Every market sector has its ups and downs, and cannabis is no different.

This sector has been a classic textbook example of bubble plays and an excellent opportunity for investors to observe and learn. These lessons are vital in helping you become a successful trader in the future.

The MJ sector showed all the signs of a classic bubble: early excitement and overestimation of sector expectations; skyrocketing share prices; and company valuations transcending to unrealistic heights and the subsequent back to reality deflation and market correction.

I recently wrote an article on market bubbles and how to spot them, which every discerning investor should read now. The article can be found here.

From my research, it looks like the dust may finally be settling for cannabis stocks and now could be an opportune time for investors to take a further look at the sector.

The cannabis sector is in its infancy when compared to other sectors. It was literally born just a few years ago, along with the legalization of medical marijuana and cannabidiol (CBD).

While marijuana has seen some movement towards legalization across the globe, it is still recognized as largely an illegal substance that can net users a stay in the local jail or worse.

This has held back marijuana companies from entering the mainstream worldwide markets and limiting secondary growth. I think this mindset is about to change.

The stigma of marijuana is still strong enough to keep many politicians (the US included) at arm’s length from any association to marijuana legalization legislation.

Surely the tide is turning towards full legalization and regulation but the speed of that process is a question mark.

Meanwhile, US states are acting to put together policies allowing cannabis companies to continue to do business within their own state borders.

I predict the cannabis sector will be volatile for several more months, and maybe even years, as young companies find their footing in a maturing and evolving market. While the risks for investors are high, the rewards could be even higher, especially when and if cannabis is made federally legal in the United States.

Companies are still figuring out their niche, and specialization is key to survival in this rapidly changing space.

As the sector matures, we will see a continued path towards less volatility.

Already, wild speculation has given way to more levelheaded growth estimates and realistic corporate valuations. The current share prices of many cannabis stocks are reflecting this, and valuations are becoming in line with growth estimates.

This is a good time to begin your research into profitable cannabis companies in my opinion.

Read on and I’ll show you my favorites...

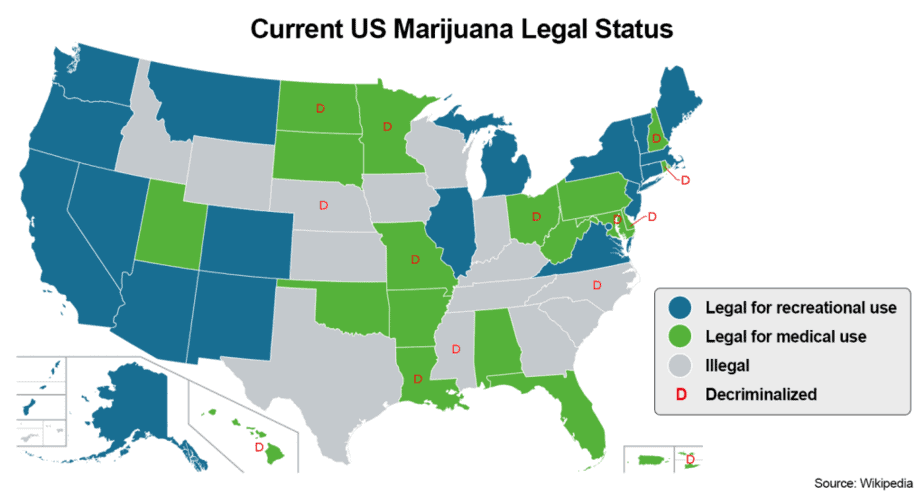

While Canada federally legalized recreational marijuana back in 2018, in the US, legalization of cannabis has largely fallen to the individual states. The Feds have mostly stayed out of the way of states’ moves to legalize, control and tax marijuana.

The low-hanging fruit has for the most part already been plucked but what remains could be even bigger if we see full legalization of recreational marijuana in both the US and Mexico.

Opening these two markets would be a boon to cannabis stocks and the investors who hold their shares.

Both the US and Mexico are toying with full legalization, but the political process is painfully slow. There are not many politicians willing to put their name on a bill that connects them to what many still believe to be the devil’s drug.

Americans will not easily forget the indoctrination of the once popular anti-drug campaign called DARE (Drug Abuse Resistance Education) introduced back in the early 80s. (Even today, they are against the legalization of marijuana.)[1]

In addition, Nancy Reagan’s “Just say NO!” was the backbone of intensifying the renewed War on Drugs. The campaign’s mantra was that cannabis was the gateway to a life of drug addiction, which we now know is not true as it has been debunked by several studies.[2]

Sadly these pushed myths will not die.

But money talks and the lure of millions in tax revenues are changing a lot of minds.

California, Colorado and a few other states that have legal adult recreational cannabis have seen huge windfalls of tax dollars coming into their coffers.

The deficit plagued federal government has taken note with prominent politicians now testing the political waters and mentioning the idea of legalization.

In July of this year, Senator Chuck Schumer, along with a handful of his colleagues, threw their weight behind a cannabis decriminalization and tax bill.

The proposed bill would deschedule cannabis as an illegal drug, clear past marijuana convictions, give states control over marijuana policies, and tax the sale of cannabis products to fund equity programs.

The bill has been sidelined as the legislature battles over the infrastructure bill and the deficit ceiling limit increase.

Interestingly, Amazon (NASDAQ: AMZN) recently announced its support for the Schumer bill and endorsed the recently introduced Cannabis Administration and Opportunity Act.[3] The company has removed drug testing from its application process as well.

I can’t help but wonder if Amazon has other motives, i.e. adding the lucrative distribution of cannabis products to their online store ready for next day delivery.

And speaking of big names and money jumping into the cannabis game, Justin Bieber announced the sale of his pre-rolls called Peaches, named after his latest hit song.[4]

Bieber is the latest in a long line of celebrities already operating in the marijuana space.

Country music legend Willie Nelson has been a long-time proponent of marijuana legalization and now has a large range of cannabis products for sale under Willie’s Reserve Brand.

The world-famous rapper Jay-Z is chief visionary officer of the California-based marijuana company, The Parent Company (OTCQX: GRAMF / NEO: GRAM-U). And Martha Stewart has partnered with Canopy Growth Corp. (NASDAQ: CGC) to launch a line of cannabidiol-rich gummies.[5]

In all, support is getting traction from all sides, and calls for changes in cannabis laws are getting louder. For now, federal marijuana legislation is on pause until they clear the docket of budget-related bills.

The issue will probably not be discussed again until at least 2022, which leaves the individual states to continue to create their own policies. State after state have now approved marijuana legalization with a majority now approving medical marijuana use.

Medical marijuana is now medically legal in 36 states, with 18 states allowing adult recreational use.

A major problem for marijuana companies is that they have no legal access to the national banking system since cannabis is still illegal on a federal level. All transactions are cash-based.

The Cannabis Banking Bill would give banks federal authorization to work with cannabis companies. Unfortunately, that bill is also languishing in the US Senate.

Meanwhile south of the border, Mexican voters are now more open to the idea of legalization after decades of seeing firsthand the devastating effects of the War on Drugs that has ravaged their country.

In 2018, Mexico's Supreme Court ruled that marijuana prohibition was unconstitutional and ordered lawmakers to put together regulations for possession and cultivation.

Since the ruling, the legislature has essentially sidelined the legislation with little or no political will to pursue the Supreme Court’s mandate.

In June of this year, the Supreme Court once again took matters into their own hands and decriminalized cannabis.

The Mexican legislature now is forced to act on regulations that will be discussed this legislative session.

Once enacted, Mexico would join Canada and Uruguay in a small but growing list of countries that have legalized marijuana in the Americas.

All said, both the US and Mexico governments are working towards some form of legalization, regulation, and taxation of cannabis — albeit at a snail’s pace.

A few of these companies I have covered before in previous articles. Their shares are still holding up even after the latest sell-off in February this year.

Which says a lot considering many cannabis companies saw a -30% to -40% reduction in their share price over the past six months.

The companies below are what I found in my research and represent a diverse selection of companies that are focusing their businesses on niche markets, i.e. cultivation of specialty strains, retail, CBD, biotech, hemp.

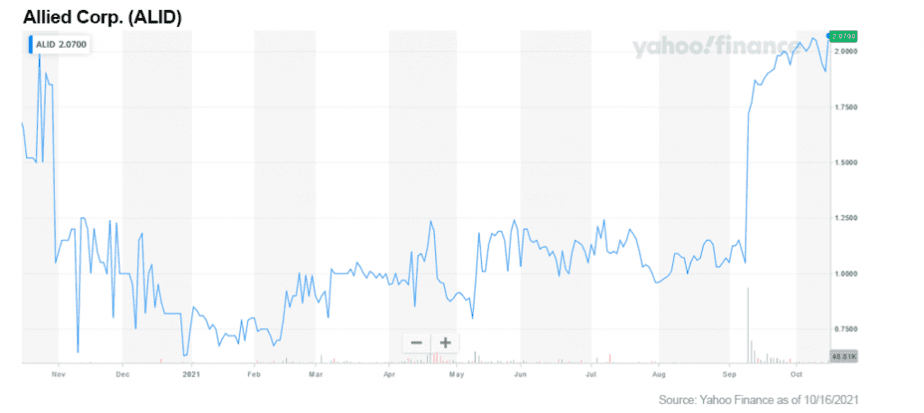

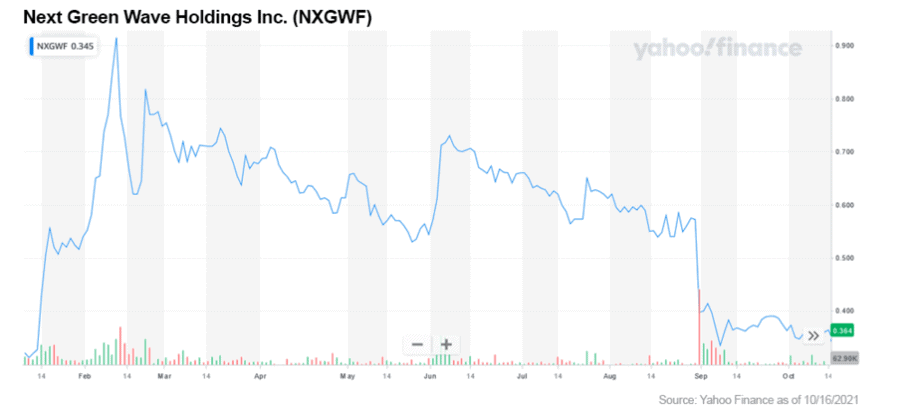

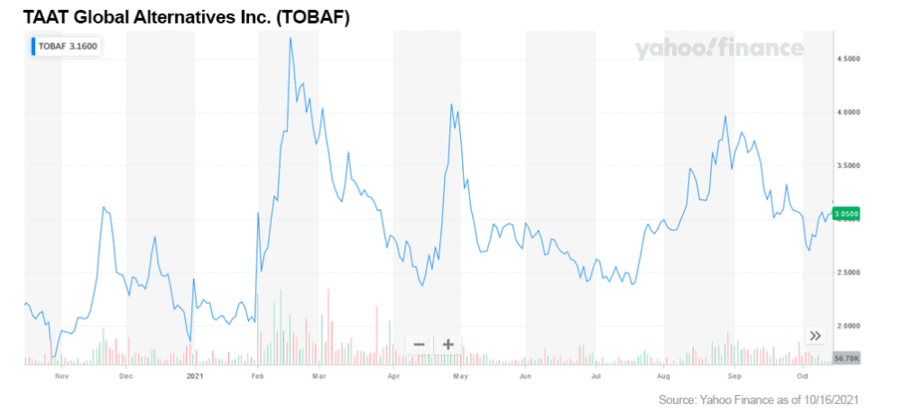

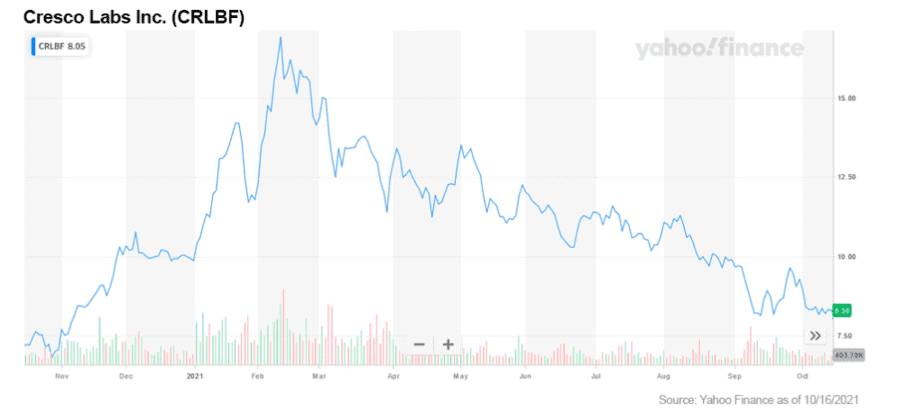

Note: All charts are for the past 12 months. I found this date range to better show where the company share price was today vs. historically. I was looking for a leveling out of the share price after the latest sell-off indicating sustained shareholder support over the past few months.

1. Allied Corp. (OTCQB: ALID)

I wrote extensively about Allied Corp back in March of this year, so the research is already prepackaged for you to dive in.

Read my full article here to learn more about this uniquely positioned company.

When doing my initial research on Allied, I spoke with the CEO and a couple other members of the management team. These guys are super knowledgeable about marijuana and are passionate about what they do.

Allied is working on cannabis (mind altering + CBD) and psilocybin isolate combinations to create powerfully effective treatments for PTSD, opioid addictions, alcoholism and chronic depression/anxiety disorders.

The company holds several provisional patents and recently announced advances in their trademarked psilocybin product called Psilonex.™

Allied is cultivating high-grade cannabis & hemp in Colombia for export to other countries. It is able to produce a very high-quality cannabis flower at a fraction of the cost that otherwise domestic hydroponic facilities produce today. The future is high quality at a low cost, and Allied seems to be one step ahead of others.

The company share price has doubled since my report. With all the projects it has in the pipeline that are just beginning to mature, I believe the company's share price could well double again in the next year.

2. Amyris, Inc. (NASDAQ: AMRS)

Amyris is a synthetic biology company that works on the development of molecules used in a variety of products. Those molecules are manufactured at scale and sold to partners around the world.

One ingredient the company has developed is a THC-free cannabinoid used in cosmetics and personal care products. The CBG cannabinoid skips the cannabis cultivation/extraction process and uses a fermentation-derived natural molecule that is bioidentical to cannabigerol (CBG). This is a huge step forward for the industry as the cost savings are substantial.

Apart from the CBG ingredient, Amyris has an impressive lineup of other ingredients that are naturally derived and made to replace depleted stocks from the wild, such as shark squalene used in cosmetics and skincare.

This company is a must-have in your watchlist or portfolio.

3. Next Green Wave Holdings Inc. (OTCQX: NXGWF / CSE: NGW)

Next Green Wave is another company I presented to FNN readers back in November of 2020.

My full company research is worth your time. You can read my original article here.

NGW’s CEO Mike Jennings is shockingly astute about the cannabis industry and is extremely focused on where his company needs to be positioned to win in this highly competitive game.

Mike was literally born and raised cultivating premium California bud. It is no wonder that he has now become one of the leaders in California specializing in boutique super high-grade marijuana flower, derivatives and edibles. By the way, Next Green Wave is also operating in the largest marijuana market in the world. Yes, you guessed it, California!

The company recently released their 3rd QTR results, and revenues are up over +30% quarter-over-quarter. The company continues to be profitable with new products in the pipeline.

The company’s share price has weathered well over the past year with about a +30% gain overall. This is amazing considering the overall cannabis sector has taken a hit of over -30% on the downside since February 2021.

It just speaks to the quality of the company and management.

If you already own this stock, it’s a keeper in my opinion.

4. TAAT Global Alternatives Inc. (OTCQX: TOBAF / CSE: TAAT)

TAAT is a recent startup that landed on my desk a few weeks ago. All I can say is WOW… I love this company!

The company is not wasting anytime in promoting and selling their all-hemp cigarettes nationally and now internationally in the UK.

The company recently touted it is selling in over 1,200 stores in the US and have sold over 600k packs to date.

TAAT just shipped 43k packs to the UK after winning government approval there and they are now looking at deals in Australia.

The company has a huge leg up on the big tobacco companies in that since its product does not contain tobacco, it is not restricted in how it brands and markets its product. It is literally allowed to advertise in places that the big tobacco companies cannot go.

TAAT's packaging can be brightly colored and appealing to consumers without all the horrible images of lung cancer patients printed on the wrapper.

The company has not pulled in a profitable quarter since going public, but at the current rate of sales, it looks like it could well be in the ‘green’ very soon.

This is another one to add to your watchlist or take the plunge and buy a few shares to add some excitement to your portfolio.

5. Cresco Labs Inc. (OTC US: CRLBF)

Cresco Labs is a pure cannabis play. It operates in 10 states, holds 44 retail licenses, and operates 18 production facilities and 32 dispensaries.

The company is growing organically as well as looking at profitable acquisition targets nationally.

Its recent acquisitions have added significant value to the company. One of the acquisitions is a leading gummy edible company. Another company that was recently acquired is a grow and retail operator in Florida, a highly lucrative market for cannabis.

The company's business plan is working.

Cresco reported a record 2nd QTR at the end of June. Sales were up +123% YoY to $210M. Net profits were up +106% to $2.7M YoY.

The cannabis sector has come back down to earth and looks to be reasonably valued for investors to re-enter.

The cannabis sector is far from dead. As the market matures, we will see these wild swings in share prices subside.

In my opinion, companies that are specializing in niche segments within the maturing marijuana sector have the greatest chance of survival in the long term.

The blue sky upside for investors is the promise of legalization in both the US and Mexico — both incredibly lucrative markets for cannabis companies.

Be sure to do your homework and choose the companies you are interested in sooner rather than later. I believe we could be at the beginning of some nice upside in a sector in bloom for those investors who are both patient and are betting on federal legalization in the US and Mexico eventually happening.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

DISCLOSURE: Allied Corp., mentioned within this article, is a client of FNN. As such, readers should consider ALID a potential conflict of interest as FNN recently provided paid marketing services to the company.

[1] https://dare.org/marijuana-legalization-talking-points/

[2] https://www.history.com/topics/1980s/just-say-no

[3] https://www.maxim.com/news/amazon-fights-to-legalize-cannabis

[4] https://www.theguardian.com/music/2021/oct/04/i-got-my-weed-from-california-justin-bieber-launches-joints-named-after-song?CMP=oth_b-aplnews_d-1

[5] Ibid.