Time to take a deep breath and exhale slowly.

We are heading into unknown economic waters…

The US economy has come under inflation stress not seen since 2008/2009, but economic indicators are showing positive signs the economy is in decent shape.

Needless to say, capital markets are currently in shambles, and investors are taking a beating across the board — right from junior stocks through to blue-chip holdings.

As an investor myself, these are times to be adaptive in this highly dynamic stock market landscape. New strategies are needed to not only help protect assets, but to also provide some gains to offset rising inflation.

In this article I will go over current market forces that are unwinding in different directions on a daily basis and illustrate how the elite investor is looking to capitalize and protect assets in these uncertain times.

Read on to learn more…

The US economy is flashing red and green at the same time, and it has economists scratching their heads as to what direction we will be heading in over the next 12 months.

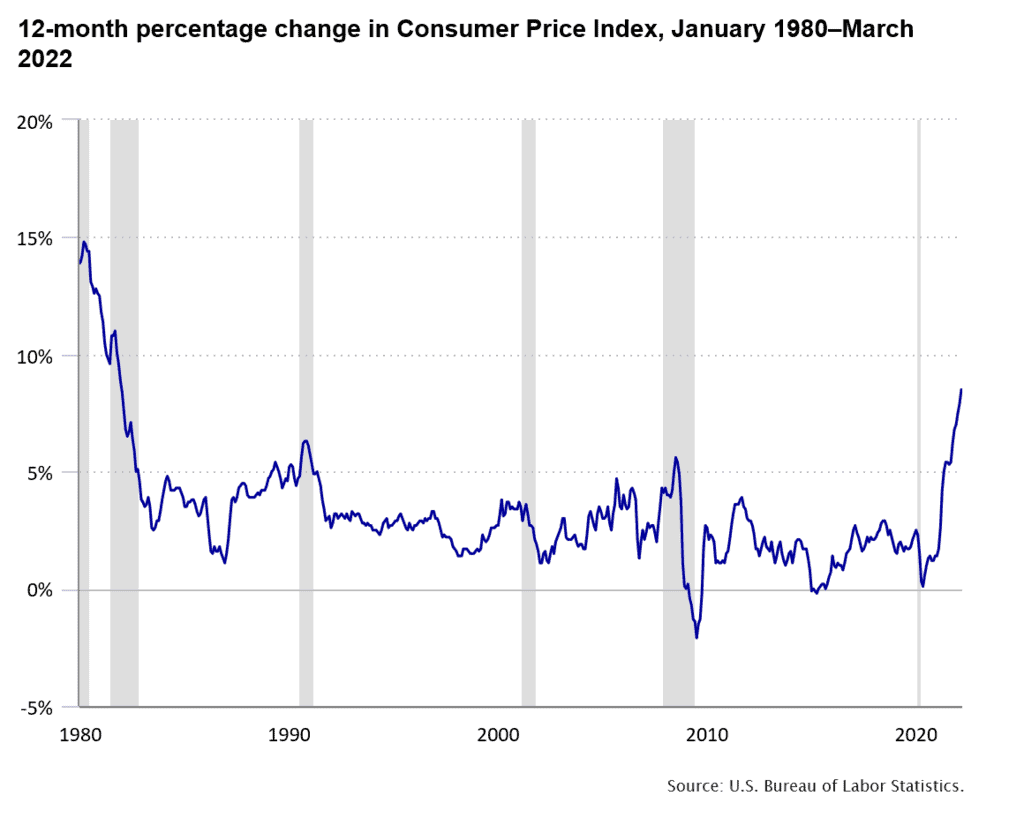

On one hand, you have a red flag as the inflation rate spiked up to 8.5% in March 2022, a near 40-year high.[1]

This can be directly attributed to two things.

First is the quantitative easing that has been going on since March 2020 when the Federal Reserve wisely stepped in to save the economy from the COVID pandemic. Billions of free money was thrown into the monetary system with seemingly little impact on inflation. For the most part, there has been close to zero inflation for most of the past two years.

Inflation started to raise its head back in October 2021, and we have seen a steady increase from that point forward.

The second reason for rising inflation is the severe supply shock the world is experiencing as a direct result of the Ukraine-Russia conflict. That conflict, now in its third month, is negatively affecting the supply of many essential commodities including oil, wheat, cooking oils, palladium and nickel to name a few, sending their prices skyrocketing.

Those skyrocketing prices in turn get passed down the line to consumers in the form of higher food and energy costs.

Energy costs (fuel oil, gasoline, electricity and natural gas) made up 32% of consumer price increases over the past year.

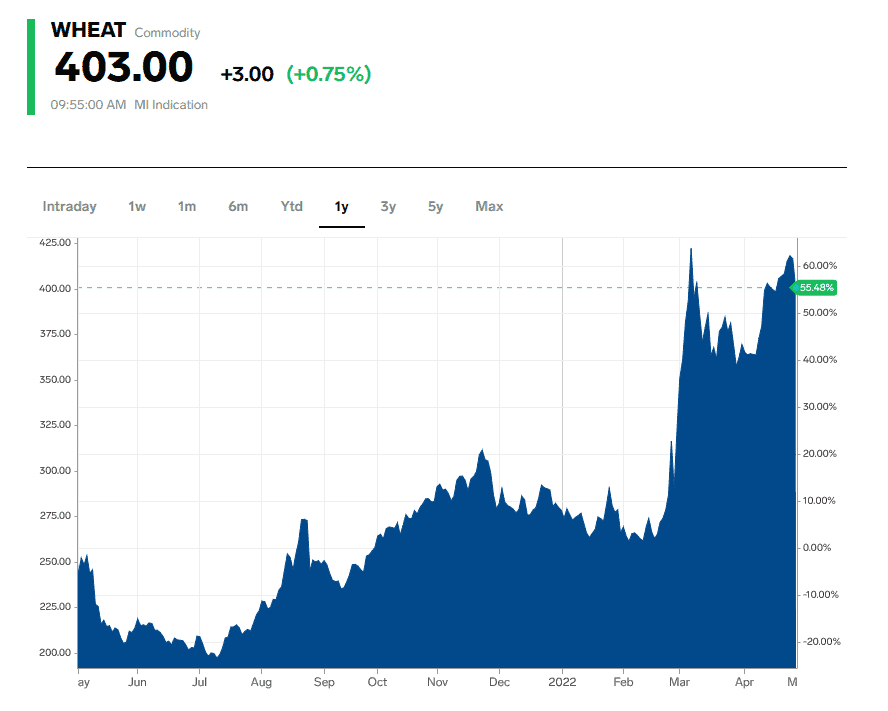

Check out this 6-month chart for the wheat spot price. This will give you an idea of the huge increases in basic food prices, which is already translating to higher prices at grocery stores.

Below you can see the Consumer Price Index (CPI) chart to get an idea of where inflation is at since its last peak in the early 1980s.

On the other hand, the US economy looks healthy and is showing green trending signals.

In the past 12 months, employers added nearly 6.5 million jobs. Weekly jobless claims fell 5,000 to 180,000. Unemployment is now at a ridiculous low rate of 3.6%.[3]

For the first quarter this year, consumer spending was recently reported as rising a healthy 2.7% after inflation. This is the highest it has been in three quarters.

Business investment also surged 7.3%, the biggest increase in over a year.[4]

These stats show the economy is currently in good health despite such high inflationary numbers. I’m not so sure considering the war in Ukraine rages on, supply chain bottlenecks still persist, and consumer demand remains high. All these factors will likely weigh on the Consumer Price Index (CPI), or weighted average of a selection of consumer goods and services, for the coming months ahead.

The rising inflation rate is obviously alarming to many investors, and the Federal Reserve has kicked into high gear, working to mitigate further rising inflation and attempting to cool things down.

Their only tool to fight inflation is increasing interest rates. This is a double-edged sword because while that may bring the inflation rate down, rising rates could also have the negative effect of slowing the economy down too much, resulting in a possible recession.

I am hoping the FED finds that fine line balance in increasing rates to bring down inflation, but at the same time keep the capital markets moving forward. This is easier said than done.

US Federal Reserve Board Chairman Jerome Powell’s recent language was strongly worded and echoes this sentiment:

“Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices and broader price pressures.”

“The invasion of Ukraine by Russia is causing tremendous human and economic hardship.”

“On the other hand,” he said, "Russia’s war in Ukraine is not only adding to inflation by raising the prices of crucial commodities like oil and wheat, it is increasing the uncertainty in the economic outlook.”

Mr. Powell maintained that the US economy remained strong and that this was a good time to prevent the “entrenchment” of runaway inflation.[5]

The Federal Reserve has announced a series of rate hikes over the coming year with whispers of pulling back on the quantitative easing that has been going on since the beginning of the COVID pandemic.

Obviously, markets are jittery. Where will we be in the coming 12 months?

Walking a tight rope would be putting the current situation mildly.

One thing is for sure, the war in Ukraine has to come to a peaceful solution sooner rather than later or we are all going to be feeling the pain in a big way.

As Mr. Powell pointed out, the Ukraine-Russia conflict is only making matters worse.

Aside from supply chain shocks due to rising commodity prices, Europe is in a high-risk position of losing their critical access to Russian oil and gas. As they send arms to Ukraine to confront the Russian invaders, they risk enraging Putin who will look for ways to retaliate.

If the Russians decide to cut off oil and gas supplies to the West, Europe would be devastated economically with reverberations that will be felt globally.

Is Russia, and specifically Putin, going to do that? I do not believe so. The Russian economy is extremely dependent on that oil and gas income, and they know they cannot live without it.

But I was wrong about the Ukraine invasion. I thought it was all a bluff to get concessions from Europe and the US.

At this point, I would have to say anything is possible with Putin. He has not acted rationally in a long time…

Add to the mix the recent resurgence of COVID in China with citywide lockdowns currently going on in several parts of the country. This could again adversely affect the supply chain channels in many industries, specifically in semiconductors and consumer electronic goods coming from Chinese factories.

Investor sentiment right now is low, to say the least. Many investors are feeling pessimistic about the near-term future of the overall capital markets.

The NASDAQ Composite has fallen -18.7% from its high back on November 2021. A number of economists believe the risk of a recession is rising and could land in the next year or so.

While the specter of a recession sounds like a bad thing, such economic events are part of the natural ebb and flow of any developed economy whether within the US Capital Markets or internationally.

Investors should view recessions as an opportune time to buy shares of high-quality, well-run companies. I recently wrote an article about what prior stock market crashes can teach us.

In that article, my research strongly showed that historically market crashes have always turned positive. Seasoned elite investors have seen the value of their investments come back and continue to grow, given enough time and patience.

Whenever I am in a slump and feeling like everything is grey, I turn to the Oracle of Omaha, the OG of elite investors…

In a letter to Berkshire Hathaway investors back in 1986, I found this pearl of wisdom from Warren Buffet that helped me feel a bit of calm, even during this latest storm:[6]

“What we do know, however, is that occasional outbreaks of those two super-contagious diseases, fear and greed, will forever occur in the investment community.

“The timing of these epidemics will be unpredictable.

“And the market aberrations produced by them will be equally unpredictable, both as to duration and degree.

“Therefore, we never try to anticipate the arrival or departure of either disease.

“Our goal is more modest: we simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.”

Repeat after me: Be fearful when others are greedy and greedy when others are fearful.

Certain equities offer a reliable haven during inflationary times and historically produce returns that exceed inflation.

There are a number of sectors that tend to be more protected from inflation and recessions. Below are some of the sectors that I believe are good choices for safe haven status. I have also included a few companies in each sector that will help jump start your research.

These potential recession-resistant stocks can help put your portfolio in a defensive posture if a bear market does indeed come into play.

Basic Materials: Lithium Mining

Lithium is critical in battery technology and renewable energy storage. It is a key component in moving our economy away from fossil fuels.

Lithium mining will continue to be a strong investment choice moving into the next couple of years as the green energy revolution continues to gain traction.

Technology and Semiconductors:

Technology will continue its long-term growth well into the next couple of years and beyond. Our world will continue to see technology advance and this underlying need for semiconductors have an increasing role in playing a part in our daily lives moving forward.

Science fiction is happening now and investing in any of these three companies will most likely provide investors with a positive performance on their investments.

Infrastructure: 5G Broadband

No matter what happens to the economy, 5G broadband will continue to be rolled out by worldwide governments with help from large communications companies.

In fact, the US government has already allocated $65 billion in broadband spending.

Companies such as AT&T and Verizon use subcontractors to manage the work of installing new towers, transmitters and cabling.

These cell tower installation companies stand to gain big during the next 5 years. The 5G revolution will gain further traction as consumers begin to see the potential of this exciting advance in technology that will change all of our lives in fundamental ways.

FNN contributor Blake Desaulniers wrote an excellent report on 5G and the incredible opportunities for early investors. This is a must read.

Healthcare:

Healthcare is another industry that is protected from inflationary or recessionary pressures. People will always need healthcare, and the aging population of baby boomers will only increase the growth potential for the healthcare industry.

Below are two companies that stood out in my research that look well-positioned to weather any economic storm.

Consumer Cyclical: Home Improvement

If and when the sh*t hits the economic fan, I believe these two companies are safe bets for investors. I went ahead and put in two consumer cyclical stocks as I see the DIY crowd utilizing the home improvement stores during times of economic stress.

If the water boiler goes out, do you call a repairman and spend an extra $550 for installation, or do you go on YouTube, learn how to do it and install the new boiler yourself? I’m going to lean towards do it yourself…

Consumer Defensive:

No matter what happens in the next 12 months, consumers will still need to go out and buy essentials.

This sector will be virtually untouched by any economic headwinds that may lie ahead and could even see a bump as consumers take a pass on going out to eat at restaurants and spend more time at home.

If there is anything that we have learned over the course of many years in the markets, it is one thing: the markets always recover.

But we have to also be aware that certain sectors will be harder hit than others in any downturn. The elite investor knows that defensive positioning is critical in preserving asset gains.

The threat of inflation or a subsequent idea of a recession should be seen as an opportunity to fine-tune your holdings and pick up solid companies at value prices.

Warren Buffett has learned and practiced this one thing and look where he is today. I believe he is an excellent mentor to follow.

Repeat after me: Be fearful when others are greedy and greedy when others are fearful.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.bls.gov/opub/ted/2022/consumer-prices-up-8-5-percent-for-year-ended-march-2022.htm

[2] https://www.bls.gov/opub/ted/2022/consumer-prices-up-8-5-percent-for-year-ended-march-2022.htm

[3] https://www.npr.org/2022/04/13/1092291748/economy-recession-inflation-federal-reserve-interest-rates

[4] https://www.marketwatch.com/story/did-the-u-s-economy-really-shrink-in-early-2022-is-a-recession-near-no-and-heres-why-11651155255

[5] https://www.nytimes.com/2022/03/17/business/federal-reserve-inflation-recession.html

[6] https://www.berkshirehathaway.com/letters/1986.html