.[5]

The semiconductor subsector rocketed up over 65% in 2019 according to the S&P Semiconductors Select Industry Index.[6]

2020 looks to be another good year for the semiconductor industry.

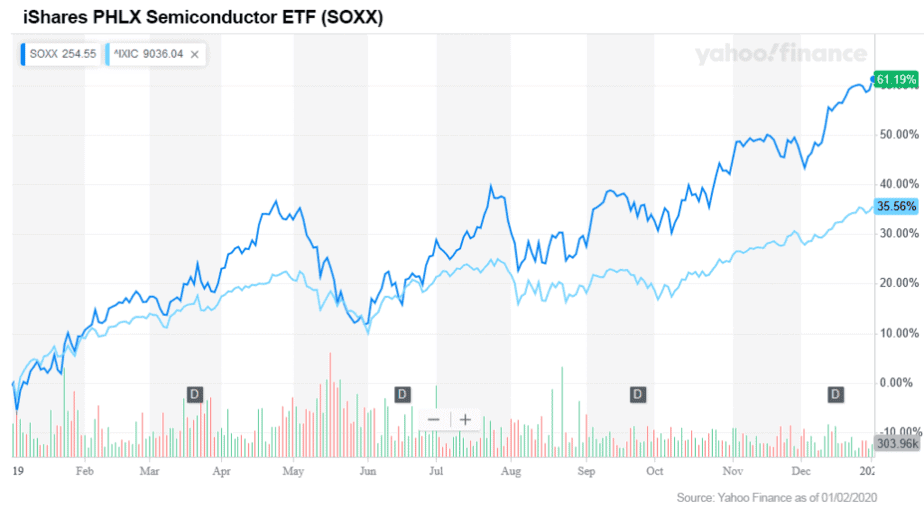

iShares PHLX Semiconductor ETF (NASDAQ: SOXX)

iShares PHLX Semiconductor ETF (SOXX) consists of a tight group of 30 companies that design, distribute, make and/or sell semiconductors or semiconductor equipment.

Nvidia (NASDAQ: NVDA), Qualcomm (NASDAQ: QCOM) and Texas Instruments (NASDAQ: TXN) are among the top 10 holdings, with each carrying a roughly 8% weight. Other blue chips in the fund include the likes of Intel (NASDAQ: INTC), Broadcom (NASDAQ: AVGO) and Taiwan Semiconductor (NYSE: TSM).

SOXX saw a stellar year in returns for investors for 2019—up over 61%!

The health sector is another promising area that you should pay attention to in 2020. Thanks to the spectacular capabilities of technology, the health sector is growing at a rapid pace with multiple advanced medical technologies for you to invest in. Think enhanced surgical tools, improved x-ray imagery, and even robots that could support patient care / recovery in their very own homes.

The health sector has been an outperformer since 2009. However, within the health sector there are multiple subsectors. One of the most consistent successful subsectors in health is medical devices.

Looking at the 63 stocks in the S&P 500 healthcare sector, seven of the top 10 performers over the past five years make medical devices.[7]

The trend is clear: Medical device makers and distributors are already an outperforming sector, which leads to my next ETF selection.

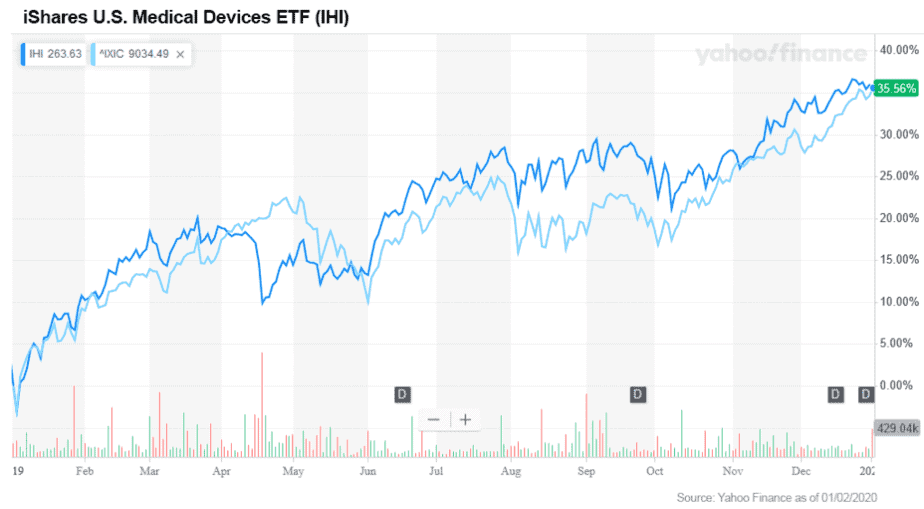

iShares U.S. Medical Devices ETF (NYSE: IHI)

Over the past three years the iShares U.S. Medical Devices ETF has greatly outperformed the S&P 500 healthcare sector, while doubling the return of the entire S&P 500 (with dividends reinvested).

The iShares U.S. Medical Devices ETF has $4.6 billion in assets. It is designed to track the performance of the Dow Jones U.S. Select Medical Equipment Index. The exchange traded fund is rated five stars (the highest) by Morningstar.[8]

2019 saw gains of over 35% for IHI. 2020 looks promising for continued growth as “boomers” age and, more importantly, require more medical care.

The Feds have kept interest rates at near zero and that encourages people to spend more borrowed money. Home, auto, student loans and credit card debt have all risen in the past few years. That means financial services companies are profiting as consumer debt continues to rise.

The financial services market is expected to reach a value of roughly $27 trillion by 2022.[9]

The Dow Jones Consumer Finance index chart below shows a solid upward slope for the past five years.[10]

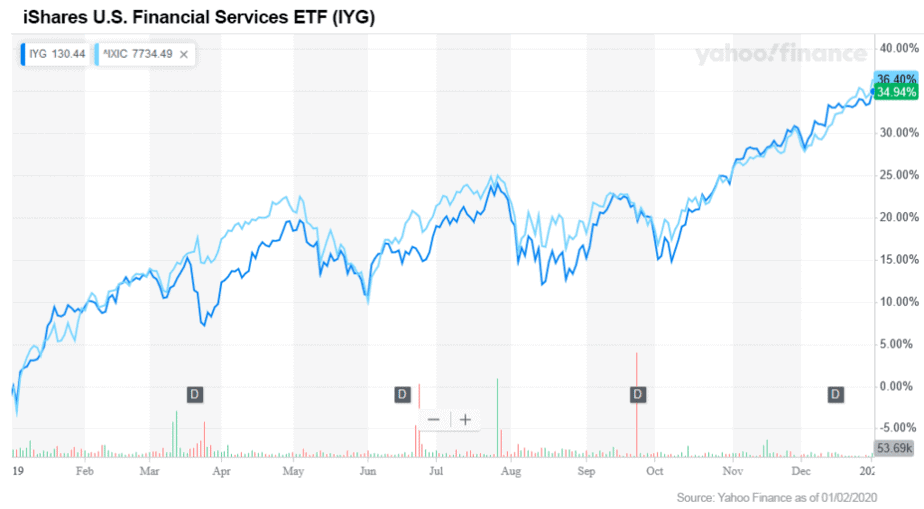

iShares U.S. Financial Services ETF (NYSE: IYG)

IYG saw gains of over 35% in 2019. The financial sector looks to continue its pattern of growth into 2020 and beyond.

The majority of the fund holdings include the major credit card companies, rounded out by banks, savings and loans associations, specialty financial firms, and other financial services firms.

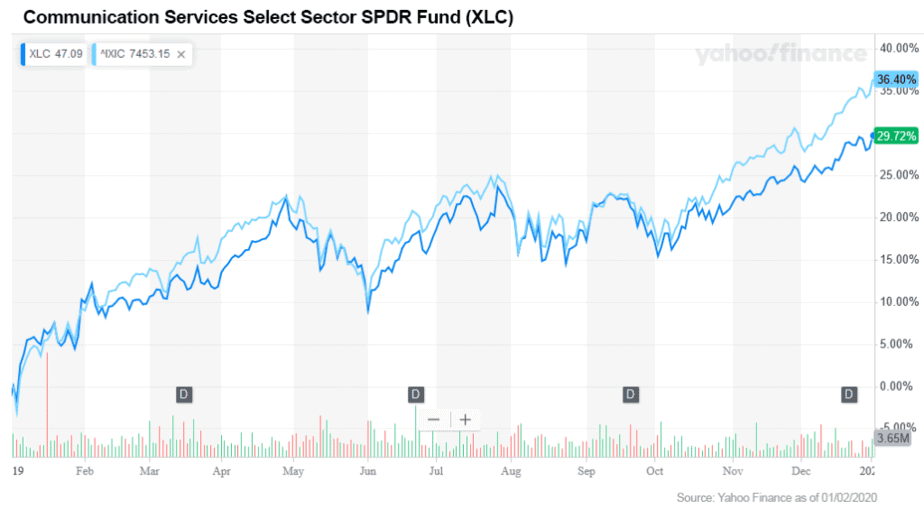

This sector promises to be one of the hottest in 2020. 2019 saw gains of over 28% and I believe it is just getting started.

Communication Services Select Sector SPDR Fund (NYSE: XLC)

The Communication Services Select Sector SPDR Fund (NYSE: XLC) seeks to provide precise exposure to companies from media, retailing, and software and services industries in the U.S.[11]

The fund is heavy into the biggest communication services companies, Facebook (NASDAQ: FB) and Alphabet (NASDAQ: GOOG).

But they also have exposure to the growing streaming trend with holdings in the main streaming contenders like Netflix (NASDAQ: NFLX) and Disney (NYSE: DIS) and Comcast Corporation (NASDAQ: CMCSA).

They also are investing in the growing video gaming sector, including the up-and-coming esports segments.

All said, this is well-diversified fund in the exploding communication services sector.

While the 2020 markets do have some question marks looming over the coming year, the U.S. economy as a whole appears to be on pretty solid ground and shows promise of another good, if not decent year for investors.

The sectors and subsectors I discussed above have the potential to give the best returns while sheltering investors from downside the markets might see in 2020.

These ETFs should be a starting point for your personal research and serve to begin creating your investment strategy for 2020.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://fortune.com/longform/best-stocks-to-buy-2020-tech-finance-health-care-consumer-emerging-markets/

[2] https://www.cnbc.com/2019/12/06/cibc-private-wealth-in-a-volatile-2020-these-sectors-can-climb.html

[3] https://us.spindices.com/indices/equity/sp-north-american-technology-software-index

[4] https://www.zacks.com/funds/etf/PSJ/profile

[5] https://www.cnbc.com/2019/12/20/industry-of-the-decade-chipmakers.html

[6] https://us.spindices.com/indices/equity/sp-semiconductors-select-industry-index

[7] https://www.marketwatch.com/story/had-enough-of-ok-boomer-not-if-you-want-to-make-money-with-these-stocks-2019-12-04?siteid=yhoof2&yptr=yahoo

[8] https://finance.yahoo.com/quote/IHI/holdings?p=IHI

[9] https://www.fool.com/investing/2019/10/29/the-3-best-sectors-for-long-term-earnings.aspx

[10] https://www.investing.com/indices/dj-consumer-finance

[11] https://www.ssga.com/us/en/individual/etfs/funds/the-communication-services-select-sector-spdr-fund-xlc