It’s not often that you find a 95-bagger, a stock that gives you gains of 95,000%. But that’s what you’d be pocketing if you had been an early investor in Netflix (NFLX).[1]

A simple $1,000 investment would have returned $950,000, just $50,000 this side of a cool million.

Those gains include more than doubling from August 2017 to August 2018, an unheard-of feat for a $200 stock. But then, the company has been unconventional since the beginning.

Netflix was conceived when its founders, flush with millions of dollars from the sale of a Silicon Valley tech company, decided their next venture would be “the Amazon.com of something.” With DVDs just being introduced at the time, they decided to be the Amazon.com of mail order DVD rentals, the first of its kind.[2]

At the time, Blockbuster was the undisputed king of the movie rental business with close to 6,500 brick-and-mortar stores worldwide and $4.7 billion in revenue.[3] But it wouldn’t take long for Netflix to displace Blockbuster, and in 2010 Blockbuster declared bankruptcy, signaling the end of the brick-and-mortar video rental era.

By that time Netflix had already transitioned from DVD rentals to streaming video, leading yet another revolution. Expanding broadband enabled fast growth, and by 2012 the company boasted more than 29 million streaming customers.[4] By the end of 2018, they would have more than 148 million subscribers.[5]

Now Netflix is the largest digital media and entertainment company in the world. Its market cap, $158 billion, briefly soared higher than traditional entertainment giants Comcast and Disney last year. 2018 4th quarter earnings came in at $4.19 billion with strong growth in both domestic and international subscriber additions. Revenue totals mark a 28 percent year-over-year jump.

Investors and the market appear to like the company’s strategy of producing original content instead of licensing content from other studios, which they also do. This requires larger upfront cash costs – to the tune of $8 billion this year alone – but gives them a portfolio with lasting value.

Especially since they are focusing on quality content, reaping 112 nominations for the 2018 Emmy Awards, more than perennial leader HBO.

It’s that kind of intellectual property that often makes the difference between a revolutionary company and a wannabe, or a lasting company and a has-been. Intellectual property (IP) creates a high barrier of entry for would-be competitors, and is a key ingredient for startups to get a competitive advantage in the market. What’s more, investors typically reward companies with solid IP.

Netflix blew the roof open and added 8.8 million global paid memberships during the fourth quarter, beating Wall Street’s and its own estimate of 7.6 million.[8]

The outsized gains enjoyed by NFLX has investors looking for the next multi-bagger. Many are turning to small/microcaps as the most likely to return the market’s biggest gains.

A $5 stock only has to gain $5 to double your money, while a $100 stock has to gain $100.

Some investors have the impression that all microcaps are questionable pink sheet penny stocks, but that’s far from the truth.

Microcaps are simply companies that have market capitalizations of between $50 and $500 million. (A company’s market cap is its share price times the total shares outstanding.) You might not even be aware that microcaps account for almost half of the approximately 16,000 companies that trade on US exchanges.[9]

Their low capitalization makes it harder for funds and institutions to invest in them, which means they have very little analyst coverage. That puts the burden on individual investors to do their own research and due diligence.

Microcaps typically suffer from high volatility. But let’s face it, high volatility is what gives investors the potential for big gains in a relatively short time frame. You can find plenty of recent examples of big life-changing gains:

There are several criteria you can use to score a potential microcap investment. Overall, what you want to see is year-over-year improvements:

Of course, many microcaps are speculative in nature, which means you must judge them based on whether they have a product or service that fills a market need, intellectual property protection, and a reasonable pathway to profitability within a year or two.

But more than anything, investors seek companies that might have “the Next Big Thing,” a truly disruptive idea that can revolutionize markets.

Within the 8,000 or so microcaps that trade on US exchanges, there are several sectors that are performing spectacularly.

Many of today’s biggest microcap stock profits can be found in the emerging cannabis market. Few companies have reached profitability yet, but the market is young and the growth potential is tremendous. For these reasons, investors are reaping profits like:

I don’t recommend investing in those stocks, as their biggest gains are behind them. The entire sector suffered a correction between September and December of 2018. That gives you a perfect buying opportunity as stocks are now beginning to roar back higher.

The first wave of monster stock returns went to cannabis growers like the ones above. But the next big growth market is projected to be in cannabis beverages, edibles, and topicals.

The market demand is already strong, and a recent scientific breakthrough means that edibles makers can now deliver a product that offers the full potency of cannabis in a measurable, predictable, quick-onset form. That was never possible until now, and it could mean big growth for the industry.

Most interesting, the rights to this technology in Canada, Israel, Jamaica, Australia and the entire European Union are held by Sproutly Inc. (OTCQB: SRUTF, CSE: SPR, FRA: 38G). You can learn more about Sproutly written on this website here.

Another place to find big profits is in microcap cybersecurity stocks.

Cybercrime is on the rise, and companies are increasing their cybersecurity spending in order to meet the threat. A recent IT spending survey reveals that cybersecurity is the top spending priority among chief investment officers.[18]

Investors are starting to notice, and cybersecurity stocks are responding with increasing gains. But the industry is still well below its 2015 highs, which means there’s still time for savvy investors to jump in.

Goldman Sachs forecasts that the industry is expected to grow sales at nearly three times the pace as the S&P 500, and to trade at below-average relative valuations.[19]

Since August of 2016:

Qualys Inc (NASDAQ: QLYS) is up 271% since February of 2016

Proofpoint Inc (NASDAQ: PFPT) is up 176% in the same time

Splunk Inc (NASDAQ: SPLK) is up 192% in the same time

Those are some hefty profits. But there are smaller, less-known companies that are just starting to get investor attention. Their biggest gains are just around the corner, which means these are the stocks you should focus on now.

The cybersecurity market is on fire. Cybercrime is growing beyond belief, and hackers have stolen an insurmountable amount of information, including breaches at Yahoo, Experian, JP Morgan Chase, Uber, Equifax, and most recently at Facebook.

There is a new breed of crime fighter on the block…

One of the most promising cybersecurity companies is VirtualArmour International (US: VTLR; CSE: VAI; FRA: 3V3). For two years in a row, in 2017 and 2018, the company was named one of the “world’s hottest and most innovative cybersecurity companies” by Cybersecurity Ventures, the world’s leading cybersecurity forecaster.

VirtualArmour services a wide range of clients, including Fortune 500 companies, and several industry sectors in over 30 countries across five continents.

And they have enjoyed a 100% client retention rate for the past six quarters.[20]

You can learn more about VirtualArmour in my article on cybersecurity stocks here.

It’s no secret that microcap stock prices are volatile, and it’s often hard to find good information about the companies. But if you’re looking for big gains and you can handle a bit of risk, there is plenty of opportunity.

One of the only ways to make big profits in stocks is to find a stock that is not priced efficiently. The bigger the company, though, the more efficiently it is priced, the result of thorough analyst data and many thousands of investors who even out price swings.

For the same reason, it’s easier to beat expectations in microcaps. Most large cap companies are studied relentlessly and forecasted fairly accurately, making it hard to beat expectations. It’s easier for microcap stocks to outperform without anyone noticing.

Finally, you’re more likely to find growth in young companies, which is generally a quality of microcaps. Large companies typically have already enjoyed their rapid-growth years. You saw a moment ago that Netflix logged a recent growth spurt, sprinting from $200 to $400 in 12 fast months.

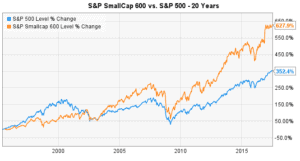

But Netflix is an exception to the rule. If you want fast growth, you’ll find more of it in microcaps (and small caps) than you will in large caps.

Of course, not every potential high-flyer is going to pan out to become the next Netflix. But enough will to make it worthwhile to scour the ranks of microcaps to find your own multi-bagger stock.

Cynthia Berryman, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

DISCLOSURE: This article includes sponsored links.

[1] Split-adjusted $0.45 9/30/02 - $423.21 6/18/18 93,947%

[2] https://www.washingtonpost.com/opinions/five-myths-about-netflix/2014/02/21/787c7c8e-9a3f-11e3-b931-0204122c514b_story.html?utm_term=.96858cf63780

[3] https://www.nasdaq.com/markets/ipos/company/blockbuster-inc-10470-5223

[4] https://en.wikipedia.org/wiki/Netflix

[5] https://www.statista.com/statistics/250934/quarterly-number-of-netflix-streaming-subscribers-worldwide/

[6] https://www.netflixinvestor.com/ir-overview/profile/default.aspx, https://www.cnbc.com/2019/01/16/netflix-earnings-q4-2018.html

[7] https://www.hollywoodreporter.com/news/netflix-amazon-double-originals-catalog-1146802

[8] https://www.netflixinvestor.com/ir-overview/profile/default.aspx, https://www.cnbc.com/2019/01/16/netflix-earnings-q4-2018.html

[9] D Gentry, Small Stocks, Big Money: Interviews with Microcap Superstars, Wiley, 2015

[10] 12/12/16 – 8/10/16

[11] 5/16/16 – 8/6/18

[12] 2/8/16 – 7/30/18

[13] 2/12/16 – 5/4/18

[14] 2/9/16 – 8/2/18

[15] 4/21/17 – 12/22/17 US: MYMMF

[16] 10/30/17 – 1/2/18 US: NXTTF

[17] 9/28/15 – 2/25/19 US: OGRMF

[18] https://www.cnbc.com/2018/07/13/goldman-cybersecurity-stocks-present-tactical-opportunity.html

[19] IBID

[20] https://ir.virtualarmour.com/news-releases/news-release-details/virtualarmour-reports-preliminary-q2-2018-results-revenue-50