The crypto world has finally shaken off its sluggishness, and it once again looks like we’re heading “for the moon.” Bitcoin (BTC) and Ethereum (ETH) are on a strong upward trajectory, and we are almost certainly entering another major bull period.

It’s about to get even better as Ethereum has accelerated the timeline to roll out its London update. This will have enormous implications for Ethereum investors, and the update will help to solve the most pressing problems facing Ethereum.

Ethereum has long been one of my favored investments (read more here) simply because of its potential. Rather than attempting to ape Bitcoin and be yet another store of value, Ethereum was designed to serve as the next infrastructure step in a new era of computing: a decentralized supercomputer.

The development of smart contracts, codes that are operated entirely on the blockchain, means that Ethereum has an incredible amount of utility. Decentralized Apps (dApps) have been able to do everything from power video games, create decentralized crypto exchanges, or even build digital collectables with non-fungible tokens (NFTs).

Despite this awesome potential, there has always been a big problem: scalability. Ethereum has traditionally relied upon a Proof of Work (PoW) consensus method to process transactions and distribute ETH.

When a transaction is made on the Ethereum blockchain, a few things happen. The first is that the transaction enters a pool and a fee must be paid in order for it to be processed. Currently this fee is calculated based on network demand. It is also possible for a user to pay a higher fee in order to ensure that their transaction is prioritized to go onto the next block due to be processed.

Once a transaction has entered this pool, it is processed by users running networks of computers. These computers are all competing to solve complicated equations to gain the right to process a block. They are then rewarded with some newly minted Ethereum, and the fee is paid to process the transactions. This method, typically called mining, helps to secure the blockchain and control the distribution of new Ethereum.

This system works well with relatively low numbers of transactions, but it becomes a significant bottleneck when large numbers of transactions are all competing for a place on a block.

This is because each block can contain a limited amount of data, so each transaction is forced to pay a premium to miners in order to secure their “place.” It takes longer to get on a block using PoW.

This has already had real world implications. There have been multiple points in Ethereum’s history where large network demand has led to huge network fees. At the heights of Decentralized Finance (DeFi) mania, the transaction fees for some complex dApps was as high as $1,000.[1]

This scalability crisis has become an increasingly challenging issue for the Ethereum team. The problem is so acute that a number of new DeFi projects have opted to use Binance Chain or other smart contract platforms. This represents an existential crisis for Ethereum that needs to be dealt with.

In order to combat this crisis, Ethereum developers have come up with a series of proposals that will make it easier and cheaper to process large numbers of transactions. This has resulted in a long-term road map that will hopefully improve the state of Ethereum over the coming months, and one of the most important of these is the London Upgrade.

At the core of the London Upgrade is EIP-1559.[2] This proposal does two key things that will help to ease congestion issues in the short term. The first is that it doubles block sizes, allowing each block to hold more transactions. The second is that it changes how fees are calculated and burns any fee paid to process a transaction rather than paying it to a miner. Instead, users are able to pay a tip to miners in order to get their transaction prioritized.

The immediate change most users noticed after the London Upgrade was that all fees are now pre-calculated using a base rate. This means that it is much easier for users to understand how much they are paying before initiating a transaction, and allows people to decide whether or not to make a transaction more effectively.

It should also prevent major fluctuations in the price of ETH, which will help improve the utility of Ethereum-powered dApps.

Another less intuitive change is the increased block size. Rather than being designed to process more transactions, it is supposed to give more leeway when processing transactions.

It is designed to operate like a ferry or airplane, and transactions are priced to be around half full. However, if there is a sudden spike in demand, there will be enough “seats” left on the block for these extra transactions to go through without putting strain on the network.

The fact that the transaction fee is burned rather than paid to miners is also significant but not for the reasons that you might think. There has been some excitement about EIP-1559 because there is a belief that it could bring about deflationary economics to Ethereum. This is theoretically possible but very unlikely.

For Ethereum to become deflationary, the burn rate would need to be higher than the amount of new Ethereum being minted. This is unlikely to happen unless there is significant strain on the network, and even if it does, the impact would be transient.

The more interesting aspect of EIP-1559 is that it eliminates a key revenue source for miners. Now to make money, they will need to rely upon tips from users who need rapid transactions and newly minted Ethereum. This could significantly squeeze their revenue source, and some have pointed out that it may discourage Ethereum mining.

This change goes hand-in-hand with another important part of the London Upgrade, EIP-3554.[3] This proposal moves up the deadline for the next “difficulty timebomb” to December 2021.

In December, a new code will go live that will trick Ethereum’s algorithm into believing there are millions of new “miners.” This will make it significantly harder for real miners to earn the right to process blocks and impossible for them to earn money. The purpose of this is to close the on-ramp for new miners, and accelerate the network’s transition to a new form of consensus: Proof of Stake (PoS).

Proof of Stake requires users to stake (lock) 32 Ethereum in order to become a validator in the network. Validators will take over the responsibilities previously handled by miners: ordering transactions and creating new blocks so that all nodes agree on the state of the network.

If a user doesn’t have 32 Ethereum, they can instead delegate a smaller amount to a staking pool, which will handle the validation process on their behalf. In exchange for delegating, a user will receive a percentage of their stake as a reward — not unlike collecting interest in a bank account.

When a user submits a transaction, a validator is algorithmically selected to be responsible for adding the transaction to a shard block.

The validators who are not selected will be able to confirm that a proposed block is valid, and these attestations are recorded in the beacon chain. 128 validators are required in order to make a block valid, and the validator who proposed the block gets their reward.

Validators who commit bad actions, for example, allowing their node to go online or committing a fraudulent transaction, can lose some or all of their stake. Additionally, any validators attempting to engage in a 51% attack on the network will have their entire stake burned. This helps to encourage good validator behavior with a carrot and stick approach.

Proof of Stake is enormously positive for Ethereum investors for two reasons. The first is that it will significantly increase the viability of the Ethereum network overall. Take power usage, for example. The average Ethereum transaction requires around 62 KWh of energy, which for reference, that’s around the same amount of energy required to run my fridge for 55 days.[4] A switch to PoS has the potential to reduce energy usage by 99.99%.[5]

Power usage associated with cryptocurrency has become a hot button topic. For example, Elon Musk cited the large energy usage for Bitcoin mining as a key reason for Tesla’s (NASDAQ: TSLA) U-Turn on accepting the cryptocurrency as payment.[6] The switch to Proof of Stake is probably the best solution to the environmental challenge.

The other benefit is that the change will help make the Ethereum network more sustainable. If Proof of Work is able to solve the last big scalability issue with Ethereum, it will reduce the incentive for dApp developers to use alternative platforms. This will help to increase the Ethereum dApp ecosystem and increase the likelihood that the project will remain the go-to smart contract platform.

The second important consideration is that Proof of Stake provides a way for Ethereum holders to monetize their investment without liquidating it. Users who participate in a staking pool will be able to earn 5.82% annually on their investment, and those who elect to run validator nodes can earn as much as 6.53%.[7]

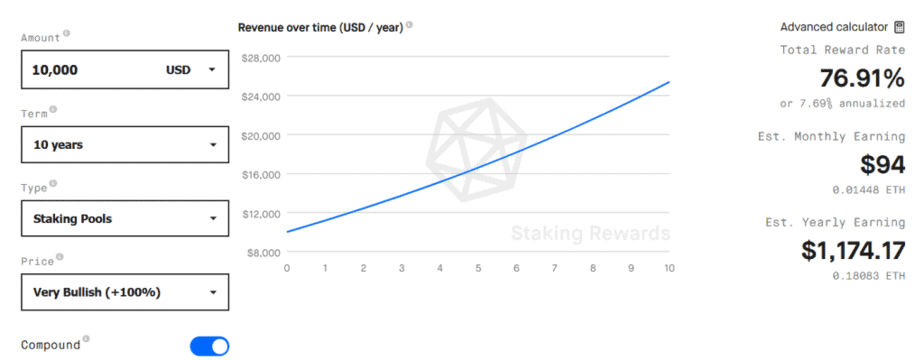

This might not sound like much but keep in mind that this is not a return on your initial investment — but an additional return on top of any Ethereum price rises. Assuming that you had $10,000 in Ethereum, and the price of ETH rises by around 100% over the course of 12 months, you would be able to earn $1,179 in compound interest just by holding Ethereum.[8] This would translate to an extra $15 thousand worth of Ethereum within ten years without purchasing any more for your portfolio.

These figures are particularly conservative in light of another useful side effect of PoS: reduced liquid supply. If staking Ethereum remains a desirable choice, it significantly reduces the reasons for anybody to liquidate their assets. Why take smaller gains now when a larger holding will increase the benefits of any “interest” you earn from rewards.

This will have the knock-on effect of significantly reducing the available supply of Ethereum, which in turn could lead to increased price pressure as Ethereum becomes scarcer. This would create a virtuous cycle where prices are forced upwards as more and more users elect to lock their Ethereum stake.

For anybody who has already taken the leap, it is possible to stake your Ethereum today. While running a validator node is technically demanding, it is incredibly simple to stake your Ethereum using a custodial staking solution or a normal staking pool. You can find a list of staking pools here, or check out Lido if you’re interested in a custodial solution.

While I personally stake my Ethereum, there are some drawbacks. The first is that it is uncertain when you will be able to withdraw your Ethereum stake. Whenever you stake any Ethereum it is converted from Ethereum 1.0 to Ethereum 2.0.

The Ethereum 2.0 blockchain does not yet have withdrawal capacity and there isn’t a firm deadline on when that will be added. This can be overcome by using a project like Lido, which has created a 1:1 Ethereum 2.0 backed DeFi token that can be traded on most DeFi exchanges.

The other risk is in using a staking pool. If the operator of a pool fails to be online, or commits a malicious act, it is your stake that is at risk. This problem can be mitigated by doing research on any pool you decide to use or by going with larger custodial solutions.

These updates are a huge step in the right direction for Ethereum and give me confidence that it is on track to become the go-to smart contract solution as the cryptocurrency ecosystem expands. It will solve the scalability problems and extreme energy use concerns that have been plaguing Ethereum for some time.

Additionally the ability to lock cryptocurrency will help to reduce the amount of liquid supply, and further encourage Ethereum investors to hold onto their assets rather than liquidate them or day trade.

I believe that Ethereum is the most interesting opportunity in cryptocurrency right now, but you should do your own research and decide whether it’s right for you.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds Ethereum, Bitcoin, Uniswap and other crypto assets.

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://cointelegraph.com/news/ethereum-posts-new-highs-as-defi-gas-fees-top-1-000-on-complex-protocols

[2] https://github.com/ethereum/EIPs/blob/master/EIPS/eip-1559.md

[3] https://eips.ethereum.org/EIPS/eip-3554

[4] https://www.trgdatacenters.com/most-environment-friendly-cryptocurrencies/

[5] https://www.nbcnews.com/tech/tech-news/cryptocurrency-goes-green-proof-stake-offer-solution-energy-concerns-rcna1030

[6] https://www.reuters.com/technology/musk-decries-bitcoins-insane-energy-use-after-tesla-payment-u-turn-2021-05-13/

[7] https://www.nbcnews.com/tech/tech-news/cryptocurrency-goes-green-proof-stake-offer-solution-energy-concerns-rcna1030

[8] https://www.stakingrewards.com/earn/ethereum-2-0 se blank check vehicles raised over $82.1 billion.