As any seasoned investor knows, your investment portfolio is like a garden. You search for your seeds that have the best hope of growing and producing fruits of your labor. Some of the seeds will grow, and some will not. But overall, if you did your research thoroughly, many of the seeds will produce results and in turn could make your portfolio grow.

The markets look to start off 2019 with a few bumps in the road, which makes finding sound investment opportunities all the more important.

I have zeroed in on five investment sectors that I think have the best chance of weathering any market volatility in the coming year. Those five sectors are: Cannabis, Cybersecurity, 5G Wireless Technologies, Homeland Security and Metals.

Now, let me tell you why I chose these sectors, and offer up a few gems that I uncovered in my research.

2018 will be remembered as the year the marijuana industry became legitimate: Canada became the first industrialized country in the world to legalize recreational cannabis; a majority of US states now have legal medical and/or recreational marijuana; and the US Food and Drug Administration approved the first cannabis-derived drug.[1]

And in the last week of the year, US lawmakers passed the Farm Bill, officially ushering in the legalization of hemp in the United States. Hemp is a species of cannabis that contains CBDs, a non-psychoactive ingredient in marijuana already used in an assortment of beverages, cosmetics and for anxiety and pain relief.

We now have a situation where the marijuana industry is no longer seen as taboo, and billions of dollars of black market sales are moving into the legal economy.

And with these legalization and legitimacy gains came the herd of investors looking to snap up any "pot stock" they could find. Gains in the triple digits were common and every investor on Wall Street was singing the praises of the "Green Revolution."

But as the old saying goes, "What goes up, must come down," and that is precisely what happened in the last months of 2018. Lofty market caps were challenged, sending share value lower, leaving some investors bruised along the way.

Now that the hype has softened and the sector begins to mature, I believe this is a good time to revisit the sector with a careful and educated approach. There are still loads of opportunities in the sector as more and more US states and countries around the world move towards legalization.

Estimates are bullish for this growth to continue well into the future — at an annual average rate of 25%, by some estimates.[2] The industry is just getting started. Estimates of potential market sales run upwards of over $200 Billion worldwide:

I believe that the booming legal marijuana market is going to be the biggest generational opportunity of our lifetime. (Read my recent article on the marijuana sector here.)

I’ve been patiently waiting for the market to reach a maturity level that I am comfortable with, and I believe that time is right NOW!

My pick for 2019 in the cannabis sector is Sproutly (OTCQB: SRUTF, CSE: SPR, FRA: 38G). Sproutly has acquired the rights to a patent pending water extraction method for THC and CBDs in marijuana.

The ability to naturally extract cannabinoids in water is a huge step forward in delivering a wide range of medicinal and recreational marijuana products. The market is clamoring for alternatives to smoking and current generation of oil-based edible forms of consumer products.

An advantage of having the active ingredients in marijuana in a water soluble state is the onset time (time to feel the effect) and the offset time have the same effects as inhaled marijuana. That means consumers could feel the effects in five minutes or less, and be free from the desired effect in approximately 90 minutes — completely changing the game how cannabis is ingested with respect to current methods.

The key word for me here is BEVERAGES. The largest alcoholic beverage companies in the world are putting serious skin in the game. Constellation Brands dropped US$4 billion on a deal with Canopy Growth Corp. (one of the largest players in the cannabis space),[6] and that is only one of many deals that went down in 2018.

Follow me here. Imagine an adult beverage with water soluble THC that would be similar to having a beer with your lunch. I'm smelling take over territory here with a potential strong upside for early investors.

Get all the details related to Sproutly, previously featured on this website, here. I think you will agree this is an attractive opportunity.

Another hot button topic for 2018 and it only promises to become hotter in 2019.

There is now a growing body of evidence that the Russians actively hacked the US political system to win over certain candidates. The Chinese have been known to be stealing intellectual property for years hidden behind "rogue hackers."

And, of course, there are the daily phishing emails and hacked sites with malware installed waiting for the unsuspecting user to click on a link and automatically download ransomware that locks them out from their files if they don't pay a huge ransom.

It is quite literally a nightmare. We rely on the internet and our connected computers to access a myriad of personal data and websites. From banking to stock trading, researching investments to sending emails, we are exposed to malicious characters looking to take advantage at every step.

On March 15, 2018, the Department of Homeland Security (DHS) and the FBI issued an urgent warning about a national security threat that signals the changing nature of war in the 21st Century.[7]

In response, businesses have ramped up cybersecurity efforts, pushing overall spending from $120 billion a year in 2018 to an estimated $1 trillion by 2025.[8] This rate of spending growth is making cybersecurity one of the most buoyant stock sectors today, outperforming the S&P 500 by 12 to 1.[9]

My favorite in the field is VirtualArmour (OTCQB: VTLR / CSE: VAI / FRA: 3V3), a fast-growing Denver-based company that was named one of the “world’s hottest and most innovative cybersecurity companies” by Cybersecurity Ventures in 2018.[10]

VirtualArmour services a wide range of clients, including Fortune 500 companies, and several industry sectors in over 30 countries across five continents.

The company has enjoyed a 100% client retention rate within the past six quarters, which all but eliminates expensive client churn, and is a testament to the company’s stability and quality.

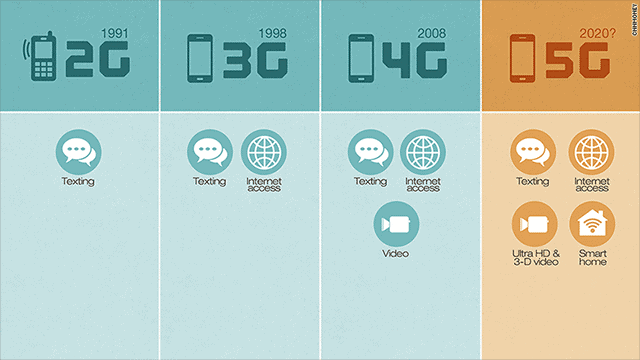

5G is coming, and it’s going to have a massive impact on almost every facet of how we use technology, with faster speeds of up to 10X faster than current 4G technology.[11]

5G refers to the fifth generation of wireless technology — the upgrade from 4G and 4G LTE communications infrastructure.

The technology will literally change the wireless data landscape and the world we live in. 5G will be the connective tissue for the Internet of Things (IoT), autonomous vehicles, and mobile media, just to name a few. The list goes on, and at this stage in the game, it's impossible to predict how it will play out.

It's like talking about the internet back in 1990. It was literally impossible to grasp the profound changes that the technology would have on our daily lives, and this is exactly where we are at now with next stage 5G.

One thing is for certain, 5G technology will require a retooling of the wireless infrastructure and devices capable of working on a 5G network. Think antennas, towers and wireless routers. Five to 10 times the data will be going in and out of a 5G base station, requiring more complex antennae and upgraded data connections.

Barclays has estimated that rolling 5G out to the entire United States will cost $300 billion.[12]

5G spending will be orders of magnitude beyond the 4G cycle.

– Harsh Kumar, Analyst for Piper Jaffray[13]

Consequently, telecom infrastructure developers will have enormous opportunity for growth.

– IRG Wireless Research

I am putting my bets in the sector on companies working on building out infrastructure and related services to support the 5G initiative.[14]

Early parts of the communication-services value chain are already benefiting from 5G.

Keysight Technologies (NYSE: KEYS) told investors at a recent conference that its 5G business has grown by double or triple digits for 10 straight quarters. [15]

National Instruments (NASDAQ: NATI), which helps customers design 5G products, called it a “major growth opportunity” in a recent press release.[16]

I am currently working on a 5G report that will be released shortly. Stay tuned...

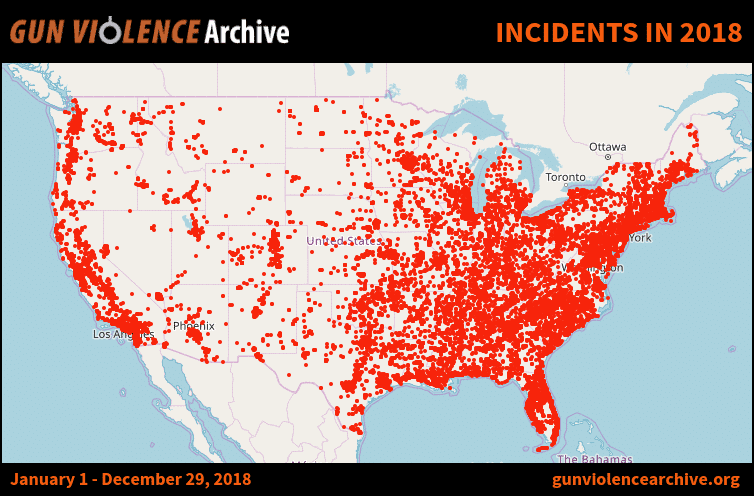

Sadly domestic terrorism and gun violence in schools, public spaces and the workplace are more common than ever. In 2018, there were 56,213 incidents of gun violence that resulted in a staggering 14,443 deaths.[17]

Governments are scrambling to contain the problem — some calling for outright gun bans, and others on the opposite extreme calling for arming civilians in the work place. Both sides seem further from a resolution than ever.

While the debate rages on in Washington, tech companies are heeding the call and finding solutions that can stop an attack before it happens. X-ray technology, facial recognition, low light infrared cameras, and body scanners have moved from the pages of science fiction into airports, concert venues, hotels and other public venues.

Many of the technologies are still in the development phase and just beginning to be deployed in public places. But the results are promising in the fight to help bring down the number of innocent people killed in gun violence.

Washington is keen on beefing up our defenses to make sure that future system failures don’t happen. And that means more business for the related companies. The US government counterterrorism budget was $175 billion in 2017. To put it in perspective, $175 billion is approximately 2.5 times the 2019 budget for Health and Human Services.[18]

One company I am watching is Patriot One Technologies (TSX.V: PAT) (OTCQX: PTOTF) (FRA: 0P1). Patriot One has developed breakthrough radar technology designed to be placed at key access points utilizing radio wave emissions to safely target, identify and notify of a concealed weapons threat through software recognition of specific wavelength patterns.

This first of its kind security tech was developed through a NATO-funded project at McMaster University. The near field radar developed has a higher resolution in detecting small objects, as well as a range of up to 2 meters (6.5 feet).

The system is coupled with cutting edge AI proprietary software that learns what is a weapon and what is not a weapon to reduce false positive identifications. Machine learning software using various algorithms is then shared across the network.

And recently they announced the acquisition of EhEye Inc. The acquisition further cements Patriot One as a leader in automated video surveillance for the public safety and security of large, critical infrastructure locations.[19]

Read more in my Patriot One Technologies article on Financial News Now here.

In the metals sector, there are two standouts in my opinion: copper and lithium.

On the copper front, the overall long-term trend for copper prices points upward, and current market conditions, a pullback from recent highs, marks a potential entry point for smart money investors.

The fundamentals of the copper market going forward remain intact, despite near-term uncertainty and lower prices driven mainly by trade war fears and the end of labor problems at BHP’s Escondida copper mine in Chile, the world’s largest supplier.

The gloomy outlook for copper may not last. More than a third of capital spending by big diversified miners is being dedicated to the metal at the moment, up from levels of 20 percent or less earlier in the decade. That represents a substantial bet that forecast deficits for copper over the next decade will indeed materialize.[20]

All by itself, the growing number of electric vehicles hitting roads is set to fuel a nine-fold increase in copper demand from the sector over the coming decade.[21] That will move the sector’s consumption from one percent to six percent of all copper produced in the world within a decade.

A few ideas for starting points in copper are:

Read more about copper's electrifying outlook by reading Blake Desaulniers' fantastic Financial News Now article found here.

World demand for lithium continues to surge. The global lithium market is projected to reach US $5.87 billion by 2020, representing a compound annual growth rate of 13.22 percent.[22]

While mine capacity appears to be strong into the near future, processing capacity is not expected to expand sufficiently to keep pace with demand.[23] That fact will limit the amount of usable lithium available for battery production, helping to drive prices higher.

It is also important to note that lithium equities have under performed lithium prices so far this year. All things being equal, we would argue that the market bias is now to the upside in lithium stocks for the near term.

Read more about lithium in Financial News Now's article here.

While 2019 looks like a volatile to bumpy start out of the gate, I believe there are opportunities that can help your investment portfolio realize some upside. Dig deeper and do your research in the coming weeks to discover those hidden gems.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

DISCLOSURE: This article includes sponsored links.

[1] https://www.fda.gov/newsevents/newsroom/pressannouncements/ucm611046.htm

[2] http://www.ibtimes.com/how-much-money-does-weed-make-every-year-north-american-marijuana-sales-hit-67b-2016-2468721

[3] http://www.macleans.ca/news/canada/how-big-is-canadas-marijuana-market-really/

[4] https://www.moneyandmarkets.com/reports/SMR/streamlined-millionaires/?ccode=&em=&sc=ENCP&ec=7636108&campid

[5] https://mjbizdaily.com/canadian-medical-marijuana-companies-tap-insane-growth-overseas/

[6] https://www.cnbc.com/2018/08/15/corona-maker-constellation-ups-bet-on-cannabis-with-4-billion-investm.html

[7] https://www.us-cert.gov/ncas/alerts/TA18-074A

[8] https://cybersecurityventures.com/cybersecurity-market-report/

[9] INTZ, RPD, TMICY, PANW, CYBR, SPLK, FTNT, SAIL through 10/10/18

[10] https://www.stockwatch.com/News/Item.aspx?bid=U-z7300619-U%3aVTLR-20180607&symbol=VTLR®ion=U

[11] https://5g.co.uk/guides/how-fast-is-5g/

[12] https://money.cnn.com/2018/06/27/media/sprint-t-mobile-5g/index.html

[13] https://www.barrons.com/articles/tech-stocks-could-really-use-5g-right-about-now-1541797048

[14] https://www.zacks.com/commentary/89921/strong-growth-potential-for-us-telecom-industry

[15] https://www.fool.com/earnings/call-transcripts/2018/05/30/keysight-technologies-inc-keys-q2-2018-earnings-co.aspx

[16] http://investor.ni.com/news-releases/news-release-details/national-instruments-reports-record-revenue-and-record-net-0

[17] https://www.gunviolencearchive.org/

[18] https://www.investopedia.com/articles/investing/061215/what-countries-spend-antiterrorism.asp

[19] https://finance.yahoo.com/news/patriot-one-completes-acquisition-eheye-130000476.html

[20] https://finance.yahoo.com/news/miners-budgeting-recovery-copper-200021166.html

[21] https://www.economist.com/finance-and-economics/2017/02/16/a-bullish-case-for-copper

[22] https://www.networknewswire.com/clients/standard-lithium-ltd/?symbol=stlhf

[23] CANACCORD Genuity Specialty Minerals and Metals, April 16, 2018