If you are as tired of watching the volatility regarding Bitcoin and cryptocurrencies as I am, change the channel and start tuning into the explosive growth expected from the build out of 5G.

While in the US 5G has been slow to get out of the gate, early investors in the 5G space could reap huge rewards over the coming years as the exciting new technology becomes a reality globally.

President Biden’s massive infrastructure plan has $100 Billion earmarked for broadband internet and 5G installations in rural America.

This just adds rocket fuel to a sector that was already on fire due to everything and everyone moving online during the pandemic. We are now moving towards Web 3.0 (the next generation of the internet), and 5G will be an integral piece.

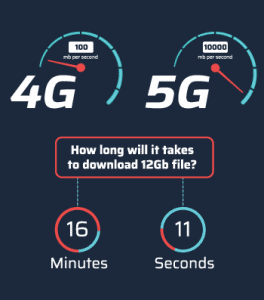

In short, the emerging wireless 5G market is expected to reach a total value of $250B. 5G is projected to be 100 times faster than 4G LTE and 10 times faster than Google Fiber (a physical connection).

To put this into perspective, a high-definition movie will take less than a second to download on 5G compared to 10 minutes on 4G LTE.[1]

My fellow FNN contributor Blake Desaulniers has written two excellent articles about 5G tech and the amazing effects it will have on our daily lives. You can check out his 5G articles here:

Investors should take note: 5G is literally such a paradigm shift in how we will consume and use data that it is difficult to imagine all the possibilities from where we sit today. It will touch every sector of our economy, spawn new technologies and applications, and generate new revenue streams that we are only now beginning to comprehend and imagine.

Looking back to 1996 and what would become our first dial up connection to the internet, I don’t believe many people back then could fathom all the changes that would take place.

In 25 short years, high-definition video calls, searchable websites on any topic imaginable, e-commerce and the ability to purchase anything from around the world with just a few clicks, unlimited access to data and information, instant communication with anyone around the world through your phone, and the ability to work from home effectively are all commonplace today.

5G will make the last 25 years of building to 4G look like a microcosm when comparing advancement in speed, latency and opportunity that 5G is about to bring.

We are on a rocket ship of innovation and smart investors are placing their bets on those companies leading the revolution.

5G is that watershed moment where once again we are presented with a technology so powerful it will literally change how we live, see and interact with the world around us.

I believe the demand for 5G service will exponentially grow as users begin to see the capabilities of this new and exciting technology.

For savvy investors, this is a time to place your stakes. Investors who are patient throughout the lengthy deployment of 5G are likely to see some eye-popping returns in years to come.

5G represents potential 10-Bagger opportunities.

Without further ado, here are my gems I believe will lead the pack in profits for the coming year. I have broken them out into three sections: Semiconductor Plays, Equipment and Infrastructure, and Real Estate.

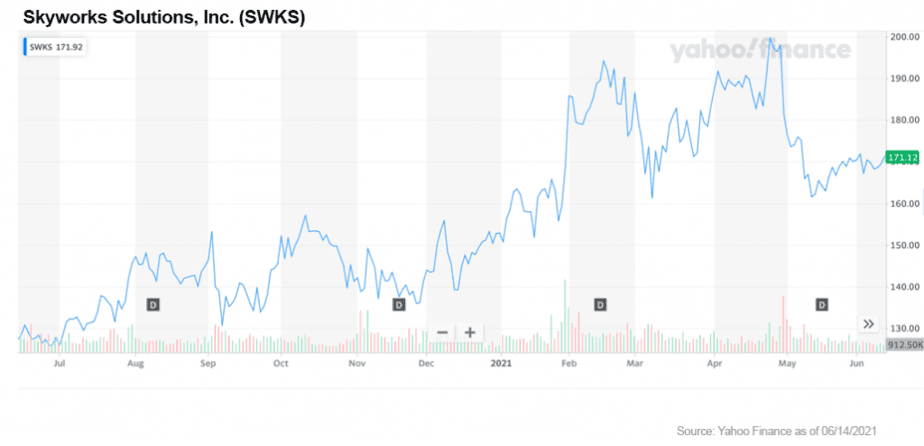

Skyworks is a minor 5G chipmaker compared to some of the other companies on this list.

However, Skyworks is a major supplier for Apple iPhone components, which accounts for a large share of its revenue. The rollout of Apple’s iPhone 12 5G phones helped Skyworks reach record revenue of $1.5 billion in Q1 of 2021.[2]

They also sell some of the basic components that power 5G networks. The company is actively looking into other revenue streams including smart home devices, connected industrial equipment and medical devices.

The company share price has received a lot of attention this year and recently hit a 52-week high at the end of April — but has since seen a correction in the last month — a positive for investors looking to add some shares on the dip.

The company sports a healthy balance sheet and looks to strongly benefit from the tailwinds that the 5G rollout will bring.

The company stock will not see any huge gains until later in the 5G rollout when there are more users and demand for new installations increases.

The stock is undervalued in my opinion, and this is a good time for early investors to add some Broadcom shares and take a balanced portfolio approach limiting exposure early on.

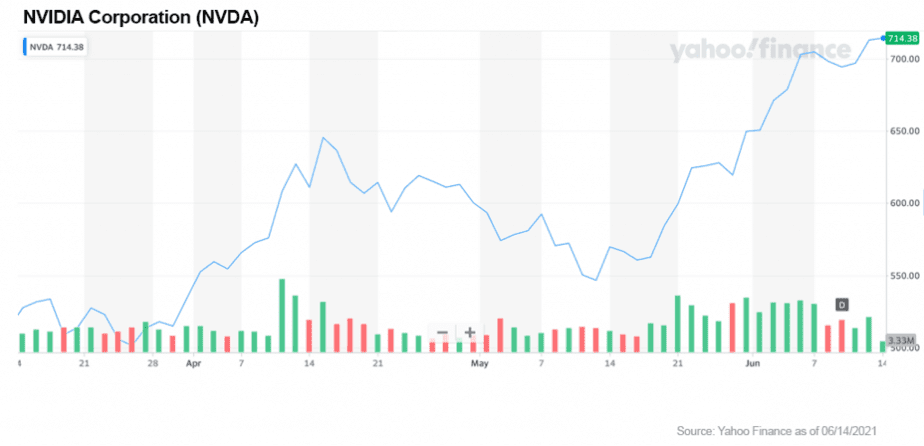

One of my favorites for many years, Nvidia creates chips and graphic processing units (GPUs) essential for powering 5G networks. Nvidia’s GPUs are being used by telecoms and equipment makers in 5G installations, and 5G deployment will only increase the demand for these critical components.

Nvidia is also a big player in cloud computing components, self-driving cars, robotics and artificial intelligence (AI), all in support of the emergence of 5G supported technologies.

This is a company that is making science fiction happen today.

This company will be a big player in 5G implementation.

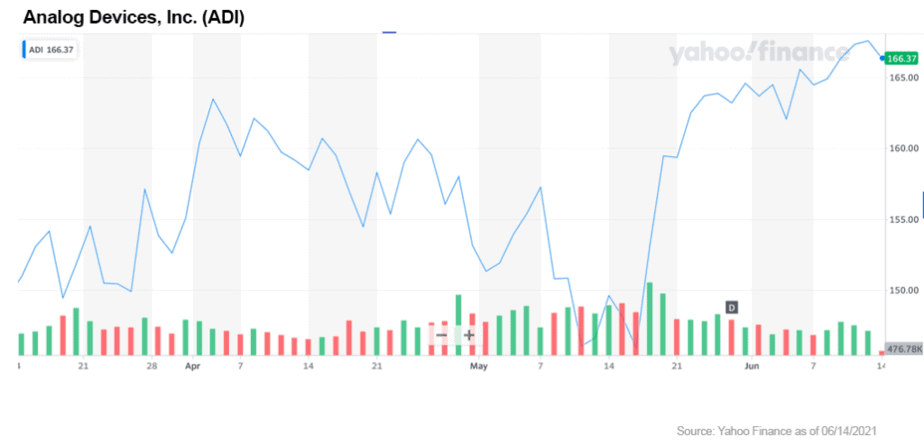

Analog makes chips specifically built for smartphones. The chips are vital for 5G radio signal chain technology, owning around a 70% market share in the field.

Another longer-term play, investors should be looking to buy into the dips. Once again, taking a balanced portfolio approach is best with ADI.

One of the bigger semiconductor manufacturers on this list, Qualcomm is a huge supplier of 5G chips in smartphones. The latest 5G iPhones use chips from Qualcomm, which were previously supplied by Intel.

While Apple is looking to use its own chips in 2023, Qualcomm will still benefit.[3] Apple and Qualcomm reached a 6-year licensing agreement in 2019 which will enable Qualcomm to profit through 2025.[4] Qualcomm charges license fees to phone makers based on wireless patents it owns regardless of whether they use its chips or not. Nice!

In addition to Apple, the company boasts multiple revenue streams, such as royalties from wireless devices and infrastructure, as well as 5G developmental platforms such as AI, Internet of Things (IoT) and up-and-coming robotic products connected to 5G networks.

Qualcomm has a strong balance sheet with lots of cash on hand to drive further innovation. Another bonus, the stock has paid a dividend for nearly two decades.

The company is sure to be a big winner with the adoption of 5G. Look for sell offs and buy into the dips. QCOM is a five-star buy rating from my perspective.

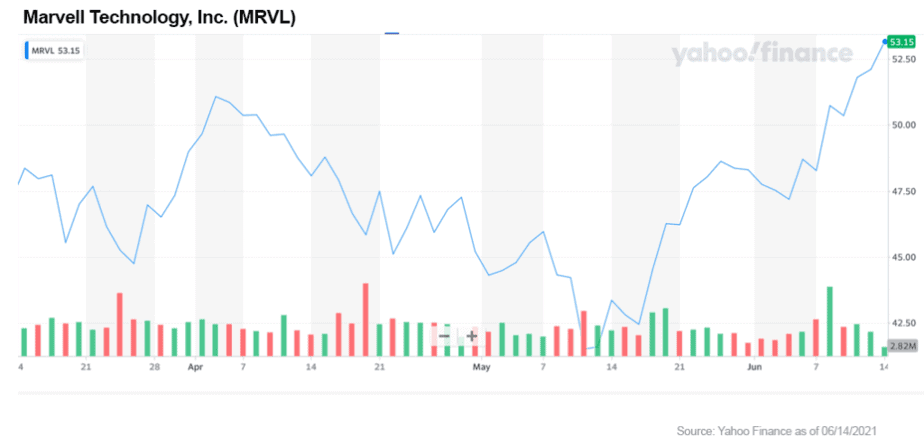

Another one of my long-time favorite stocks, Marvell is an innovator. Its semiconductors are critical to smartphones as well as 5G base stations. As 5G infrastructure growth rapidly expands, I believe Marvell stock will do the same.

Marvell chips are also used in robotics, AI and IoT devices, all markets set to grow exponentially in the coming years, once again mentioned due to the build out of 5G.

This is possibly a long-term play for the patient investor, and in my opinion, definitely a keeper in any balanced portfolio.

Ciena is squarely placed in the 5G landscape. They are a big provider to telecommunications companies such as Vodafone and Verizon. They provide equipment and help companies set up fiber optic networks — what could become essential to 5G networks in rural America.

The company also sells other 5G equipment such as routers, network software and transport networks — all optimized for 5G.

I believe this company will be in the center of 5G deployment and stands to profit handsomely in the coming year(s). Ciena is well placed to handle 5G configuration, installation and management of fiber optic backhaul.

The company boasts little debt and solid cash reserves on their balance sheet.

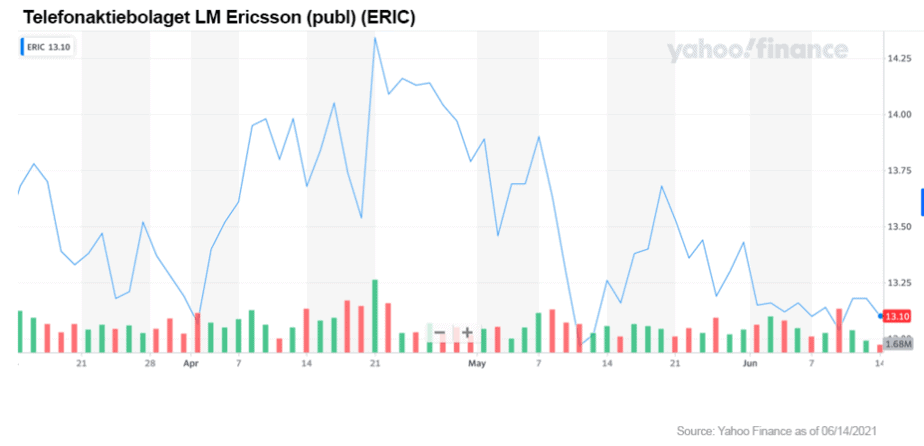

Ericsson is a long-time player in wireless networks and has firmly planted its stake in the global deployment of 5G infrastructure and equipment needs.

The company has its hands in multiple revenue streams including…

Ericsson is a solid 5G company that stands to profit handsomely over the next year and beyond. Look for sell offs to pick up shares on the cheap. I really like Ericsson as a 5G play that deserves placement in anyone’s portfolio.

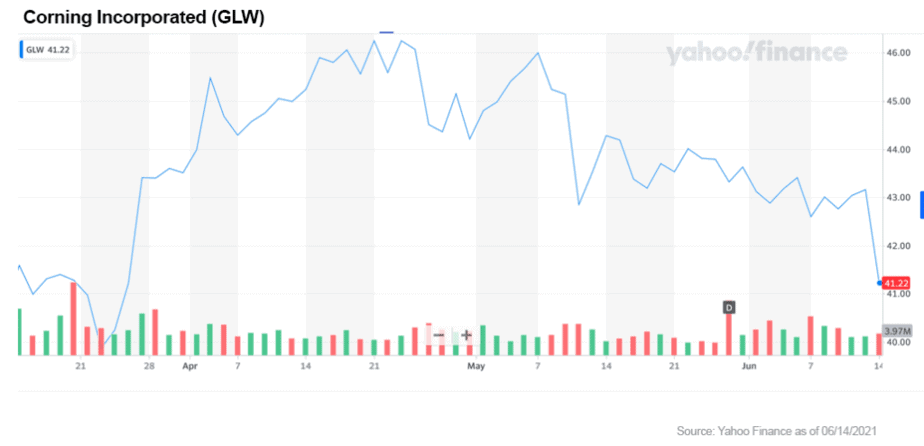

Corning is a top provider of critical fiber optic equipment and networks that will be the backbone of 5G installations.

More exciting is their move into one of the most important components of 5G systems, the small cell antenna. 5G signals are weak and do not travel over long distances or through solid surfaces very well. Corning is on the forefront of solving some of these critical technical issues.

Corning has partnered with Qualcomm to supply network equipment for interiors of buildings. They are heavily invested in R&D, looking for ways to solve the problem of 5G signal penetration through solid surfaces such as walls (as noted above).

A solid player in the 5G network rollout, the company also pays a dividend.

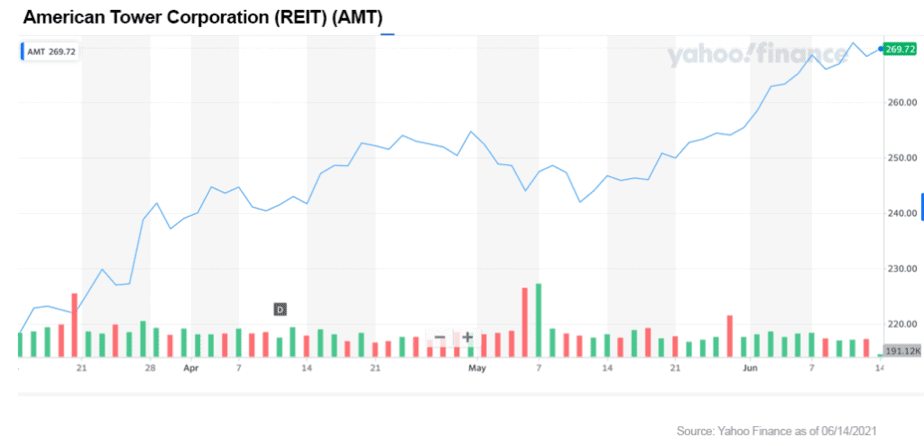

5G networks require many more transmitters to cover an area. All those small cell transmitters have to be installed on towers, light poles, telephone poles and other structures, but first they have to be installed on an existing tower network.

American Tower Corp is an obvious winner as the company boasts ownership of over 170,000 telecom sites — critical to 5G network installations.

In addition, the company also designs, installs and manages fiber optic installations.

While maybe not a super sexy stock pick, it is a solid play as demand grows for 5G and subsequent tower installations are required.

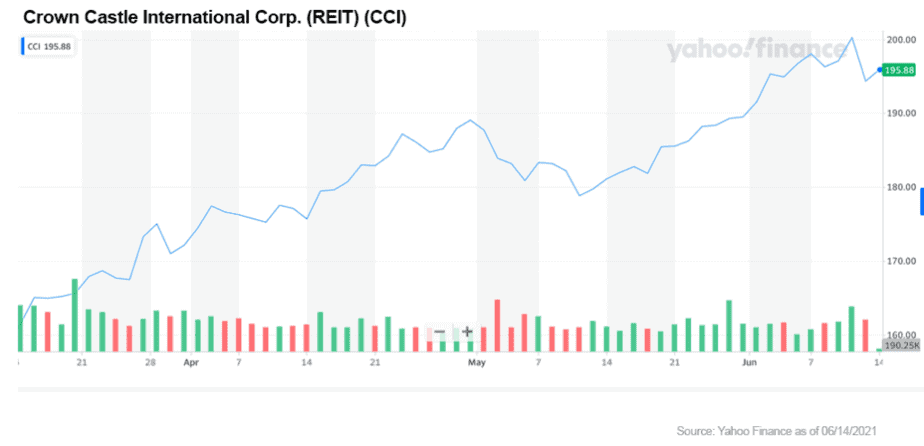

Crown Castle is another real estate investment trust (REIT) whose core focus is on acquiring and providing space to hang 5G network equipment. As 5G networks see more demand, there will be a need to add more infrastructure to tower locations.

Currently, the company is a 5G infrastructure partner of the Dish Network (NASDAQ: DISH), leasing space to Dish for up to 20,000 towers.[5]

They are also providers of the critical ‘small cell’ radio antennas for 5G service in urban areas. The antennas are hung on light poles or placed on rooftops to provide coverage of a 5G signal over an area.

Rysavy Research says there will be 1 million outdoor small cell antennas in the US by 2028.[6] That gives you some idea of the market demand that Crown Castle could see for its rollout to support 5G.

Again, maybe not a super sexy deal but nonetheless a solid and critical part of 5G networks that will see profits increase as demand for 5G grows. I’m very high on Crown Castle and I do like CCI as an important inclusion in anyone’s portfolio.

Bitcoin and cryptocurrencies are investments with extremely high risk and you are engaging in a volatile up and down market. Look… if you can play the crypto market effectively on a day-to-day basis and you are making money, you are one of the few. But for many of you, investing in crypto is like someone punching you in the stomach as you see your investment drop 25% in one hour, recover 10 minutes later, and then drop once again.

I don’t know about you, but I don’t need that level of day-to-day stress in my life. I prefer more meaningful and longer-term bets where I can invest in the next big thing, and in this case, it's 5G.

True equity investors know that the long haul is often a profitable option with much lower gut-wrenching changes in the market. Don’t get me wrong, volatility can be great if you are a 24/7 day trader… I am coming at this more importantly from my investment perspective and adding companies to a portfolio that makes sense to build wealth.

The 5G rollout is just beginning in America and it’s going to be big. This demand will grow exponentially as users realize the power and possibilities of 5G over the next 3–5 years.

Smart investors should be doing their due diligence now and finding those companies that are focused on 5G. My list above is merely an early starting point with what I believe are some solid picks for the coming year and more.

These are exciting and profitable times, so buckle up and don’t be left behind! I’m betting 5G is the next big thing and many new opportunities will be born from it. It’s time to get your foot into the investment door earlier rather than later.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://spectrum.ieee.org/telecom/wireless/design-and-optimization-of-fbar-filters-to-enable-5g

[2] https://investors.skyworksinc.com/news-releases/news-release-details/skyworks-reports-q1-fy21-results

[3] https://www.apple.com/newsroom/2019/04/qualcomm-and-apple-agree-to-drop-all-litigation/

[4] https://www.bloomberg.com/news/articles/2020-12-10/apple-starts-work-on-its-own-cellular-modem-chip-chief-says

[5] https://www.fiercewireless.com/financial/dish-inks-long-term-deal-crown-castle-for-up-to-20k-towers

[6] https://www.investors.com/news/technology/5g-stocks-5g-wireless-stocks/